U.S. Jobless Claims, Wholesale Prices, and Trade Gap – Mixed Economic Message

Economics / US Economy Apr 13, 2012 - 06:02 AM GMTBy: Asha_Bangalore

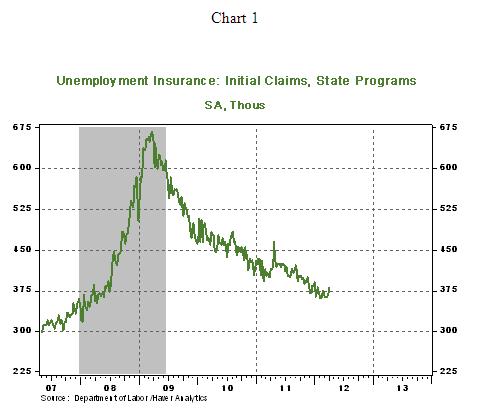

Initial jobless claims rose 13,000 to 380,000 during the week ended April 7, putting the four-week moving average back at 368,500 after posting readings below this level in the past two weeks. Continuing claims, which lag initial jobless by one week, fell 98,000 to 3.251 million. The soft payroll gains in March and the currently weekly gain in claims support the view that labor market conditions are improving only gradually.

Initial jobless claims rose 13,000 to 380,000 during the week ended April 7, putting the four-week moving average back at 368,500 after posting readings below this level in the past two weeks. Continuing claims, which lag initial jobless by one week, fell 98,000 to 3.251 million. The soft payroll gains in March and the currently weekly gain in claims support the view that labor market conditions are improving only gradually.

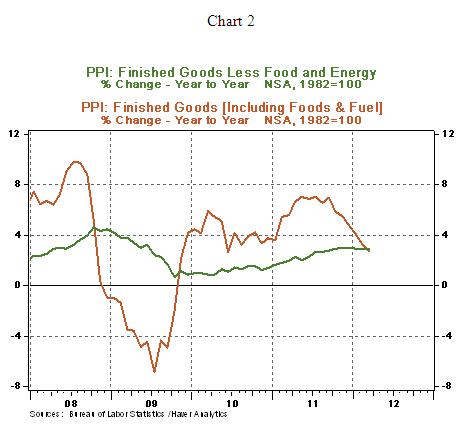

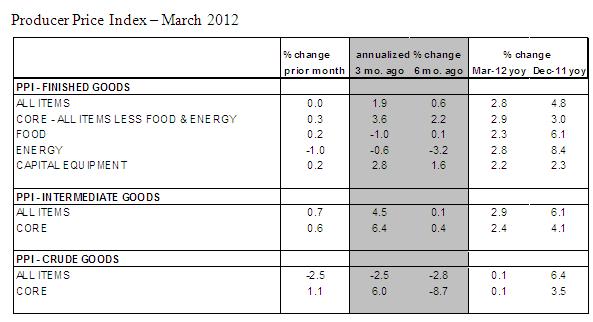

The Producer Price Index (PPI) of Finished Goods held steady in March vs. a 0.4% jump in the prior month. The energy price index declined 1.0% in March, while the food price gauge advanced 0.2% following three monthly declines. The core PPI, which excludes food and energy, moved up 0.3% in March to mark the fifth monthly gain. Higher prices for light trucks (+0.7%), passenger cars (+0.8%), and detergent were the major culprits for the increase of the core PPI. The Producer Price Index for Finished Goods and the core PPI do not present an inflationary threat. The PPI shows a distinct decelerating trend (see Chart 2) and the core PPI is stabilizing. These trends are supportive of the Fed’s easy policy stance and allow the Fed to watch-and-wait.

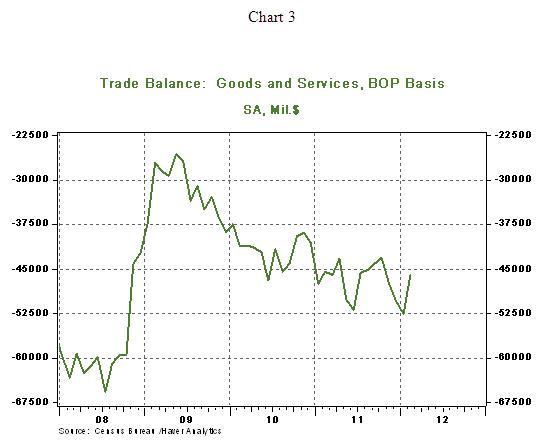

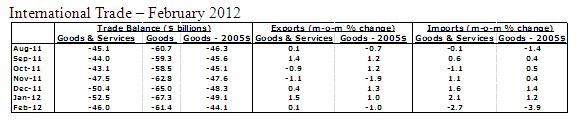

The trade deficit narrowed to $46 billion in February from $52.5 billion January. The improvement in the trade gap reflects a decline in inflation adjusted imports (-3.9%) and a smaller drop in exports (-1.0%) compared with imports. Imports of petroleum products fell 7.8% and that of consumer goods excluding food and autos declined 6.2%. Non-petroleum imports edged down 2.9% during February, after posting gains in December and January. The January-February trade numbers point to a slightly smaller trade shortfall in the first quarter barring a very large widening of the March trade gap.

The U.S trade deficit vis-à-vis China (-$19.4 billion vs. -$26 billion in January), Euro area (-$5.8 billion vs. -$7.6 billion in January) and Canada (-$2.8 billion vs. -$4.9 billion in January) narrowed in February, while it widened with respect to Japan (-$7.0 billion vs. -$6.2 billion in January) and Mexico (-$5.8 billion vs. -$4.2 billion in January)

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2012 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.