Gold Stocks Cheap or Silver Stocks Expensive?

Commodities / Gold & Silver Stocks Apr 03, 2012 - 10:56 AM GMTBy: Willem_Weytjens

Although Gold prices are off their highs of 2011, they still remain at a reasonably high level.

Although Gold prices are off their highs of 2011, they still remain at a reasonably high level.

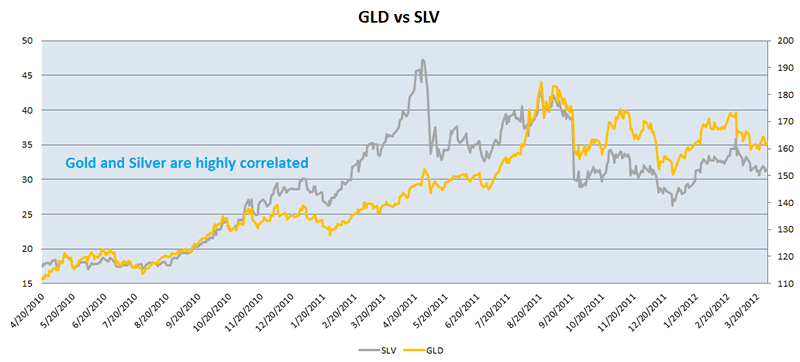

From the chart below, we can see that Gold and Silver are highly correlated:

Despite the fact that Gold prices remain high and the fact that the stock markets are near their highs would make one assume that Gold Stocks did well too, right? Wrong!

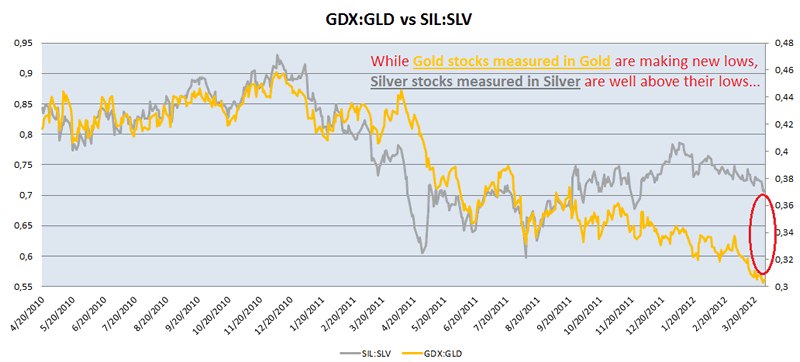

When we measure Gold Stocks (we take GDX as a proxy for Gold Stocks) in Gold (we take GLD as a proxy for Gold prices), we can see that they are setting new lows. This is in contrast with Silver stocks (we take SIL as a proxy for Silver stocks) measured in Silver (we take SLV as a proxy for Silver prices), which are still well above their lows…

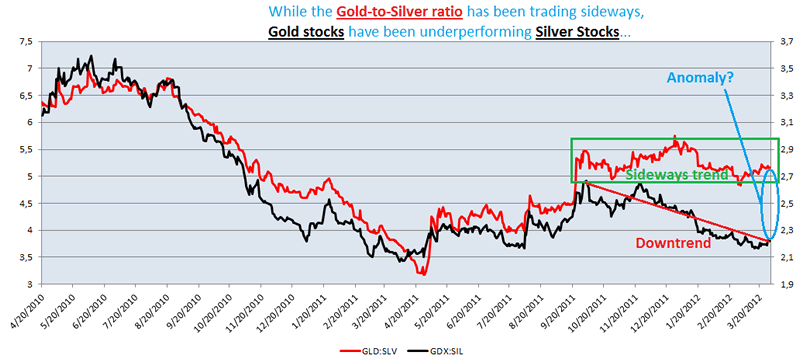

It gets even more interesting to see that this underperformance of Gold stocks measured in Gold relative to Silver stocks measured in Silver occured at a time when the Gold-to-Silver ratio was flat (which means that Gold and Silver moved in line with each other)…

The fact that “Gold Stocks measured in Gold” have underperformed “Silver Stocks measured in Silver”, can be seen in the following chart, as the ratio of (GDX:GLD)/(SIL:SLV) drops to new lows…

The spike in early 2011 in the following chart can be attributed to the fact that Silver prices outperformed Silver stocks dramatically when Silver shot up towards $50 per ounce:

What is the reason for this recent “Anomaly”?

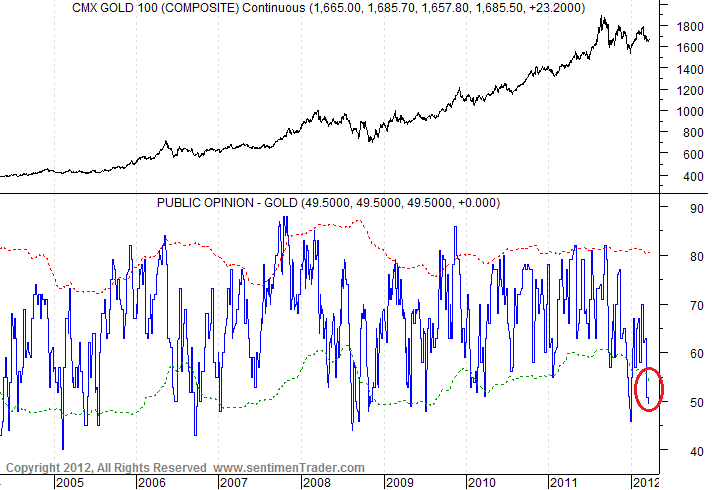

Well, as always, I think “Sentiment” explains a lot:

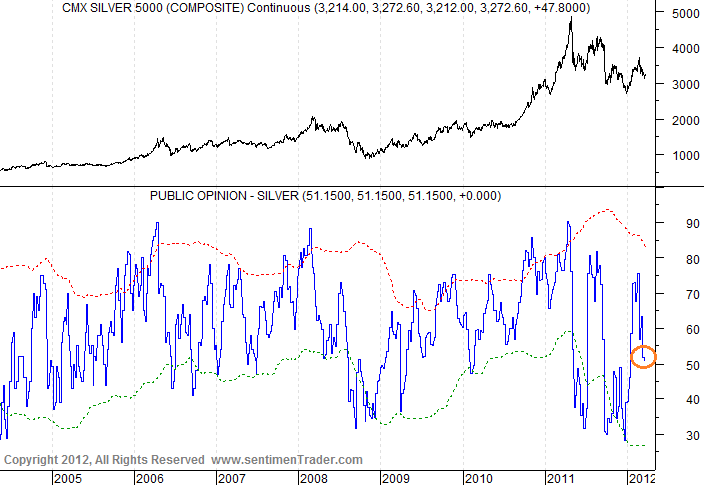

As we can see in the charts below (courtesy Sentimentrader.com), sentiment for Gold (first chart) is reaching an extreme low as it has pushed through the lower band of the standard deviations, while sentiment for Silver (second chart) is neutral and thus far from reaching extreme lows…

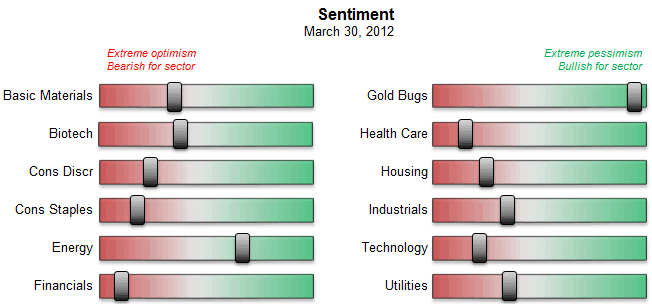

No wonder the Sentiment for Gold Bugs is also extremely low… :

From this perspective, I like Gold Stocks better than Silver stocks at the moment.

Wouldn’t it be a nice trade for hedge funds to go “Long Gold stocks + Short Gold + Long Silver + Short Silver stocks” now? Time will tell…

Good luck investing.

For more articles, trading Updates, Nightly Reports and much more, please visit www.profitimes.com and feel free to sign up for our services!

Willem Weytjens

www.profitimes.com

© 2012 Copyright Willem Weytjens - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.