Crushing National Debts and Deficits, Economic Revolutions, and Extraordinary Popular Delusions

Economics / Technology Apr 03, 2012 - 02:34 AM GMTBy: John_Mauldin

Professor Andrew Odlyzko leads off this week's Outside the Box with a familiar litany:

Professor Andrew Odlyzko leads off this week's Outside the Box with a familiar litany:

"A superpower with crippling debt, exorbitant taxes, glaring inequality, wages far exceeding those of competitors, high and persistent unemployment, lack of basic workplace skills, malnutrition, a rapidly growing rival across the ocean to the West, heated debates about the role of government in the economy, and widespread pessimism about the future."

And then he asks the obvious question: "Could that be any country but the U.S. today, with China as the looming threat?" The answer of course is yes, but do you know which country, and when? Here's another hint: a technological revolution was largely responsible for pulling this country back from the brink and setting it on a sustainable course again.

Another hint for you: this is the onlycountry in history that has pulled off such a feat. It did it in part by issuing 3% "perpetual" bonds (which never had to repay the principle, though they eventually did), an option no nation is likely to get away with today; but the author's point – and it's a very important one, given our present situation – is that it can in fact be done. If we can manage to make a few reasonably smart shortand medium-term fiscal and other policy decisions, and then provide the right set of conditions for the next great technology breakout – I'm thinking the incredibly fertile and dynamic interface involving biotech and nanotech, robotics and artificial intelligence, along with next-gen telecom and energy revolutions – then there's no reason why the 2020s can't go down in history as the opening era of a global golden age.

This is more economic history than macroeconomics, but I find it very instructive and oddly hopeful. Professor Andrew Odlyzko is a professor in the School of Mathematics at the University of Minnesota. He is engaged in a variety of projects, from mathematics to security and Internet traffic monitoring. His is currently writing a book that compares the Internet bubble to the British Railway Mania of the 1840s, and explores the implications for the future of technology diffusion. I look forward to reading that book.

On Tuesday morning, April 24 I will be speaking at a conference on demographics sponsored by the Global Interdependence Center. It will be held in Philadelphia at the LeBow College of Business of Drexel University and chaired by Bill Dunkelberg, who I am working with on a book on employment. (Bill is a professor at Temple University and the chief economist for the National Federation of Independent Business). The conference is quite reasonably priced and focuses on a topic I am quite fond of. You can find out more at http://www.interdependence.org/prog...

I am back in Dallas for the evening but leave tomorrow morning on a 7:30 flight to NYC to speak at a Bloomberg Trade Book event, then back late Wednesday afternoon, in time to take my daughter Amanda to a Mavericks game. And I'll be home for almost two weeks! And then I resume a rather peripatetic bout of travel for almost two months, concluding with a few weeks in Tuscany.

Have a great week!

Your ever hopeful that we'll deal with the deficit analyst,

John Mauldin, Editor

Outside the Box

JohnMauldin@2000wave.com

Crushing national debts, economic revolutions, and extraordinary popular delusions

Andrew Odlyzko School of Mathematics University of Minnesota Minneapolis, MN 55455, USA odlyzko@umn.edu http://www.dtc.umn.edu/~odlyzko

Introduction

A superpower with crippling debt, exorbitant taxes, glaring inequality, wages far exceeding those of competitors, high and persistent unemployment, lack of basic workplace skills, malnutrition, a rapidly growing rival across the ocean to the West, heated debates about the role of government in the economy, and widespread pessimism about the future. Could that be any country but the U.S. today, with China as the looming threat? Toss in costly military misadventures in the Middle East, Greece unable to pay its debts, a sclerotic domestic legal system clogging up the economy, and the rising competitor flouting copyright and other property rights and relying on slave labor, and the case seems clinched. Yet this is also an accurate description of Britain around 1850, with the United States as the transatlantic rival. Surprisingly, what followed was an explosive acceleration of the Industrial Revolution that saw the UK sprint ahead of others during the "Great Victorian Boom" of the third quarter of the 19th century.

The notion that the Industrial Revolution started at some specific time has been discredited. Instead, it is known that there was a long period in Western Europe of accelerating economic growth and of improved technology, going back to at least the beginning of the 18th century. However, it is widely recognized that Britain was the leader in these developments, and that there was a noticeable change around 1850. That's when the "Great Victorian Boom" started. The pace of economic growth accelerated significantly. Furthermore, as is visible in Fig. 1, the wild fluctuations in the economy that prevailed before 1850 were replaced by relatively smooth growth. This helped convince the public that continuing growth was possible and that the Malthusian specter could be banished.

Some speculations on what we can learn from those events are presented at the conclusion of this piece. First, though, let us explore this little known story, and the part played in it by Charles Mackay. He is known today primarily as the author of the 1841 book Extraordinary Popular Delusions, and thereby the first famous chronicler and debunker of bubbles. A surprising recent discovery is that he was actually one of the most enthusiastic cheerleaders for the British Railway Mania of the 1840s. This episode of investor exuberance ruined most shareholders, who included such famous figures as Charles Darwin, John Stuart Mill, and the Bronte sisters. However, it likely was a key element in sparking the "Great Victorian Boom" that followed, and may have saved Britain from a revolution.

Fig. 1. Gross Domestic Product at current prices in the United Kingdom from 1830 to 1870.

Britain in the 1840s

Britain in the 1840s was the world's leading power, militarily, economically, technologically, and financially. However, there was pervasive doubt as to whether it could maintain its leadership. By far the most vociferous debates on economic topics were about trade barriers, especially for food. One of the arguments that protectionists used for the maintenance of high tariffs was that the British advantage in trade and manufactures was a fleeting one, earned by success in the Napoleonic wars, and that rising powers (the United States, in particular) were bound to forge ahead.

A key reason for the pessimism about Britain's future was its national debt. It did emerge victorious from over a century of wars with France, but at a staggering cost. In 1815, national debt was over twice the country's GDP, possibly as high as 250%, and even in the 1840s, it was around 150% of GDP, a level that is currently exceeded among the large industrialized countries only by Japan. (The joke was that half the debt was incurred pushing the Bourbons off the throne of France, and half putting them back in.) This burden was far higher than it seems by modern standards. The economy of the time was barely industrial, and hence taxes, although regarded as the world's highest and barely tolerable, brought in only about 10% of GDP to the national government (and another 2% to local ones). The widely hated income tax was brought back in the early 1840s (by a Conservative government, as a "temporary" measure), at what was regarded as an extortionate rate of 3%. National debt was about 15 times the annual spending by the UK government, as opposed to perhaps 7 times for Japan today. Interest on the debt took about half of the national budget. This debt burden was a national obsession, and figured heavily in almost all policy discussions.

Military spending was also heavy, as the Pax Britannica was not easy to maintain. One of the greatest of Britain's disasters in Asia took place in 1841, during the first AngloAfghan War, when only one person escaped a massacre of a fifteen-thousand person British column retreating from Kabul. The central government spent very little aside from paying for the military and the debt service.

By contrast, the United States had little military spending (at least until the start of the Mexican-American War), and practically no national debt. The individual states were a different matter, and many defaulted on their bonds during the deep depression of the early 1840s. A few even "repudiated" their debts, by claiming that various technicalities absolved them from any obligation to pay the (largely British) investors. The indignation in Britain at the lightly taxed Americans refusing to pay their contractual debts was extreme. They called on the federal government to step in and right the grievous wrong. But Washington, which had bailed out the individual states after the American Revolution, refused in this case to either pay the creditors itself or compel the states to do so. The perceived commercial immorality of the United States was compounded by its refusal to provide copyright protection to foreign authors, in spite of sustained campaigns by famous writers such as Dickens, who complained of the widespread piracy of their works.

The British, who had peacefully freed their slaves in the 1830s, felt that slavery in the United States was another indication of the moral inferiority of Americans. But, just as Americans who complain about exploited Chinese labor but cannot resist inexpensive goods from China, the British did not allow moral scruples to interfere with their commerce too far. In spite of their abhorrence of slavery, they could not wean themselves off their dependence on the supplies of inexpensive slave-grown cotton for their textile industries!

Unlike the UK, United States had plenty of land, and rapid population growth, both from immigration and from high fertility. Thus incentives to invent and install labor-saving machinery were higher than they were in Britain, which was plagued with unemployment and underemployment. A Martian arriving on the scene would surely have predicted that the U.S. was a much more promising place for major economic and technological advances.

Poverty in Britain was widespread, and malnutrition was rife. The malnutrition was not the kind that has led to the recent epidemic of obesity in the United States and many other modern countries, but one of hunger. Contemporary readers of Dickens' Oliver Twist were not shocked by the famous scene where the request by Oliver in a workhouse, "Please, sir, I want some more," was treated as an outrageous impudence. Outright starvation was becoming less frequent, but was common. The Irish Potato Famine, one of the great tragedies of modern European history, in which about one million out of the eight million inhabitants of Ireland perished, took place during this period.

About half the population was illiterate, and lack of skills was a topic of frequent discussion and complaints. Inequality was glaring. The middle class was growing, but it was small, and a wide gap separated it from the bulk of the "lower classes." The Brontes were lower middle class, but their £200 annual income was equivalent, on a GDP per capita basis, to about $500 thousand for the U.S. today, and they had servants. (Charles Darwin and John Stuart Mill by this standard lived on about $2.5 million per year, yet were only upper middle class.) The truly rich were far richer yet, and lived opulent lives. But all tended to die young, as medicine had not advanced much beyond bleeding and snake oil. (In addition to the potato blight that resulted in the Irish Famine tragedy, a serious cholera epidemic hit Europe in the late 1840s, at a time when people did not even know what caused it, and thousands from all walks of life died.)

Although poverty was widespread, hordes of lawyers were doing very well. The fictional Jarndyce and Jarndyce inheritance case of Dickens' Bleak House dragged on for generations, until "the whole estate [was] found to have been absorbed by costs." It may have been inspired by several notorious cases in Britain that took decades to settle.

Yet out of such unpromising circumstances came the full flowering of the Industrial Revolution, and it was Britain, with its huge national debt and other handicaps, that was the leader.

The Railway Mania

Many observers in later Victorian times credited railways with sparking the rapid economic growth that they found so astonishing. One of the most exuberant and poetic claims of this nature occurs in Disraeli's novel Endymion, published in 1880. Disraeli wrote there how the early 1840s were dominated by the "overwhelming" "depression of trade in the manufacturing districts," the riots, the political agitation, and the "depressing effect on the spirit of the country" caused by "[t]he humiliating disasters of Afghanistan." His description of the recovery from that depression credited railways:

"And yet all this time, there were certain influences at work in the great body of the nation, neither foreseen, nor for some time recognised, by statesmen and those great capitalists on whose opinion statesmen much depend, which were stirring, as it were, like the unconscious power of the forces of nature, and which were destined to baffle all the calculations of persons in authority and the leading spirits of all parties, strengthen a perplexed administration, confound a sanguine opposition, render all the rhetoric, statistics, and subscriptions of the Anti-Corn Law League fruitless, and absolutely make the Chartists [a political reform movement that was regarded as dangerously subversive by the British establishment] forget the Charter.

"The new channel came, and all the persons of authority, alike political and commercial, seemed quite surprised that it had arrived; but when a thing or a man is wanted, they generally appear. One or two lines of railway, which had been long sleepily in formation, about this time were finished, and one or two lines of railway, which had been finished for some time and were unnoticed, announced dividends, and not contemptible ones. Suddenly there was a general feeling in the country, that its capital should be invested in railways; that the whole surface of the land should be transformed, and covered, as by a network, with these mighty means of communication. When the passions of the English, naturally an enthusiastic people, are excited on a subject of finance, their will, their determination, and resource, are irresistible. This was signally proved in the present instance, for they never ceased subscribing their capital until the sum entrusted to this new form of investment reached an amount almost equal to the national debt; and this too in a very few years. The immediate effect on the condition of the country was absolutely prodigious. The value of land rose, all the blast furnaces were relit, a stimulant was given to every branch of the home trade, the amount suddenly paid in wages exceeded that ever known in this country, and wages too at a high rate. Large portions of the labouring classes not only enjoyed comfort, but commanded luxury."

This description should not be taken too literally. After all, Endymion is a work of fiction, and this passage mixes up the smaller railway mania of the 1830s with the big Railway Mania of the 1840s, and the recovery from the depression of the early 1840s with the "Great Victorian Boom." Still, similar, if less poetic, sentiments were widely expressed about the contribution of railways to the post-1850 period of rapid growth. They were taken so seriously that Gladstone, Disraeli's great rival and opponent in politics, felt compelled to refute them. In early 1880 (the same year that Endymion was published), and just before embarking on his second term in office as Prime Minister, he published an article arguing it was free trade, and not railways, that was responsible for the great economic progress of the previous three decades.

What sparked the "Great Victorian Boom"? It was likely a combination of factors. But the role of railways should not be underestimated. They provided Britain with the world's leading transportation infrastructure, which not only lowered costs of moving goods and people, but served to create more of a "real-time economy," able to respond quickly to changes in demand and to minimize inventory costs. Some recent scholars have come up with low estimates for railways' contribution to British economic development, but those estimates may be missing some of the most important intangible benefits. Certainly contemporary investors and the public thought railways were important. By 1880, when Endymion and Gladstone's article were published, total investment in that industry came to more than half of the country's GDP, comparable to $8 trillion for the United States today.

Railways and the British non-revolution of 1848

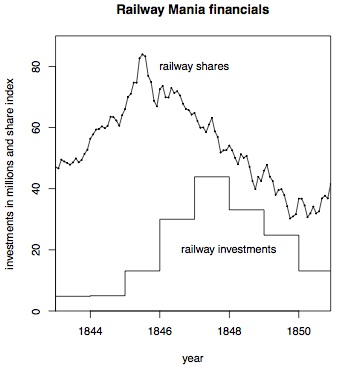

In addition to helping spark the "Great Victorian Boom," the Railway Mania likely had other beneficial effects on Britain. The Marxist historian Eric Hobsbawm has claimed that railways saved British capitalism from a crisis by providing a productive outlet for excess savings. But perhaps more important (but related) was the contribution that railways made towards preventing a revolution in Britain in 1848. Most of continental Europe was convulsed that year by a series of armed revolts. The UK remained an oasis of unusual calm. While conventional histories usually regard this as a puzzle, some observers have suggested this was due to the Railway Mania. The political grievances on the continent were greatly magnified by the economic downturn that started in 1846 and deepened in 1847 and 1848. Britain was singularly alone in basking in relative prosperity. (It was not complete prosperity, as the Irish Famine and other economic crises occurred during this period.) The gigantic flows of money into railways, visible in Fig. 2, amounting to around 7% of GDP in 1847 (comparable to a trillion dollars for the U.S. today, and over two trillion, if we compare investments not to GDP, but to government spending) produced plenty of jobs, and, in Disraeli's words, likely helped "make the Chartists forget the Charter."

Fig. 2. Index of railway share prices in Britain and railway capital investments in millions of pounds sterling, 1843 through end of 1850.

In the peak year 1847, direct employment just in construction of new lines involved an army of manual workers that was over twice the size of the British Army. On top of that were the spillover effects from goods and services provided to those workers. Railway investment was more than twice as large as the military budgets. All this money was coming from the pockets of individual investors, in pursuit of private profit. It was a pseudo-Keynesian stimulus, in effect. It produced a supply-side shock to the economy that compensated for the negative effects of famine and of disruption in foreign trade.

Charles Mackay and railway investors' extraordinary popular delusions

It is very likely that the Railway Mania of the 1840s was a substantial factor in preventing a revolution in 1848 and in starting the "Great Victorian Boom" soon afterwards. And it was all the work of private enterprise. So is there anything to dislike about it? Well, if we care about the investors who paid for these developments, then there is the awkward detail that most lost their shirts. In late 1849, Charlotte Bronte wrote that "[m]any—very many are—by the late strange Railway System deprived almost of their daily bread." The supply did not generate enough demand to give adequate rewards to investors.

What is remarkable is that not only did investors provide those astronomical sums, but that they did it in the face of a stock market that was telling them they were making a mistake. Fig. 2 shows share prices declining relentlessly from the peak in the summer of 1845 to the trough at the end of 1849. But for the first couple of years of this decline, the rate of investment just kept increasing. The investors' faith in the eventual profitability of their ventures eventually proved a tragic delusion, but at the time it was strong enough to make them ignore the negative signals they were getting from the market.

Investors' faith in railways was reinforced by the messages they heard from many observers, including Charles Mackay. While today he is known almost exclusively as the author of the book Extraordinary Popular Delusions, he was also a popular poet and journalist with a voluminous output. From the end of 1844 to the middle of 1847 he was the editor of the Glasgow Argus, an influential newspaper in one of the largest cities in the UK. His editorials there display his abiding faith in the profitability of railways.

Mackay was a Liberal of the early Victorian period. In modern terms, this means that he was an extreme free-market libertarian. As an example, he fought ardently against the Ten Hours Act, which limited working hours for children and women. (But not of men, that was too extreme an intervention in the market to be considered seriously at that time.) He was a great enthusiast for technology and economic development. When writing about the opening of the new Royal Exchange building in London, he waxed poetic about "the enterprise and the glories of trade," and how such an event was "splendid and gratifying, and in importance infinitely beyond the innumerable squabbles of rival factions, or the recital of the wars and jealousies of nations, which it is but too often the unpleasant duty of the conductors of newspapers to detail to the world." He saw railways as a means for social and economic uplift for the laboring classes, the finest specimen of British genius and enterprise. It was common for contemporary observers to wax poetic about the effect of railways in "annihilating space and time." There were frequent predictions that railways would bring social classes and nations closer together, and help end war.

There were many shades of opinion on the effect of the new technology. While Liberals like Mackay welcomed railways as a means of social and economic change, many Conservatives (such as Disraeli) welcomed them as a way to limit change. Thus there was wide support for railway expansion from across the political spectrum.

Although railway construction had wide support, there were many cautionary voices, even among this technology's enthusiasts, that too much was being attempted at once. Many skeptics saw disturbingly close similarities between the Railway Mania and the South Sea bubble. Mackay, with his extensive knowledge of that earlier episode of extreme investor exuberance, reached "the very opposite conclusion." He concluded that "[w]ith Railways the foundation is broad and secure. They are a necessity of the age. ... Success to them must be the desire of every friend of humanity; ... [and that they were] destined ... to effect social and economical reforms of the highest value and importance, and to increase both individual and national wealth." During his time at the Glasgow Argus, he consistently sought to reassure his readers that railway investment had a bright future.

Mackay devoted inordinate efforts to refuting William Wordsworth attacks on a particular railway project. Apparently he felt the famous poet's verses could damage the cause he held dear. On the other hand, while he did reprint a few pieces from other papers that expressed some doubts about the future profitability of railways, he never bothered to argue against them, presumably because he did not think they were worth paying much attention to. And so British railway investors continued pouring money into their railways, until they were, in Charlotte Bronte's words, "deprived almost of their daily bread." But their country prospered!

Conclusions

It has often been said that "history does not repeat, but it rhymes." Thus we should not expect the future to unfold exactly the way the past did. There is no reason to expect a great spurt of growth for the U.S. On the other hand, we should not be shocked if it does materialize. A very persistent lesson from the past is that predicting the future is very difficult. Railway Mania investors learned this at great cost. As another example, Britons of the mid-19th century worried about the potential threats, economic and military, from the United States, czarist Russia, and, perhaps most, from their ancient enemy France. Hardly anyone worried about Germany, the ancestral home of the British royal family, and at that time broken up into numerous independent states.

Still, there are many useful lessons we can draw from the experience of the midnineteenth century. One can easily dismiss that period as ancient and irrelevant history. But that would be a mistake. There is value in taking a long view. The early 19th century is particularly instructive, as it saw several sharp financial crises. It also saw the emergence of modern capitalism, with corporations almost impossible to set up legally in Britain until 1825, and general limited liability only becoming available in the mid-1850s. Therefore this period is one of the richest available in terms of illustrating how and why the basic institutions of modern economies arose.

As a small example, Britain managed its huge national debt by relying on debt instruments ("consols" and similar bonds) that were perpetual yet callable. That meant that sudden spikes in interest rates, associated with wars or financial crashes, had limited impact on government solvency. Compare this to the danger that Italy and other European countries are facing, with the need to refinance over the next few months large fractions of their (much smaller) national debts. There was certainly a cost in terms of higher interest rates to British financial policy. But in retrospect one can argue that British authorities were wise to take that course, and that in general they were smarter than ours not to be deluded by the promises of liquid and rational markets, and were prepared for upheavals. For all the sophistication of our economic theory, our ancestors may have been more sophisticated than we are in truly understanding how the world works.

The British elite were certainly not treating their national debt in a lackadaisical fashion. There was a constant search for economies. National creditworthiness was regarded as paramount, and a key to Britain's victory over the larger and richer France in over a century of wars that ended in 1815. While there are frequent claims that debt levels exceeding 90% of GDP are dangerous, it is worth remembering that the UK had periods with debt more than twice as high; not only in the early 19th century, but also after World War I and World War II. On the other hand, Greece has been in default for about half of its modern history, since gaining independence in the 1820s! So it is not just the absolute level of debt that matters. Other factors also play important roles.

What made the "Great Victorian Boom" boom possible was the growth of private enterprise. The British elite made valiant efforts to encourage it. The second quarter of the 19th century was perhaps the most extreme example of laissez faire policy in history. However, it was not complete laissez faire, as the government took active steps to promote economic activity. Lawyers could drag on private lawsuits such as Jarndyce and Jarndyce for decades. However, once Parliament approved a railway project, say, the exercise of eminent domain land condemnation was swift. Landowners were compensated (overcompensated, in the view of railway promoters), but the process could not be dragged on for years through lawsuits and environmental impact statements. The notion of regulating interior decorators, as some states in the United States do, would have seemed ludicrous.

At a higher level, British observers were right to be paranoid about their future. The boost that the Railway Mania and other factors gave to their economy did lead to the "Great Victorian Boom." However, they did not reform their economy and society, and by the end of the 19th century both Germany and the U.S. moved firmly ahead of Britain in economic and technological developments.

Finally, we should always remember that pleasant surprises do occur. Furthermore, what seems a serious handicap may actually turn out to be a useful feature. For example, the seeminly crippling national debt gave Britain a large and sophisticated financial system that could cope with the huge demands of the railway industry.

Not least, let us not forget that the US has some unappreciated advantages. In particular, it is the home of Hollywood. Steve Jobs, regarded as the paragon of technological and managerial leadership, achieved renown in movies with Pixar before reviving Apple, and his "reality distortion field" appears to have been a key element in his many successes. Hence there are plenty of people with the skills of Charles Mackay to draw enticing pictures of a rosy future that excite investors. All that is needed is a moderately convincing vision of how some new huge investments might lead to profits!

Notes

For detailed studies of the Railway Mania and related topics, including Charles Mackay's role in it, see the author's web page

http://www.dtc.umn.edu/∼odlyzko/doc/bubbles.html

By John F. Mauldin

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2012 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.