Fixed Rate Savings Interest Rates Take a Tumble

Personal_Finance / Savings Accounts Jan 15, 2008 - 01:48 PM GMTBy: MoneyFacts

Rachel Thrussell, Head of Savings at Moneyfacts.co.uk, comments: “High savings rates have been a by-product of the credit crunch, as providers source deposits as an alternative option to raising funds on the money markets. Competition is still alive, with rates paying almost 1% more than Bank of England base rate in the variable market, and as much as 1.35% within the fixed market.

Rachel Thrussell, Head of Savings at Moneyfacts.co.uk, comments: “High savings rates have been a by-product of the credit crunch, as providers source deposits as an alternative option to raising funds on the money markets. Competition is still alive, with rates paying almost 1% more than Bank of England base rate in the variable market, and as much as 1.35% within the fixed market.

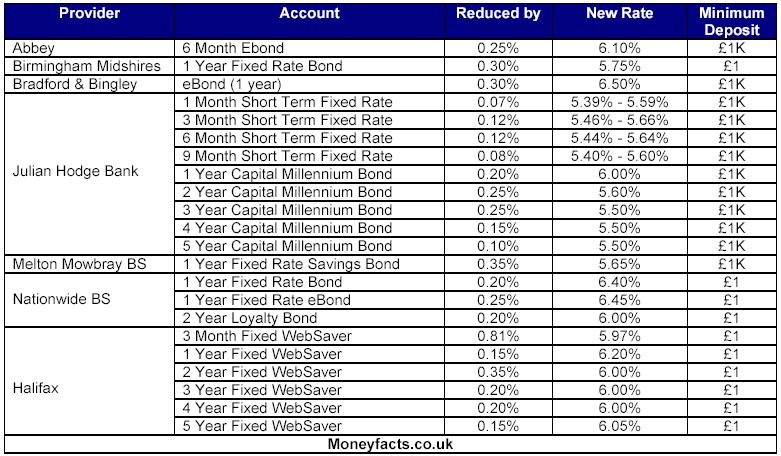

“The fixed rate market has seen many ups and downs over the last quarter of 2007, peaking in September and December for very short periods of time at 7%. However the last few weeks have seen the market take its latest downturn, with six providers reducing rates by as much as 0.81%.

“Typically the deals hit have been bonds of one year or less. The table below shows the most recent reductions:

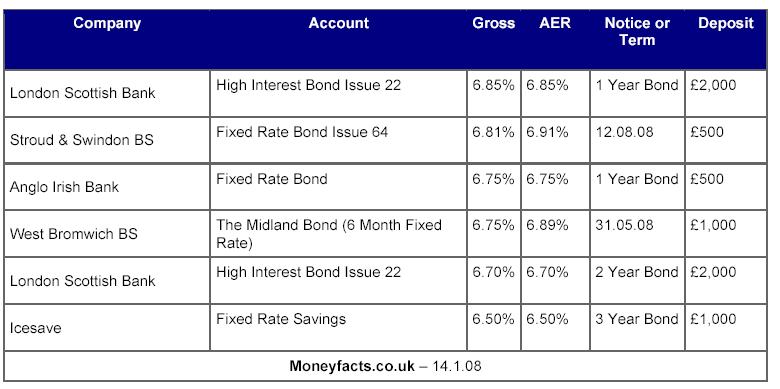

“While the overall market is falling, with several deals dipping below 6%, there are a handful of exceptional rates still available. But savers may need to act sooner rather than later if they want to nab themselves one of the high rates still left.

“If base rate does continue to fall throughout 2008, investors in fixed rate bonds could see their savings working extra hard for them, compared withto the variable rates which will inevitably fall, especially when the top paying fixed rates are already higher than any variable rate found today.

“But before jumping head first into a bond, make sure you know the full terms of the account. While some bonds will permit access, for most you will be sacrificing access for the whole term of the deal. Always make sure you have a safety net of savings which is accessible, otherwise breaking into a bond could see your hard earned return disappear and you left looking for a new home for your savings as the bond closes early.”

“Savers who have seen their variable rates cut by as much as 0.55% over the last few months could see the piece of mind that a fixed rate deal offers as a very attractive option.

“The best savings portfolio will spread risk and access to achieve a workable yet rewarding savings pot, and should always include making the most of any tax free savings such as ISAs.

Moneyfacts.co.uk Best Buys

www.moneyfacts.co.uk - The Money Search Engine

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.