Gold Market Sentiment Very Poor Despite Strong Fundamentals

Commodities / Gold and Silver 2012 Mar 21, 2012 - 06:59 AM GMTBy: GoldCore

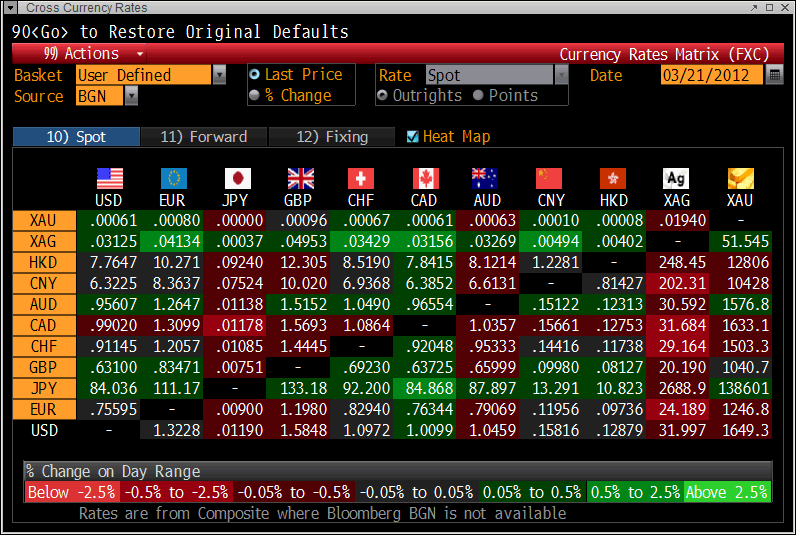

Gold’s London AM fix this morning was USD 1,656.00, EUR 1,248.21, and GBP 1,042.95 per ounce.

Gold’s London AM fix this morning was USD 1,656.00, EUR 1,248.21, and GBP 1,042.95 per ounce.

Yesterday's AM fix was USD 1,648.50, EUR 1,248.86 and GBP 1,039.01 per ounce.

Cross Currency Table – (Bloomberg)

Gold fell 0.89% in New York yesterday and closed at $1,650.80/oz. Gold edged higher in Asia and ticked slightly higher before falling in Europe this morning where gold is now trading at $1,649.30/oz.

The weak dollar helped the buying strength in Asia but a drop in physical demand and hopes for the US economic recovery limited gains.

The US housing data figures reaffirmed hopes that the US economy is improving. Some investors have closed out positions in order to buy more risky high yielding assets.

Still stubbornly high oil prices are bullish for gold but have not led to higher gold prices so far.

Gold Market Sentiment Very Poor Despite Strong Fundamentals

Risk appetite remains high as seen in equity indices near record highs and gold more than 15% below its recent record high (nominal).

The fragile US economic recovery remains close to lapsing into a recession which would see a reversion to QE and currency debasement.

Similarly, the Eurozone debt crisis is nowhere near being solved and the risk of contagion remains - whether that be from Greece or from Portugal, Spain or Italy or a combination thereof.

The risk of the global debt crisis leading to an international monetary crisis or currency crisis remains and is underestimated - in the same way that the debt bubble was underestimated.

Geopolitical risk remains high with instability throughout much of North Africa and the Middle East and the risk of a military confrontation between Israel and Iran.

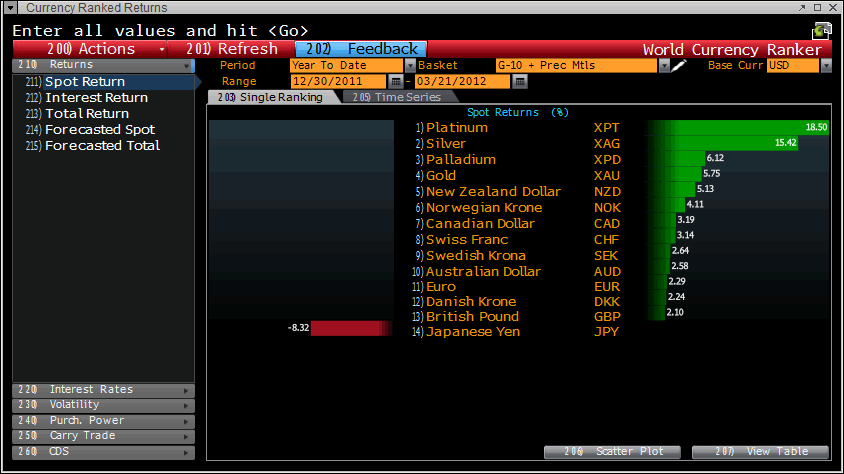

Currency Ranked Returns - (Bloomberg)

Competitive currency devaluations continue and the Japanese remain ahead of the curve in the currency wars as the stealth devaluation of the yen continues.

The yen has fallen by more than 7% against the euro, 9% against the dollar and 13% against gold year to date - in less than 11 weeks.

Despite the favourable macroeconomic, monetary, systemic and geopolitical fundamentals - sentiment in the gold market remains lukewarm - especially among the retail public and media in western markets.

There remains scant media coverage of the gold market in the non specialist financial press and media and what coverage there is tends to be quite negative.

Gold’s long term diversification value and benefits continue to be almost completely ignored in favour of simplistic assertions from gurus and a superficial focus on gold’s recent nominal price action.

Short term speculators and weak hands have again been washed out of the paper market on the recent sell off and some are even short now due to the poor technicals.

However, some banks are viewing this correction as an opportunity to buy the dip (see Other News yesterday and today).

Coin and bar demand has been lacklustre in recent days and weeks and indeed there has been a degree of nervous selling by some bullion owners. This is something we have hitherto not seen in this gold bull market.

Asian demand has also been quite slow and despite the sell off with Indian and Chinese demand slower recently, while demand from Thailand and Indonesia continues.

Asian consumer and "social security" gold demand does not appear to be the primary driver of the market place today.

Rather, central bank demand is likely providing the fundamental support to the market as emerging market central banks continue to quietly accumulate gold tonnage on price weakness either directly or through the Bank of International Settlements (BIS) as reported by the FT last week.

Those seeking to protect and grow their wealth in the coming months and years would be wise to emulate central banks and reduce counter party risk and diversify their wealth with an allocation to gold.

Bernanke’s Lack of Nuance on Gold Standard

Federal Reserve Chairman Ben Bernanke spoke at George Washington University yesterday in his first of four public lectures about the financial crisis.

The former Princeton economics professor speaks again on Thursday and twice next week in an effort to create some positive spin on his handling of the US financial crisis.

In his first lecture he dismissed proponents of the gold standard, saying that such a system limits the government's ability to address economic conditions.

"Since the gold standard determines the money supply, there is not much scope for the central bank to use monetary policy to stabilize the economy," Bernanke said.

"Under a gold standard, typically the money supply goes up and interest rates go down in a period of strong economic activity - so that's the reverse of what a central bank would normally do today."

Ironically, it is monetary policies of recent years that have contributed to this financial crisis and a quasi gold standard may have led to more prudent monetary and fiscal policies.

Proponents for a gold standard such as Republican presidential candidate Ron Paul, advocate the closure of the central bank and a return to a gold standard where every dollar issued must be backed with equivalent reserves of precious metal.

Fed critics rightly point out how Greenspan and then Bernanke let the housing bubble and debt bubble (including subprime) balloon out of proportion. The other criticism and warning is that continually ultra loose monetary policies and QE (overnight interest rates near zero since 2008 & $2.3 trillion in bond purchases) will lead to dollar debasement and the pain of inflation for consumers in the coming months.

Bernanke did not touch on the economy or monetary policy but did note that he will not rush to undo the Fed’s QE

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.