Energy Sector Investment Traps

Commodities / Energy Resources Mar 29, 2012 - 10:29 AM GMTBy: Marin_Katusa

Marin Katusa, Casey Research : Every salesman wants to present his product in the best light possible and the salesmen of the stock market are no exception. Public companies always highlight the positives about their projects, their financial positions, and their outlooks, and downplay negative news as much as legally possible.

Marin Katusa, Casey Research : Every salesman wants to present his product in the best light possible and the salesmen of the stock market are no exception. Public companies always highlight the positives about their projects, their financial positions, and their outlooks, and downplay negative news as much as legally possible.

In the resource sector there is a long list of tactics that companies use to put their best foot forward. Many of these tactics revolve around how certain numbers are calculated and presented. Financial metrics are designed to convey a complicated set of information in a number or two, but the devil is in the mathematical details. How many expenses were labeled "extraordinary" and therefore excluded from a net-profit analysis? How does a company calculate the size and value of its reserves? While it may seem that net return and basic valuation information should be reliable, there are a lot of accounting tricks that are regularly used to transform red into black.

Successful investing is based on comparing good information about hundreds of companies and selecting those that stand out. The thing is: you can't compare apples with oranges. Comparisons only work when each candidate can be examined across a standard set of parameters. When companies calculate their own metrics using their own methods, odds are pretty good that the parameters aren't going to be comparable.

When it comes to energy producers, there are a couple of parameters that companies regularly wrangle and wrestle until they are as positive as possible. While these accounting methods are legal, the average investor can't possibly know how to assess the reliability of each calculation. Beware of the misinformed value trap.

Today, I am going to discuss three very common "investor traps" in the energy sector. Each one is a figure that describes a financial or production level – and each can be shined up to gleam even when the real situation is not all that rosy.

The BOE Scam

Most oil wells produce some natural gas and natural gas wells often produce some oil, so most energy companies produce both kinds of fuel. To simplify reporting, producers have long lumped quantities of the two into one calculation: the "barrel of oil equivalent" (BOE).

The BOE is a unit of energy, defined as the energy released when one barrel of crude oil is burned. Since different grades of oil burn at different rates, the value is an approximation, set at 5.8 x 106 BTU or 6.12 x 109 joules. The BOE concept then lets us combine different fuels according to energy equivalence. Barrels of oil equivalent are most commonly used to combine oil and natural gas: one can say that one barrel of oil is equivalent to 5,800 cubic feet of natural gas because both produce approximately the same amount of energy on combustion.

It is understandable that companies want to distill their production or reserve information down into a single number that summarizes the situation for investors. The problem is that details are lost during the distillation process – and they are important details.

See, the BOE concept would be great if we valued companies based on the energy contained in their reserves, but we don't. We care about the money they can earn from those reserves; that valuation depends on the market prices for oil and gas, which are just a tad bit different. One barrel of oil is equivalent in energy to 5,800 cubic feet of natural gas, but the difference in value is very significant – and that is the trap.

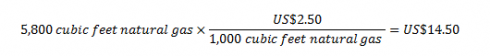

Using an oil price of US$100 per barrel and a natural gas price of US$2.50 per thousand cubic feet (the spot price is currently US$2.14 per thousand cubic feet) we can calculate the value of a BOE of natural gas priced as gas:

Unfortunately, a barrel of oil is not worth US$14.50, but rather is currently worth more than US$100 per barrel. Yet a BOE with 100% gas is worth is only worth US$14.50. Those two valuations are nowhere close to equivalent! The barrel of oil is actually worth almost seven times more than the supposedly equivalent "barrel" of natural gas. Certain companies purposely use this misleading concept because they want to value their gas reserves at more than seven times their actual value. As an investor, when you see a company's production in terms of BOEs you need to ask yourself: "What percentage of production is oil versus natural gas and NGLs?"

That is definitely a value trap that every investor wants to avoid.

Well Decline Rates

The news release announces with great fanfare that Company X's new well produced at a stellar rate of 1,450 BOE per day. That's fantastic – a rate like that puts it in the top 10% of oil wells ever drilled! Sounds like a great investment, right? Well, read a little further through the news release. A few paragraphs in, the company reveals that the production rate was measured during the well's first 22 hours of production.

That is where you run into the problem of decline rates. When a well first starts spouting oil, the flow can be fast and furious, but that rate can decline a heck of a lot in very little time. Depending on what type of shale formation this well is in, it's altogether possible that within a month production could decline to 200 BOEPD; after a year its output could easily drop to 100 BOEPD. The uninformed investors pile in, which at first drives the price of the stock up significantly, but then the well decline-rate reality sets in and brings with it the investment blues.

Not all wells decline like that, but such short initial-production rate tests are an inaccurate yardstick for a new well. Production rates and decline rates vary with the geology of the field, size of the field, the number of wells, and the amount of gas being re-injected to maintain field pressure, among other variables.

Of course, every company is going to jump on the opportunity to announce a gushing new well even if the initial rates do not carry much meaning, creating another value trap that energy investors have to be very careful to avoid. Understand the type of field you're investing in and be cautious of short-term initial test rates – they're sexy but meaningless.

Netback Nonsense

There are all kinds of financial metrics available to assess the value in an energy producer. One of the ones we like best is the "netback," which is the net profit a company derives from each unit of production, whether that unit is barrel of oil or a thousand cubic feet of gas or ton of coal. Proper netback calculations mean you can value a company's projects according to the net profits they will generate. However, as with all financial metrics, you're best off calculating netbacks for yourself, because companies engage in all kinds of netback nonsense. One of my biggest pet peeves is when an oil and gas company presents high netbacks but yet the company does not make any money for the shareholders.

To put all producing oil and gas companies on the same playing field you have to calculate netbacks fairly, which means subtracting all of the expenses involved in production from the cash flow. Of course, lots of companies make their netbacks look a little rosier by not including some expenses. Oftentimes these accounting tricks perform double duty by also burying some of the company's less palatable expenses, like fat salaries and huge debt-interest financing costs. If a company claims big netbacks yet cannot seem to make any money for its shareholders, it is probably presenting misleading netbacks.

To get around these shenanigans, we at Casey Research developed our own netback formula – which companies hate us for using – called the "Casey True Netback." Every quarter, we publish a chart of the top field netbacks and the top Casey True Netbacks. The lists are starting to get quite the following within the sector.

The formula: we subtract depreciation costs, amortization costs, royalties, general and administrative costs, and interest and financing costs to determine the actual amount each producer earns from its production. The results are often alarming in how much they differ from a company's claimed netback. It is the only way we can know how each field actually performs – and it's the kind of information that every investor need to know.

Tricks like publishing BOE valuations for gas reserves, initial production rates for rapid-decline fields, or polished netback numbers are the reality of the energy industry. The way to avoid the traps they create is with careful, calculated due diligence – you have to calculate your own netbacks, dig through financial statements to determine the breakdown in a company's BOE reserves, and research the geology and activity of an entire field to understand how much heft to give an initial well production rate.

Or you could let us do it for you – we're pretty darn good at numbers. The Casey Research energy team spends its days (and most of its nights) developing analytical models that grind through data in our proprietary company databases to churn out real financial metrics. The result: we actually compare apples with apples. It's no secret that some of the biggest investors in the energy sector use our numbers for their own analysis.

Our methods aren't infallible. Investing is tough no matter how long and hard you chew on financial data, and there is no perfect method. All we can do is our best, which means combining our deep understanding of the sector, our vast network of industry professionals and knowledge of deal flow, and the data we've gathered on numerous site visits with advanced financial analysis to find companies with as-yet unrealized potential. The three tricks we discussed here are among hundreds of variables that companies manipulate before presenting their figures to the unsuspecting investor.

We are not so unsuspecting.

[Learn more about the energy trends expected to unfold this year – download Casey Research's free 2012 Energy Forecast to help fine-tune your energy portfolio.]

© 2012 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.