India Investing: How to Play the Pullback

Stock-Markets / India Mar 19, 2012 - 09:40 AM GMT India is a global business hub that consistently ranks as one of the world’s fastest-growing economies. From its dense, over-crowded metropolitan centers to its dirt-road villages and sparsely populated outreaches, India is a hotbed of diversity, culture and innovation.

India is a global business hub that consistently ranks as one of the world’s fastest-growing economies. From its dense, over-crowded metropolitan centers to its dirt-road villages and sparsely populated outreaches, India is a hotbed of diversity, culture and innovation.

India also has been one of the world’s top emerging markets in 2012, which has prompted investors to take some profits off the table.

Indian equities aren’t as cheap as they were in late 2011. But there’s room for upside, should company earnings meet or exceed low expectations. A new earnings upgrade cycle could propel this Asian stock market higher, absent a huge surge in oil prices.

That being said, a clear slowdown in India’s economy invites questions about the sustainability of the market’s upward trend, particularly in light of elevated oil prices.

Expensive crude is a sticking point for India because the government still subsidizes fuel, an effort equivalent to 1.3 percent of gross domestic product (GDP). Higher oil prices exert inflationary pressures on the Subcontinent, although the impact, at least at the headline statistical level, is mitigated by the fact that oil accounts for only 10 percent of the country’s inflation basket.

Still, India’s relatively weak fiscal and current account positions—3 percent and 6 percent of GDP, respectively— make higher oil prices a legitimate worry that can’t be ignored.

Inflation, historically a problem for India, has improved. The latest numbers show that inflation grew 6.6 percent in January, down from 7.5 percent in December. Moderating food prices and softer demand have combined to cage the inflation beast. If inflation remains contained, the Reserve Bank of India will be more comfortable cutting rates and lowering reserve requirements to support economic growth.

India’s government debt is about 71 percent of GDP. Financing this debt remains a dilemma, one made only more difficult by higher oil prices. Ninety percent is owed to domestic creditors, which means India is relatively immune to the whims of foreign investors.

Encouragingly, India’s typically fractious politicians have set aside their differences long enough for the central government to fast-track power- related infrastructure projects in an effort to jump-start an investment cycle and push economic recovery.

The Indian economy is oriented toward domestic demand, buttressed by steadily rising incomes and a relatively healthy banking system. The population is growing rapidly, and the exploding Indian middle class is quickly becoming brand-conscious and purchasing more modern amenities.

India also is home to growing ranks of technology-savvy, collaboration- minded young professionals who are infusing the old school methods of business with fresh thinking. They grasp the nuances of outsourcing methodologies, combining their insights with high levels of education and an excellent command of English. Indian business leaders are developing a reputation as globally focused, pragmatic and conscientious.

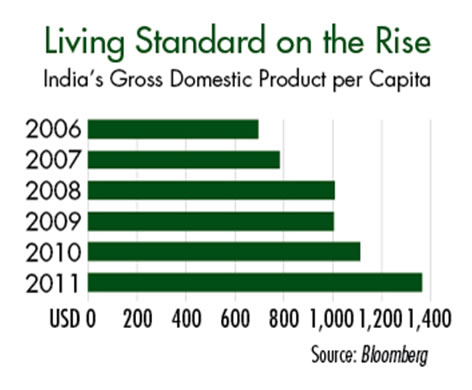

Per capita income has almost doubled since 2006 and is expected to reach $2,000 sometime in the next three years. (See “Living Standard on the Rise.”) As a result, services now represent about 59 percent of GDP and employ around 25 percent of the population. Given that exports remain on the back burner, any prolonged failure to reignite domestic demand could have serious consequences for India’s short- and medium-term future.

HDFC Bank (Mumbai: HDFCB, NYSE: HDB) is one of India’s biggest private banks, with 2,200 branches and 15 million retail clients. It’s among the top two or three players in all consumer loan segments except mortgages. Although HDFC Bank’s stock trades at a premium to its peers, the financial institution’s strong domestic position and its consistent delivery of solid operating results warrant a higher valuation.

HDFC Bank is a big beneficiary of demographics: India is a nation of young people with rising incomes who are driving consistent domestic demand. The company has substantial room to grow in a financial services market that remains remarkably underpenetrated.

Most of HDFC Bank’s new branches are located outside metropolitan regions that are ripe for service by the banking industry. HDFC Bank and others have turned a regulatory mandate into opportunity, because it has allowed them to attract more accounts from smaller towns. About 62 percent of the firm’s branches are now outside India’s nine biggest cities.

I consider HDFC Bank as a top growth stock. It is one of Asia’s best- run financial institutions, and management has a strong track record of producing steady growth without incurring excessive risk.

By Yiannis G. Mostrous

Editor: Silk Road Investor, Growth Engines

http://www.growthengines.com

Yiannis G. Mostrous is an associate editor of Personal Finance . He's editor of The Silk Road Investor , a financial advisory devoted to explaining the most profitable facets of emerging global economies, and Growth Engines , a free e-zine that provides regular updates on global markets. He's also an author of The Silk Road To Riches: How You Can Profit By Investing In Asia's Newfound Prosperity .

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.