Does Gold Ever Pay?

Commodities / Gold and Silver 2012 Apr 16, 2012 - 09:12 AM GMTBy: Adrian_Ash

Is it fair to characterize gold bullion as an investment...?

Is it fair to characterize gold bullion as an investment...?

WHY BOTHER investing? Five years into the financial crisis – and more than a decade after the US market hit its big top in real terms – you might well ask. Especially now that cash, bonds, Treasuries and stocks pay between zero and sweet nothing in yield, just like gold bullion.

The aim if not the outcome of investment is simple, however. "Investing [is] the transfer to others of purchasing power now with the reasoned expectation of receiving more purchasing power – after taxes have been paid on nominal gains – in the future," as Warren Buffett wrote earlier this year to his Berkshire Hathaway shareholders.

Buffett should know all about that. The world's third richest man, he famously seeks under-priced investments that look set to rise to fair value. Delivering a better than inflation return (after taxes are paid), that makes tomorrow's consumption cheaper for the investor in terms of what s/he puts at risk today.

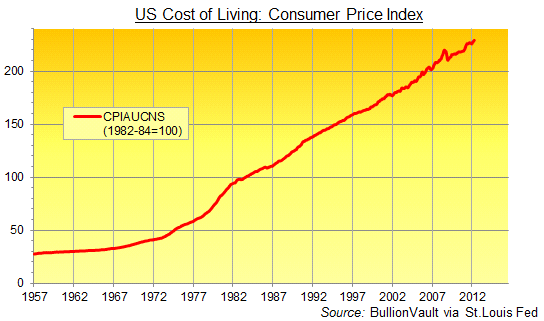

Put $10 in, take $20 out, and you're ahead – provided that inflation (or tax) hasn't eaten the real value of your extra money meantime. Because as Buffett says, it's real purchasing power that matters. So here's what US citizens trying to make future consumption cheaper have had to contend with since roundabout the time he got started investing.

As you can see, you now need $2.30 to enjoy the quantity of goods and services you got for 27¢ back in 1957. But that's only in terms of plain cash, stuffed in your wallet or purse, rather than invested in anything as simple as a bank deposit account.

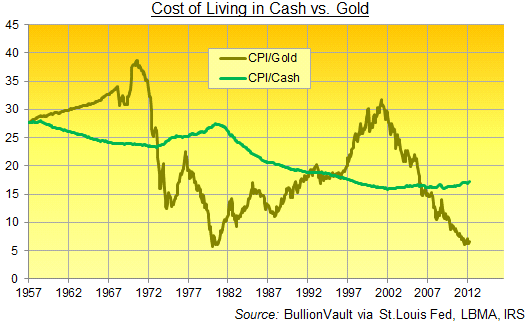

So here's how holding cash-in-the-bank has performed instead, after interest. You have to pay tax on such income of course, and that's included here at the 15% rate charged to the average US household. By way of comparison, non-yielding gold bullion is shown too – this time with the current US capital gains tax of 28% included instead.

Keeping cash in the bank has helped fend off inflation long term, even after you've paid 15% tax on the interest. But there have been times when keeping cash on deposit failed to keep its head above water – the 1970s of course, but now also over the last decade. Gold bullion, in contrast, has gone the other way in both of those periods. Similarly, gold's long bear market (1980-2001) coincides on our chart with a long winning streak in the real value of cash.

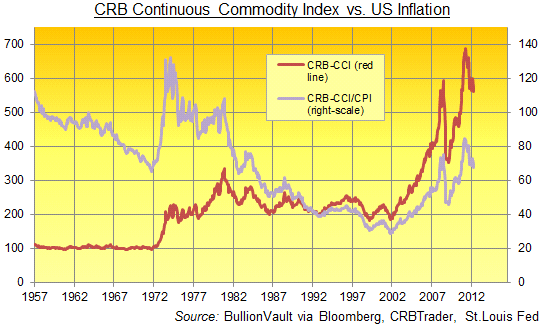

Of course, the United States' official Consumer Price Index is often called into doubt. The methodology has mutated so much, it's hardly the same index today as it was in the late '90s, let alone six decades ago. Raw materials, in contrast, are still priced in Dollar and cents. So what do the broad commodity markets say about the investment value of gold versus cash?

Yes, the CCI index has also been subject to change, but its inputs remain the most heavily used natural resources (crude oil, copper, wheat etc) and the computational changes are tiny next to the mutation of the official Consumer Price Index.

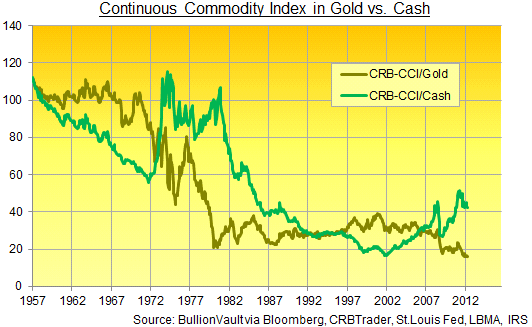

Just for kicks, the violet line above measures the CCI in the CPI, showing how the "real price" of commodities steadily fell (oil crises aside) in the 45 years to 2002. And once more, you could have enjoyed a very much lower cost of food, energy and other basic materials again simply by opting to buy gold or put cash in the bank.

Like earning interest on cash, gold bullion has indeed proven itself a decent investment under Warren Buffett's definition. Because it has reduced the real cost of raw materials over the long run, albeit with major shakes along the way. Gold lost half its tax-adjusted value for investors between 1980 and 2000. Cash in the bank has lost more than that in the 12 years since.

Cash up, gold down in short. And vice versa as the charts show.

By Adrian Ash

BullionVault.com

Gold price chart, no delay | Buy gold online at live prices

Formerly City correspondent for The Daily Reckoning in London and a regular contributor to MoneyWeek magazine, Adrian Ash is the editor of Gold News and head of research at www.BullionVault.com , giving you direct access to investment gold, vaulted in Zurich , on $3 spreads and 0.8% dealing fees.

(c) BullionVault 2012

Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.