Stock and Currency Markets, Who is Leading Who?

Stock-Markets / Financial Markets 2012 Apr 02, 2012 - 02:11 AM GMT The US stocks markets continue to chop around, although if you look under the hood there are some startling clues which either will correct themselves or they are suggesting that some markets have already topped and will head lower. Thus I suspect eventually the US markets will follow.

The US stocks markets continue to chop around, although if you look under the hood there are some startling clues which either will correct themselves or they are suggesting that some markets have already topped and will head lower. Thus I suspect eventually the US markets will follow.

The US markets have held their ground recently but other markets that are interlinked and closely follow US stocks are starting to peel away, so if that continues I suspect US stocks will follow, it's just a matter of time.

It was my idea/thesis that when the FX risk pairs started to head lower from completed ideas, that US and European stocks would follow.

The 1st part I got right, the risk FX pairs have indeed headed lower, for the past month or so AUDUSD and NZDUSD have pulled lower, however stocks, especially those in the US have managed to hold up, but there is increasingly more clues that are suggesting that some markets are ahead of the curve and if the declines continue then imo the US stocks markets will break lower.

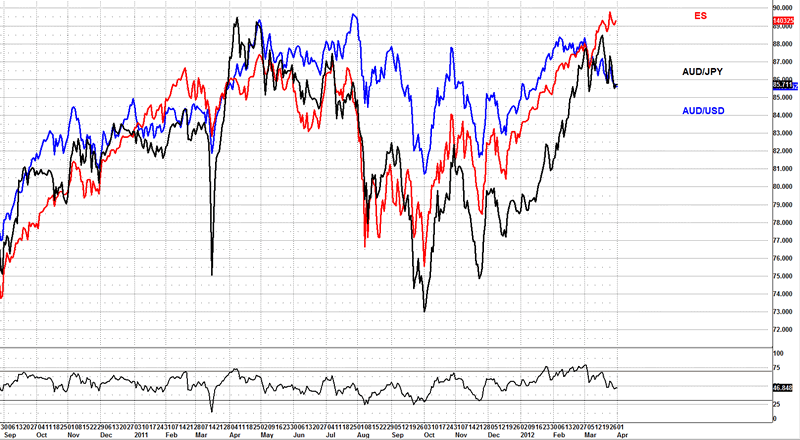

AUDUSD, AUDJPY Vs ES

You can see how the AUD crosses have been part of this rally from the Dec 2011 lows, now what is so important about these FX pairs.

There both represent the carry trades that have been part of the fuel to lift risk markets higher.

So if the AUDUSD and AUDJPY pairs are slowly breaking lower, the carry trades are going to unwind in the USD and JPY.

If you look at what happened last May 2011 you will see that the AUDJPY pair start to break lower with stocks and the divergence is growing daily between all 3 markets, so much as I think this could be a vital piece of information that is probably being overlooked by most traders.

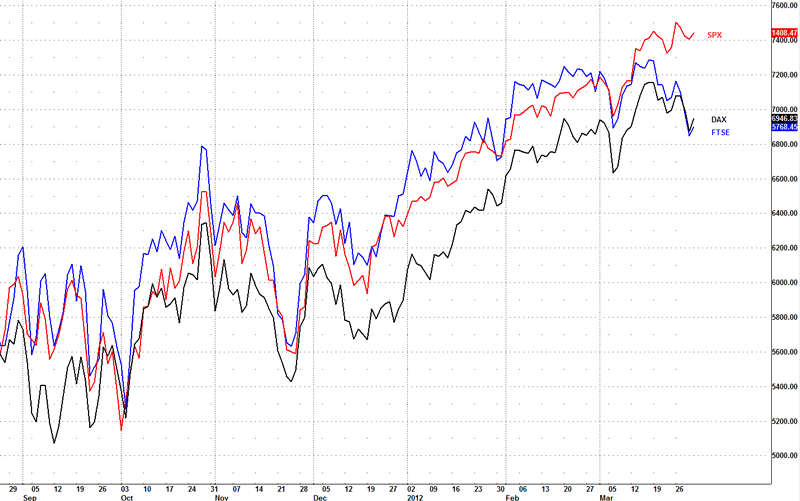

Europe VS US

Well what about the fact that European markets appeared to have broke ranks already, so it's the US markets that are out of sync, how long the US markets can hold up on their own? If the AUD crosses continue lower as well as the European markets, well that is anyone's guess.

I think the bulls need a strong upside move to kill these divergences, as if this risk pairs continue lower, I suspect that the US markets will head lower and eventually play catch up.

We have some setups in all markets that we are watching early next week to either confirm or negate the declines we have seen in these markets already.

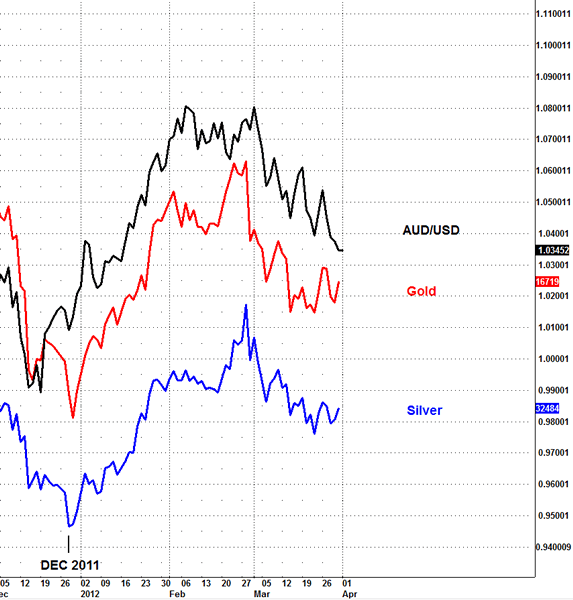

Precious Metals Vs AUDUSD

It even goes as far into the metals, whilst we are working some clearly bullish setups atm, we are not going to mess with any markets should they start to see further downside in risk markets.

For the past 3 months you can clearly see that the precious metals have been tracking the AUDUSD pair.

If the AUDUSD pair gets any traction to the downside it's going to put pressure on our ideas, and potentially invalidate them should we see this correlation continue, so it's vital for the metals traders to watch this clue as well.

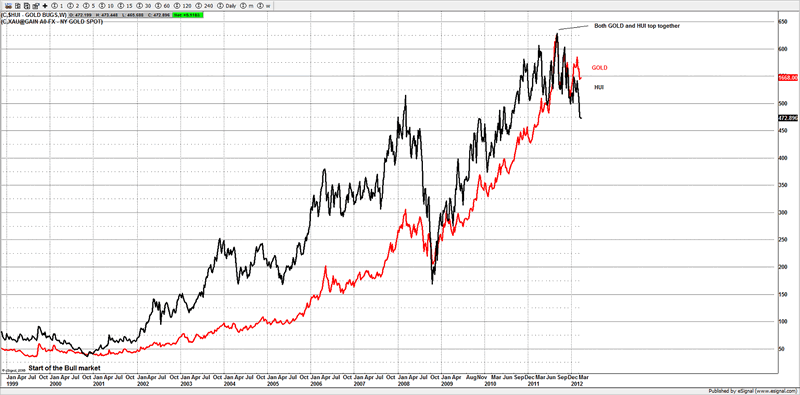

HUI Vs Gold

That's nothing compared to the HUI Vs gold idea.

Is the HUI actually telling us a message?

Back last year I used the HUI for the idea of finding a high in gold, it was a major clue in finding that high and being very vocal about it, it was not just a plain old simple guess, it was an actually predication based on a number of factors.(It paid off well I might add)

I have been watching the HUI lately and frankly I don't like it one bit, we have broke what I call the "granite floor" and if that level is resistance on the way up, I think it might just be a warning sign for gold stocks holders.

Being bullish is fine; having a bias is fine, but as long as the clues confirm that bias.

So we will be watching carefully next week our signals to negate or confirm our ideas.

If you're interested in finding out what we are looking for, then join up and start trading profitably instead of looking inside the box, starting looking outside the box.

Until next time.

Have a profitable week ahead.

Click here to become a member

You can also follow us on twitter

What do we offer?

Short and long term analysis on US and European markets, various major FX pairs, commodities from Gold and silver to markets like natural gas.

Daily analysis on where I think the market is going with key support and resistance areas, we move and adjust as the market adjusts.

A chat room where members can discuss ideas with me or other members.

Members get to know who is moving the markets in the S&P pits*

*I have permission to post comments from the audio I hear from the S&P pits.

If you looking for quality analysis from someone that actually looks at multiple charts and works hard at providing members information to stay on the right side of the trends and making $$$, why not give the site a trial.

If any of the readers want to see this article in a PDF format.

Please send an e-mail to Enquires@wavepatterntraders.com

Please put in the header PDF, or make it known that you want to be added to the mailing list for any future articles.

Or if you have any questions about becoming a member, please use the email address above.

If you like what you see, or want to see more of my work, then please sign up for the 4 week trial.

This article is just a small portion of the markets I follow.

I cover many markets, from FX to US equities, right the way through to commodities.

If I have the data I am more than willing to offer requests to members.

Currently new members can sign up for a 4 week free trial to test drive the site, and see if my work can help in your trading and if it meets your requirements.

If you don't like what you see, then drop me an email within the 1st 4 weeks from when you join, and ask for a no questions refund.

You simply have nothing to lose.

By Jason Soni AKA Nouf

© 2012 Copyright Jason Soni AKA Nouf - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.