U.S. Student Debt To Reach $1.4 Trillion by 2020

Interest-Rates / Student Finances Mar 14, 2012 - 03:01 AM GMTBy: EconMatters

Student loan debt is surging, partly boosted by many who became unemployed during the Great Recession going back to school hoping for a better job prospect. An analysis by the Federal Reserve Bank of New York (FRBNY) showed that student loan debt stands at $870 billion nationally, surpassing the nation’s outstanding balance on auto loans ($730 billion) and credit cards ($693 billion) as of third quarter, 2011.

Student loan debt is surging, partly boosted by many who became unemployed during the Great Recession going back to school hoping for a better job prospect. An analysis by the Federal Reserve Bank of New York (FRBNY) showed that student loan debt stands at $870 billion nationally, surpassing the nation’s outstanding balance on auto loans ($730 billion) and credit cards ($693 billion) as of third quarter, 2011.

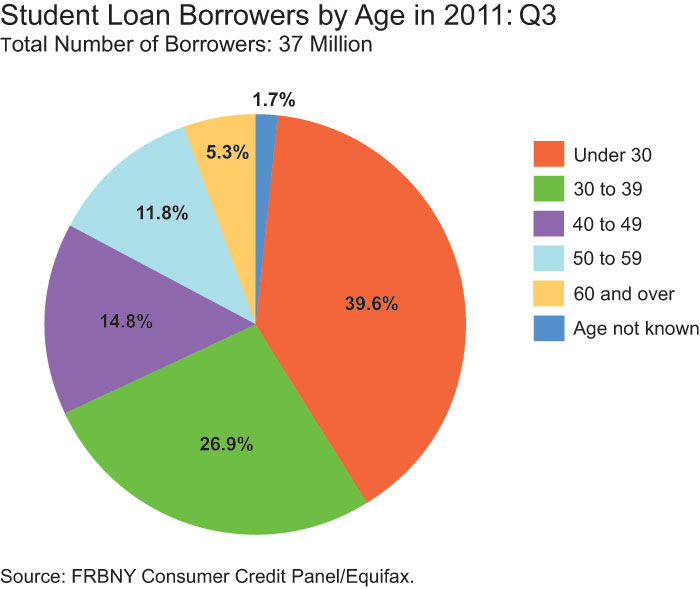

Of the 37 million borrowers who have outstanding student loan balances, 14.4%, or about 5.4 million borrowers, have at least one past due student loan account. Together, these past due balances sum to $85 billion, or roughly 10% of the total outstanding student loan balance.

However, the majority of total lending comes from federally backed loans, whose repayment is deferred until the student graduates from school and can then be pushed back by another six-month grace period. So since no payment is due until graduation, these deferred student loans, although included in the total balance, are excluded from the calculation of past due balance. FRBNY estimated that as many as 47% of student loan borrowers appear to be in this bracket. To adjust for this distortion, FRBNY did an estimate by excluding this class of borrowers, and found 27% of the borrowers have past due balances, while the adjusted proportion of outstanding student loan balances that is delinquent is 21%.

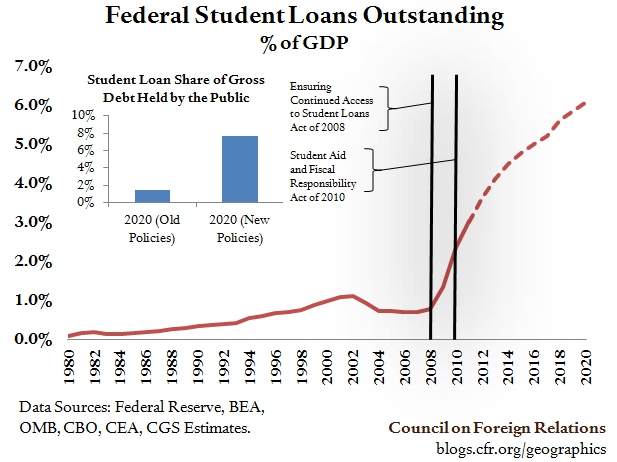

A couple of new laws in 2008 and 2010 has made the U.S. government the sole supplier of Federal student loans, rather than just the ultimate guarantor. That means student loan is now part of the gross U.S. national debt.

Falling state government support for public higher education has put pressure on public universities and colleges to raise tuition and reduce the education quality. Federal aid is also running dry. For example, Federal loan subsidies for graduate students will seize in July 2012. Those federally subsidized Stafford loans for graduate students, which used to not accrue interest until after graduation, will start accruing interest at a fixed rate of 6.8% while borrowers are still in school. Furthermore, with globalization and rising total labor supply, a college degree can no longer guarantee a high wage needed to pay down student loan.

These factors could conspire to form a vicious cycle pushing student debt higher and higher. Council on Foreign Relations (CFR) projected the outstanding direct federal student loan will reach $1.4 trillion by 2020 representing roughly 7.7% of gross debt. This is 6.3 percentage points higher than it would have been had the scheme not been nationalized (See Chart Below).

And according to a recent survey by the National Association of Consumer Bankruptcy Attorneys, more than 80% of bankruptcy lawyers have seen a substantial increase in the number of clients seeking relief from student loans in recent years.

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2012 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.