Euro Crisis Next Phase All About Spain, the Mother of All Housing Bubbles

Economics / Eurozone Debt Crisis Apr 01, 2012 - 03:17 AM GMTBy: John_Mauldin

Last Monday I was in Paris and was asked to do a spot on CNBC London. I arrived at the studios an hour early due to a misunderstanding of the time zones, so while trying to catch up on the news I listened to CNBC. I had just written about Spain in last week's letter and guessed that was what they wanted to talk to me about, but for the full hour before I got on it seemed like every guest wanted to talk about Spain. When I had my turn and indeed got the Spain question, I smiled and noted that we were now in a period when it would be "All Spain All the Time," for at least the next year. I should have noted that there would be brief interruptions where we glanced at Portugal and perhaps Ireland, but the real focus would be on Spain.

Last Monday I was in Paris and was asked to do a spot on CNBC London. I arrived at the studios an hour early due to a misunderstanding of the time zones, so while trying to catch up on the news I listened to CNBC. I had just written about Spain in last week's letter and guessed that was what they wanted to talk to me about, but for the full hour before I got on it seemed like every guest wanted to talk about Spain. When I had my turn and indeed got the Spain question, I smiled and noted that we were now in a period when it would be "All Spain All the Time," for at least the next year. I should have noted that there would be brief interruptions where we glanced at Portugal and perhaps Ireland, but the real focus would be on Spain.

I fully intended to write about something other than Europe this week, but the events of the last 24 hours compel me to once again look "across the pond" at the problems that not only plague Europe but will be a drag on world growth as well, as Europe goes through its continued painful adjustment as a consequence of trying to adopt a single currency. Since Spain is going to be on the front page for some time, it will be useful to look at some of the problems it is facing, to put it all into context. And what I heard while in Europe in private meetings is troubling.

All Spain All the Time

Spain is in a recession, though only down an estimated 1.7% in 2012, if things go well. Unemployment is at 23%, which is higher than Greece for the latest Greek data that I can find. But more than half of young Spaniards (over 51%) are out of work, creating a lost generation that has been hardest hit by Spain's economic woes. The total number of unemployed has climbed above five million, and Spanish under-25 unemployment has nearly tripled, from 18% just four years ago.

" 'This is the least hopeful and best educated generation in Spain,' said Ignacio Escolar, author of the country's most popular political blog and former editor of the newspaper Publico. 'And it's like a national defeat that they have to travel abroad to find work.' Young Spaniards are now living in the family home longer than ever before, pushing the average age of independence from their parents to well into their thirties." (The Telegraph)

Unions called a general strike on Thursday as the recently elected Spanish government delivered its new austerity budget. While the protests were mostly peaceful, the pictures we see are of youth in partial riot mode. It is eerily similar to the onset of riots in Greece just a few years ago – except that unemployment is higher than when the Greek crisis started. And while Spanish leaders will protest that Spain is not Greece, there are striking similarities .

As an aside, let's remember that Habsburg Spain defaulted on all or part of its debt 14 times between 1557 and 1696 and also succumbed to inflation due to a surfeit of New World silver. Portugal has defaulted on its national debt five times since 1800, Greece five times, Spain no less than seven times. There have been more than 250 sovereign debt defaults since 1800.

Structural versus Cyclical Dilemmas

A country (or a family) can face two different types of crises. A cyclical crisis is typically temporary and due to a business-cycle recession. When the problem that caused the recession is dealt with, the economy comes back and employment returns to normal.

Structural problems are more difficult to deal with. Structural unemployment is a more permanent level of unemployment that's caused by forces other than the business cycle. It can be the result of an underlying shift in the economy that makes it difficult for certain segments of the population to find jobs. It typically occurs when there is a mismatch between the jobs available and the skill levels of the unemployed. Structural unemployment can result in a higher unemployment rate long after a recession is over. If ignored by policy makers, it can then even lead to a higher natural unemployment rate.

Structural unemployment can be created when there are technological advances in an industry. This has happened in manufacturing, where robots have been replacing unskilled workers. These workers must now get training in computer operations to manage the robots and employ other sophisticated technology, in order to compete for fewer jobs in the same factories where they worked before. ( about.com)

But structural unemployment may also be caused by government policies that make it difficult or even uneconomic for businesses to hire workers. Typically these policies are put in place by well-meaning if economically ignorant politicians (nobody wants to create unemployment), but the problems are there no matter what the intentions were. Let's look at a few Spanish structural problems.

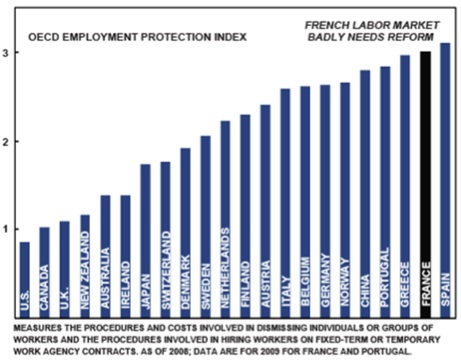

The first is a rather poisonous employment environment. The graph below was created by The Bank Credit Analyst to discuss structural employment problems in France, but the country that is even higher on the employment protection index is Spain. Note that both countries are higher than 3rd and 4th place Greece and Portugal.

In an open market, the large majority of jobs are created by small businesses. But when you make it difficult and more expensive for small businesses to hire workers, it is not surprising that you get fewer jobs. In the US, our experience is that when the minimum wage rises, youth unemployment rises as well, even in times of recovery. This has been consistent over the last few decades, when statistics have been kept. There are a lot of reasons for this, which we will not go into today, but there is every reason to believe that Spain in particular and Europe in general would be no different in that respect from the US.

The Mother of All Housing Bubbles

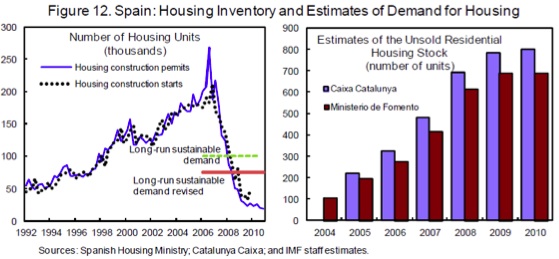

Spain had its own housing bubble, in most ways worse than that of the US. In 2006, the Guardian wrote that 50% of new EU jobs had been created in Spain during the previous five years. But in 2011 housing starts were down by 94% and new mortgages by 81% (IMF, 2011). The IMF notes that "The stock of unsold units may take around another four years to clear. The lowest estimates of the stock of unsold units are at close to 700,000 units, with considerable regional variations but with a downward adjustment that has only started at the end of 2010. These only include newly completed units, and do not fully include units repossessed by financial institutions, unsold secondary market houses, or unfinished units."

The Wall Street Journal suggests the number may be more than double that:

"Some 1.5 million unfinished, unsold or unwanted residential units stand scattered across the country, products of a still-deflating housing bubble that threatens to undermine Spain's broader economy for years to come. It is the hangover after an epic fiesta, a period Spaniards now refer to as "cuando pensábamos que éramos ricos"—'when we thought we were rich.'"

Let's put that in context. The US has about 6.5 times more people than Spain. There are 2.43 million existing homes for sale plus shadow inventory in the US, estimates of which vary. Using the WSJ number, this would suggest Spain has the equivalent of 15 million-plus homes for sale. That in a country where unemployment is more than double ours and where population growth and household formation is certainly slower than in the US. Only Ireland can rival Spain for the largest housing bubble.

The number of homes being foreclosed on is estimated to triple in Spain. About 120 evictions take place every day. Those who default on their mortgages cannot walk away from the debt, as in the US. A story is out tonight about one resident who lost her job and is being foreclosed on. She will still owe over about half her debt, or more than €100,000, plus court costs and penalties. From the Huffington Post:

"If the bank manages to sell a foreclosed home, that amount is struck off the remaining debt. But the norm these days is that the property is put up for auction and nobody bids. That has meant the bank then takes over the house for just half its originally assessed value, and wipes the amount off the remaining debt – leaving the borrower still owing a bundle. The legislation passed last week raises the proportion the bank has to effectively pay in the event of non-sale to 60 percent."

Home prices have fallen just 10-20%, as banks cannot afford to write down mortgages (more on that later). Realistic estimates assume a 40-50% total drop is more likely, and anecdotal evidence suggests it could be even more if the economy does not recover soon. And as we will see, that is going to be tough.

Spanish Banks en Bancarrota

I am not sure if the Spanish term for bankrupt is en bancarrota or quebrado, as Google didn't make it clear.

(Sidebar: The former sounds suspiciously Italian, as it is the term for "broken bench," which was the medieval term for what happened when a merchant bank went under. Its bench was literally broken. Our guide pointed to a spot in Sienna where she said the first banks and the term originated. And it is where the English word bankrupt comes from.)

In any event, there is widespread agreement that the regional Spanish banks, the cajas, are bankrupt, as they made massive loans for construction and mortgages. The government has taken some action, forcing 45 caja savings banks that were threatened by bankruptcy due to bad property loans to consolidate down to 14. But although bank regulators have estimated that Spanish banks will need €26 billion in extra capital, many skeptics believe this severely underestimates future losses and that the government may have to step in with a much larger bailout for the financial sector. The Bank of Spain contends that construction debt to banks stands at some €400 billion, of which repayment of €176 billion is questionable, with €31.6 billion of those considered nonperforming. (WSJ)

Spanish private debt is 220% of GDP, dwarfing government debt, which is high and rising. So not only are banks being forced to raise capital and reduce their loan books, consumers and businesses are also overextended. The government wants to increase taxes or reduce spending by 17% to get the deficit down from over 8% to 5.5%, a combination that is not geared for growth.

€12.3bn will be raised in new taxes, with €5.3bn coming from corporations, and €2.5bn is projected to come from a temporary amnesty on tax evasion (you've got to love the optimism). We have seen how such policies worked in Greece. They meant lower, not increased, revenues. Note that Britain also raised taxes on "the rich" and saw revenues fall in that category, not increase as projected.

Further, as we go along this year, watch for "breaking" news that off-balance-sheet guarantees by the Spanish government will be huge, adding multiples of 10% to total debt-to-GDP. Spain's admitted government debt is over 70% of GDP, which in comparison to other European countries is not all that bad. Except that is not the extent of the problem. There is regional debt, bank-guaranteed debt, sovereign guarantees, etc. that take it to roughly 85%.

And then we add the guarantees that Spain has made to the EU for all the stabilization funds, ECB liabilities, etc., at which point Mark Grant suggests that Spanish debt may be closer to 130% of GDP. (Of course, if we count all debt and guarantees, something that a normal bank would make you or me do if we wanted a loan [at least since the subprime debacle], then Italy has over 200% debt-to-GDP. Just saying.)

Spain is going to have an uphill struggle to keep its deficit down to 5.5%. Unemployment is still rising, as Spain is after all in a recession and costs will be up and revenues down. But the current budget buys time and what will amount to good will from the rest of Europe, as Spain will be seen to be trying, conducting yet another experiment in austerity. When those deficits come in higher, then what will Europe do? With each piece of bad news, the problem of funding Spanish debt will grow. Right now, Spanish banks are buying Spanish government debt with everything they can muster, which is to say, ECB loans at 1% for three years, invested in 5.5% bonds. With 30 times leverage. All the while trying to cut losses and reduce their loan books – a trick worthy of Houdini.

Meanwhile in the Rest of Europe

Let's quickly take a turn around Europe. Germany is preparing to reduce its budget, which will reduce inflation and also relative labor costs, which will make it more difficult for peripheral Europe to catch up on their massive trade deficits. In a story tonight in the Telegraph, with the headline "Germany launches strategy to counter ECB largesse," Ambrose Evans-Pritchard notes that "The plans have major implications for monetary union, dashing hopes in Southern Europe that Germany might accept a few years of mini-boom at home to help lift the whole system off the reefs.... 'The Bundesbank does not want to be blamed for making the same mistakes as central banks in Ireland and Spain where they did not address asset bubbles early enough,' said Bernhard Speyer from Deutsche Bank.... The German authorities are in effect preparing a form of quasi-monetary tightening to offset ECB largesse."

I keep noting that the third leg of the euro crisis, the trade imbalance between northern and Southern Europe, must be addressed or there is no real solution, just short-term Band-Aids. Ambrose's column goes on to note that Germany is hoping the rest of the world will do their job to provide a positive trade balance for peripheral Europe, all the while continuing its own massive surpluses. Unless and until the peripheral countries adopt their own currencies, the adjustment will be slow and painful, and the countries will be in recession for years, until wage costs (income to workers) drop by 30% relative to Germany. That is the ugly reality.

Wolfgang Munchau, writing in the Financial Times, notes that even with the proposed increases in the European bailouts funds (the sources and variety of which are quite confusing, so let's look at them in the aggregate) there is not going to be enough for Spain:

"The current ESM is big enough to handle small countries, but not Spain. I expect Madrid eventually to apply for a programme, specifically to deal with the debt overhang of the Spanish financial sector. But even a minimally enlarged version of the ESM will not be big enough.

"What this stand-off tells us is that we are approaching the political limits of multilateral programmes. If you want to claim funds of such size, you need joint and several liability – ie all eurozone countries need to be jointly liable – not individual liability among member states. Call it a eurobond, call it what you like. If you do not want that either, then you have to accept that there is simply no backstop for Spain. As I said, welcome back to the crisis."

And Two More Leaked Documents

And also tonight, we get two leaked documents from today's meeting of the European finance ministers. (I am not certain why they keep trying to keep these documents secret, as the press typically gets them before the ministers do.)

The first document tells us that €1 trillion in ECB largesse is not enough and has simply calmed the storm. "Contagion may ... re-emerge at very short notice, as demonstrated only a few days ago, and re-launch the potentially perverse triangle between sovereign, bank funding risk and growth," one of the analyses, prepared by the EU's economic and finance committee and seen by the Financial Times, said.

From the Financial Times:

"The second document, which was prepared by the Commission, warned bluntly: 'The euro crisis is not over. Many of the underlying imbalances and weaknesses of the economies, banking sectors or sovereign borrowers remain to be addressed.'

"The paper argued the elements of the recent restoration of confidence – finalising a second Greek bailout, increasing the eurozone's rescue fund, EU-wide bank recapitalisation, new eurozone fiscal discipline rules, and efforts to pass policies to encourage growth – must be fully implemented or leaders risk losing their last chance to act.

" 'If this window of opportunity is not most effectively used ... we might have missed the last chance for a considerable amount of time,' the analysis said."

The Fat Lady Has Not Sung

As I wrote last week, I was at the Global Interdependence Center conference on central banking in Paris. It was the coming out of the GIC Global Society of Fellows, ably headed up by my friend Paul McCulley, formerly of PIMCO. David Kotok, who runs Cumberland Advisors (and who runs the annual August fishing trip in Maine) is the GIC vice-chair. He wrote a short note of his take-aways, and I found it striking and worth a few minutes of your time, as a few years ago he wrote a very bullish book on Europe. His candor, given that former view, is sobering. The rest of the letter is his:

Back from Paris

David Kotok

We are back from Paris. The head is filled with new info. For the publicly available portion of the conference, see the GIC website, www.interdependence.org. The remaining comments will be my personal "takeaways" from both public and private conversations. By Chatham House Rule and Jackson Hole Rule, these words are attributable only to me. All errors are mine.

1. In my view, the situation in Portugal is unraveling. This may be the second shoe to drop in the European sovereign debt saga. Now that Greece has paved the way, the speed of unwind with Portugal may be much faster. I do not believe the markets are prepared for that. Runs are affecting Portuguese banks. Euro deposits are shifting to other, safer countries and the banks that are in those countries. Germany (German banks) is the largest recipient. Remember, deposits in European banks are guaranteed by the national central banks and the national governments, not the ECB. There is no FDIC to insure deposits in the Eurozone.

2. The issue is that Greece was supposed to be "ring-fenced." Notice how European leaders have stopped using that word. Their new word is firewall. If a second country (Portugal) restructures, the sovereign debt issues become systemic rather than idiosyncratic. That becomes the second game-changer. Systemic risk needs big firewalls. We learned that the hard way with Lehman and AIG, which were systemic, vs. Countrywide and Bear Stearns, which were "ring-fenced" – or thought to be ring-fenced at the time.

3. A game-changer was the use (not threat) of the collective action clause by Greece. CAC altered the positions of the private sector. It rewrote a contract after the fact. That is why Portugal's credit spreads are wide: the private-sector holders of Portuguese debt know that a CAC can be used on them, too. The same is true for all European sovereign debt. A re-pricing of this CAC risk is underway.

4. Private holders of Greek debt had several years to get out before the eventual failure. Those that did not get out were crushed in the settlement. Greece is now a ward of governmental and global institutions like the ECB, IMF, and others. It is unlikely to have market access for years. This is another game-changer. In the old crisis days, the strategy was to regain market access quickly and restore private-sector involvement. In the new Eurozone-CAC crisis days, the concept is to crush the private-sector holders, and that means no market access for a long time. Instead, we will have ongoing and increasing sunk costs by governmental institutions. Caveat: government does not know how to cut losses and run. Government only knows how to run up small losses until they are huge. Witness Fannie Mae in the US. Witness the sequence that allowed Greece to fester for years. Government does not know how to take the "first loss," which is usually the smallest lost. Government does know how to run up moral hazard.

5. The term moral hazard means the action is done today and the price is determined later, after the chickens come home to roost and crap all over the coop. That is the nature of government everywhere. By the time the chickens return, the political leaders have changed. Those who took the moral hazard risk are gone. Those who inherited their mess are blamed during the cleanup. That is where we are today in Europe. Hence, the political risk is rising daily. Elections could change these governments, and the new governments may repudiate the actions of the old ones. We expect more strikes and unrest. That is how elections can be influenced.

6. European debt-crisis issues are lessons for the US. They belong in the political debate. Both political parties are responsible for our growing debt issues. Bush ran up huge deficits. Obama continued them. Each party blames the other. Neither takes on the responsibility of their actions. We shall see how this evolves between now and November.

I am more pessimistic about peripheral Europe than I have been. All that my co-author Vincenzo Sciarretta and I wrote in our book several years ago is now being reversed by policies. In the beginning, the Eurozone benefited immensely from economic integration and interest-rate convergence. Now it faces disintegration and divergence. Reverse the chapters in the book and play the film backwards.

Can Europe find a stabilizing level and resume growth? Time will tell. Meanwhile, political leaders and central bankers are going to be tested again.

This ain't over. Yogi is correct.

San Francisco, New York, and Philadelphia

It is time to hit the send button, but let me first mention a few important things. I have had a number of readers ask me about the skin care crème I mentioned a few times early last year. As many of you know, I acquired the rights to market a revolutionary new skin crème that contains skin stem cells, and that has showed very positive results. Bottom line, the product works as I said; but it was too much for us to take on and to remain focused on my main mission, which is research and writing about investments and economics. So I gave those rights back to the company, Lifeline Skin Care, a subsidiary of International Stem Cell Corporation.

I still use the crème every day. I also have heard from a LOT of readers who, like me, use it and love it. It does stimulate your skin to grow. Most of my readers may not be interested, but those who are you might look at the following link. Guys, your wives will love you. Trust me on this. And if you are like me, you will like the results as well. You can see a one-minute video of a TV news story and get all the details: http://www.lifelineskincare.com/ahead-of-the-curve.

I am off to San Francisco in a few hours to attend a conference on life extension, where I will catch up with my good friend Pat Cox and (editor of Breakthrough Technology Alert). Pat is introducing me to several biotech executives from the area, and I am going to one of the more important companies anywhere. I will also get to have lunch with Colonel Doner, an old friend and one of the great raconteurs. It is possible that we were separated at birth. I may also get to once again spend extended time with Dr. Mike West, the chairman of BioTime, which I consider to be one of the true leading lights in the rejuvenation world. Mike West has a handle on stem cell technology like none other.

Then it's back to Dallas for a night and then on to New York to speak at an Investorside independent research program cosponsored by Bloomberg. It is at the Bloomberg building on 59th and Lexington. Attendance is limited. http://www.investorside.org/events/IndependentsDay2012_agenda.html

The next day I do some media spots in the morning, finish up with lunch with Barry Ritholtz, and then hop a plane back to Dallas.

It will be a full week, while trying to get the next book done. Have a great week and make sure you see some old friends who mean a lot.

Your fading fast, too far past midnight analyst,

By John F. Mauldin

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2012 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.