Sovereign Debt, Gold and Okun's Law

Stock-Markets / Global Debt Crisis 2012 Apr 13, 2012 - 12:50 PM GMTBy: Richard_Mills

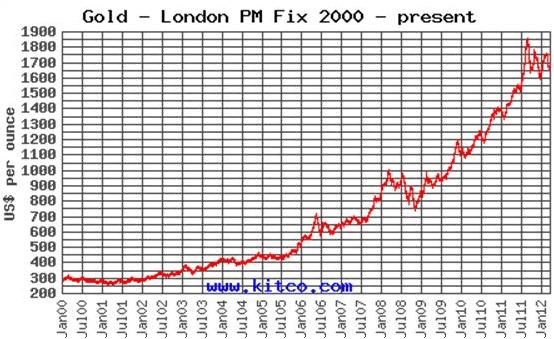

Is gold's run over? Let's look at some facts.

Is gold's run over? Let's look at some facts.

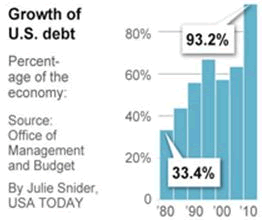

The amount of money the federal government owes to its creditors, combined with IOUs to government retirement and other programs, now tops $15.23 trillion. That's roughly equal to the value of all goods and services the U.S. economy produces in one year: $15.17 trillion as of September, 2011.

Among advanced economies, only Greece, Iceland, Ireland, Italy, Japan and Portugal have debts larger than their economies.

The U.S. government spent over 454 billion dollars just on interest on the national debt during fiscal 2011.

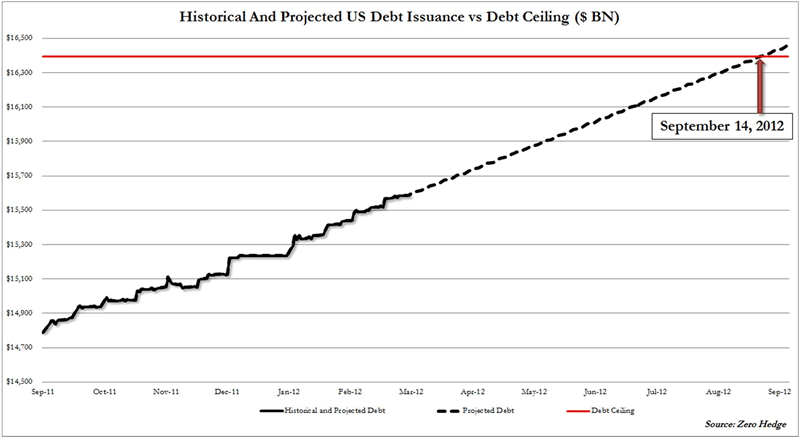

The debt ceiling stands at nearly $16.4 trillion. Some predict the U.S. will run out of money by September 2012. The next increase to the debt ceiling could be as high as $2 trillion.

Since Barack Obama was elected, the U.S. government has added five trillion more dollars to the national debt.

The United States government is responsible for more than a third of all the government debt in the entire world.

Mandatory federal spending surpassed total federal revenue for the first time ever in fiscal 2011.

The deficit has ballooned to nearly $48,000 for every man, woman and child in the U.S.

During fiscal year 2011, the U.S. government spent 3.7 trillion dollars but it only brought in 2.4 trillion dollars.

"The government's total indebtedness -- its fiscal gap -- now stands at $211 trillion, by my arithmetic. The fiscal gap is the difference, measured in present value, between all projected future spending obligations -- including our huge defense expenditures and massive entitlement programs, as well as making interest and principal payments on the official debt -- and all projected future taxes." Professor Laurence J. Kotlikoff, CNN

Obamacare will add 17 trillion dollars more to US long term unfunded obligations.

The FT World Markets Index EX U.S. declined 3% in March.

President Obama's 2012 budget shows the debt soaring past $26 trillion a decade from now.

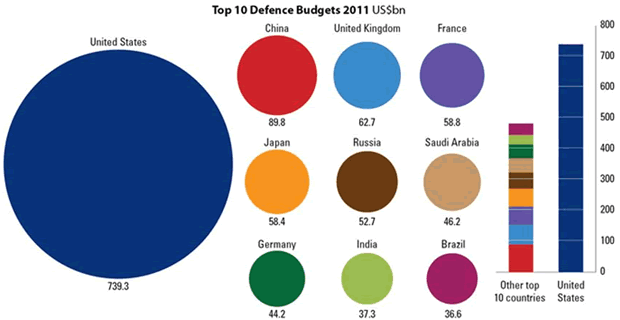

The US accounts for 45.7 percent of total military spending by the world's 171 governments and territories.

Adding in all of these non-DOD agencies' costs:

- The $20 billion in military retirement spending by the Treasury Department

- Military aid to countries like Israel and Pakistan

- Secret or black operations costs

- Homeland defense costs in the Department of Homeland Security

- The costs of caring for veterans of past and current wars in the Department of Veterans Affairs

- The budget for nuclear weapons is in the Department of Energy

Plus a share of the annual interest on the national debt gets total US defense-related spending up to $1 trillion.

Currently spending by the federal government accounts for 24 percent of GDP. In 2001, it accounted for 18 percent.

"The time for austerity is not today. If we were to put in austerity measures right now, it would take the economy in the wrong way." White House Chief of Staff Jack Lew, NBC News, Meet the Press

Your government cannot spend more than the sum of what it has and what it can raise. The places a government can get its money from are:

- Taxes - no politician will raise taxes, they would never get re-elected

- Debt

- Income - government income is small and limited

- Fines - revenue here is limited as well

- Inflation

The top five percent of all income earners already pay nearly 50 percent of all federal taxes.

The United States already has world's highest corporate tax rate (includes central government, regional and local taxes) at 39.5 percent.

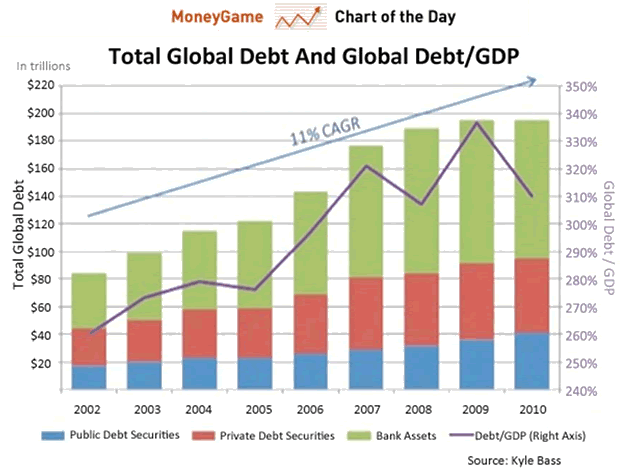

Countries like China are shunning U.S. Treasuries, "In 2009, such foreign purchases of U.S. debt amounted to 6 percent of GDP and has since fallen by over eighty percent to a paltry 0.9 percent." Money News article

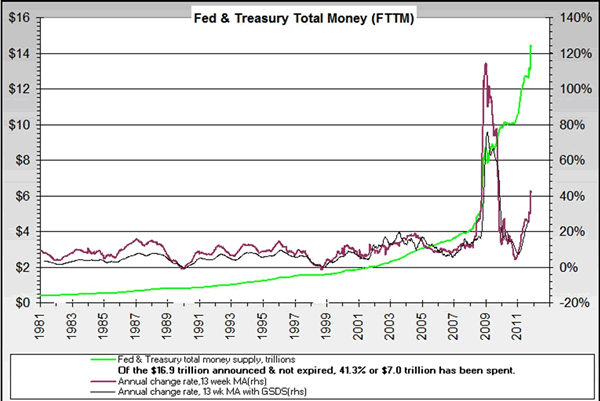

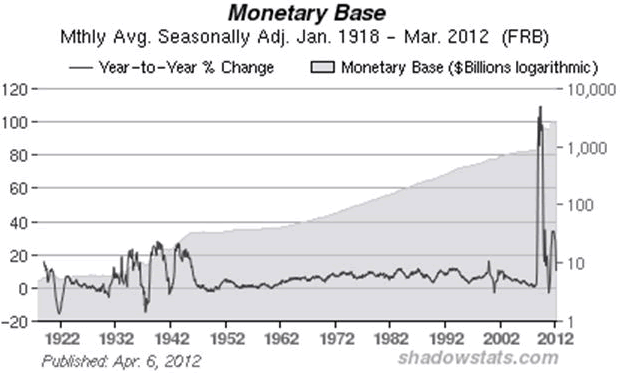

The Federal Reserve bought approximately 61 percent of all government debt issued by the U.S. Treasury Department in 2011.

This is called "monetizing the debt" - printing money to buy your own debt is the most inflationary thing a country can do.

Consider:

- There are more than 12 million officially unemployed. The unofficial number is 22 million

- There are 46 million people on food stamps

- Home prices are falling despite near record low mortgage rates

- The BRICS nations are actively seeking an alternative to the U.S dollar for settlement of trade, this threatens the dollar's reserve currency status

- A possible war in the Middle East

- A "Super Committee" of Democrats and Republicans couldn't agree on a deficit reduction plan. After the last budget battle the credit rating of the U.S. was downgraded. US debt was just downgraded again - citing the lack of any tangible progress on addressing the problems and the continued rise in debt to GDP Egan-Jones downgraded the US to AA from AA+.

- The US, and most other countries, are going to continue to run deficits and build up debt. They will finance their debt by printing money. Their currencies are going to be worth less and less and less and less. None of this debt will be paid back.

businessinsider.com

When the only tool in your toolbox is a hammer, everything is a nail. All central banks, and the US's Federal Reserve, have in their toolbox is the ability to print money - inflate. The Fed's answer to everything is to print more.

inflation.us.com

The Fed has already spent $2.3 trillion in two rounds of Quantitative Easing (QE), so far the money has been hoarded by banks to prop up their balance sheets and to buy over priced stocks to make the markets look good and help management cash out on their option plans.

Okun's Law

Despite what can only be described as a very weak economic recovery the US unemployment rate dropped, from nine percent to 8.3 percent this quarter. Yet Okun's Law holds that an economy, it's GDP, must grow above its potential to reduce the unemployment rate.

Okun's Law says that year-on-year economic growth of two percent above the trend (considered to be 2.5 percent) is needed to lower unemployment by one point. Many are forecasting real GDP growth of less than two percent for this quarter, not 4.5 percent, yet the unemployment rate is falling.

The apparent failure of Okun's law could be caused by faulty growth estimates and misleading unemployment figures.

"While it is true that growth was stronger in the fourth quarter, most of that growth was due to inventory accumulation...To begin with, the economic data looked brighter at this point in 2010 and again in 2011, only to fade as we got into the second and third quarters of those years...

Although the sharp decline in the unemployment from 9 percent last September to 8.3 percent in February suggests we are doing better than that, it is important to recognize that about half of that decline was due to a declining labor force participation rate. In fact, had the labor force participation rate not declined from around 66 percent in mid-2008 to under 64 percent in February, the unemployment rate would still be over 10 percent." William Dudley, President New York Federal Reserve

Is Quantitative Easing Over?

Early in 2012 a faint, but false glimmer of hope was given to consumers by way of increased economic growth estimates and improving employment figures. Consumers responded, personal spending increased 0.8% in January - while during the same time period personal income was up just 0.2%.

Can consumers, on their own, continue spending .06 percent above the rise in personal income? Not according to Ben Bernanke, Federal Reserve head...

"Further significant improvements in the unemployment rate will likely require a more-rapid expansion of production and demand from consumers and businesses, a process that can be supported by continued accommodative policies."

Bernanke's speech was from March 26th, before the April 6th jobs report - which said 120,000 new jobs were created. That's half of the number that the consensus of analysts were expecting, and half the number created in the prior month.

Conclusion

It's obvious to this author gold is on hold and solidifying its gains from over the last decade - gold's run is not over.

The U.S. dollar, the euro, the yen, all the world's currencies, are being de-valued by the massive money creation that has taken place and that will continue to happen. Gold's not really rising - it's fiat currencies that are falling.

The fact that gold is being treated as money, the fact that gold is being valued according to its relationship with other currencies, the fact that the world's central banks are buying, and not selling gold, should be on all our radar screens, are these truths on yours?

By Richard (Rick) Mills

If you're interested in learning more about specific lithium juniors and the junior resource market in general please come and visit us at www.aheadoftheherd.com. Membership is free, no credit card or personal information is asked for.

Copyright © 2012 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.