Public Pension Funds: Tens of Billions at Significant Risk

Personal_Finance / Pensions & Retirement Apr 06, 2012 - 04:16 AM GMTBy: EWI

To meet ambitious investment return targets, some public pension funds must now swing for the fences.

To meet ambitious investment return targets, some public pension funds must now swing for the fences.

But many are down two strikes already, due to their previous big bets with hedge funds.

....the [pension] funds with a third to more than half of their money in private equity, hedge funds and real estate had returns that were more than a percentage point lower than returns of the funds that largely avoided those assets. They also paid nearly four times as much in fees.

New York Times, April 1

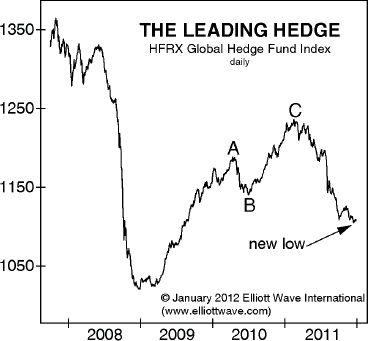

The same article describes how other pension funds have embraced this risky strategy, and how funds generally have their assets at risk. In 2007 pension funds allocated 10.7 percent to "high-growth" investments; by September 2011 they had increased that bet to 19 percent. All the while, hedge funds have underperformed, as this chart from our January 2012 Financial Forecast shows:

The [HFRX Global Hedge Fund Index] hit a new low on December 14, producing a rash of articles about how hedge funds got tripped up in 2011. "Many hedge-fund managers who came into 2011 riding a wave of momentum ended the year scratching their heads and nursing losses, whipsawed by markets that seemed to punish them month after month." "Head scratching" is just right for this still-early stage of the bear. Through the first ten months of 2011, 123 Asian hedge funds shut their doors, the second highest number of closures since 2008, the year world markets collapsed.

Financial Forecast, January 20

The California Public Employees' Retirement System (CalPERS) is the nation's largest public pension fund. It recently lowered its investment return target from 7.75 percent to 7.5 percent. The system's actuary had recommended lowering it to 7.25 percent.>

The CalPERS board members were told by their staff that they had only a 50 percent chance of hitting or surpassing the 7.5 percent target, yet they adopted that assumption. Others say the odds are even worse than that.

If CalPERS loses the bet, as it is likely to, the next generation will pay the shortfall...

....if CalPERS or any other public-pension system banks on higher-investment returns, it must take greater risks to meet the target...Cal-PERS chief investment officer told Pensions and Investments newspaper last year, his system has "a reasonably ambitious return target" and "needs to have a portfolio with a lot of growth exposure."

San Jose Mercury News, March 24

Is now the time to take greater risks? You saw the 2011 performance of hedge funds, and that was a year when the DJIA was up. Imagine the scenario if the market takes a serious tumble.

As an independent thinker, you have a way to prepare for your retirement: An unbiased, objective analysis of the facts and the future. That's exactly what you get when you download the free 50-page Independent Investor eBook. It's filled with analysis that will help you prepare for your financial future. You'll get some of the most groundbreaking and eye-opening reports ever published in Elliott Wave International's 30-year history; you'll also get new analysis, forecasts and commentary to help you think independently in today's tumultuous market. |

This article was syndicated by Elliott Wave International and was originally published under the headline Public Pension Funds: Tens of Billions at Significant Risk. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.