Money Is Starting to Burn a Hole in Households’ Pockets

Economics / US Economy Mar 31, 2012 - 07:36 AM GMTBy: Paul_L_Kasriel

February personal consumption expenditures (PCE) increased 0.8% month-to-month in nominal terms and 0.5% in real terms. In real terms, the February PCE increase was the strongest since last September. From some of the naysayers out there (David), we keep hearing that the economic “green shoots” that have emerged this past winter were due to the unusually mild temperatures. Really? One area of consumer expenditures that has not been boosted by the mild temperatures is electricity and natural gas.

February personal consumption expenditures (PCE) increased 0.8% month-to-month in nominal terms and 0.5% in real terms. In real terms, the February PCE increase was the strongest since last September. From some of the naysayers out there (David), we keep hearing that the economic “green shoots” that have emerged this past winter were due to the unusually mild temperatures. Really? One area of consumer expenditures that has not been boosted by the mild temperatures is electricity and natural gas.

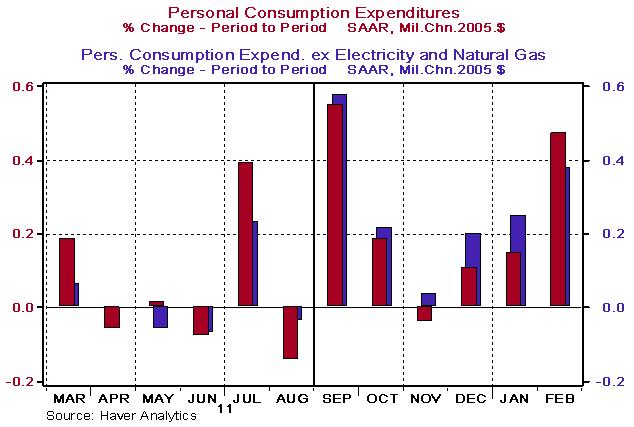

In the four months ended January, real PCE for electricity and natural gas contracted at a seasonally-adjusted annualized rate of 36%. (In February, growth in real PCE on electricity and natural gas exploded at a seasonally-adjusted annual rate of 96%!) Now, of course, the "savings" that households experienced on their winter utilities bills could have been spent on more discretionary goods/services, such as ski vacations. Oh, I forgot, there was not a lot of good snow for skiing this winter. Perhaps households could have used these utilities “savings” for more mundane expenditures such as snow removal services or new snow blowers. Oh, I forgot, there was not a lot of snow this winter. Chart 1 shows month-to-month percentage changes in total real PCE and real PCE excluding electricity and natural gas. Notice that starting in September 2011 through January 2012, growth in real PCE excluding electricity and natural gas exceeded growth in total real PCE. So, evidently, households chose not to spend all of their "savings" on winter utilities bills.

Chart 1

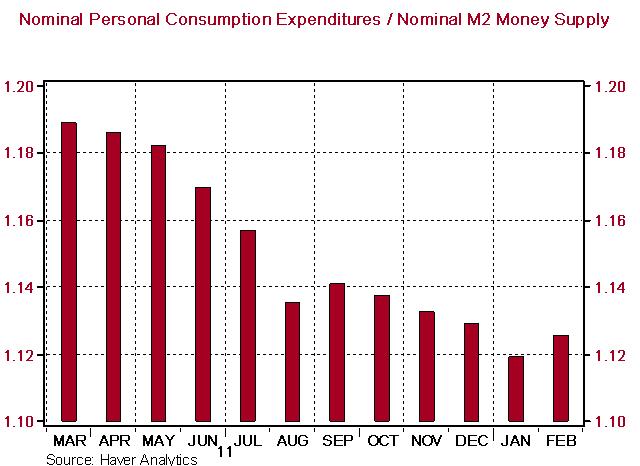

It would appear that households preferred to simply hold on to more "cash" rather than spend their utilities “savings” on other goods and services. Chart 2 shows the ratio of nominal PCE to the nominal M2 money supply. This is akin to the concept of the velocity of money. A decline in the ratio plotted in Chart 2 means that households prefer to hold more M2 money per dollar of their expenditures on consumer goods and services. The decline in this concept of money velocity started this past summer, becoming more pronounced this past fall through January. In February, this money velocity rose. I think, as the old saying goes, this money "savings" from lower winter utilities bills is starting to "burn a hole" in households’ pockets.

Chart 2

A Note on the Velocity of Money

In my March 29 commentary, I said that an increase in household saving would not lead to a decrease in aggregate spending unless that increased saving took the form of increased deposits and currency held by households. An increased demand to hold deposits and currency is the same thing as a decrease in the velocity of money, very similar to what I have discussed today in the section above. All else the same, a decrease in the velocity of money will lead to a decrease in total spending in the economy. Why? Won’t my increased deposits give my bank more funds with which to lend to other spenders? Yes, my bank will have more deposits. But from where did my bank’s deposits come? From someone else’s deposits. For example, I get paid this week. My deposits rise and my employer’s deposits fall by a like amount. If I bank at a different institution than my employer, then the bank of my employer loses the funds that my bank receives. If we happen to both bank at the same institution, then our bank neither gains nor loses funds. If I choose to increase my saving by purchasing new bonds, then my spending goes down, but the bond-issuer’s spending goes up. If, however, I choose to increase my saving by holding more deposits, then my spending goes down and no other entity’s spending goes up. The banking system does not gain any additional funds to make new loans by me choosing to hold more deposits.

Post-April 30 email: Econtrarian@gmail.com

Paul Kasriel is the recipient of the 2006 Lawrence R. Klein Award for Blue Chip Forecasting Accuracy

by Paul Kasriel and Asha Bangalore

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2011 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.