Fake Gold Bar (1 Kilo) Filled With Tungsten Found in UK

Commodities / Gold and Silver 2012 Mar 26, 2012 - 07:10 AM GMTBy: GoldCore

Gold’s London AM fix this morning was USD 1,658.00, EUR 1,255.02, and GBP 1,047.91 per ounce.

Gold’s London AM fix this morning was USD 1,658.00, EUR 1,255.02, and GBP 1,047.91 per ounce.

Friday's AM fix was USD 1,651.00, EUR 1,246.04 and GBP 1,040.85 per ounce.

Gold rose 1.23% in New York on Friday and closed at $1,666.22/oz. Gold rose sharply at the open in Asia before determined selling at the $1,670/oz level saw gold fall. Weakness continued at the open in Europe which has gold now trading at $ 1,657.80/oz.

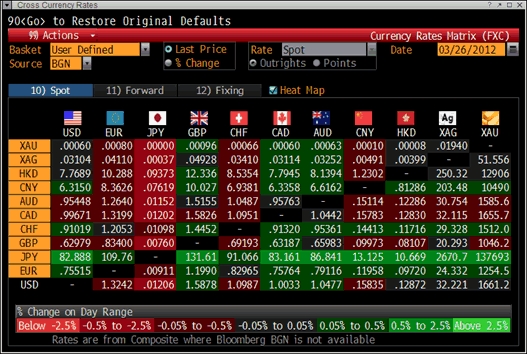

Cross Currency Table – (Bloomberg)

Gold prices pushed higher in Asia at the open Monday as the dollar fell near a 2 week low, which supported bullion’s safe haven appeal.

Bullion futures saw their greatest advance in 4 weeks on March 23 with many investors believing that gold demand will continue as an alternative to the weak dollar. Market participants will watch the pending US Home Sales for February today.

This morning German business sentiment surprised markets as it rose for the 5th month in a row in March, showing that Europe's largest economy continues to outpace other euro zone members struggling with the sovereign debt crisis.

The Munich-based IFO think tank said on Monday its business climate index, based on a monthly survey of some 7,000 companies, rose to 109.8 in March from a revised 109.7 in February. Although German manufacturing contracted this year, the closely-watched IFO index blew away expectations for a steady reading and climbed to its highest level since July 2011.

1 Kilo Tungsten Filled Gold Bar Found in UK

What appears to be a tungsten filled gold bar has been found – this time in the UK. It is believed that a scrap dealer bought the Metalor 1 kilo gold bar of 99.98% purity from a member of the public.

Tungsten Filled Gold Bar

Metalor are a leading international gold refiner and bar manufacturer, headquartered in Zurich. The bar appears to have been tampered with and may have had holes drilled into it or melted out and then had tungsten rods inserted or tungsten poured into the holes.

Tungsten is a metal with a similar density to gold but which bullion dealers and experts in physical bullion can easily identify.

It follows an incident of a tungsten filled gold bar (500 gram) originating from an unnamed bank being found by Heraeus in Germany two years ago and there have been rumours of tungsten filled gold bars in Asia, China and in Vietnam.

There was also an unverified report in 2009 that the Chinese received a fake shipment of gold that, in fact, was tungsten. The bars have led to much speculation regarding the possibility that some of the gold bars making up central bank gold reserves may not be investment grade gold bullion.

Presidential candidate, Ron Paul has raised the question as to whether the gold bars in Fort Knox are authentic and even asked whether some of the US gold reserves have been secretly sold off and asked questions regarding the authenticity of the US gold reserves gold bars.

In the UK, there have been doubts about the quality of Britain's paltry remaining gold stock as some of the gold bars are reportedly cracked, have fissures and are ‘beginning to crumble’. The Bank of England have denied suggestions that the gold may have been ‘adulterated’, and insisted that most of the hoard is in ‘mint condition’.

Some have simplistically suggested that this latest discovery is bearish for the gold market as uncertainty will put off prospective investors and buyers. We believe this is incorrect and that the discovery is in fact bullish for the market.

If there are many fake or forged gold bars in the bullion market then there is even less supply of physical bullion then had hither to been assumed.

Also, it is important to remember that tungsten filled gold bars still have value as tungsten is a rare and expensive metal. Many of MF Global’s clients who lost their entire gold investment (every cent) would wish that they had owned gold bars – even if some or all of them had been adulterated with tungsten.

Uncertainty regarding the provenance of gold bars will lead to gold buyers becoming more diligent in their purchases. It will add to the existing trend of moving away from ETFs and other large institutional vehicles where audit and authenticity of gold bars is an issue – not to mention significant counter party risk.

Australian 1 oz Nugget from Perth Mint

It will likely lead to further demand for bullion coins and gold sovereigns as 1 ounce formats (and 0.2354 ounce coins) are uneconomical and nearly impossible to forge and forgeries are very easily detected. It will also lead to further demand for storage of small coins and bars in allocated accounts in specialist depositories.

The incident shows the importance of dealing with reputable and trusted experts in physical bullion coins and bars and with dealing with counter parties who take these issues seriously.

For breaking news and commentary on financial markets and gold, follow us on Twitter

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.