Gold and Silver Price Manipulation and How They Do It

Commodities / Gold and Silver 2012 Apr 18, 2012 - 03:08 AM GMTBy: Submissions

Marshall Swing writes: This article is about what I call classic gold and silver manipulation by the commercial banks.

Marshall Swing writes: This article is about what I call classic gold and silver manipulation by the commercial banks.

I list steps in the commercial process that ends in commercial positions profiting and speculator positions with losses or no gains:

1.Commercial long accumulation

2.Speculator long accumulation

3.Commercial short accumulation

4.High frequency and day trading selloff

5.Commercials selloff of shorts in the money

6.Commercial long accumulation

7.Speculator short accumulation

8.Speculator long accumulation

9.Commercial short accumulation

10.Price settling action

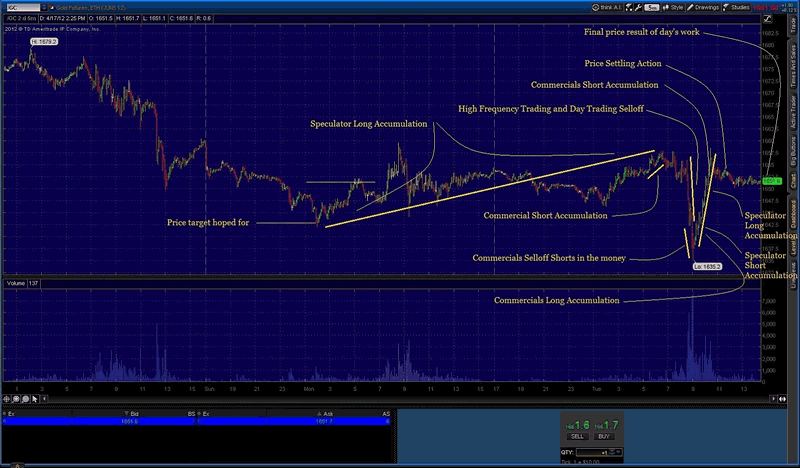

Refer to the gold chart:

Classic gold and silver manipulation begins with speculator long accumulation over an undecided length of time. In the case of this example, gold, the accumulation of speculator longs began early Monday morning until around 5AM Tuesday. Price rose from $1642 to $1647. Near the end of the speculator long accumulation, The commercials begin purchasing (selling) short positions.

Next, what is pegged as commercial high frequency trading (HFT) and day trader selloffs. These players are always focused on short term positions so they buy and sell rapidly trying to make small profits and price can change dramatically. In this case the commercials take the price down and trip the stops of the speculator longs so they are out of the money or even lose money depending on where they bought on the way up.

This is followed by the selling of the commercial short positions for profit near the bottom and rapidly buying long positions at the bottom. Then after regaining their composure the speculators buy shorts thinking they can profit because they perceive the commercials will in fact take the price lower and they are wrong.

Near the next top the commercials are buying shorts positions and the speculators near the middle to top are buying long positions. At the top, the commercials sell their long positions they bought low and then the price settling action begins to run up to the end of the trading day.

What we see on the price ride up beginning Monday morning is little interest in the market from the commercial shorts. They are waiting for a predetermined top so they can take profits and hopefully are able to manipulate the price lower. In this case, while they obtained profits, some of the speculator longs were resolute and the overall price was not lowered significantly at the close of Tuesday afternoon.

Don't count it a victory for the speculators just yet. The commercials will be back to achieve another price low. They have no intention of being out of the money.

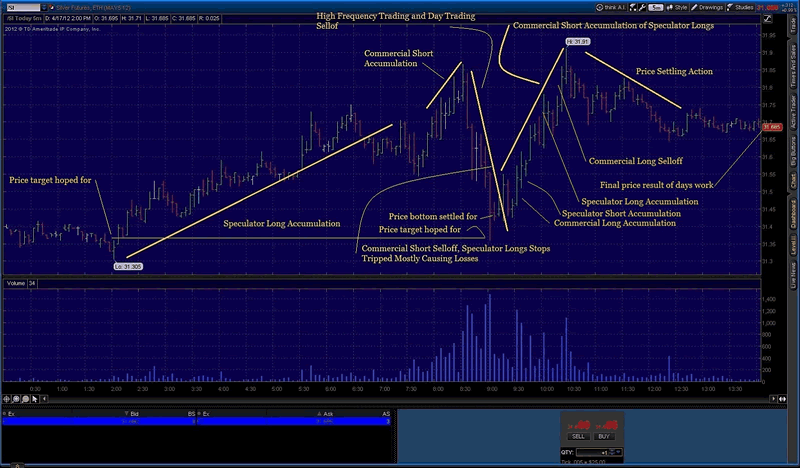

Below is the silver action from the same timeframes. We see the same 10 steps, same method of profiting, and somewhat better price lowering than gold.

Refer to the silver chart:

Terminology:

1.Commercials. A handful of traders who have unusually large short and long positions particularly heavy on the short side.

2.Speculators (Large and Small). Institutions and private traders. Some large speculators have large positions but are dwarfed by the commercial positions.

3.Day traders. Private individuals and smaller companies who practice to make a profit during the trading day but who do not usually hold their position after closing.

4.High Frequency Traders (HFT). Those traders for large corporations and particularly the commercial banks who practice day trading with the intent of moving price.

Marshall Swing

The Got Phyzz? Report

© 2012 Copyright Marshall Swing - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.