Gold Bull Market Real Interest Rates Critical Metric

Commodities / Gold and Silver 2012 Apr 04, 2012 - 02:03 AM GMTBy: Jeff_Clark

Jeff Clark, Casey Research : There are many reasons why gold is still our favorite investment – from inflation fears and sovereign debt concerns to deeper, systemic economic problems. But let's be honest: It's been rising for over 11 years now, and only the imprudent would fail to think about when the run might end.

Jeff Clark, Casey Research : There are many reasons why gold is still our favorite investment – from inflation fears and sovereign debt concerns to deeper, systemic economic problems. But let's be honest: It's been rising for over 11 years now, and only the imprudent would fail to think about when the run might end.

Is it time to start eyeing the exit? In a word, no. Here's why.

There's one indicator that clearly signals we're still in the bull market – and further, that we can expect prices to continue to rise. That indicator is negative real interest rates.

The real interest rate is simply the nominal rate minus inflation. For example, if you earn 4% on an interest-bearing investment and inflation is 2%, your real return is +2%. Conversely, if your investment earns 1% but inflation is 3%, your real rate is -2%.

This calculation is the same regardless of how high either rate may be: a 15% interest rate and 13% inflation still nets you 2%. This is why high interest rates are not necessarily negative for gold; it's the real rate that impacts what gold will ultimately do.

What History Tells Us

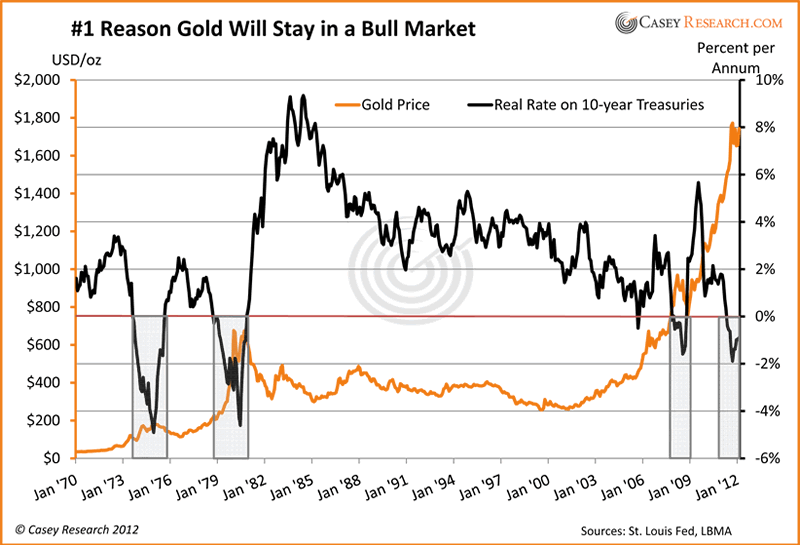

The chart below calculates the real interest rate by extracting annualized inflation from the 10-year Treasury nominal rate. Gray highlighted areas are the periods when the real interest rate was below zero, and as you can see, this is when gold has performed well.

Gold climbs when real interest rates are low or falling, while high or rising real rates negatively impact it. This pattern was true in the 1970s and it's true today.

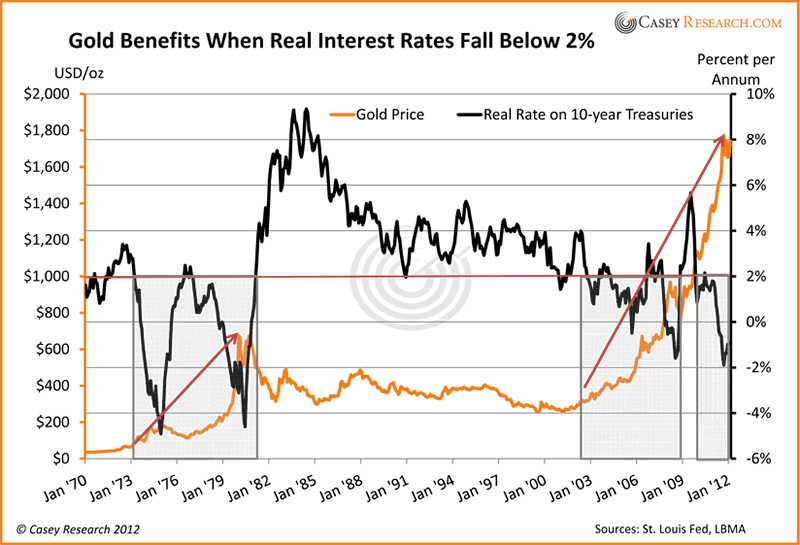

A closer study of this chart tells us there's actually a critical number for real rates that seem to have the most impact on gold. Take a look at how gold performs when real rates are at 2% or below.

The reason for this phenomenon is straightforward. When real interest rates are at or below zero, cash or debt instruments (like bonds) cease being effective because the return is lower than inflation. In these cases, the investment is actually losing purchasing power – regardless of what the investment pays. An investor's interest thus shifts to assets that offer returns above inflation… or at least a vehicle where money doesn't lose value. Gold is one of the most reliable and proven tools in this scenario.

Politicians in the US, EU, and a range of other countries are keeping interest rates low, which, in spite of a low CPI, pushes real rates below zero. This makes cash and Treasuries guaranteed losers right now. Not only are investors maintaining purchasing power with gold, they're outpacing most interest-bearing investments due to the rising price of the metal.

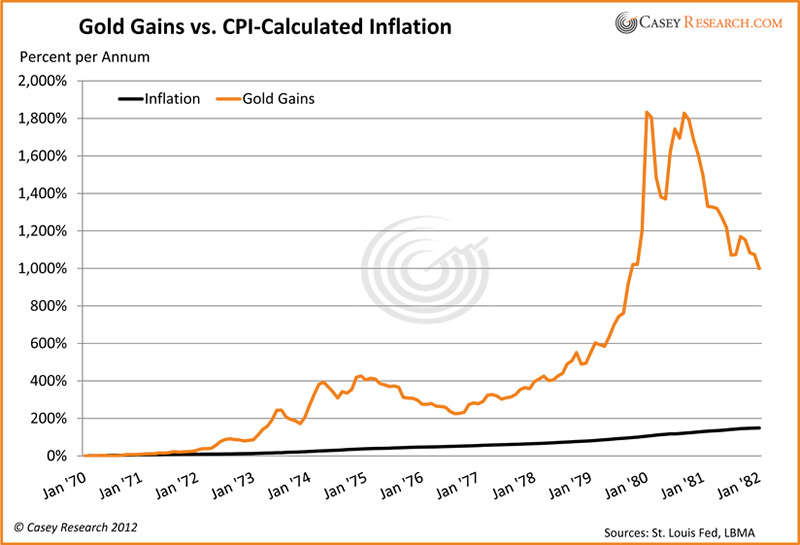

Here's another way to verify this trend. As the following chart shows, from January 1970 through January 1980 gold returned a total of 1,832.6%. This is much higher than inflation during that decade, which totaled 105.8%.

In the current bull market, gold has gained 556.3% since 2001, while inflation has thus far totaled 30%.

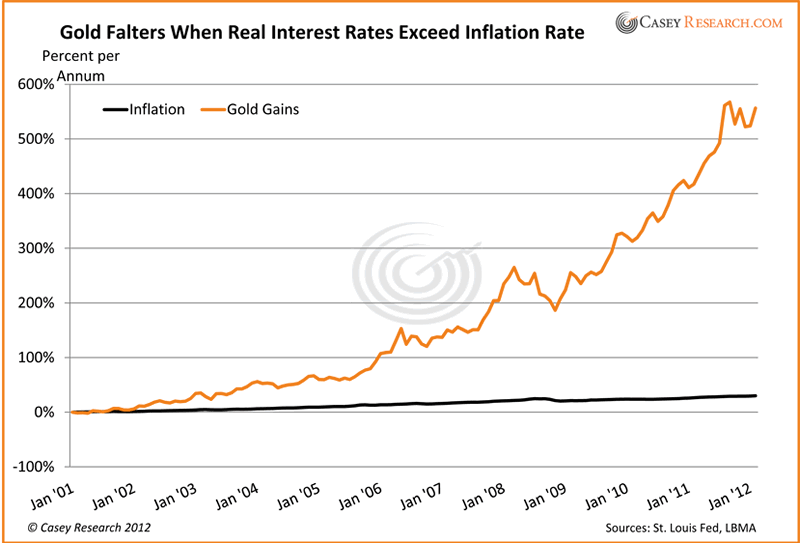

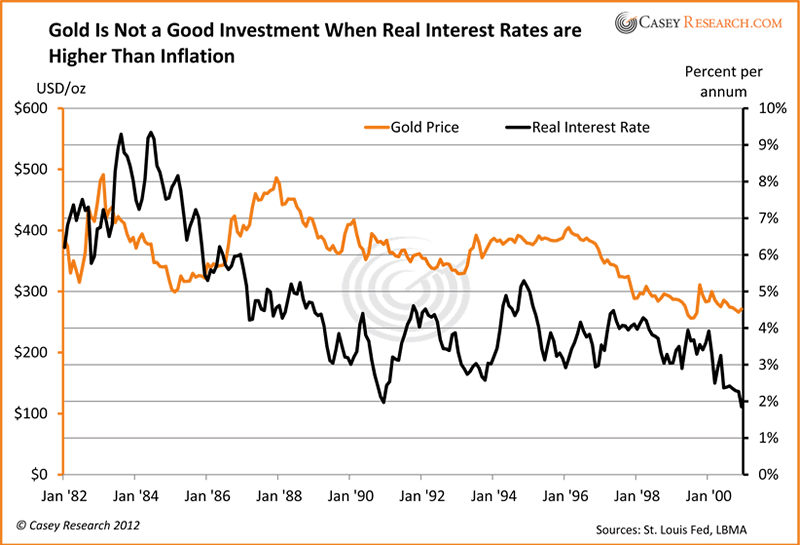

Further supporting this thesis is the fact that when real rates are positive, gold has not performed well. You can see this in the following chart of when real interest rates were higher than inflation.

The gold price fluctuated between $300 and $500 for the twenty-year period when rates were positive. This is a strong reminder that bull markets don't last forever – even golden ones – and that at some point we'll need to sell to lock in a profit.

So if history demonstrates that gold does well during a negative-rate environment and poorly during positive periods, the natural question becomes…

How Much Longer Will Negative Real Rates Last?

US Federal Reserve Chairman Ben Bernanke stated in January that he expects to keep short-term interest rates close to zero "at least through late 2014." This low-rate, loose-money policy is intended to "support a stronger economic recovery and reduce unemployment." While his strategy is debatable, this implies that almost any inflation at all will continue to keep the real rate negative and thus gold will stay in a bull market.

What if the economy improves? After all, there are economic data showing the economy may be finding its footing, making some believe interest rates could be raised earlier, as soon as next year. Based on the data above, the answer to the question is, "What does inflation do?" In other words, interest-rate fluctuations alone aren't important; it's how the rate interacts with the inflation rate. If inflation simultaneously rises and keeps the real rate negative, we should expect gold to remain in a bull market.

With the obscene amount of money that's already been printed, high inflation seems almost certain at some point, even if there isn't any more money creation. This is why we think the end to the gold bull market is not yet in sight.

One more point. You'll notice in the above charts that this trend doesn't reverse on a dime. It takes anywhere from months to years for investors to shift from interest-bearing investments to metals – and vice versa. And the longer the trend, the slower the change. Real rates have been negative for a decade now, and with broad institutional investment in gold largely still in absentia, it seems reasonable to expect that the trend in gold won't shift anytime soon.

Implications for Investors

Armed with these data, there are definite steps you can take with your investments at this point, as well as reasonable expectations you can have going forward:

- You can buy gold today. As long as real interest rates are negative, gold will remain in a bull market. If you already own some gold, you can and should ask yourself if it's enough at a time when money in the bank is a losing proposition.

- Don't get flummoxed when you hear talk about rising rates. Watch the real rate instead.

- In our opinion, real rates will be negative for some time for the simple reason that we think inflation will be rising for some time. Ask yourself: Will the Fed and other central banks raise rates aggressively enough to catch up to inflation? Someday, sure… but not anytime soon.

- When real rates turn positive, especially above 2%, it may be time to sell. We'll have to see what's going on in the world at that time; if there's financial chaos, the fear factor could cause gold to depart from this historic pattern. But even if not, keep in mind that while the price of gold fluctuates every day, the shift out of gold-based investments won't occur overnight. There should be time to gain clarity.

There are a lot of reasons to own gold today, and there will likely be more before it's time to say goodbye. In the meantime, we take comfort in the fact that the strongest historical indicator of all tells us the gold bull market is alive and well and has years to play out.

Carpe aurum.

[To learn more about the best ways to invest in gold today and in the months ahead, you won't want to miss this free call with two of Casey Research's seasoned metals analysts: Gold Investing in 2012 and Beyond: Your Questions Answered! Hurry if you want to get in on it – at midnight EDT on April 6, signups will close.]

© 2012 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.