Apples Do Fall From The Trees, Now Not the time to Buy AAPL or Silver

Companies / Company Chart Analysis Mar 21, 2012 - 10:13 AM GMTBy: Ned_W_Schmidt

Question we are pondering today is whether or not investors do learn from their prior mistakes. Small children learn lessons, such as not to touch the hot stove again. They remember that lesson all of their lives. Humans spend a considerable part of their lives learning and remembering such lessons. However, when some well learned children grow into investors they seem to develop a mental block that prevents learning. Chart below of the price of Apple's stock over the past year suggests that something, perhaps it is greed, has interfered again with the learning process. Trees do not grow to the sky, and apples do ultimately fall from the trees.

Question we are pondering today is whether or not investors do learn from their prior mistakes. Small children learn lessons, such as not to touch the hot stove again. They remember that lesson all of their lives. Humans spend a considerable part of their lives learning and remembering such lessons. However, when some well learned children grow into investors they seem to develop a mental block that prevents learning. Chart below of the price of Apple's stock over the past year suggests that something, perhaps it is greed, has interfered again with the learning process. Trees do not grow to the sky, and apples do ultimately fall from the trees.

Source: yahoo.com

AAPL was launched onto a parabolic price rise beginning last Fall. That condition exists when the slope of the price line becomes steeper. In the real world if we throw an apple into the sky the momentum of that apple slows until such point that gravity becomes the more dominant force. In a parabolic stock pattern that natural phenomenon is overcome by greed. As the stock price rises it begins to rise at a faster rate in defiance of the rules of common sense and gravity.

Precious metal investors, or at least some of them, have learned a lot in the past year or so. In particular, they learned about the ramifications of ignoring such a pattern. Silver rose in such fashion, and subsequently crashed by ~45%. While that development was expected, many chose to ignore it. They chose that behavior because they had not yet learned what is known about such patterns. First, no adequate tool exists to determine when the price at which failure will occur. Second, that pattern always leads ultimately to severe pain, as Silver investors discovered.

In reading a portion of the many words written this past week we learned that the upside for AAPL's business is unlimited. Just as Polaroid and Xerox had unlimited potential to sell their innovative products in their time, so too is the view of AAPL today. That optimism has led AAPL to become the most valuable U.S. company.

That situation suggests several questions. Should a company that essentially sells electronic toys be the most valuable company? Have investors forgotten that all technological innovations are ultimately priced as commodities? Did investors learn nothing in the internet/technology or mortgage bubbles? What do the lessons of Silver suggest for AAPL? Silver collapsed by ~45%. That suggests that AAPL will sell at far less than $400 before the end of the year.

We chose our topic today not simply because of the importance of learning, but also that one of the reasons for AAPL's rise is also the reason that Gold and Silver have rallied since last Fall. Paper equities have rallied dramatically since because of the continued offering of free money by central banks in response to the financial failure of Keynesian theology in Greece. Worry over the ramifications of hat event led to the repatriation to the U.S. of massive amounts of dollars from the EU and an equally massive injection of liquidity by the ECB. That money fuel pushed up paper equities, inflated the AAPL bubble, and pushed Gold and Silver into a rally.

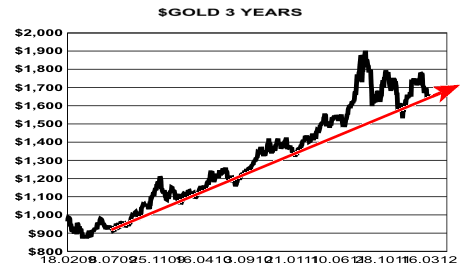

In the above chart on $Gold the parabolic rise such as the one now unfolding in AAPL can be observed. Many ignored the warnings from that pattern, and $Gold plunged to near $1,500. The recent rally from the Fall low, fueled by cheap money, has now failed. $Gold has now failed to rise above the previous high twice and has violated the previous low. That pattern suggests that previous low must be tested. While the pain of that development will be felt by owners of Gold, Silver will be where the true pain will be felt. Now is not the time to buy either AAPL or Silver!

By Ned W Schmidt CFA, CEBS

Copyright © 2011 Ned W. Schmidt - All Rights Reserved

GOLD THOUGHTS come from Ned W. Schmidt,CFA,CEBS, publisher of The Value View Gold Report , monthly, and Trading Thoughts , weekly. To receive copies of recent reports, go to www.valueviewgoldreport.com

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.