Gold Down 2% On FOMC Minutes – Fundamental Support From Negative Real Interest Rates

Commodities / Gold and Silver 2012 Apr 04, 2012 - 07:35 AM GMTBy: GoldCore

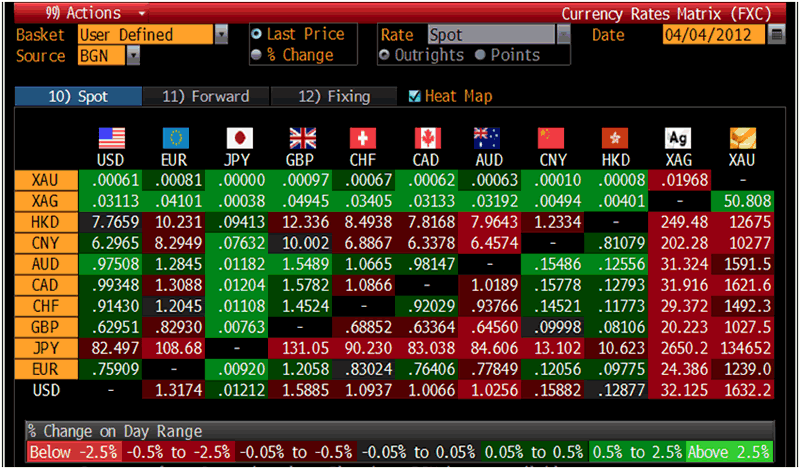

Gold’s London AM fix this morning was USD 1,631.75, EUR 1,239.65, and GBP 1,027.75 per ounce. Yesterday's AM fix was USD 1,674.75, EUR 1,254.03 and GBP 1,044.17 per ounce.

Gold’s London AM fix this morning was USD 1,631.75, EUR 1,239.65, and GBP 1,027.75 per ounce. Yesterday's AM fix was USD 1,674.75, EUR 1,254.03 and GBP 1,044.17 per ounce.

Silver is trading at $32.01/oz, €24.31/oz and £20.16/oz. Platinum is trading at $1,622.20/oz, palladium at $640/oz and rhodium at $1,350/oz.

Cross Currency Table – (Bloomberg)

Gold fell $30.70 or 1.83% in New York yesterday and closed at $1,646.30/oz. Gold traded sideways in Asia prior to a further $10 drop after the open of European trading.

Heightened risk aversion saw all markets fall yesterday after the Federal Reserve said inflation appears to be under control and suggested that the Federal Reserve may be reluctant to further debase the dollar with more QE.

This weakness continued in Asia where the Nikkei fell by 2.3% and European indices are down this morning.

The minutes came out just a week after Fed chairman Ben Bernanke alluded to the possibility that further QE and stimulus was needed in the US economy, which pushed equity & commodity markets up.

Very contradictorily, the minutes suggested the Fed’s appetite for further quantitative easing had waned.

However, the Fed and Bernanke have received much criticism for the ultra loose monetary policies of recent years and the ostensibly somewhat more hawkish stance may be an attempt to position the Fed as being monetarily prudent and wishing to protect the value of the US dollar.

Prudent investors will rightly remain skeptical and will as ever judge the Fed by its actions and the data rather than its words.

With interest rates remaining near zero and continuing negative real interest rates, and these set to continue in 2012 and into 2013, monetary policy is set to remain extraordinarily accommodative.

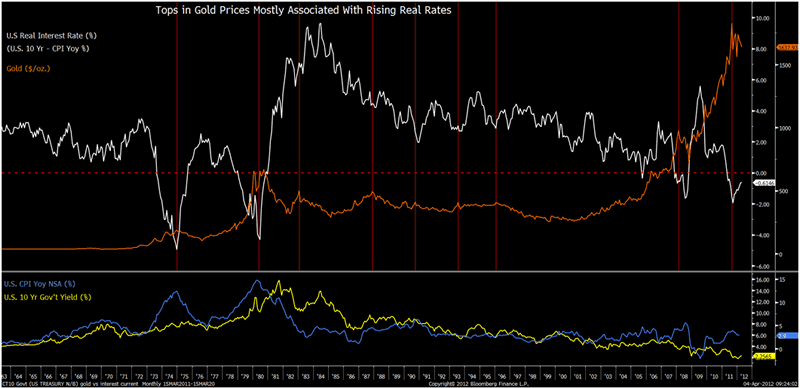

Gold’s bull market will almost certainly continue as long as we have negative real interest rates (see chart below).

Tops in Gold Prices Mostly Associated with Rising Real Interest Rates - (Bloomberg)

Gold’s price peak in 1980 came about when US 10 year bonds were yielding over 12% and with rising real interest rates. Today the US 10 year is yielding a historically low and negligible 2.26%.

Real rates are have risen marginally but levels below 2% have been supportive of rising gold prices.

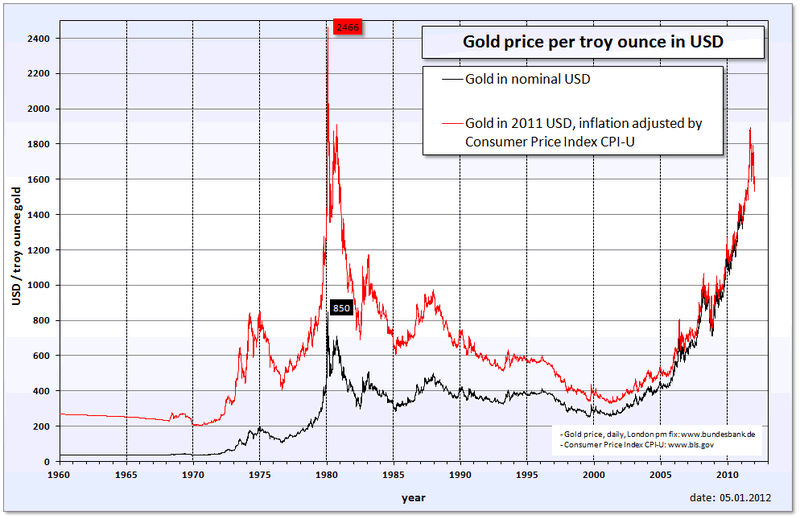

Gold price per troy ounce in USD - (Wikipedia)

The degree of monetary debasement seen in recent years means that gold’s inflation adjusted high of $2,400/oz remains a very viable price target.

Indeed, the scale of the European and coming US debt crisis and the real risk of currency devaluations makes $2,400/oz a conservative price target in the long term.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.