European Countries Lining Up to Debt Default

Interest-Rates / Eurozone Debt Crisis Mar 13, 2012 - 06:56 AM GMTBy: John_Mauldin

Today's Outside the Box comes to us from Grant Williams, who covers the world from his perch in Singapore, in his always instructive and always entertaining Things That Make You Go Hmmm... I felt for him right at the outset today, because (like yours truly) he was trying really hard ... not to talk about Greece.And so, he announced, he was going to talk about Spain and about oil; but then, before he even made it through his opening paragraph, there was this:

Today's Outside the Box comes to us from Grant Williams, who covers the world from his perch in Singapore, in his always instructive and always entertaining Things That Make You Go Hmmm... I felt for him right at the outset today, because (like yours truly) he was trying really hard ... not to talk about Greece.And so, he announced, he was going to talk about Spain and about oil; but then, before he even made it through his opening paragraph, there was this:

"... ahhhh NUTS! They did it AGAIN.... ok... the Greek restructuring. It's not as though I could ignore it, now, is it? ... Oil can wait until next time.... no doubt it'll be an issue then too."

But he's determined to talk about Spain ... so let's talk about Spain. But ... (What is this? Why is Greece such a strange attractor?) on his way to the pain that falls mostly on the plain in Spain, Grant just can't help sharing with us this wry factoid:

"... some 2,400 years after 10 Greek municipalities became the first sovereign entities to default when they stiffed the temple of Delos, birthplace of Apollo."

But Spain, Grant! Yes:

"Spain's GDP of $1.4 trillion, somewhat surprisingly perhaps, puts it just behind oil-rich Russia and Canada and people-rich India. Spain is a big country. Spain matters.

"Spain is now about to become the country everyone cares about all over again and, when the world's focus returns to the Iberian Peninsula, it will realise that the large, grey shape in the corner of the room was a Spanish elephant."

Spain's public debt-to-GDP ratio is a relatively appealing 68%, Grant notes (that's just a little over half of Italy's, at 120%), but here's the rub:

"As manageable as Spain's public debt would appear to be at face value, her private debt is an altogether different story – standing at a staggering 227% of GDP and, according to McKinsey, Spanish corporations hold twice as much debt relative to their output as US companies and, in comparison to Germany, that number goes up to six times....

"As Spain reduced its deficit in accordance with the EU's Growth & Stability Pact, it meant an increasing reliance on private debt was needed in order to prolong the enormous construction boom that had been ongoing in Spain since the 1970s but which really picked up steam in the 90s and 00s. The outcome of that reliance? A tripling of average household debt."

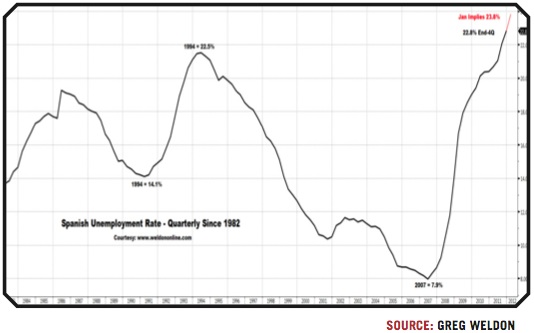

Throw in the part about the Spanish unemployment rate skyrocketing toward the 25% mark this year (and twice that for those under 25) and the bit where the new Spanish prime minister, Mariano Rajoy, draws a line in the sand by unexpectedly announcing that his government's budget deficit would be 5.8% of GDP in 2012, more than 30 percent higher than the 4.4% agreed on with his supposed masters in Brussels, and we have all the makings for quite a spicy little paella.

But stop reading at about the middle of page 10 if you just don't think you can stomach another helping of spanakopita.

I did something rather fun this morning. The wonderful people at the Commonfund were kind enough to invite me and my co-author of Endgame, Jonathan Tepper, who lives in London, to update their attendees on the sovereign-debt crisis we predicted in our book. This was the first time we had done a full-on presentation together. It was fun and came off rather well, and I think the attendees appreciated our combined views. We both agreed we need to do it more. Jonathan is a very brilliant young man. He makes me look good (I will take whatever help I can get). Enjoy the week!

Your losing my taste for Continental cui$ine analyst,

John Mauldin, Editor

Outside the Box

JohnMauldin@2000wave.com

European Countries That Make You Go Hmmm...

Grant Williams, March 12

"... the Spain which emerged around 1960, beginning with its economic miracle, created by the invasion of tourists, can no longer result in impassioned dedication on the part of its intellectuals, and even less on the part of foreign intellectuals."

– JUAN GOYTISOLO

"In order to fully realise our aspirations, we must create in the masses of the people the sense of sacrifice and responsibility that has been the characteristic of the anarchist movement throughout its historic development in Spain."

– FREDERICA MONTSENY

"It is we the workers who built these palaces and cities here in Spain and in America and everywhere. We, the workers, can build others to take their place. And better ones! We are not in the least afraid of ruins."

– BUENAVENTURA DURRUTI

Well, I promised you when we last met that I would NOT be talking about Greece this time and, I am going to be true to my word. Today, we are going to discuss two topics that have been on my mind recently but that the good folks of the Hellenic Republic and their captive audience in Brussels have managed to shunt from the introduction of Things That Make You Go Hmmm....., but that remain sources of continual fascination and consternation for me; Spain and oil ahhhh NUTS! They did it AGAIN.... ok...the Greek restructuring. It's not as though I could ignore it, now, is it?

Oil can wait until next time.... no doubt it'll be an issue then too.

So Let's begin with Spain.

Spain is a problem. A real problem. Greece today triggered the biggest sovereign default of all time as it reneged on its commitments to pay back investors the €210 billion it had promised them some 2,400 years after 10 Greek municipalities became the first sovereign entities to default when they stiffed the temple of Delos, birthplace of Apollo.

Greece's debts are five times those of Argentina when it became the titleholder in 2001 and Greek GDP, which stands at US$305 billion, qualifies it for 32nd place on the list of the world's biggest countries nestled nicely between Denmark ($310 billion) and the UAE ($302 billion).

Spain is twelfth.

Spain's GDP of $1.4 trillion, somewhat surprisingly perhaps, puts it just behind oil-rich Russia and Canada and people-rich India. Spain is a big country. Spain matters.

When the PIIGS first muscled their way up to the trough a lifetime ago, the initial diagnosis was that Ireland, Portugal and Greece neither mattered in the grand scheme of things nor were likely to get out of hand, but that Spain and more importantly, Italy, would be REAL problems if they got sucked into the morass.

Of course, we were all reassured that both countries (in fact all of Europe) were in robust fiscal health and that we shouldn't count all our chickens with regards a cascade of defaults:

(Reuters, Jan 19, 2009): European Economic Affairs Commissioner Joaquin Almunia told the same news conference that the markets and credit rating agencies would take a more positive view of the situation had they been at the ministers' talks and heard the extent of the commitment to stable public finances.

Almunia dismissed a news conference question about the risk of any country defaulting, saying contingency planning was not even an issue in that regard.

But the trouble with chickens is that they have this annoying tendency to come home to roost and here we are, three years, several bailouts and hundreds of billions of euro in cash later staring down the barrel of the largest sovereign default of all time.

Last year it was widely accepted that, should Spain and Italy be pulled into the European maelstrom, things would take a material turn for the worse. Conveniently, Marketwatch laid out five reasons why Italy, at least, is not Greece:

1. Italy's average debt maturity is much longer, meaning any rise in yields is not an immediate problem and "will take some time to filter through into Italy's debt burden."

2. Italy collects many more taxes than its debt service costs, even if it hypothetically had to pay 7% on all its debt.

3. Its overall debt burden – combining private and public debt – is relatively low compared to developed countries.

4. More than half of Italy's debt is held domestically, which gives the government a little more say. For example, "bond swaps can be foisted on domestic institutions. Domestic institutions can be required to hold more government bonds in, say, pension portfolios."

5. Finally, Italy "has other sources of wealth." The country has a whole lot of gold – the fourth highest reserve in the world.

"This is generally true of Europe as a whole. There is great wealth. There is sufficient wealth in Europe in general and Italy in particular to address the debt crisis."

..."Italy's problem is primarily one of confidence not solvency."

But whilst Italy may not look much like Greece, it would be difficult NOT to admit that Spain bears more than a passing resemblance to the country currently occupying Wall Street.

Italy may have a high sovereign debt, but it has a low level of private debt. It runs a primary surplus and its fiscal deficit is actually quite low in comparison with most major economies. The completely coincidental buying of Italian government bonds that occurred just after the ECB's LTRO operations has meant that Italian yields, while still high in a relative sense, are now at a level that makes them at least manageable even if they could do with being lower. This is great news for Italy. This is terrible news for Spain.

Spain is now about to become the country everyone cares about all over again and, when the world's focus return's to the Iberian Peninsula, it will realise that the large, grey shape in the corner of the room was a Spanish elephant.

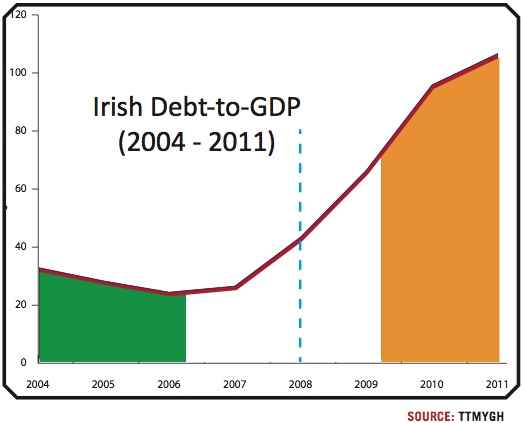

When discussing Spain, much of the focus has been on its relatively low sovereign debt-to-GDP level, which, at roughly 68%, is far lower than that of Italy which stood at 120% in 2011 (though it has already doubled since the crisis began in 2008). So far so good. However, cast your minds back to September 2008 when the Irish government made a decision that ranks as among the very worst since General Custer said "this looks like a nice place to camp for the night".

(FT.com, Sep 30, 2008): Ireland's government on Tuesday unveiled a wide-ranging guarantee arrangement to safeguard the deposits and debts at six financial institutions in response to turmoil in the financial markets.

The scheme, which guarantees an estimated €400bn (£315bn, $567bn) of liabilities, covers retail, commercial and inter-bank deposits as well as covered bonds, senior debt and dated subordinated debt.

Most depositors were already covered by an existing deposit insurance scheme for up to €100,000. But Tuesday's initiative was primarily aimed at easing the banks' shortterm funding, which had seized up in recent days.

Shares in the country's three biggest banks rose sharply after the government announced the immediate start of the scheme, ...

Irish government debt soared from 24.9% in 2007 to 41.8% in 2008 and hasn't looked back since reaching 105% in 2011 and necessitating the crippling austerity measures that have blighted Ireland since 2009.

As manageable as Spain's public debt would appear to be at face value, her private debt is an altogether different story standing at a staggering 227% of GDP and, according to McKinsey, Spanish corporations hold twice as much debt relative to their output as US companies and, in comparison to Germany, that number goes up to six times (incidentally, Portugal the PIIG that nobody cares about has even worse numbers with public debt at 93% and private debt at an eye-watering 249%, still as high as it was at the height of the GFC. Portugal is unsalvageable it's just that nobody seems to think it will matter. It will.)

As Spain reduced its deficit in accordance with the EU's Growth & Stability Pact, it meant an increasing reliance on private debt was needed in order to prolong the enormous construction boom that had been ongoing in Spain since the 1970s but which really picked up steam in the 90s and 00s. The outcome of that reliance? A tripling of average household debt.

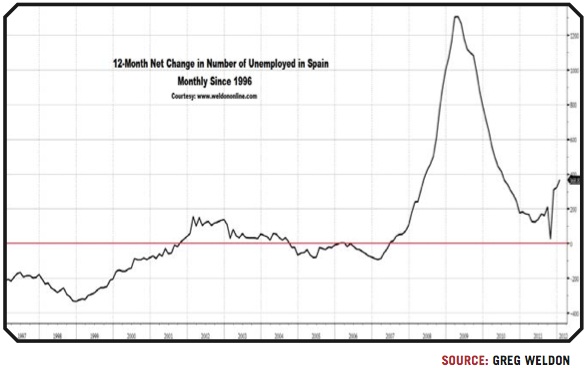

With the die cast, the Zapatero government was voted out last year and the incoming Rajoy administration vowed further austerity would be implemented in order to bring the deficits under control, but January's numbers would imply that austerity is anything but the magic bullet that the policymakers of Europe seem to believe it to be. When Greg Weldon, dug into Spain's unemployment numbers last month, his findings were chilling:

Spain's January Unemployment data was of GREAT interest, revealing the THIRD LARGEST EVER single-month expansion in the Number of Unemployed, pegged at +177,470 ... which represents a MASSIVE monthly rise equal to +4.0% ... and ... a sizable +35.6% yr-yr increase !!!

For reference, a 'population-equivalent' rise in US unemployment would be akin to a (-) 1.2 million single month LOSS in Non-Farm Payrolls.

Further, the oversized January increase was enough to boost the 'rolling' 12-Month Change in the Total Number of Unemployed back above +350,000, as evidenced in the chart on display [below, left]. Indeed, by this measure the Spanish labor market has been in a recession since the second half of 2007, and with a re-acceleration to the upside, this gauge is back to crisis levels.

Note the acceleration in the year-year rate of increase in the Number of Unemployed, dating back to the spring of last year:

Jan-12 ... +8.72%

Dec-11 ... +7.86%

Nov-11 ... +7.55%

Oct-11 ... +6.73%

Sep-11 ... +5.20%

Aug-11 ... +4.06%

Jul-11 ... +4.38%

Jun-11 ... +3.50%

May-11 ... +3.04%

We also note that EVERY business-industry sector posted an increase in the Number of Unemployed, which also rose across-the-board in terms of BOTH sexes, and EVERY age group.

As a result of the oversized seasonal gain in January, Spain's Unemployment Rate seems set to rise further when 1Q figures are posted in two months.

Already at a MULTI-DECADE HIGH as of the last report, for the 4Q (revealing a 22.8% rate, which violated the previous high of 22.5% set in 1994) ... the gain in January implies a rise of one-full percentage point, which would put the Unemployment Rate at a newer new high of 23.8%, as evidenced in the chart on display [below].

(You can head to www.weldononline.com to sign up for a free trial of Greg's phenomenal work. I cannot recommend it highly enough)

Naturally, against this backdrop of spiralling unemployment, crippling debt levels in the private sector and rigid austerity measures, something had to give. That something? Well, funnily enough, it was the Spanish government's willingness to play ball with the EU. Ominously, it was couched in somewhat nationalistic terms which could be a harbinger of things to come:

(UK Daily Telegraph): Spain is already planning to breach its budgetary targets, defying European leaders on the day they signed their historic fiscal pact.

Mariano Rajoy, prime minister of Spain, said the budget deficit would be 5.8pc of GDP in 2012 more than 30pc higher than the 4.4pc target agreed by Brussels.

In a move that was heralded in Spain as defiance against the German-led austerity drive, Mr Rajoy said he had decided to set a new target rather than extract €44bn (£36.6bn) from the budget at a time of economic crisis. Mr Rajoy said it was now a "sensible and reasonable" target. "This is a sovereign decision made by Spaniards," he said...

Mr Rajoy insisted the slippage was just on an interim target and Spain would still honour its commitment to bringing its deficit down to 3pc of GDP by 2013. But the announcement was seen as rebuffing other European leaders since the figures do not have to be confirmed until April.

Ambrose Evans-Pritchard had some thoughts of his own on the significance of Rajoy's bold move:

In the twenty years or so that I have been following EU affairs closely, I cannot remember such a bold and open act of defiance by any state. Usually such matters are fudged. Countries stretch the line, but do not actually cross it.

With condign symbolism, Mr Rajoy dropped his bombshell in Brussels after the EU summit, without first notifying the commission or fellow EU leaders. Indeed, he seemed to relish the fact that he was tearing up the rule book and disavowing the whole EU machinery of budgetary control.

Right on cue, the leader of Holland's Freedom Party, an important part of the ruling Dutch coalition, took up Rajoy's baton and sprinted ahead in surprising fashion:

(UK Daily Telegraph): The Dutch Freedom Party has called for a return to the Guilder, becoming the first political movement in the eurozone with a large popular base to opt for withdrawal from the single currency.

"The euro is not in the interests of the Dutch people," said Geert Wilders, the leader of the right-wing populist party with a sixth of the seats in the Dutch parliament. "We want to be the master of our own house and our own country, so we say yes to the guilder. Bring it on."

Mr Wilders made his decision after receiving a report by London-based Lombard Street Research concluding that the Netherlands is badly handicapped by euro membership, and that it could cost EMU's creditor core more than €2.4 trillion to hold monetary union together over the next four years. "If the politicians in The Hague disagree with our report, let them show the guts to hold a referendum. Let the Dutch people decide," he said...

The study said the eurozone cannot survive in its current form. The longer Europe's politicians dither, the more costly it will become. "The euro can only survive if it becomes a fiscal transfer union with national sovereign debt subsumed in eurozone bonds," said coauthor Charles Dumas.

The Dutch have always been 'Europeans' to the core and staunch allies of the Germans at the heart of the EU. This is a troubling development indeed for the architects of the European Dream. Throw in Francois Hollande's promise to renegotiate the 'fiscal compact' if elected in France when elections get under way next month (he is currently leading in early polling) and it becomes ever-clearer that we are a long way from being out of the woods.

With 50% of Spain's under-25s out of work (a situation that won't improve for years), stifling austerity measures in place that, in order to meet EU debt limits, will ensure that the chance of generating any growth in the Spanish economy becomes about as likely as Kim Kardashian refusing to pose for a photograph, it is obvious that it's only a mater of time before

Spain becomes the new Greece. Like Greece, the trouble will really begin with public sector strikes, followed by social unrest as the Summer heat hits Southern Europe and end with politician pandering to angry demands for an exit from Europe and upheaval.

Uncannily, after writing that previous sentence last night, I wake up to this article in the FT:

(FT): Spain's two largest unions, Comisiones Obreras and UGT, voted on Friday to call for a general strike on March 29 against reforms they called "the most regressive in the history of Spanish democracy".

The labour reforms of Mariano Rajoy's government grant employers greater flexibility to pay lower compensation when they fire workers, a change Mr Rajoy argues is crucial to increase Spain's economic competitiveness, but one that has enraged the country's unions.

Spain is going to be the country on the front pages this summer so best get yourselves acquainted with the problems facing it. If it saves you any time, they are by and large similar to those faced by Greece only much, much larger. Lather. Rinse. Repeat.

Speaking of Greece, Europe's perennial prodigal son, managed to hold a gun close enough to the collective heads of their investors to make them realise that volunteering for a restructuring of their outstanding debt was an extremely smart idea. After the decision by Greece to not pay back a hundred billion-odd euros that it had promised to bondholders was finally recognised as a default this week (sigh), and after a marathon 8-hour session ended in the members of the ISDA committee realising that this constituted a credit event (8 hours, guys? Seriously?) which in turn triggers roughly $3bln in CDS payments, the terms of the restructuring will go to the EU to be ratified.

The problem is solved. That ought to allow everybody to breathe a sigh of relief, right?

Nicolas Sarkozy certainly would like us to believe so:

I would like to say how happy I am that a solution to the Greek crisis, which has weighed on the economic and financial situation in Europe and the world for months, has been found. Today the problem is solved. A page in the financial crisis is turning

It's all uphill from here, folks.

Sadly, the record of those at the top table in prognostication is a little...... spotty. Remember any of these:

"There is no bailout and no "plan B" for the Greek economy because there is no risk it will default on its debt" European monetary affairs commissioner, Joaquin Almunia, January 2010

"I've always said publicly that [a Greek] default is out of the question." Then-ECB Jean-Claude Trichet, April 2010

"There will be no [Greek] default." Economic and Monetary Affairs Commissioner Olli Rehn, April 2010

And the daddy of them all:

Restructuring is not going to happen. There are much broader implications for the eurozone should Greece have to restructure its debt. People fail to see the costs to both Greece and the eurozone of a restructuring: the cost to its citizens, the cost to its access to markets. If Greece restructures, why on earth would people invest in other peripheral economies? It would be a fundamental break to the unity of the eurozone." George Papaconstantinou, former Greek Finance Minister, September 2010

Amazing how 'certain' you have to can be when in office.

Immediately after the Greek default was announced, Wolfie & Olli set about ensuring the Greeks knew that this was their last 'last chance':

(FT): Wolfgang Schäuble, the German finance minister, said: "Greece has today been given the chance to make it. But Greece will now have to seize this chance itself."

In a stern message to Athens, Olli Rehn, Europe's economics commissioner, called the second bailout "a unique opportunity not to be missed" and said: "I now expect the Greek authorities to maintain their strong commitment to the economic adjustment programme and to rigorously and timely implement the policy package."

As a precaution, Schaeuble also fired a shot across the bow of any further bailout-seekers:

Wolfgang Schaeuble, the German finance minister, says the ISDA decison of Greek CDS won't affect aid. He has also ruled out another restructuring like Greece, which will be worrying for Portugal, Italy and Spain.

Hitting out at Greece, Schaeuble says the country shouldn't blame the EU or Germany as it can't expect others to help it, it needs deep structural reforms.

Once again, in the wake of an 'outcome' the political posturing has begun and the campaign to evict Greece from Europe continues in earnest.

In an article published on Saturday, Liam Halligan anecdotally explained the level of confidence amongst those whose opinions matter most in this process; bond buyers:

(UK Daily Telegraph): A couple of weeks ago, I sat on the speakers' podium during the opening panel of the Euromoney Bond Investors' Congress in London. Together with leading industry experts, including senior ratings agencies' officials, we engaged in a detailed discussion of the contentious aspects of the Greek debt debacle and the fate of the eurozone.

The audience was "top drawer; the room packed with 500 of the world's biggest bond market participants; the combined assets under management measured in the trillions of dollars.

"Who thinks the upcoming Greek bail-out will be the last, drawing a line under the eurozone's sovereign debt crisis?" asked the senior Euromoney staffer chairing the panel. "Put your hands up".

Delivered with a serious demeanour, this was exactly the right question. So deadly was the inquiry, and so germane, that the mood in the room grew uneasy, barely camouflaged by an outbreak of coughing. Scanning this ultra-influential audience, I saw rows of delegates cowed, keeping their eyes locked forwards but staring down slightly, not daring to look elsewhere.

Not a single hand was raised. Not a single hand among hundreds of the world's leading bond market practitioners was stirred to support a debt swap now presented as the key to the world economy shaking off the post sub-prime torpor and taking us into the sun-lit uplands of sustainable global growth.

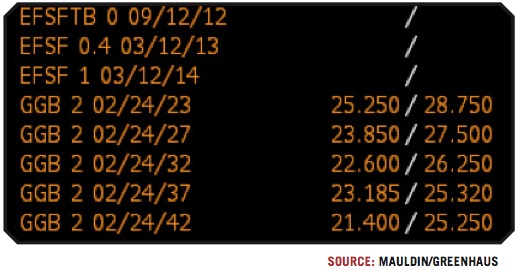

But perhaps the easiest way to illustrate the level of confidence in the Greek 'solution' is to look at the prices of the restructured bonds themselves, and for that, I will yield the floor to my friend John Mauldin who, in another excellent letter this week had this to say on the subject:

Greek is having an "orderly" default. The taxpayers of Europe are in theory going to lend €130 billion to Greece to pay back €100 billion in Greek debt that is owed to private lenders. Greece has to pass several difficult tests in order to get the money. €100 billion of debt to private lenders will be written off. Thus the net effect will be that they owe €30 billion more. How does this help Greece, except that they get €30 billion more they cannot pay?

The "new" debt is already trading in the market, even though it has not actually been issued. (Don't bother traders with messy details, just do the deal.) This page from Bloomberg [below, left] is just too delicious not to print, sent to me courtesy of Dan Greenhaus of BTIG. It shows the new Greek bonds trading at over a 71-79% discount, depending on the length of maturity. Note this is AFTER the 53% haircut already imposed. That reads to me like the market value of original Greek debt is now between 12 and 14% of the original face value.

I have said it before, I will say it again; Greece is finished as a member of the EU. I thought the coup de grace would be applied before March 20th (and it might yet prove too much to get the necessary approvals in time which could mean all bets are off once again before the deadline), but either way, they are done. Out. Finished. It is purely a matter of how and when and I rather suspect the answers to those two questions are likely be 'badly' and 'soon'. Once the problem of Greece has finally been dealt with by Europe, it'll be a question of 'who's got next?' and, while the answer to that is most likely Portugal, in terms of when it happens, Europe's new problem child is set to be the country with great weather, the world's best soccer team, a busted banking system, spiraling unemployment and tapas.

By John F. Mauldin

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2012 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.