Stock Market Primary Trend is Up

Stock-Markets / Stock Markets 2012 Apr 18, 2012 - 04:17 AM GMTBy: Puru_Saxena

The world’s most influential central bank wants to inflate American asset prices; thus it is conceivable that the ongoing rally on Wall Street will continue for several months. Look. The Federal Reserve has made it clear that it will keep rates on hold until at least December 2014 and it is also buying US Treasuries across the entire yield curve. Put simply, Mr. Bernanke is suppressing interest rates and he is forcing investors to search for yield.

The world’s most influential central bank wants to inflate American asset prices; thus it is conceivable that the ongoing rally on Wall Street will continue for several months. Look. The Federal Reserve has made it clear that it will keep rates on hold until at least December 2014 and it is also buying US Treasuries across the entire yield curve. Put simply, Mr. Bernanke is suppressing interest rates and he is forcing investors to search for yield.

In our view, when it comes to investing, monetary policy trumps everything else. Furthermore, as we explained in last month’s Money Matters, the risk free rate of return determines the value of all asset prices. Therefore, the Federal Reserve’s commitment of keeping short term rates near zero is favourable for risky assets.

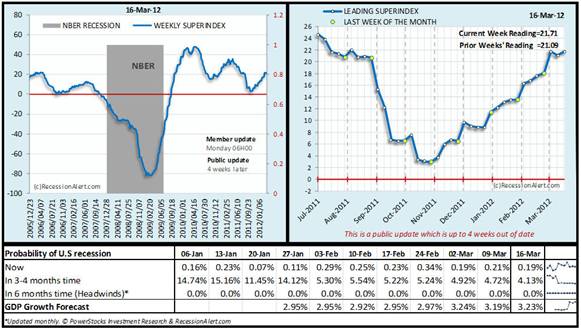

Turning to the economy, it is notable that recent data suggests that things are improving in the US. Fortunately, unemployment is coming down and housing seems to have bottomed out in most parts of the nation. More importantly, the forward looking leading indicators are also suggesting that the US will avoid slipping into a recession within the next six months.

Figure 1 confirms that after last autumn’s dip, Recessionalert.com’s Weekly SuperIndex continues to climb and suggests only a 4.13% probability of a recession within the next 3-4 months. Furthermore, their Headwinds model suggests a 0% probability of a US recession within the next 6 months.

Figure 1: Low probability of US recession

Source: http://recessionalert.com

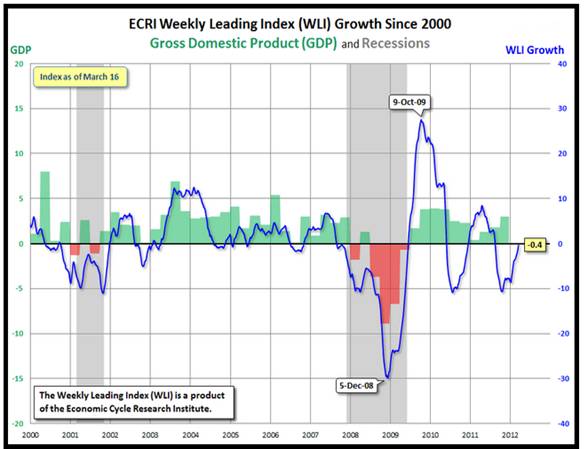

Despite the recent improvement in economic data, it is interesting to observe that the ECRI is maintaining its recession call. You may remember that the ECRI came out with its recession call last autumn and it is still predicting a contraction in the world’s largest economy.

Although we are not economists, the ECRI’s current recession call appears strange because its own Weekly Leading Index has been rising since October 2011 and after falling to -10% last autumn, its growth rate has now climbed to -0.4% (Figure 2).

Figure 2: ECRI Weekly Leading Index Growth Rate

Source: ECRI

The ECRI’s recession call notwithstanding, it is worth noting that consumer discretionary stocks in the US are doing exceptionally well and in an economy where consumption accounts for 70% of GDP, the ongoing strength in this sector is very bullish. In our opinion, if the US economy was about to contract, consumer discretionary stocks would be lagging the broad market. Instead, this sector is one of the strongest in terms of stock market performance and this supports the view that the US economy will continue to muddle along for several more months.

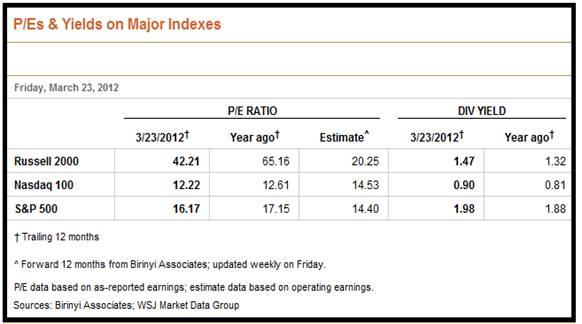

If the US economy continues to grow at a modest pace, it is probable that the American stock market will continue to appreciate. After all, short term interest rates in the US are close to zero and the 10-Year US Treasury Note yields a miserly 2.05%. More importantly, given the historically low interest rates, Wall Street’s valuation is reasonable.

Figure 3 shows that the S&P500 Index is currently trading at 16.17 times reported earnings and at 12.22 times reported earnings, the NASDAQ 100’s valuation is even more compressed! Furthermore, with the S&P500 Index yielding almost the same as the 10-Year US Treasury Note, it is hardly surprising that capital is flowing towards Wall Street.

Figure 3: Wall Street valuation and yield

Source: The Wall Street Journal

Whether you like it or not, the truth is that unless the US slips into a vicious recession, American stocks are reasonably priced. Moreover, the Federal Reserve’s pledge to keep short term interest rates near zero for at least another 32 months should assist the ongoing stock market rally.

It is no secret that Wall Street is extremely important for investor sentiment and an uptrend over there has a positive effect on other stock markets. When Wall Street is in rally mode, most stock markets join the party and when major US indices enter a downtrend, global stocks feel the heat. Thus, the ongoing party on Wall Street can only be viewed positively for global equities and it is our contention that the uptrend will probably continue until interest rates rise.

Looking at specific sectors, it is notable that consumer discretionary, technology and consumer staples are the strongest and this bodes well for the US economy. Whilst it is true that some sectors such as housing and financials are still struggling, other industries are performing well. Moreover, in this era of globalisation, many American multinationals are growing their business at a rapid pace and their stocks reflect this reality.

Today, investor sentiment is lousy, monetary policy is accommodative, American companies are flush with cash and valuations are reasonable. Thus, the stage is now set for a sustainable rally on Wall Street.

Figure 4 depicts the monthly chart of the S&P500 Index. As you can see, the S&P500 Index has been trapped in a trading range since March 2000. However, in an encouraging development, it has recently climbed above its last year’s high and it appears as though the 1,550-1,600 area will offer initial overhead resistance. Furthermore, the monthly histograms (bottom panel of the chart), have recently turned bullish and this also suggests that the ongoing rally may continue for several more months.

Figure 4: S&P500 Index (monthly chart)

Source: www.stockcharts.com

In any event, we are not in the prediction business and do not know what tomorrow will bring. What we do know is that Wall Street is currently in an uptrend and the path of least resistance is up for now. Accordingly, we have invested our equity portfolio in leading growth stocks which are growing their earnings at a torrid pace. Furthermore, we have invested our fund portfolio in Latin America, developing Asia, US small to mid-cap companies, technology and energy.

Puru Saxena publishes Money Matters, a monthly economic report, which highlights extraordinary investment opportunities in all major markets. In addition to the monthly report, subscribers also receive “Weekly Updates” covering the recent market action. Money Matters is available by subscription from www.purusaxena.com.

Puru Saxena Website – www.purusaxena.com

Puru Saxena is the founder of Puru Saxena Wealth Management, his Hong Kong based firm which manages investment portfolios for individuals and corporate clients. He is a highly showcased investment manager and a regular guest on CNN, BBC World, CNBC, Bloomberg, NDTV and various radio programs.

Copyright © 2005-2012 Puru Saxena Limited. All rights reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.