Hot Oil Anyone?

Commodities / Agricultural Commodities Mar 29, 2012 - 10:25 AM GMTBy: Ned_W_Schmidt

The topic of hot oil probably conjures up fantasies that are beyond the boundaries for this public discussions. And no, neither are we referring to the oil made into gasoline, though the price of that oil has been hot lately. We are referring to that oil which goes on your salad, used to fry your dinner, or is a critical ingredient in many of our favorite foods. We are talking here about vegetable oils, or edible oils. While not a regular topic for investors, it may become one as edible oil prices could get hot in coming years.

Top three edible oils ranked by size are palm oil, soybean oil, and rapeseed. The latter being known as canola oil to most. Together those three represent ~80% of the world's edible oil consumption. In terms of size by weight, the world consumes 150+ million tons each year. For comparison, that is ~60% of the size of the world's total production of soybeans.

Several factors contribute to our interest in edible oils. First, demand is near perfectly price inelastic. That means you are going to put it on your salad or fry in it regardless of the price. Second, production of edible oils is limited to a few companies. Third, global inventories are only about 30-35 days of consumption, making edible oil prices vulnerable to supply tightening and disruptions due to weather. Fourth, over the most recent four years total global demand has grown by 20%. Fifth, China and India are net importers of edible oils and will remain so. For more discussion on this topic see the April issue of Agri-Food Value View.

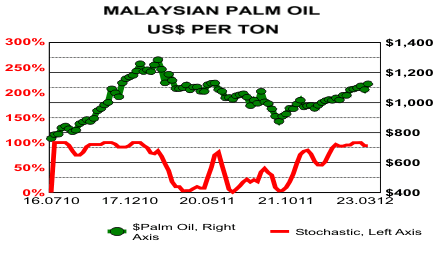

Above chart is of the U.S. dollar equivalent price of palm oil in Malaysia. Indonesia is the other major producer. With help from the unhappy soybean situation in South America, palm oil prices are moving toward the 90-week high. Over the most recent four years demand for palm oil, the most used edible oil in the world and in particular in Asia, rose ~25%. Those factors have contributed to the strength in palm oil prices.

Edible oils may develop may as a critical vulnerability in the global Agri-Food system. Over the past five years the increase in palm oil prices has ranked number four of the fifteen Agri-Commodities we follow. We expect palm oil prices to continue rising in the future, with the natural up and downs of all Agri-Commodities, due to rising import needs of Asia bumping up against a limited source of supply.

Soybeans is perhaps the edible oil source most likely to compete with palm oil. Soybeans also will likely remain in generally short supply for the foreseeable futures. Could soybeans become the new "corn" as corn prices decline to perhaps $5+ after the Fall harvest in North America?

Primary beneficiaries of this trend in the public company arena include Wilmar International and ADM. BG also is a producer of edible oils and should benefit. All three of these opportunities should be considered for core positions within investment portfolios. Investors should be researching these companies for the opportunities they might offer as edible oils get hot in the years ahead.

9th Agri-Food Commodities: An Investment Alternative, April 2012, is set for release late next week. This report, ~140 pages, is the definitive quarterly review of returns produces by Agri-Commodities versus U.S. and Chinese equities, U.S. government bonds, U.S. Treasury bills, and Gold. This edition begins the only major exploration of the Agri-Commodity component of commodity indices. Learn why your portfolio is simply inefficient without exposure to Agri-Commodities.

By Ned W Schmidt CFA, CEBS

AGRI-FOOD THOUGHTS is from Ned W. Schmidt,CFA,CEBS, publisher of The Agri-Food Value View, a monthly exploration of the Agri-Food grand cycle being created by China, India, and Eco-energy. To contract Ned or to learn more, use this link: www.agrifoodvalueview.com.

Copyright © 2012 Ned W. Schmidt - All Rights Reserved

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.