Super-Cooled Natural Gas is Red Hot in International Markets

Commodities / Natural Gas Mar 28, 2012 - 02:05 AM GMTBy: Elliot_H_Gue

Natural gas transforms into a liquid when it’s cooled to minus 260 degrees, enabling exporters to load the liquefied commodity onto specialized carriers for shipment to an import terminal.

Natural gas transforms into a liquid when it’s cooled to minus 260 degrees, enabling exporters to load the liquefied commodity onto specialized carriers for shipment to an import terminal.

LNG frees gas from the physical constraints of the global pipeline system. Before the widespread commercialization of LNG technology, natural gas located far offshore or in remote areas was considered stranded and had no economic value because producers couldn’t deliver output to consumers. LNG allows natural gas produced in Australia or offshore West Africa to high-demand markets such as Europe and Asia.

Global consumption of natural gas should grow at a faster pace than any other fossil fuel in coming years, according to projections from the US Energy Information Administration (EIA).

Source: Energy Information Administration

Whereas the EIA expects global demand for natural gas to surge almost 50 percent between 2010 and 2035, oil demand is expected to grow by 30 percent and coal demand is expected to jump by 40 percent.

This forecast appears conservative relative to industry estimates. For example, ExxonMobil Corp (NYSE: XOM) expects global gas demand to increase at an annualized pace of 1.6 percent over the next 30 years, compared to a 0.9 percent annualized growth rate for aggregate energy demand.

In either case, there’s a good chance that natural gas will overtake coal as the world’s second-largest source by the middle of the coming decade. Two factors will fuel this paradigm shift: Natural gas is more plentiful than oil and burns cleaner than oil or coal.

The global LNG trade continues to grow at a faster pace than both overall demand for natural gas and volumes transported by pipeline. In 2005 LNG accounted for about 26 percent of the 722 billion cubic meters of natural gas that exchanged hands in the global market. By 2010, global trade in natural gas had surged to more than 975 billion cubic meters; LNG accounted for about 31 percent of the market.

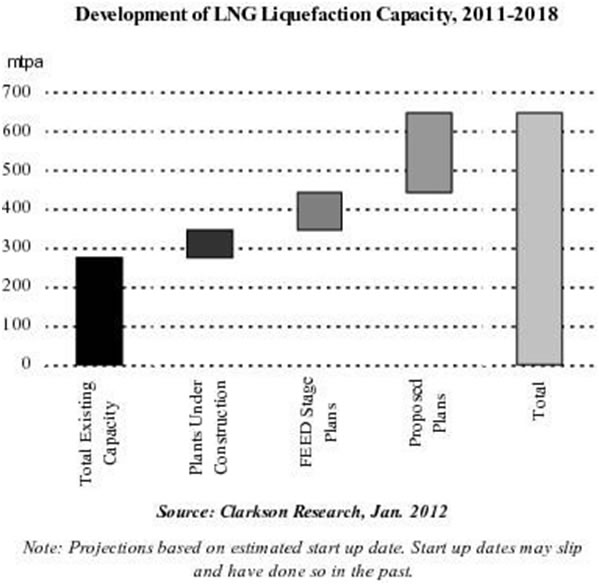

With a number of liquefaction projects slated for completion over the next few years, the global LNG trade should expand substantially over the next few years. At the end of 2011, global LNG export capacity stood at about 275 million metric tons per annum; plants currently under construction will expand global capacity by about 25 percent, while capacity could surge to 650 million metric tons per annum in 2018 if all the planned or proposed projects come to fruition.

Source: GasLog F-1A Filing

That being said, a number of the proposed LNG export terminals likely won’t be built, while delays should push out the completion date of a number projects that are currently under construction. Even with these inevitable slippages, global liquefaction capacity should increase substantially in the next few years.

Investors must distinguish between the North American market and international markets for natural gas. The frenzied development of the Marcellus Shale in Appalachia, the Haynesville Shale in Louisiana and other unconventional plays has glutted the US market. As I stated in Energy Investing: Your Questions Answered, with production still likely to outpace demand, US natural gas prices should remain depressed for at least the next two to three years.

With domestic natural gas prices hovering near record lows, some US-based investors overlook the growth opportunities in international markets for natural gas. Utility stocks and other major gas consumers in Europe and Asia lack rapidly growing domestic supplies of natural gas and rely heavily on imports to meet supply.

Natural gas has been growing in popularity in China, particularly in power-generation facilities located near major cities. Concerns about air quality mean that many of the high-rise residences constructed during China’s recent housing boom are equipped for piped gas. Further migration to urban areas will only increase demand.

Even after China’s annual consumption of natural gas more than tripled between 2000 and 2009, this extraordinary growth shows no signs of abating. The National Development and Reform Commission (NDRC) estimates that in the first 10 months of 2011, domestic natural gas demand surged to 3,676 billion cubic feet (bcf)–up 20.4 percent from year-ago levels. Meanwhile, energy companies in China produced only 2,916 bcf of natural gas over the same period, an increase of 6.6 percent. To offset this shortfall, the country’s imports soared by 86.5 percent, to 904 billion cubic feet.

LNG accounted for about half China’s imports in the first 10 months of 2011; these volumes are expected to grow substantially in coming years. Check out Shale Oil and Gas in China for more analysis on investing in this trend.

Meanwhile, Japan and South Korea, which is cut off from Asia’s pipeline network by North Korea, import the majority of their natural gas via LNG tankers. As I wrote in America’s Overlooked Energy Advantages, with many of its nuclear reactors still shuttered for evaluation and maintenance, Japan’s LNG imports remain near record highs.

Additionally, Germany’s decision to close all its nuclear power plants over the next 10 years likewise bodes well for activity in the global LNG market.

For more analysis and stock picks, check out my energy stocks page on Investing Daily.

Elliott H. Gue is editor of Personal Finance, a one-stop source for market-beating investing advice. Mr. Gue scours the world for the best investments – whether it be growth stocks, bonds, Master Limited Partnerships or commodities – to build and protect your wealth no matter what the “market” does. Mr. Gue delivers in-depth insight and analysis that cuts through the noise and hype to reveal the truth about the economy, the market and your investments.

Mr. Gue is also editor of The Energy Strategist, helping subscribers profit from oil and gas as well as leading-edge technologies like LNG, CNG, natural gas liquids and uranium stocks.

He has worked and lived in Europe for five years, where he completed a Master’s degree in Finance from the University of London, the highest-rated program in that field in the U.K. He also received his Bachelor’s of Science in Economics and Management degree from the University of London, graduating among the top 3 percent of his class. Mr. Gue was the first American student to ever complete a full degree at that business school.

© 2011 Copyright Elliott H. Gue - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Elliott H. Gue Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.