Jim Rogers “I Will Buy More” Gold – Still Long Term Bullish

Commodities / Gold and Silver 2012 Apr 05, 2012 - 07:32 AM GMTBy: GoldCore

Gold’s London AM fix this morning was USD 1,622.50, EUR 1,239.21, and GBP 1,022.82 per ounce. Yesterday's AM fix was USD 1,631.75, EUR 1,239.65 and GBP 1,027.75 per ounce.

Gold’s London AM fix this morning was USD 1,622.50, EUR 1,239.21, and GBP 1,022.82 per ounce. Yesterday's AM fix was USD 1,631.75, EUR 1,239.65 and GBP 1,027.75 per ounce.

Silver is trading at $31.36/oz, €24.00/oz and £19.80/oz. Platinum is trading at $1,595.75/oz, palladium at $635.80/oz and rhodium at $1,350/oz.

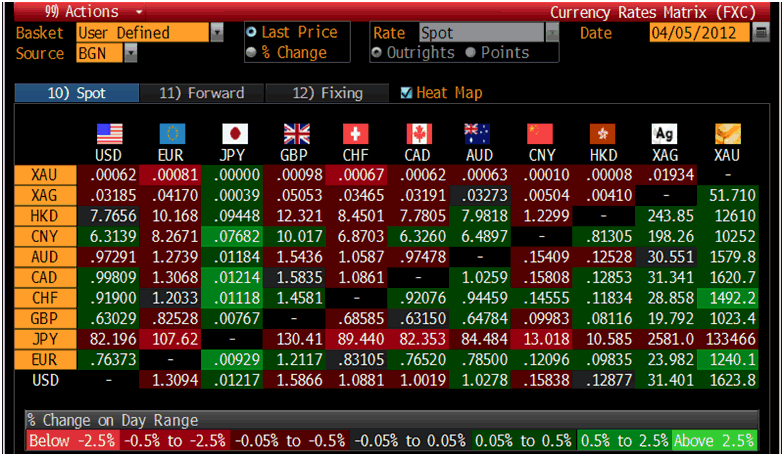

Cross Currency Table – (Bloomberg)

Gold fell $27.90 or 1.69% in New York yesterday and closed at $1,618.40/oz. Gold ticked higher in Asia prior to further slight gains in Europe.

Gold dropped to its lowest level since January but remains higher on the year. It is poised for its first lower weekly close since mid March adding to the poor technical picture.

The very poor Spanish debt auction and renewed concerns about the euro zone debt crisis has led to another sharp bout of risk off in global markets. Euro zone concerns and concerns that cheap money and QE policies may end saw world stocks (MSCI World) fall 1.9% while gold fell 1.7% yesterday.

European indices are lower again today on renewed risk aversion.

Commodities fell too yesterday. Platinum for July delivery fell $61.90, or 3.7%, to $1,598.60/oz. Palladium for June delivery fell $26.85, or 4.1%, to $632.75/oz and copper for May delivery fell 12.85 cents to $3.7905 a pound. U.S. crude oil fell $2.54, or 2.4%, to finish at $101.47 a barrel in New York.

Comments from ECB President Mario Draghi that the euro zone's growth economic outlook is subject to downside risks related to the debt crisis and inflation upside risks were gold bullish.

It sounded if the ECB President is concerned about and warning about stagflation in the Eurozone.

This and concerns about the possible abandonment of QE led to hedge funds, traders and more speculative players selling many of their positions and again piling into the perceived safety of US Treasuries and the US dollar.

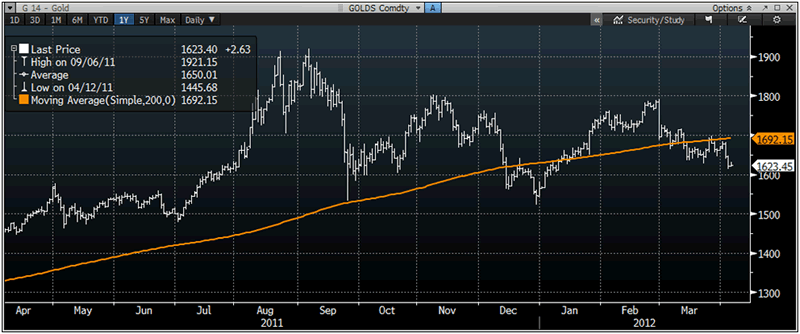

Gold 1 Year Chart – (Bloomberg)

Gold’s short term correlation with equities and commodities has been seen frequently in recent months and years with gold falling in unison with riskier assets in the initial stages of sell offs and at intermediate stock market highs. However, what has happened subsequently is that gold has fallen less than equity and commodity markets and then recovers faster and rises again soon after short periods of correction and consolidation.

We expect this pattern to be seen again. While gold’s sell off has been sharp, the charts below put them into context and should help create perspective.

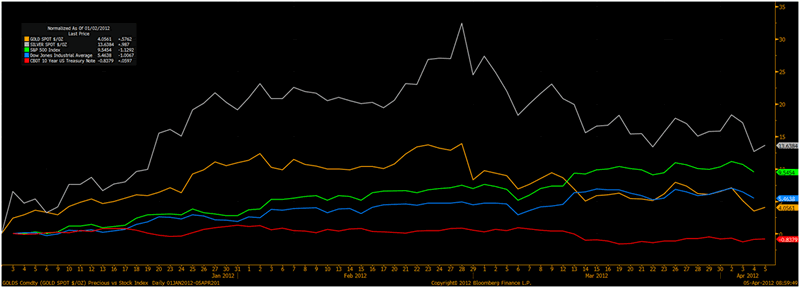

Gold, Silver, S&P, DJIA, US 10 Year - YTD

The GoldCore trading desk was unusually busy yesterday with a large percentage of clients selling their bullion holdings including some quite large sell orders. It could be indicative of a bottom as there has been capitulation by weak hands concerned about the recent price fall.

Despite a recent decrease in physical demand both from Asia and in western markets, the fundamentals driving the market have not changed and will be supportive. Demand has abated after the record levels of demand seen at the height of the Greek debt crisis in November and December.

However, this demand will likely return in the coming months when Spain, Italy and potentially the UK, Japan and US all experience similar debt crises.

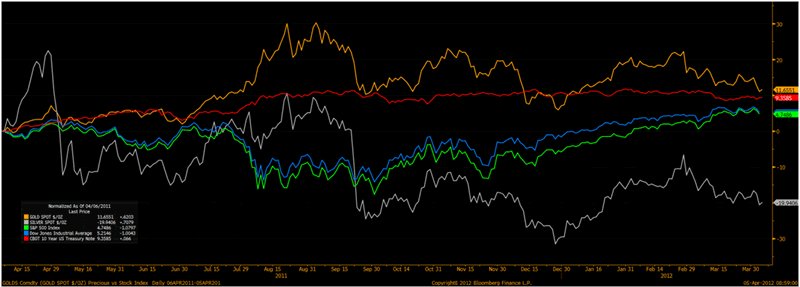

Gold, Silver, S&P, DJIA, US 10 Year – 1 Year

Risk adverse investors and the prudent should maintain a “buy and hold” strategy and should continue to accumulate on the dip.

Jim Rogers “I Will Buy More” Gold – Still Long Term Bullish

The smart money continues to accumulate gold and silver on the dip.

Investor Jim Rogers, chairman of Rogers Holdings, said he remains bullish on gold and silver in the long term and he “will buy more” on price weakness.

Rogers predicted a global commodities rally and the gold and silver bull markets in 1999. He also predicted much of what has transpired in financial markets in recent months and years and has consistently warned about the risks posed to the US dollar and other fiat currencies.

In the short term he is not so optimistic about gold and silver prices. “I expect the price to decline and when that happens I will buy more,” Rogers said at a conference in Bucharest yesterday.

He recently said that he would buy gold at $1,600/oz and would increase position by even more at $1,500/oz – reiterating that gold is going much higher in the coming decade.

Rogers did not elaborate, nor was he asked, how much higher, but he said in November 2011 that gold “will easily go to $2,000 but it will reach $2,400 over the course of the bull run, which has years to run.”

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.