ECB’s Cheap Funds – Waiting for a Turnaround in Lending

Interest-Rates / US Interest Rates Mar 29, 2012 - 08:10 AM GMTBy: Asha_Bangalore

The European Central Bank’s (ECB) financial accommodation through the longer-term refinancing operation (LTRO) in December 2011 and February 2012 amounting to over 1 trillion euros has stabilized financial markets. But, the desired impact on bank lending is not visible yet. Granted, it is a bit too soon to expect positive signs, but it is an important aspect to track in the near term. The objective of LTRO’s is to prevent a severe disruption of the flow of credit to businesses and households. The February LTRO reached a larger number of institutions compared with the December package and included expanded collateral that enabled smaller financial institutions to participate.

The European Central Bank’s (ECB) financial accommodation through the longer-term refinancing operation (LTRO) in December 2011 and February 2012 amounting to over 1 trillion euros has stabilized financial markets. But, the desired impact on bank lending is not visible yet. Granted, it is a bit too soon to expect positive signs, but it is an important aspect to track in the near term. The objective of LTRO’s is to prevent a severe disruption of the flow of credit to businesses and households. The February LTRO reached a larger number of institutions compared with the December package and included expanded collateral that enabled smaller financial institutions to participate.

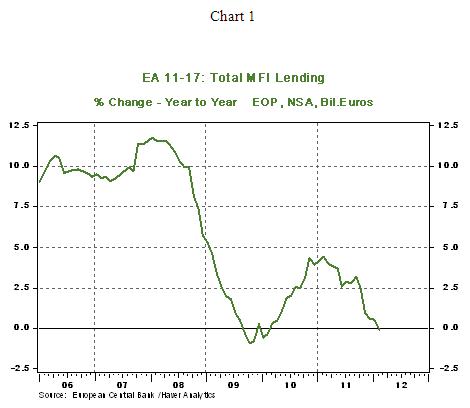

We should see the benefits of the two LTROs in the months ahead. For now, Monetary Financial Institutional (MFI) lending continues to show a decelerating trend (see Chart 1), which simply states that a credit crunch is underway in the euro area. In February, total MFI lending dropped €28.5 billion, the fourth monthly decline in the last five months. MFI lending in February held steady compared with a year ago reading (see Chart 1). By contrast, MFI lending in February 2011 posted a 4.4% year-to-year increase. The credit crunch has to be fixed for the eurozone to bounce back.

Insights from Bernanke’s TV Interview Yesterday’s ABC interview is another attempt of Bernanke to enhance the Fed’s operations. Excerpts from the interview (emphasis added) highlight his concerns. Once again, the labor market comes out at the top of the list of worries.

“Far too early to declare victory”:

DIANE SAWYER: Turning to the economy today, what is the word you would give American viewers, Americans out in the country about the economy now? Are we in a recovery? Is it sustainable? How strong is this recovery?

CHAIRMAN BERNANKE: Well, we are in a recovery. The economy's been growing-- for almost three years. And we've had some good news lately. We've-- seen the unemployment rate come down. We've seen more jobs created. And-- consumer and household-- and business sentiment have all improved, so that's all positive, but--

DIANE SAWYER: Strong?

CHAIRMAN BERNANKE: --we do have a long way to go. I-- I would say that we-- you know, it's-- it's far too early to declare victory. We have-- still 8.3% unemployment, that's-- that's too high. We've got a lot of people been un-- out of work for more than six months.

Low Federal Funds Rate is Not a Guarantee:

DIANE SAWYER: Well, I just want to follow up on a couple of things though they seemed to have reacted to. They seem to feel that you are pretty much saying it's guaranteed that till the end of-- the end of 2014 that short term interest rates are gonna be kept near zero. Is that pretty-- a guarantee, is that ironclad, that's--

CHAIRMAN BERNANKE: No-- we-- we've never-- issued a guarantee. We've said very clearly that that's our best estimate, that-- we're trying to tell the public first of all, you know, how we see the economy evolving and if the economy does evolve that way here's how we plan to react to that. But of course if the economy looks different, if-- things get a lot stronger or a lot weaker we'll have to change-- have to change our plan.

DIANE SAWYER: What is the measure-- what is the trigger that make you say we have to change our plans? Would it be-- what kind of inflation concern?

CHAIRMAN BERNANKE: Well, we have to look both at growth and inflation. And both sides are our responsibility, our mandate to look at both sides. And we look at both sides. It's a committee decision. We have-- 17 people around the table, we meet eight times a year, we talk about the economy. We try to assess whether the economy is making sufficient progress, whether inflation is under control and what our tools are, w-- are they effective? So it's not something I can give, you know, sort of a precise-- set of-- indicators or precise set of conditions. It's something that we're gonna have to keep thinking about and evaluating as we go forward

Cautiously Optimistic Chairman on Outlook:

DIANE SAWYER: How will you know-- how will we know when you believe the economy has passed all the thin ice?

CHAIRMAN BERNANKE: Well, you'll be able to tell by what-- what I say. Again at this point-- I'm encouraged, but still cautious. As-- as things-- continue to improve, if they improve at the rate I hope that they will-- we'll obviously-- change our forecasts-- and-- communicate that we think that things are normalizing.

Question on Housing Sector:

DIANE SAWYER: I-- I want to just make sure I cover housing. And we're seeing these mixed signals on housing, housing prices still low, but we are seeing some-- up-tick in new house sales and also existing house sales. Have we hit bottom on housing?

CHAIRMAN BERNANKE: Well, housing remains-- a big concern for us. Normally in a recovery you would see housing growing much more quickly, construction-- housing related industries. So far housing is-- kinda still pretty flat. We have seen a few signs-- of-- of progress-- a few extra permits for construction. We see more construction in multi-family-- housing. More people are moving into apartment buildings for example. So there's a bit of-- a bit of a green shoot there if you-- if you will. But-- you know, we're not really yet in a full-fledged housing recovery. And you know, that will be part of-- the full recovery of the economy.

Source: http://abcnews.go.com...

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2012 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.