The Truth About Corporate Earnings and How They Drive Stock Values and Shareholder Returns

Companies / Corporate Earnings Mar 21, 2012 - 11:09 AM GMT I want to start this article out with the positioning statement, that I am a fundamental investor, and that I believe in conducting a comprehensive fundamental evaluation on any Company (common stock) that I buy, or for that matter, hold or sell. My own personal core investing philosophy is about investing in businesses and not the stock market. Consequently, it is only through a comprehensive analysis of the company’s fundamentals that the investment merits of an operating business can be analyzed and evaluated.

I want to start this article out with the positioning statement, that I am a fundamental investor, and that I believe in conducting a comprehensive fundamental evaluation on any Company (common stock) that I buy, or for that matter, hold or sell. My own personal core investing philosophy is about investing in businesses and not the stock market. Consequently, it is only through a comprehensive analysis of the company’s fundamentals that the investment merits of an operating business can be analyzed and evaluated.

This thought leads me to providing an explanation of why fundamental analysis is important, and why I believe it should be conducted by prudent investors who are interested in owning good businesses rather than trading stocks. When all is said and done, the real purpose behind conducting a comprehensive fundamental analysis is to determine the core, or innate earnings power of the business that is being evaluated. This is critically important to the fundamental investor because, at the end of the day, earnings determine market price over the longer run. This is why earnings are referred to as the bottom line.

At the heart of my thesis, is the real-world reality that the “stock market” values a business by capitalizing the company’s earnings power in the long run. Later in this article, I intend to demonstrate this with real-world examples that clearly illustrate the veracity of this thesis. In other words, if a thesis is truly valid, we should be able to measure it and produce real evidence supporting its validity. When you think about it, whether people are doing it consciously or subconsciously, most rhetoric you will find by investors discussing their favorite, or least favorite stock, will relate to their expectations of the business’ earnings power. They may not state this directly, but if you read between the lines it becomes readily apparent that the company’s earnings power is what is on their minds.

I often produce reports where I analyze the merits or demerits of a specific publicly traded stock. Invariably in the comment section that follows my article, readers will often provide commentary regarding why they think the company I’ve written about is a good or bad company. They will talk about things like the risk from competitors with newer and better offerings or the loss of a patent on their key drug, or how great or bad they believe the current management team is, or the strength or weakness of their balance sheet, and the list goes on and on. But behind it all, the commentary is consciously or unconsciously discussing each commentator’s belief about the company’s future earnings power, good or bad.

Now, the idea that earnings determine the value of a business (company) will often generate an upheaval of dissenters that will offer their own favorite fundamental metric for valuing a business. One of the most common that is embraced and defended by many analysts is cash flows. Their argument is principally based on the notion that cash is cash, and earnings are optional. Frankly, there is a lot of truth behind their position, and I would add that I believe that when trying to determine the intrinsic value of a company, cash flows are one of the primary fundamental metrics that I scrutinize heavily.

However, there are numerous additional important fundamental metrics that the true fundamental investor should also consider and utilize in attempting to evaluate the strengths and value of any business they are looking at. Others, to name only a few, would include things like net profit margin, return on total capital, return on shareholder equity, retained earnings to common equity, the price to sales ratio and of course cash flow per share. In other words, when attempting to ascertain the value of the business, examination of the underlying fundamentals is essential. And, when trying to understand the quality of the company’s earnings power, cash flow analysis is one of the best tools available.

At this point, I would like to emphasize that behind any of the fundamental metrics I have already mentioned and all the ones that I haven’t, are numerous mathematical formulas that are utilized to produce the quotient being measured. However, the purpose of this article is not to provide a college course that goes into great detail illustrating and/or explaining all of the complex mathematical algorithms and formulas behind how fundamental metrics are derived. Instead, my goal is to provide the essence or common sense rationale behind each of these important fundamental values. And, in this regard, clearly illustrate not only why they are important, but how the everyday investor can use them to their ultimate benefit.

Therefore, right off, I admit to oversimplifying many of these complex concepts in order to focus on their importance and potential benefit. Consequently, I will take some liberties with the precise mathematical proofs, in order to focus on the practical applications and rationale behind the true value to investors of fundamental analysis. Because, I believe that by explaining these things in a more sensible context, the reader will be able to determine for themselves whether or not they can benefit from these activities. We will leave the details and the mathematical formulas to the professional analysts, while focusing instead on the essence and practical ways to think about these fundamental principles.

Therefore, let’s start from the top and work our way to the bottom. When analyzing a company, I always like to start with the top line, more commonly known as sales (gross revenues). Investors, professional and lay alike, need to remember that all the other important metrics, especially cash flows and earnings, ultimately come from the top line. If there are no sales, or if a company’s sales are weak or dropping, then it’s only rational to recognize that future cash flows and earnings will respond in direct proportion to what’s happening to the company’s top line, in the long run. So to me at least, I believe one of the best indicators of the true health of a business is to first evaluate the strength of its sales.

Again, as I will later demonstrate, evaluating a business is analogous to the famous children’s song Dry Bones: the toe bone connected to the heel bone. The heel bone connected to the foot bone. The foot bone connected to the ankle bone, etc. etc. etc. With a business, the top line (sales or revenues) is connected to the middle line (cash flows and free cash flows), the middle line is connected to the bottom line (earnings). Consequently, for sake of this article, the top line is sales, the middle line is cash flows, and finally the bottom line is earnings. All of them are connected, and therefore, functionally related to each other. Therefore, one is not more important than the other, because they all are tied together. But most importantly, the prudent fundamental investor considers them all before making a final investment decision.

On the other hand, when trying to determine the fair value of a business, it is only the bottom line that I have found that has a direct and measurable correlation in real-world application. As I’ve already indicated, there really can’t be a healthy bottom line, if the top line or the middle lines are sick. And just like a doctor examining the patient’s body for signs of sickness, the fundamental investor examines the important fundamental metrics of the business to determine its health. However, since this article is focused on the importance of earnings in determining the fair value of a business, the remainder will focus on the bottom line or earnings.

Famed investor Warren Buffett has often stated that he believed the value of the company was simply the total of the net owner earnings expected to occur over the life of the business. To Warren Buffett, owner earnings are calculated after taking out numerous accounting adjustments such as depreciation, depletion, amortization and other non-cash charges, etc. Warren feels that his definition of owner earnings is preferable to GAAP. However, I promised to avoid mathematical formulas.

Personally, I have my own view of owner earnings that I consider to be both relevant and practical when attempting to determine what I consider to be a fair price to pay (fair value) for a business I am considering. My definition of owner earnings refers to the earnings that the market traditionally uses to calculate the price of a common stock. As an owner of a business, the earnings that I am most interested in are the ones that can directly fall into my pocket.

Therefore, by recognizing that the market will capitalize future earnings, I also recognize that they will simultaneously determine the future value of my company. Furthermore, this tells me that future earnings will determine what I can expect to sell my shares for in the future. Consequently, I consider these “owner earnings” because they represent the money that I can expect to put in my own pocket upon the future sale of my shares. However, under the strictest sense of my definition of owner earnings, the purest form of owner earnings are dividends. This is because, I as a shareholder owner will receive the dividends in cash which I can spend or reinvest or do whatever I choose with them. I never lose sight of the fact that the level of and amount of my dividends (pure owner/shareholder earnings) are going to come directly as a result of the payout ratio from the company’s operating earnings.

Valuing a Business - The Earnings and Price Correlation

Now that I’ve developed my position regarding the importance of earnings as they relate to valuing a business, it’s time to offer some proof and evidence supporting the veracity of my thesis. Typically, and in the past, I would normally offer examples proving the earnings and price correlation using companies with very consistent fast-growing earnings. I did this because my preference is to invest in companies with consistent above-average earnings growth. Furthermore, I prefer these characteristics whether I’m investing in a growth stock or a dividend growth stock. However, with this article I offer a change of pace as I review the earnings and price relationship on several high profile cyclical stocks. I believe the reader will find that the profound correlation between earnings and market price on cyclical stocks is not only compelling, but provides prima fascia evidence of my earnings determine fair value thesis.

Since a picture is worth 1000 words, I will utilize the F.A.S.T. Graphs™ fundamentals analyzer software tool to illustrate the undeniable historical relationship between earnings and stock price with cyclical stocks. Since the earnings of cyclical stocks tend to vacillate between going up, down and sideways over time, a review of their earnings and price relationship will vividly illustrate how price follows earnings over time. At this point I also want to alert the reader to the fact that this is part one of a two-part series which will limit itself to developing the historical evidence behind the earnings and price relationship. In part two, I will switch the focus to forecasting future earnings, which is actually the key to investor success. But for now, let’s examine the evidence of the historical reality that earnings determine market price.

With the above said, this represents a good time to add an important qualifier to the earnings and price thesis. I developed an acronym, EDMP that stands for earnings determine market price in the long run. However, it is important to recognize that there is an evil twin sister EDMP acronym that stands for emotions determine market price in the short run. This is important, because my contention is that although the correlations between earnings and price are extremely profound long-term, there will be occasions when investors will see a short-term separation between earnings and price over or under. These are times when emotions such as fear or greed or hype or hysteria take hold and investors throw caution to the wind and behave irrationally. My thesis on the importance of earnings does not deny this, instead it recognizes this and uses this recognition as an opportunity to make intelligent (not perfect) buy, sell or hold investing decisions, thereby aiding the investor in avoiding obvious mistakes.

As we go through the following four examples, there are two important points of clarification that I additionally want to add. First, this article is not about the individual companies that I am using as examples. They were chosen because I felt they provide some of the clearest evidence I could offer regarding the relationship between earnings and price. On the other hand, these examples may represent some interesting investment opportunities for readers that care to conduct a more thorough fundamental analysis.

Second, the reader needs to understand that I do not simply draw an earnings line through the prices here; instead, the research tool calculates earnings growth rates and applies one of three widely accepted formulas for valuing a business. These are formulas that have been used by professional analysts to value earnings for a long time. The point is that I believe the reader will discover that it’s uncanny how well these formulas actually work with real-world applications and examples.

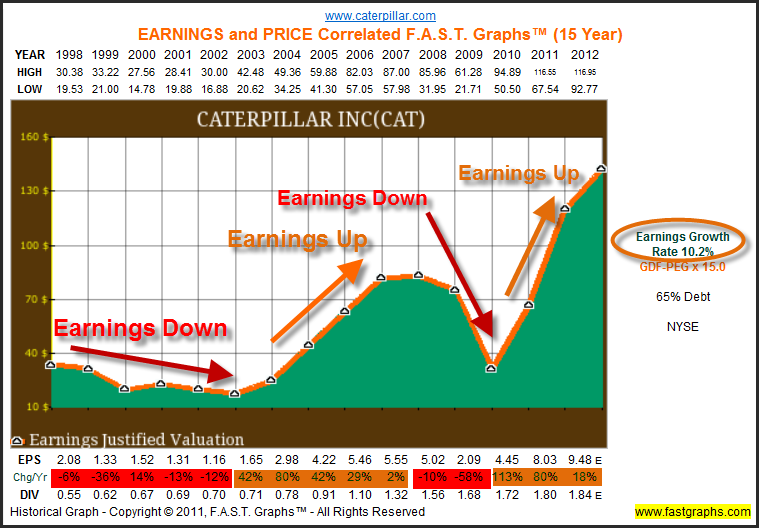

Example number one: Caterpillar Inc. (CAT)

With our first example, Caterpillar Inc. (CAT), we see from the graph plotting earnings only, that this company has a historical record of cyclical earnings. We see that earnings since 1998 were falling for approximately six years, and then rose again for another five years or so before falling again, and finally dramatically increasing over the past two years and are forecast to continue achieving strong earnings growth this year. When drawing the orange line that plots earnings there are two critical components that I would like the reader to recognize. When ascertaining fair value, part of the process is applying the appropriate PE ratio, in this case it’s a PE of 15 (coincidentally 15 also the historical normal PE of the S&P 500).

However, applying the appropriate PE ratio does not imply a rate of return. It only applies a reasonable price to pay. Once a reasonable price has been determined, I will demonstrate that the long-term rate of return (capital appreciation) will be a function of the company’s earnings growth rate. To summarize, the appropriate PE ratio implies fair value, but the earnings growth rate drives the future return.

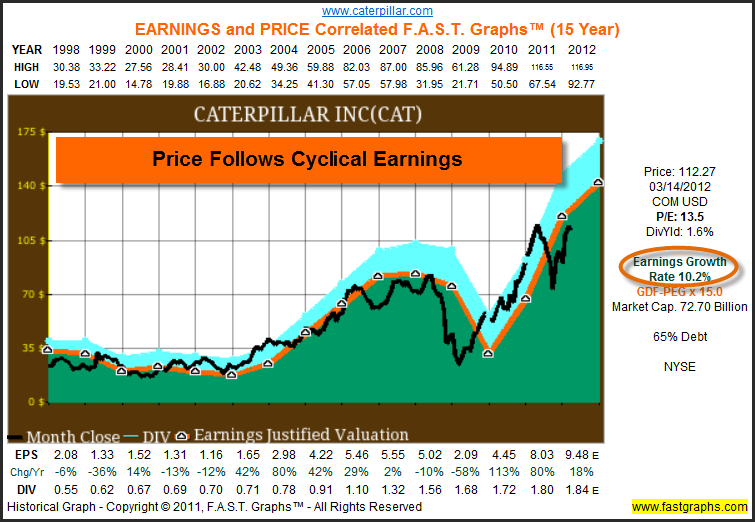

With our next graph, we introduce monthly closing stock prices for every year since 1998 to current time. What’s important to note here is that the price line is not made to fit the earnings line. The correct formula based on the company’s growth rate calculates the multiple representing fair value and when the monthly closing stock prices are overlaid, we discover a fit that correlates very closely. In simpler terms, wherever earnings go, whether up, down or sideways, the stock price was sure to follow. There are short-term deviations from this principle (emotions determine market price – EDMP) however, the longer-term trend line shows that price goes where earnings go.

We also add the light blue shaded area which represents dividends paid out of the green earnings area. This is an important add-on, because we will soon see that capital appreciation will come from and closely correlate to the company’s long-term earnings growth rate. However, dividends will provide an extra kicker or another component of total return in addition to capital appreciation. Therefore, we stack the dividends on top of earnings to symbolize the extra return they generate even though they come out of the green shaded earnings area. The market capitalizes total earnings, and dividends are paid in addition to what the market values the business at.

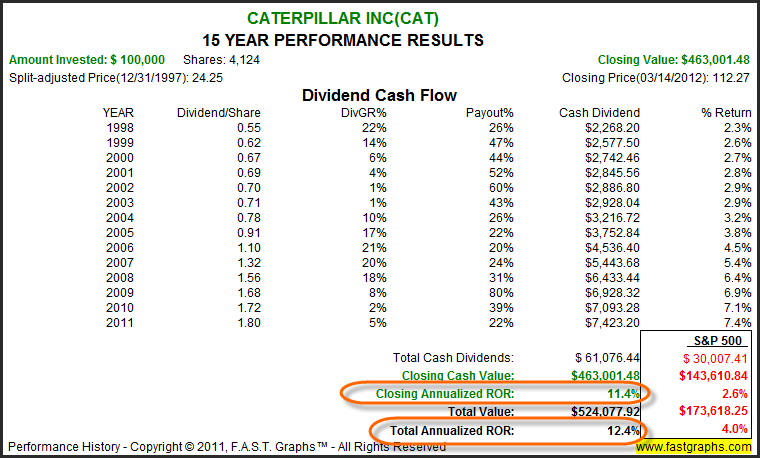

When we review the performance associated with the above graph, we discover that earnings growth and capital appreciation match very closely and that dividend income provides a return kicker. The capital appreciation component (closing annualized rate of return $463,001.48) of 11.4% annualized closely correlates to the 10.2% annual earnings growth (see orange circle on historical graph). Total cash dividends of $61,076.44 sweeten the pot, kicking the total annualized rate of return up to 12.4%.

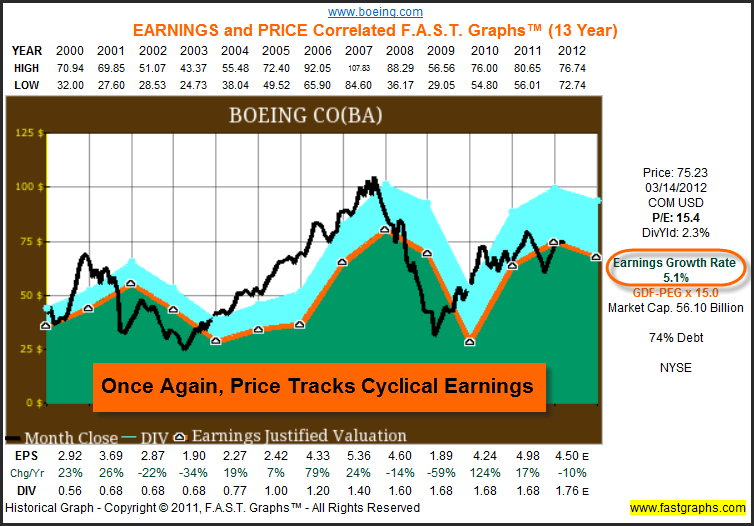

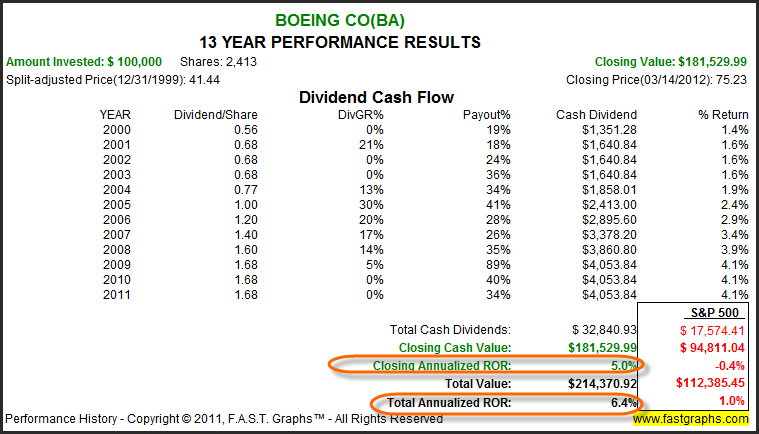

Example number two: Boeing Co. (BA)

With our second example Boeing Co. (BA), we once again discover that wherever earnings go, stock price is sure to follow. When earnings are rising, stock prices are rising, when earnings are falling, stock prices are falling, and the pattern repeats itself as the cyclical nature of Boeing’s earnings repeats itself.

Once again, as we review Boeing’s performance since calendar year 2000, we discover that capital appreciation almost perfectly matches the company’s earnings growth rate in spite of all the cyclicality. This is primarily due to the fact that price and earnings were in alignment at the beginning and at the end of this time frame. Hence, we find another clear example that the stock market capitalizes as reported earnings in the long run. Therefore, more evidence that earnings are the key to establishing the practical fair value of a publicly traded stock.

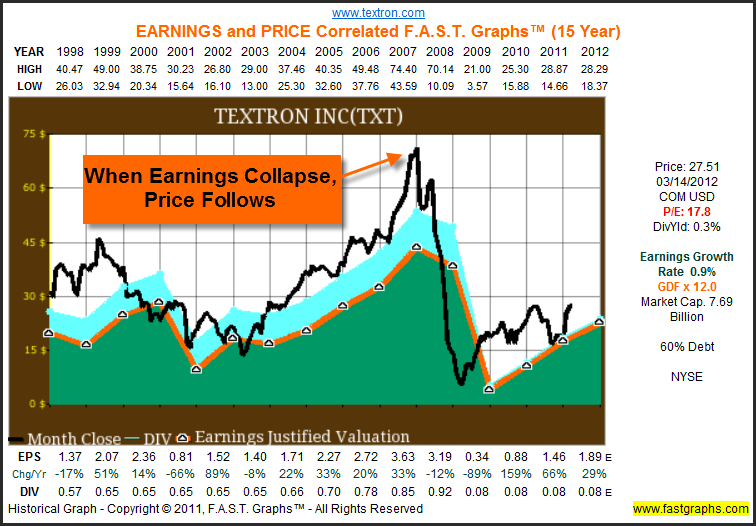

Example number three: Textron Inc. (TXT)

With our third example Textron Inc. (TXT), we again see the undeniable evidence of how stock price follows earnings over time. As an aside, the only reason the fit is not as perfect as the Caterpillar example for either Boeing Co. or Textron Inc. is because of the greater cyclicality we find with both these companies. The computer calculates earnings growth rates, but when you add in dramatic drops in earnings with dramatic increases in earnings, the averages can become somewhat skewed. Nevertheless, the earnings and price relationship remains profound.

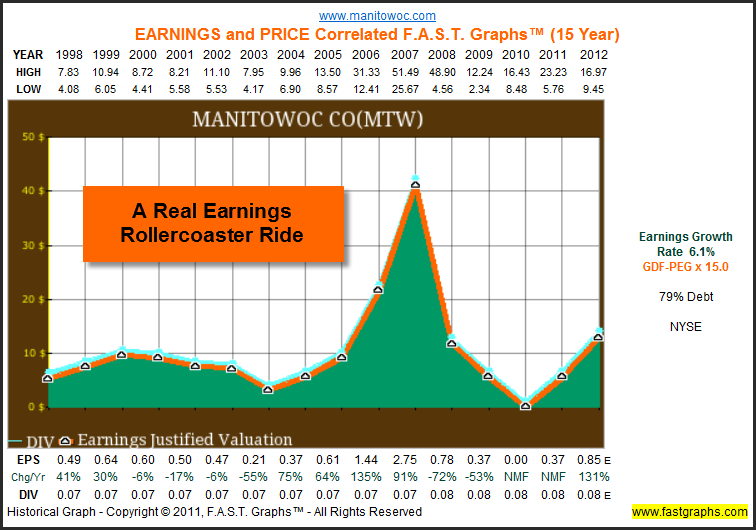

Example number four: Manitowoc Company (MTW)

Our final example, Manitowoc Company (MTW) provides a great summary and review of what we discussed so far. When you look at this company from the perspective of earnings only, we see a very dramatic picture where there is a huge increase in earnings followed by a huge collapse.

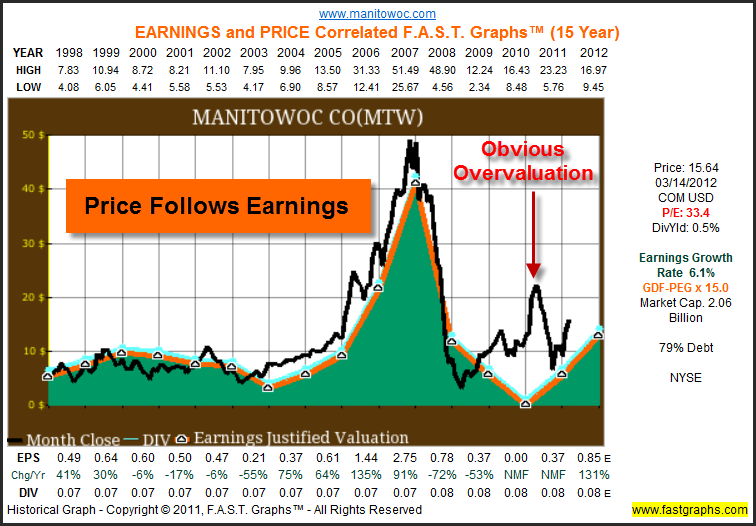

Then, when you bring stock prices into the equation, we once again see that stock prices very precisely follow earnings. We also see, by looking at 2011, that once stock price became disconnected from earnings (overvalued) they promptly reverted to the mean. Here was a case of excessive overvaluation that made no economic sense and how emotions determine market price eventually gave way to earnings determining market price.

Summary and Conclusions

The purpose of this article was several-fold. First of all, I wanted to clearly establish the importance of a comprehensive fundamental analysis before an investment decision in a specific company is made. I also wanted to establish that all fundamental metrics are important and contribute to the ability to determine the fair or intrinsic value of a publicly traded company. However, determining fair value from the perspective of the right market price to pay to buy a stock is a function of applying the appropriate PE ratio to reported earnings, and the recognition that once this is done, long-term rates of return are going to be a function of the company’s earnings growth rate achievement. Finally, my objective was to provide, what I believe to be, conclusive and undeniable evidence that this theory actually works under real-world conditions. Fair market value is clearly a function of earnings.

Up to this point, I have only established a historical perspective validating the importance of earnings in determining the fair price of a publicly traded business. In part two, I intend to move on to the much more important process of estimating fair value into the future. When looking at forecasting the future, I will discuss the relevance and importance of discounting future revenues back to the present value. But as I attempted to do in part one, I intend to refrain from explaining the complex mathematical formulas necessary to get that job done, and focus more on the essence and the philosophical practicability of these important future fair value calculations. Obviously, readers should expect less precision when forecasting the future, after all, a forecast is just that; a forecast. However, I intend to demonstrate that forecasts are more than just mere hunches or guesses. There are practical analytical methods that can be applied providing reasonable ranges of probability that can be effectively utilized when calculating the future potential viability and value of a business.

Disclosure: No positions at the time of writing

By Chuck Carnevale

Charles (Chuck) C. Carnevale is the creator of F.A.S.T. Graphs™. Chuck is also co-founder of an investment management firm. He has been working in the securities industry since 1970: he has been a partner with a private NYSE member firm, the President of a NASD firm, Vice President and Regional Marketing Director for a major AMEX listed company, and an Associate Vice President and Investment Consulting Services Coordinator for a major NYSE member firm.

Prior to forming his own investment firm, he was a partner in a 30-year-old established registered investment advisory in Tampa, Florida. Chuck holds a Bachelor of Science in Economics and Finance from the University of Tampa. Chuck is a sought-after public speaker who is very passionate about spreading the critical message of prudence in money management. Chuck is a Veteran of the Vietnam War and was awarded both the Bronze Star and the Vietnam Honor Medal.

© 2012 Copyright Charles (Chuck) C. Carnevale - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.