Is There a Bubble in U.S. Treasury Bonds?

Interest-Rates / US Bonds Mar 19, 2012 - 09:31 AM GMTBy: Mike_Shedlock

... Explaining the 2011 Treasury Rally (It's Not What You Think); Where to From Here?

... Explaining the 2011 Treasury Rally (It's Not What You Think); Where to From Here?

People have been calling a bubble in treasuries for at least a decade. The shocking result, especially to hyperinflationists, has been a stair-step decline in yields for 30 years. That's quite a long time.

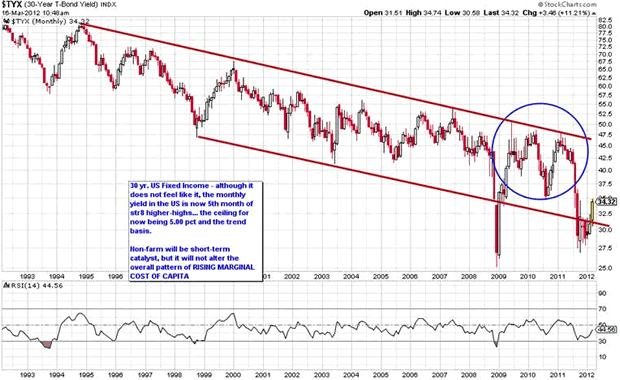

Here is a chart going back 20 years from Steen Jakobsen at Saxo bank in Denmark.

$TYX 30-Year Long Bond

Operation Print-Money-Like-a-Madman

Via email, Steen writes

I think higher interest rates are for real, and not a fluke.

The move down in US yields below its long-term channel was an unusual move - as can be seen in the above chart - 30 year US has been in solid down-ward slopping channel since 1980s. There have now been two breaks to the down-side: One in 2009 when the stock market crashed to 666 in the S&P - and now since 2011, when Fed initiated Operation Print-Money-Like-a-Madman with QE, QEII and Operation Twist plus "low rates forever".

These moves were the exception not the norm, a function of the "unconventional measures" all the central banks has been pointing to forever.

We are entering an extremely dangerous period. Valuations are stretched, even my internal bull, Peter Garnry is getting conservative. The divergence is bigger and bigger - actually to me this is beginning (on charts) to look at lot like end of 2007 into 2008.

Let's hope I am wrong, again, and this is merely a pause before the world is saved and we can all believe that more debts creates growth and reforms.

Bubble of Modern Banking

I happen to agree with Steen in his implied suggestion the world is not saved, but that is not the same as a treasury bubble (and Steen did not use that word).

However, James Grant, publisher of Grant's Interest Rate Observer is willing to state flat out that treasuries are a "Bubble of Modern Banking, a Desert of Value".

In case you missed it, please click on the above link to see an interesting Bloomberg video with James Grant and Deirdre Bolton. Here is a key transcript snip.

Deirdre Bolton: How is a bond investor to deal with this current environment? You are calling actually for a bear market in bonds, am I correct?.

Grant: I have forever. So I am no help there. But it seems to me a bond investor is almost better off in cash. If you were to go out 10 years in a US treasury security you earn yield of approximate 2%. To remain in cash and be flexible you sacrifice those 2%. The bond market is a desert of value.

Deirdre Bolton: What does this mean for gold?

Grant: The price of gold is the reciprocal of the world's faith in the deeds and words of the likes of Ben Bernanke. The world over, central banks are printing money as it has never been printed before. The European Central Bank has increased the size of its balance sheet at the annual rate of 89%. It's amazing. The Fed is far behind at only 15%. The Bank of England 67% over the past few months. These are rates of increases in the production of paper currencies we have never seen in the modern age. It takes no effort at all. They simply tap the computer screen.

Recession 2012 Means Lower Treasury Yields Says Lacy Hunt

I certainly agree with Grant on gold, but what about the idea a recession is coming in 2012, and if so what does it mean for treasuries?

Lacy Hunt at Hoisington Management in the 4th quarter 2011 review says High Debt Leads to Recession. It's the last paragraph that is of most interest to the treasury bubble debate.

The long end of the Treasury market witnessed a decline in yields from 4.34% at the beginning of 2011 to 2.89% at the end of the year. To most, this 35% return was a surprise as there was near unanimity of opinion that rates would rise in connection with the higher real economic growth rate that was expected for 2011. Similarly, faster growth seems to be embedded in most rate expectations for 2012, and concomitantly expectations are for interest rates to rise. If recessionary conditions appear in 2012, as we expect, then even lower long-term interest rates will be recorded.

Van R. Hoisington Lacy H. Hunt, Ph.D.

There you have it, Lacy Hunt one of the biggest treasury bulls you can find vs. James Grant a perpetual treasury bear. Let's step back a bit and look at the last 10 years.

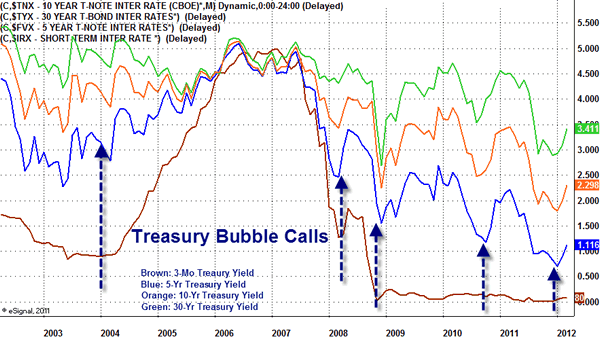

Treasury Bubble Calls

$IRX 3-month treasuries $FVX 5-year treasuries $TNX 10-year treasuries $TYX 30-year treasuries

Except for the 30-year long bond (and that divergence could be significant), the rest of the yield curve has made lower lows for 30-years. Eventually that trend will break, but is this the time and are interest rates really as low as people think?

Explaining the 2007-2011 Treasury Rally

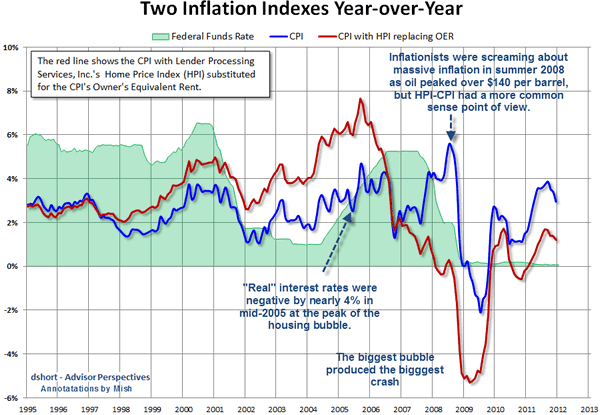

With the above, albeit lengthy, introduction let's take a look at some housing related charts. Yes, at long last this is the second half of my Home Price Index Post How Far Have Home Prices "Really" Fallen? HPI Upcoming Changes; HPI and the CPI

To quickly recap, I asked Doug Short at Advisor Perspectives to make a housing related change to the CPI. Specifically, I asked to see a chart of "real" inflation adjusted yields, were the BLS to substitute actual home prices in the CPI for Owners-Equivalent-Rent (OER).

If you missed the post you certainly need to read it to understand what follows, and you may need to take another look even if you have seen it.

Here is one of four charts from that post.

HPI-CPI

The Fed kept interest rates at historic lows between 2002 and mid-2004. The last two rate cuts by Alan Greenspan were not justified at all, by any measure, and downright absurd considering the bubble brewing in housing prices vs. rent.

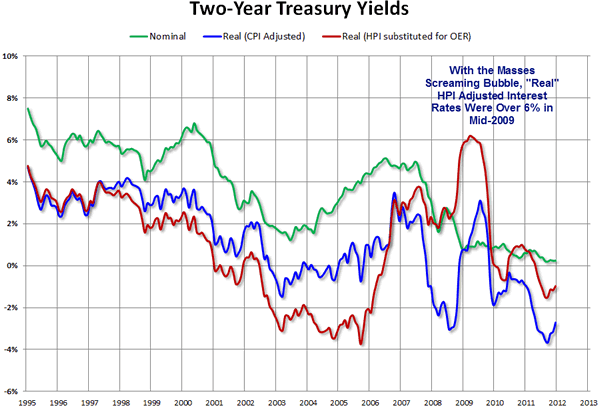

Two Year Treasury Yields

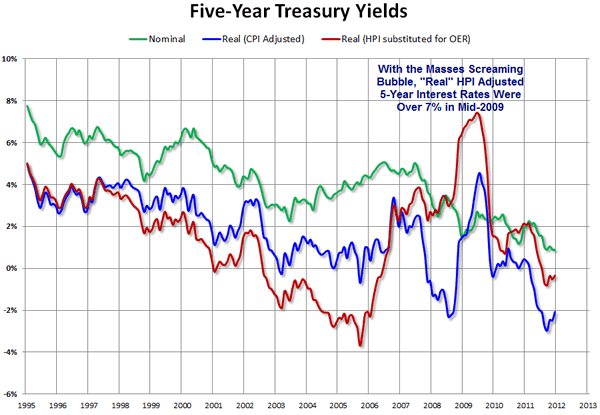

Five Year Treasury Yields

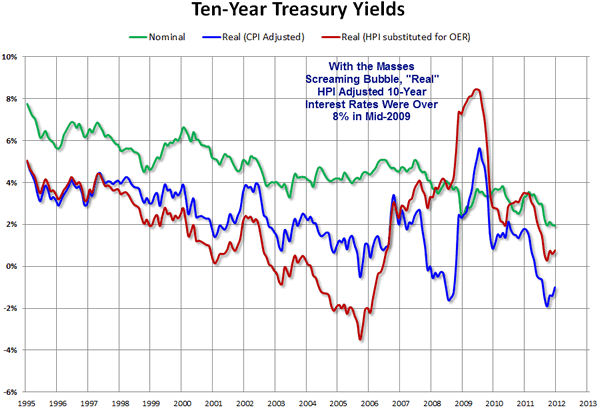

Ten Year Treasury Yields

"Operation Twist" Unwinds

Those three charts explain nicely the massive rally in treasuries since 2007. Global central bank printing, various QE and "Operation Twist" moves certainly helped, but "real" yields were far higher than most thought.

For a discussion of "Operation Twist" and the recent rise in treasury yields, please see Treasuries Hammered as "Operation Twist" Unwinds; Another Triumph of the 1% Over the 99%.

Note that HPI-Adjusted rates are still positive on the 10-year treasury note. Is this the making of a bubble?

The answer of course depends on the definition of bubble. That said, Grant is certainly correct that treasuries are devoid of value. Moreover, a 30-year rally in treasuries is quite long in the tooth. There is no value here.

Where to From Here?

Even if the 30-year long-bond does nothing more than rise to the top of that channel shown in the first chart, treasury holders will be massacred.

If the recovery is real (I do not think it is, others do), yields should rise to the top of that channel at a minimum, probably sailing even higher.

Moreover, it's certainly possible rates go sailing even if the recovery is not real. Should that happen, the US dollar will likely strengthen as well. Those are the two key take-aways at this juncture.

One thing is certain. Treasury bubbles sure take a heck of a long time to form, with many premature calls along the way.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2012 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.