2008 Asset Class Investment Outlook Studies Point to Commodities Out performance

Stock-Markets / Investing Jan 17, 2008 - 11:10 AM GMTBy: Chris_Ciovacco

2008 Off To Rocky Start

2008 Off To Rocky Start

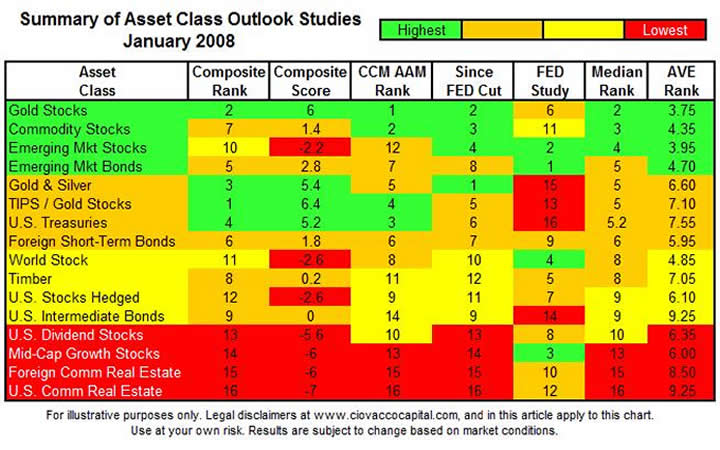

As we all know, asset markets do not like uncertainty. With SIVs (structured investment vehicles) and countless shaky mortgages floating through the financial system, uncertainty abounds. Since none of us know how bad things may get or how long this may last, adding some diversification to your portfolio might seem appealing. Below, is a brief look at the relative attractiveness of several asset classes based on what we know today and what we have experienced in the past. As in any environment, there is no perfect way to address the problems of the current day. However, some alternatives appear to be more attractive than others.

Perspective

- Technical analysis: the strength of trends from a long, intermediate, and short-term perspective.

- Economic environment: considers the slowing U.S. economy, Fed cycle, long-term global macro trends, such as U.S. debt levels and the long-term shift of economic power from developed economies to emerging economies.

- Historical perspective: considers past Fed cycles, bear markets, economic cycles.

The A Team ? Energy, Precious Metals, Agricultural Commodities

In an environment where the money supply is increasing or is expected to increase based on current and anticipated future policies, commodities are used as a hedge against depreciating paper currencies. Both recent and current trends are holding to historical form. The risk is that continued economic weakness, especially a sharper than expected recession in the U.S., could be the catalyst for sharp corrections. The safest bets are physical gold and silver and physical commodities over owning stocks in these asset classes. On the more aggressive side, agricultural commodities are getting much attention and owning stocks vs. physical commodities historically has more upside.

The B Team ? Emerging Market Stocks, Timber, TIPS, and Foreign Bonds

Similar to the comments on the pros and cons of commodity stocks above, emerging market stocks have many attractive qualities in the current environment. The possible downside to emerging market stocks is global economic weakness could spark nasty corrections. Timber is known as an alternative asset class or a place where people look to do something different when risks abound. Until recently, timber charts looked strong. The recent weakness, however, has not yet disrupted a strong up trend. While timber may seem an odd choice in the face of a housing recession, the industry can choose to let the trees grow and increase in value as paper currencies continue to depreciate. The risk with timber is this benefit may be out weighed by the negative perception of anything related to residential housing. Foreign bonds are attractive from a weakening U.S. dollar and weakening U.S. economy perspective. If a foreign bond pays 5% in the coming year and the U.S. dollar depreciates vs. the bond?s native currency by 10%, the foreign bond returns 5.5% after the currency adjustments. Another attraction is many foreign countries may fare better in a global economic downturn. Therefore the risk of default on bonds from the stronger economies would be less than a U.S.-based bond. The safe play is to stay with short maturities. The aggressive play is to buy longer maturities. Treasury Inflation Protected Securities (TIPS) are government securities designed by the U.S. Treasury to help protect investors from inflation. The benefits are obvious in the current environment. However, in the long run you must rely on the government?s published inflation data. I like TIPS in an allocation, just not too many of them.

The C Team ? U.S. Treasuries, U.S. Bonds, Hedged U.S. Stocks, U.S. Stocks, G-7 Foreign Stocks

U.S. bonds may turn out to be the best performers of all for the next six to twelve months. However, their long term attractiveness is limited. The depreciating U.S. dollar and high debt levels in the U.S. add a level of risk which many investors may be missing in U.S. bonds. If the U.S. dollar were to crash in the future, the U.S. bond market would not be the place to be. Obviously hedging strategies are highly dependent on the skill of the person(s) doing the hedging. Concerns here are the possibility of the U.S. stock market getting stuck in a long-term trading range, which requires great hedging skills in order to produce superior results. The trading range concern applies to all U.S. stocks. The worse things get economically, the more attractive hedging strategies become. If things get bad economically, but not too bad, U.S. bonds will provide a safe haven and a good relative return. Foreign stocks from many developed countries have had a lengthy run. Many developed countries face similar problems to the U.S., such as real estate bubbles, high levels of debt, and long-term entitlement problems. Another negative for some G-7-based foreign stocks is the likely lag their respective Central Banks will have in terms of lowering interest rates. It is not yet time to throw in the towel on stocks of developed foreign nations, but they merit a close watch.

The D Team ? Global Commercial Real Estate and U.S. Small Cap Stocks

Both of these asset classes have had long and outstanding runs. The credit markets and sentiment have turned against all real estate. Even foreign real estate has been unable to buck the negative trends. The risk-reward in real estate is simply unattractive. If things get better quickly, the trends could reverse, but continued weakness seems much more probable. Smaller capitalization stocks have outperformed their bigger brothers for quite some time. Consequently, there is more risk in the charts when compared to an asset class which has gone through more recent and prolonged corrections and consolidation. The perception is smaller companies are more risky during economic downturns which is another strike.

Risks ? 2000 Shows It May Be a Volatile Ride

As stated previously, if global economic weakness significantly exceeds current forecasts, the list of attractive asset classes would shrink. The uncertainty in the housing, credit, and SIV (structured investment vehicle) markets underscores the need for diversification and flexibility. If you pay close attention to what is happening, you do not need to rely on accurate forecasting to navigate through these uncertain times. The relative performance of asset classes will point you in the right direction.

Graph 1

Using the early stages of the 2000-2002 bear market in U.S. stocks as a guide, there were not many places to hide from March 2000-March 2001. If you break the 2000-2002 bear market into phases, the first two phases are depicted in Graph 1 and Graph 2. We are in a different part of the commodities cycle and there are numerous differences between now and 2000. However, the point is while the A Team above is well positioned for the next 12 to 24 months, sharp corrections could occur along the way. We?ll see how things play out and adjust accordingly.

Graph 2

Full Disclosure: The author and his clients have long positions in pooled investments which have exposure to the asset classes discussed on this article.

Chris Ciovacco

Ciovacco Capital Management

Copyright (C) 2008 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.