Full Steam Ahead for China Railroad Stocks

Stock-Markets / China Stocks Mar 20, 2012 - 12:45 PM GMTBy: Frank_Holmes

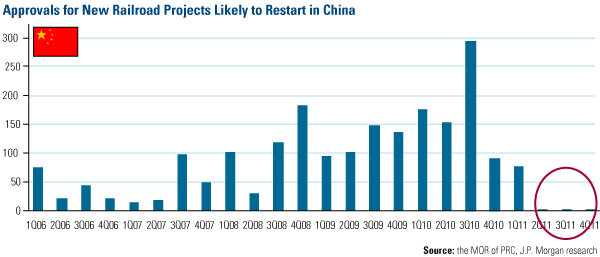

China's economic engines of growth have begun to accelerate again, but you wouldn't know it by looking at the chart below. After approvals for new railroad projects spiked to a five-year high in the third quarter of 2010, the number of new plans slowed, then completely halted throughout 2011, decreasing 89 percent by value, says J.P. Morgan.

China's economic engines of growth have begun to accelerate again, but you wouldn't know it by looking at the chart below. After approvals for new railroad projects spiked to a five-year high in the third quarter of 2010, the number of new plans slowed, then completely halted throughout 2011, decreasing 89 percent by value, says J.P. Morgan.

There were multiple reasons for the slowdown in railroad construction, says BCA. A bullet train crash caused heightened concern for safety last summer. Also, the government intentionally delayed projects as it pulled the brakes to decelerate growth and curb inflation.

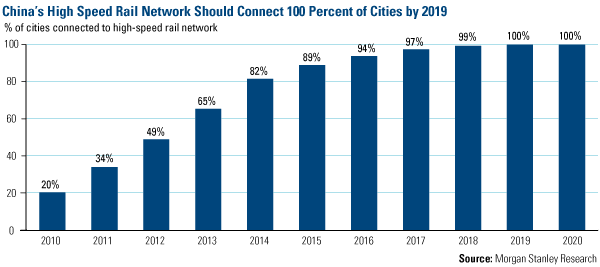

Since China received signs of slowing inflation over the past few months, it can now shift its attention toward growth. Recent policies are sending a "full steam ahead" message to railway investment. According to J.P. Morgan, in December and January, China announced tax benefits on interest income for railway bondholders, issued bonds for railway projects, and injected cash into the two largest train makers. This concerted effort should help the country meet its long-term goal to connect 100 percent of cities with a network of high-speed rail.

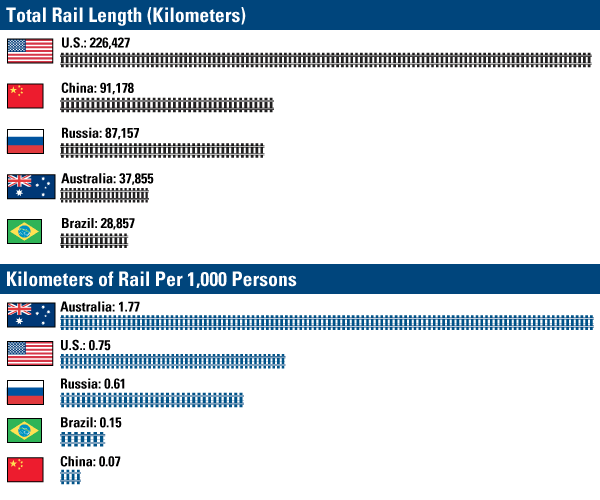

CLSA's Andy Rothman and I will be discussing in greater detail the development of China's infrastructure system and consumer demand during our webcast, Navigating China's Transition to a Consumer-Driven Economy, on April 5. Over the past two decades, China's railway system has come a long way very quickly, with track length increasing 50 percent since 1995, says BCA. However, demand has increased at a faster rate, though, as "passengers travelling on the country's railway system per year doubled during the same period, while railway freight increased by 150 percent," says BCA.

And, on a per capita basis, China's rail length is much lower than most major economies, according to BCA Research. When you compare the total length of railways in developed and emerging markets, Australia has the most rail per capital, with 1.77 kilometers of railway per 1,000 persons; Brazil has considerably less, with only 0.15 kilometers of rail track per 1,000. However, as you can see below, China lands in last place for the total length of railway per capita.

Although China has been busy constructing its railways over the past few years, this comparison shows that this infrastructure buildout has been more of a "catch-up process," rather than an "overshoot," says BCA.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

For more updates on global investing from Frank and the rest of the U.S. Global Investors team, follow us on Twitter at www.twitter.com/USFunds or like us on Facebook at www.facebook.com/USFunds. You can also watch exclusive videos on what our research overseas has turned up on our YouTube channel at www.youtube.com/USFunds.

By Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors

U.S. Global Investors, Inc. is an investment management firm specializing in gold, natural resources, emerging markets and global infrastructure opportunities around the world. The company, headquartered in San Antonio, Texas, manages 13 no-load mutual funds in the U.S. Global Investors fund family, as well as funds for international clients.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (HUI) is a modified equal dollar weighted index of companies involved in gold mining. The HUI Index was designed to provide significant exposure to near term movements in gold prices by including companies that do not hedge their gold production beyond 1.5 years. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

Frank Holmes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.