Italian Bonds/Economic Data/Materials Raise Caution Flag

Interest-Rates / Eurozone Debt Crisis Apr 03, 2012 - 01:47 PM GMTBy: Chris_Ciovacco

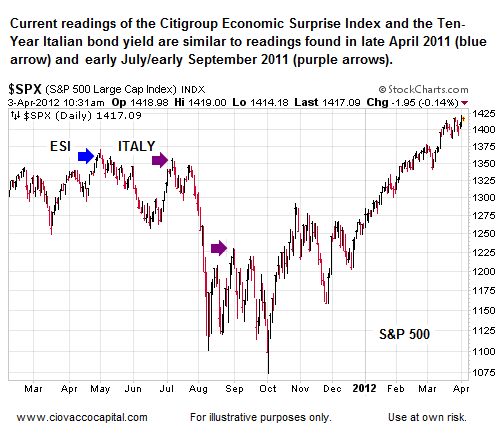

Our models remain bullish longer-term, but we have some concerns on a shorter-term time horizon. The yield on a ten-year Italian bond has crept back up over 5%, a level which was last seen just prior to recent corrections/big drops in stock prices (see purple arrows below). Economic data has started to weaken relative to expectations in a similar manner to what we saw in spring 2011 (blue arrow below).

These readings do not mean a correction is coming, but they tell us to pay attention. Note the S&P 500's performance after the blue and purple arrows below.

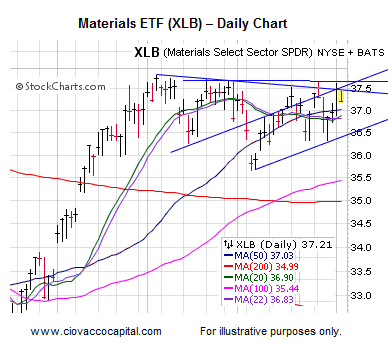

As we noted yesterday, materials stocks (XLB) are still contained within a two-month consolidation pattern. If the economic outlook is favorable, we would expect to see XLB break to the upside. If XLB can close above 37.65 in a convincing manner, it would alleviate some of our concerns relative to the market's short-term outlook. A failed XLB breakout or push below 36.50 would heighten our concerns.

Higher highs in stocks remain quite possible, but a weak push toward 1,430 could be met with resistance from sellers between Wednesday and Monday. Nothing too alarming has occurred yet, but enough to watch with a skeptical eye.

-

Copyright (C) 2012 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.