U.S. Treasury Bond Market Sell Off

Interest-Rates / US Bonds Mar 18, 2012 - 03:44 PM GMTBy: Tony_Pallotta

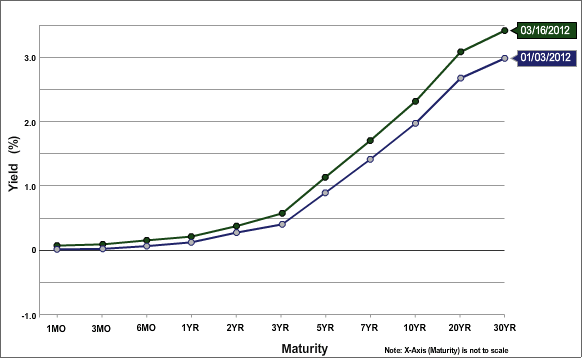

Slightly off topic Macro View this week as I really want to study the movement in treasury. The 10 year treasury yield is currently 2.30% which from an historical standpoint is very low. But a 33 basis point rise in one week is significant (100 basis points equal 1%). If the sell off in treasury accelerates things can get out of hand in very short order.

Slightly off topic Macro View this week as I really want to study the movement in treasury. The 10 year treasury yield is currently 2.30% which from an historical standpoint is very low. But a 33 basis point rise in one week is significant (100 basis points equal 1%). If the sell off in treasury accelerates things can get out of hand in very short order.

Already 30 year fixed rate mortgages have moved higher. These rates are also at historic lows but a fragile economy and housing market cannot handle much of a rise especially one as sharp as witnessed this week. The US rolls its debt between 4-5 years so a simple 50 bp point rise in five year yields equates to $75 billion in additional annual debt service.

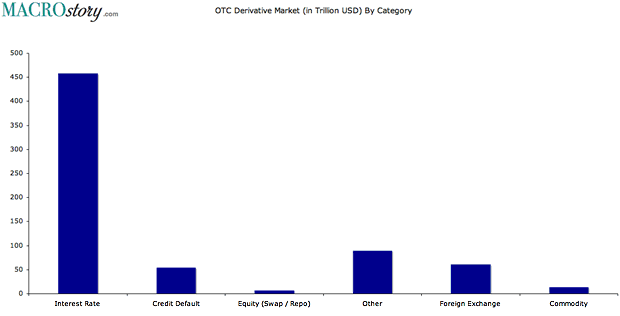

Probably the most significant danger from rising rates is that to interest rate swaps, a derivative product that allows two parties to trade fixed for adjustable rates and vice versa. This is no small market. In fact in the first half of 2011 $100 trillion in additional swaps were sold. On their own interest rate derivatives are twelve times the size of the global economy.

The banks who wrote these contracts did so in a low interest rate environment. Such as ZIRP through 2014. If rates were to rise they would be on the wrong side of a truly massive trade and unable to meet their obligations.

(The above chart is through 2010)

When Operation Twist was formally announced in late September 2011 the common thought is it would flatten the yield curve which would be a negative for the banking sector. That premise was accurate as the spread between the 5 and 30 year maturities fell from 241 basis points (2.41%) on September 22, 2011 to 228 bp as of March 16, 2012.

But this selloff in treasuries is changing the shape of the curve. Since the first of the year the yield curve has steepened by 19 bp from 209 bp. One could argue that is a positive as a steeper yield curve encourages credit formation. But the problem is the yield curve is steepening because long term rates are rising something the economy simply cannot afford.

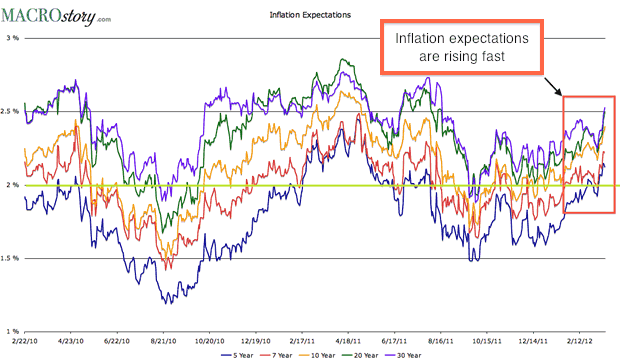

So perhaps the Fed needs to begin another round of asset purchases and drive down long term rates. Problem is look at the inflation expectations as measured by treasury TIPS (Treasury Inflation Protected Securities). It is rising fast and well above the 2% target rate.

In other words inflation is becoming a bigger threat versus deflation that preceded all other long term asset purchase programs. Another round of asset purchases will not only "fuel oil prices" and crush the economy but further increase inflation which on its own will decrease demand.

Bottom Line is this selloff in treasury cannot be allowed to continue much longer. The Fed can control the short end of the curve through ZIRP but the long end they simply have little control over. I have stated many times that the biggest threat to the US is not terrorism or Iran acquiring nuclear weapons but rather rising yields.

From an historic standpoint yields are very low and there is no reason to worry but the rate of this rise will not afford much inaction. In fact in a world where the amount of sovereign debt supply is growing faster than private capital higher yields may be necessary to simply attract capital. 2012 is the year of being able to sell sovereign debt even if that means equity prices must fall.

By Tony Pallotta

Bio: A Boston native, I now live in Denver, Colorado with my wife and two little girls. I trade for a living and primarily focus on options. I love selling theta and vega and taking the other side of a trade. I have a solid technical analysis background but much prefer the macro trade. Being able to combine both skills and an understanding of my "emotional capital" has helped me in my career.

© 2012 Copyright Tony Pallotta - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.