Gold Nears $1,700 After Bernanke QE Hints

Commodities / Gold and Silver 2012 Mar 27, 2012 - 10:04 AM GMTBy: GoldCore

Gold’s London AM fix this morning was USD 1,694.00, EUR 1,266.54, and GBP 1,059.55 per ounce. Yesterday's AM fix was USD 1,658.00, EUR 1,255.02 and GBP 1,047.91 per ounce.

Gold’s London AM fix this morning was USD 1,694.00, EUR 1,266.54, and GBP 1,059.55 per ounce. Yesterday's AM fix was USD 1,658.00, EUR 1,255.02 and GBP 1,047.91 per ounce.

Silver is trading at $33.07/oz, €24.77/oz and £20.72/oz. Platinum is trading at $1,656.75/oz, palladium at $660./oz and rhodium at $1,425/oz.

Gold rose 1.76% in New York yesterday and closed at $1,693.47/oz. Gold traded sideways during Asian trading and then buying in Europe drove it to over $1,696/oz.

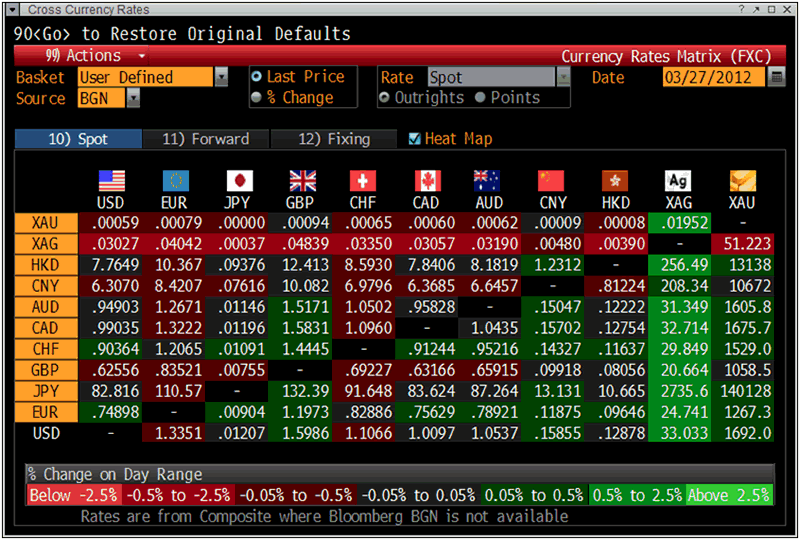

Cross Currency Table – (Bloomberg)

Gold is targeting $1,700/oz after yesterday’s Bernanke QE hints and today’s urging by the OECD to boost the Eurozone ‘firewall’ by another $1.3 trillion.

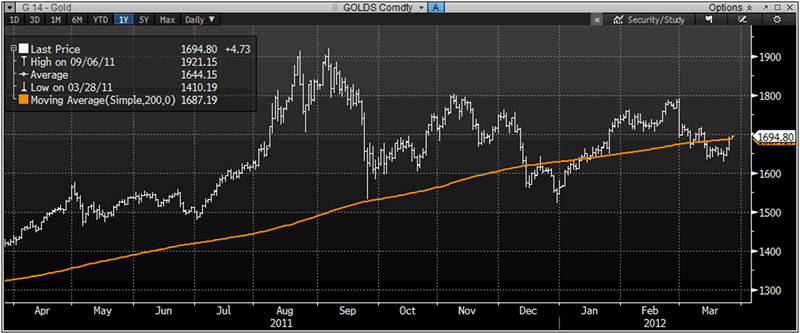

Gold is consolidating on yesterday’s gains today above the 200 day moving average (simple) at $1,687/oz after yesterday’s biggest daily gain since January. The gains came after Ben Bernanke warned of the risks to the fragile US economic recovery and signalled the Fed would keep interest rates low and further debase the dollar – boosting gold’s inflation hedging appeal.

Gold is also likely being supported by the OECD’s warning that the debt crisis is far from over. The OECD said today that the euro zone's public debt crisis is not over despite calmer financial markets this year and warned that Europe's banks remain weak, fiscal targets are far from assured and debt levels are still rising.

The OECD said that the eurozone needs to boost crisis ‘firewalls’ to at least $1.3 trillion. Gold likes the ‘trillion’ word and talk of ‘trillions’ and will be supported by the risk of the creation of trillions of more euros, pounds and dollars in the coming months.

Gold 1 Year Chart – (Bloomberg)

Bernanke confirmed what we and more bearish analysts have been saying for some time - that the US’s rate and nature of unemployment continues to hinder any real growth in the world’s largest economy and the labour markets are worrisome compared to prior recessions.

Although the employment rate appears to be shrinking the labour participation rate (number of job seekers) has dropped off. The reason is that people are remaining out of work longer - 40% of people out of work for greater than six months, while only 25% in previous downturns. The longer workers remain out of the labour force, there is an increased probability that the housing sector will continue to drag– adding to a stagnant economy.

Bernanke said ultra loose monetary policy was still needed and he again hinted another round of QE including asset purchases. This is almost inevitable despite the recent suggestion by Bernanke that it is not.

Monday's rally was the reverse of what gold experienced on February 29, when the metal posted its biggest one-day drop in more than 3 years after Bernanke suggested that there would be no further bond buying and QE.

Bernanke is bluffing which is bullish for gold and means that gold’s recent correction may be soon to come to a close – especially as the fundamentals remain as compelling as ever.

India’s Financial and Cultural Affinity and Love Affair With Gold

Analysts continue to evaluate the impact of the Indian gold jewellers strike.

Indian jewellers are on strike to protest against a government levy on gold and the strike is entering its 11th day in most parts of India. It has brought gold imports to a near standstill from the world's biggest buyer of bullion in the peak wedding season.

The Indian government for the second time in 2012 doubled the import tax on gold coins and bars to 4% along with an excise duty of 0.3 percent on unbranded jewellery.

A Reuters poll of analysts shows the belief that India's gold import duty increase may cut gold imports by as much as a third in 2012 to their lowest level in two years, allowing China to overtake it and become the world's biggest buyer of bullion.

However, many analysts wrongly asserted that Indian demand was not sustainable at $1,000/oz and said Indian demand would fall one prices rose above $1,000/oz in 2009. They badly underestimated the Indian propensity to save in gold as a store of value over their fiat rupee in Indian banks and mattresses.

Already there is speculation that while official demand figures may fall there may again be a sharp increase in smuggling of gold into India from neighbouring Asian countries and from Dubai and the Middle East.

India’s financial and cultural affinity and love affair with gold will not end due to government taxes and they will continue to prudently buy the dips.

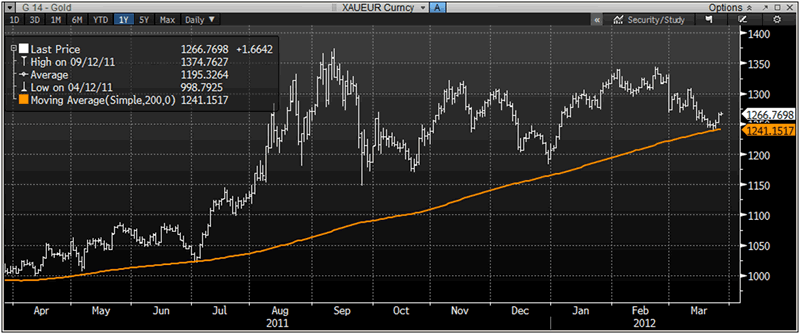

XAU/EUR 1 Year Chart – (Bloomberg)

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.