Resource Investors and the PDAC Curse

Commodities / Gold & Silver Stocks Mar 22, 2012 - 11:03 AM GMTBy: HRA_Advisory

It's that time of year again. Thirty five thousand people descended on Toronto to take part in the largest mining industry confab in the world. The PDAC has become famous for the broad range of attendees, the numerous parties and the gouging by local hotel operators. In case you only go to Toronto for PDAC, $500 a night is not the usual price for a three star hotel in Hog Town.

It's that time of year again. Thirty five thousand people descended on Toronto to take part in the largest mining industry confab in the world. The PDAC has become famous for the broad range of attendees, the numerous parties and the gouging by local hotel operators. In case you only go to Toronto for PDAC, $500 a night is not the usual price for a three star hotel in Hog Town.

For resource stock investors, the PDAC famous for something more sinister; the "PDAC Curse". So far this month is looking like this annual scourge is alive and well and making life miserable for resource stock traders yet again.

We noted in the last issue that pull backs in resource stocks seem to follow on the heels of the PDAC. The conference is often held a little later in the month of March, and it coincides with the largest freeing up of private placement stock most years. That coincidence of timing is a big part of the reason for the pullback.

The better the market is the more likely it is that late March to late April will feature large amounts of profit taking and tax gain selling. Given how metal prices and Junior resource shares have fared the past couple of weeks there seems to be no danger of things getting frothy any time soon.

Many think the hype that always accompanies the big confab is also part of the problem and we don't disagree. Most years there is very heavy news flow during PDAC week. Attending companies are trying to get investor, broker and analyst attention in a place where they can meet many of them efficiently face to face.

Big announcements are a common feature of the conference. When the dust settles, most companies simply don't have much to talk about for several weeks. That makes it even harder for companies to turn their share prices around in the short run if markets have fallen.

For reasons elucidated in last month's Journal, we don't see much danger of heavy tax gain selling. A Greek debt swap and improving metrics most other places should help the sector start healing but not enough to necessitate widespread profit taking.

There has been heavier than average news flow thanks to the PDAC but it didn't generate large gains that need to be consolidated later. The conference coincided with high fear levels ahead of the Greek debt swap and the (first) trouncing of the gold price. Even good news had little market impact. There may be delayed positive reactions to some of the recent news but that never has the same impact on trader's psyches as a big, high volume reaction to a fresh news release.

While the market has been weak since PDAC, there were some strong positive reactions to drill news during late February. Granted, most of the companies that enjoyed them did not have huge market values to begin with. Nonetheless, the fact several companies could generate triple digit gains over a day or two and then hold most of those gains is a good sign. That sort of pattern only holds when some of the speculators have returned to the market.

The other positive note in recent sessions is large placements getting announced and closed. The volume of fund raising is still low compared to last year but it's rising. Many companies have completed oversubscribed placements at above market levels. This generally indicates some large retail and fund money is starting to return to the market. Another positive sign if by no means a guarantee of future gains.

There is plenty of money on the sidelines still. That is a potential positive but won't mean much in practice unless something entices those traders back to the market. A handful of good discoveries might do it, as would a new hot subsector. There are some sectors heating up but they are not large enough to move the whole market.

Volumes were improving until traders were scared off by Ben Bernanke on the one hand and Greece on the other. Fed Chairman Bernanke had made direct references to a new round of quantitative easing early this year. That had gold bulls excited but comments during his semi-annual Humphrey Hawkins testimony to Congress dashed trader's hopes.

Several Federal Reserve board members have resisted the idea of more bond purchases right from the start. Bernanke himself seems to have backed off the idea now. His comments to that effect generated one of the biggest one day drops in the gold price in months.

Like many things in the market this is one of those unsurprising surprises. Economic readings across the board in the US continue to improve. It's much harder to make a convincing case for QE3 then it was a few months ago. The February employment gains were larger than expected as were retail sales. Consumer confidence has been improving and an increase in the US economic growth rate seems baked in the cake for Q1 and probably the full year.

The scale of the drop in the gold price when QE3 hopes were dashed shows quite a few traders were leaning too hard on that one rationale to be long the yellow metal. While the pullback hasn't been fun it was due after a long upward move. Clearing out the skittish is a necessity in any healthy bull market.

With another good job gain and more upward revision of prior month's gains it's unlikely the Fed will ease further. The market assumes the gap in relative performance between the US and the EU will widen further. This has overshadowed the Greek deal and caused the Euro to stall out even after the new bailout was agreed to.

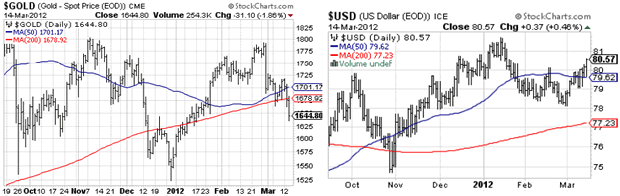

The two charts below show the gold price and the US Dollar Index for the past six months. Gold topped and the USD bottomed most recently on Bernanke's congressional testimony. The Greek debt deal slowed the Dollar's advance, but not for long. The US economy has continued to generate improving numbers. Even though Bernanke has repeatedly stated the Fed will not raise rates until 2014 market participants increasingly assume it will happen earlier.

It's going to be difficult for the Euro to strengthen under these circumstances and that in turn will make it harder for precious metals prices to advance. That is tempered by the fact the US trade deficit is growing again, the Current Account deficit is at a three year high and that gold continues to be a "risk on" trade for many.

There is still some chance that Europe can exceed traders' very low expectations. Consumer and business confidence numbers in Germany have been fairly good. Europe's largest economy is also the most likely to be able to reverse its slump. The peripheral countries won't be any help but they represent only a tiny fraction of the EU economy. If Germany can generate a bit of growth there may be some new life breathed into the Euro and, by extension, precious metal prices.

Things are more complex for base metals and materials. In addition the impact of a strengthening dollar and Euro fears these markets have to contend with fears of a slowing Chinese economy.

Beijing announced it was lowering its annual economic growth target for the current 5 year plan from 8.5% to 8%. So far, Beijing has done a better job of managing its economy that most. The 8% figure is a target and, if the last 20 years are anything to go by, it's a target likely to be exceeded in practice.

Inflation appears to finally be moderating in China. This leaves more room for stimulus if needed. Whether Beijing is ready to open the taps remains to be seen. Recent comments by Chinese leaders make it clear they are still very concerned about high real estate prices and unwilling to ease the pressure on that market.

China is moving to increase the amount of economic activity represented by consumer spending. This has to happen if the economy is going to mature and support higher incomes.

Redirecting the economy this way might mean less intensity of metal use, but that change will happen over many years, if not decades. There is still a lot of infrastructure build required in China, especially in the interior and eastern provinces.

Even if pressure to cool private real estate markets succeeds the construction boom isn't likely to end. Beijing has promised millions of units of subsidized housing. That is a promise that has to be delivered on to maintain social stability. There will be plenty of metal buying out of China for some years to come.

LME copper inventories are now below their 2010 low. It still looks like most of the drawdown is going straight to Shanghai warehouses and no further. The continued increase in optimism will support copper prices but we don't expect big lift from current levels until we see sustained decreases in both the London and Shanghai warehouse inventories.

By and large, most regions reported better than expected economic readings. Optimism has been improving and we think this will support moderate growth. Most large bourses are close to 52 week highs and some, notably the S&P and NASDAQ, have seen new post-crash highs.

It's been a tougher road for resource equities so far but we still think 2012 will be a good year on a full year basis. Precious metals have to stabilize after their recent fall but there will be room for gains once that happens. China will have to put up numbers that dispel the hard landing scenario for its economy. If that happens base metals should see some lift again.

Once it starts, the climb will be slow and probably concentrated in gold and silver explorers at least at first. Even there, a small subset of well-funded and managed companies will have to lead the way. Better growth numbers should ultimately help base metals which could broaden and strengthen a resource stock rally.

There might be a little more post PDAC selling but an overdue and well deserved rally after that looks like the path of least resistance.

David Coffin: 1955--2012

I'm sure that most of you appreciate how surreal the current situation is for me. Never in my worst nightmares did I think I would be doing back to back obituaries and that one of them would be for my brother David.

As many of you know, David and I were very, very close. Not just brothers but best friends too. We weren't twins and certainly didn't agree on everything but we didn't let that get in the way of our affection for each other. We did agree on most big picture subjects however so you needn't fear that HRA will suddenly start looking very different. HRA was a true collaboration and both of us looked at both sides of all the companies we followed. I'm better versed on geology that some of you may suspect and I have access to plenty of technical resources if I think I need them in a given case.

You will find me using the royal "we" for some time to come. Partially that is just habit, but its also because I can still hear David's voice and know his opinions. I intend to keep speaking for both of us.

Rather than an obituary, what follows is David's eulogy which I wrote for his funeral. It may give you more insight into David the man.

People tend to say nice things in eulogies of course. It's sort of bad form not to. Don't assume that you are just hearing the nice stuff though. David really was a caring and gentle man as his many, many friends can attest.

As we noted with our father's obituary we don't generally go in for overly personalizing the newsletter. That's not because we are aloof or unfriendly, but because we always aimed for objectivity. We never wanted to be cheerleaders and preferred to avoid the cult of personality that some newsletter editors seem to strive for. It would be massive understatement to say this month is a special case. I trust you will indulge me in this.

David's Eulogy

How does one sum up a life? In a word - inadequately. No brief verbal sketch can encompass a life as varied and nuanced as David's. Those who know David, know him. Those who didn't get the chance to while he lived are the poorer for it. The word Eulogy means "good words" in the original Greek so we will hold to that and say a few good words to give you a sense of the man David was.

David was born on the Gaspe Peninsula in Murdochville, a town that came into being because of a copper mine. Dave was probably too young to realize that when he moved with his family to the outskirts of Toronto at the age of three. Then again, maybe he did sense the presence of a nearby lode even then. He always seemed born to seek out value in all things and to know ore from waste.

Dave had a fairly standard suburban upbringing though he managed to add a few unique twists to the experience. He loved Scouting and took it upon himself to earn badge after badge, ultimately pressing the Scout leaders to start a Venturers troop to accommodate his enthusiasm.

Scouting represented a way for David to pursue his love of learning new things and of passing that knowledge unto others, themes that would be repeated over and over in his life. David's enthusiasm did not go unrewarded. He was selected as a Canadian representative to the World Jamboree in Osaka Japan. At the age of sixteen David boarded his first intercontinental flight on his own. He told our mother on his return that he planned to visit as many countries as he could when he got older. He never looked back.

Even back then, David was always intensely interested in politics and economics and the big questions of the day. He took it as a duty to pass on his well thought out opinions, even when they were not exactly solicited, and he loved to argue his position. Those of you who know David well may have noticed that his nose was not perfectly straight. The bump in the middle was a trophy from a high school discussion that ended abruptly. He was always a little vague on the details.

Mom always told us that David seriously considered becoming a priest or a monk when he was quite young. While we can't quite square that idea with Dave's wine collection it's not hard to picture him taking pleasure in long bouts of quiet contemplation.

Of course, Dave didn't move to a monastery but soon started spending time in what many would consider a reasonable facsimile; exploration bush camps. Dave started working in the bush during summers in high school and quickly caught the bug. He loved to explore, to crest the next hill to see what lay beyond and to unravel the meager clues Mother Nature left to guard her buried treasures. David had found a vocation and lifelong love. He attended the Haileybury School of Mines in Ontario then spent two decades exploring throughout North and Central America.

Later, David would entice his unsuspecting younger brother to join him at a local consulting group so that he could "clean up the books". Eric had largely succeeded in dodging the family business up to that point but was finally drawn in. It was the beginning of a 25 year partnership that ultimately evolved into a family of resource investment publications that most people know David by.

Working in a business that saw some of its nastiest cyclical downturns during his tenure gave David a keen appreciation of life's difficulties and the need to persevere when the odds seem long. Those were lessons he never forgot. Even when he became successful he always appreciated the difficulties of those starting out. In a very competitive business that can breed large egos, David was never arrogant. He always had time for everyone and was always patient in listening to people's stories. He offered good advice and encouragement whenever he was asked. In short, David was a kind person.

David was also a thinker. A real thinker in the way that very few are. He loved to consider problems from every angle and work his way through long chains of reasoning. He read history, politics and economics widely and had a full appreciation of the ways societies change over time. Never a follower, he talked about some of today's most important issues and changes in the world long before most others had even thought of them.

David was not all about work however. He always loved art and appreciated those that create it. In his early twenties, David started collecting original pieces, sometimes spending a large chunk of his summer earnings on a new painting. He continued collecting through his adult life. He wasn't a trend follower here either. He liked to find artists early in their careers and bought what he liked, never what was trendy.

He often returned from overseas trips with pieces of art to go with the pieces of rock. His home is full of interesting small sculptures and eclectic objects d'art and much of his furniture is one of a kind creations by local artisans.

David never married but had a wide circle of friends. While he liked a bit of time alone to contemplate he was nonetheless very convivial. He knew a good restaurant when he saw one and frequented many of them, entertaining friends and colleagues alike.

Dave always tried to be objective in his writing, so many who know him only from that might be surprised to learn that something his many friends valued most was his sense of humour. David loved to joke and tells stories and never minded when the tables were turned. He didn't take himself too seriously and didn't expect others to. He had more than a bit of a gift for sarcasm and his friends recognized the mischievous glint in his eye when he was about to deliver it.

He was generous with friends and strangers alike. If he spotted a bottle of wine or special item he thought his guests would like he would always order it. It was just something he did. He certainly didn't expect others to underwrite his taste which is one reason he was always quick to grab the bill at the end of a meal.

David was just as generous with his time and advice. Many, many times a meeting intended to sell David and Eric on a company or project evolved into David making suggestions on exploration or changing presentations or giving pointers on how best to sell their ideas.

Like anyone in his line of work David always had many demands on his time but was always willing to listen to other people's stories and ideas. Dave always worked long hours, partially because he gave his time so freely in this manner. Most people knew that so his phone rarely stopped ringing. He didn't really mind though since he loved his job and loved a good conversation.

David didn't have children but he had nieces and nephews he adored. He always had time for them too and loved to take them places and show them new things. He was always happy to step in and help brag about them on their parent's behalf. His brothers always tried to counsel their children to go easy on the gift suggestions to Uncle Dave. He was the softest touch around and even the most outrageous requests would be happily delivered on.

By this point you must be thinking David was a saint who must now be growing wings. He was a good man in the truest sense that few men are, but he'd be rolling his eyes at all this praise. Lest you think he was perfect it should be noted that David did have some issues with, well, punctuality.

His brothers would fondly - well, sort of fondly -refer to it as "Dave Standard Time". David lived by the clock; it just wasn't the same clock as the rest of us.

When he and Eric had a lot of meetings to cover, Eric was known to quote earlier (false) times to Dave in the hope he would arrive at something approximating the actual meeting times. David's many colleagues knew they could linger over lunch before heading to a meeting with him without fear that he'd be waiting at their office door tapping his foot.

Dave's family always viewed with wonder his million plus aeroplan miles total. Not because they didn't know he travelled constantly but because that total implied he must have actually arrived on time for hundreds of flights. Eric often commented that David was sure to be late to his own funeral. Of all the predictions he's made over the years that is the one Eric most bitterly regrets being wrong about.

David loved life and he lived it fully and well. Everyone wants to be missed when they are gone and know they were and are loved. Even so, he wouldn't want us to dwell on the negatives and would rather be remembered holding a glass and wearing a smile. Anyone who chooses to explore as a vocation has to be an optimist above all. Dave was and he'd want us to take what good we can from this and keep moving forward.

David loved widely and was loved in return. He got to see virtually every part of the world and enjoyed many good friendships and work that always engaged and interested him. The rest, Dave would say, was just details.

Those of you who knew David well will know that the comments about his lack of punctuality were no exaggeration. He was really, really bad at showing up on time. With that in mind I'll pass on a short story about David's funeral.

After the church service, the immediate family went to the cemetery while his friends headed to a reception in his honor. We had to make a stop on the way. When we headed back to the highway we noted to our horror that the hearse that led the procession was making a wrong turn. We had no choice but to go the correct way and hope the driver of the hearse would know a back way to the cemetery.

Twenty minutes later my brothers and I (David and I have two older brothers, Terry and Ian) found ourselves waiting at the cemetery with our mother and families but without David. Fifteen minutes later the hearse rolled in. My brothers and I looked at each other then started laughing hysterically. David, god bless him, actually HAD managed to arrive late for his own funeral!

I'll admit to not being a particularly religious person but sometimes things happen that just make you go "hmmmm". Knowing the person David was I know that if there is a better place to go to he's on his way there. And if there is, I'm equally sure our father, one of the most punctual people in history, is already standing by the gate muttering "where the hell has that kid gotten to this time?!"

By Eric Coffin

http://www.hraadvisory.com

The HRA – Journal, HRA-Dispatch and HRA- Special Delivery are independent publications produced and distributed by Stockwork Consulting Ltd, which is committed to providing timely and factual analysis of junior mining, resource, and other venture capital companies. Companies are chosen on the basis of a speculative potential for significant upside gains resulting from asset-based expansion. These are generally high-risk securities, and opinions contained herein are time and market sensitive. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer, solicitation or recommendation to buy or sell any securities mentioned. While we believe all sources of information to be factual and reliable we in no way represent or guarantee the accuracy thereof, nor of the statements made herein. We do not receive or request compensation in any form in order to feature companies in these publications. We may, or may not, own securities and/or options to acquire securities of the companies mentioned herein. This document is protected by the copyright laws of Canada and the U.S. and may not be reproduced in any form for other than for personal use without the prior written consent of the publisher. This document may be quoted, in context, provided proper credit is given.

Published by Stockwork Consulting Ltd.

Box 85909, Phoenix AZ , 85071 Toll Free 1-877-528-3958

hra@publishers-mgmt.com

©2012 Stockwork Consulting Ltd. All Rights Reserved.

HRA Advisory Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.