Silver the Restless Metal

Commodities / Gold and Silver 2012 Mar 12, 2012 - 10:30 AM GMTBy: William_Bancroft

Silver is a much smaller market than the gold market and quality research about the poor man’s gold can be less easy to find. One academic who does stand out though is the late Professor Roy Jastram, whose works on gold lead him to an investigation into silver’s monetary history and record. His book ‘Silver: the restless metal’ is much cited by silver experts like David Morgan, but being out of print is now not that easy to get hold of. The Amazon book markets in the US and UK were trading at >$140 when we looked, so we headed down to the British Library in London to get hold of a copy. Published in 1981, this book is a look at silver’s recorded monetary history with a forward look at what the future might hold for the silver price.

Silver is a much smaller market than the gold market and quality research about the poor man’s gold can be less easy to find. One academic who does stand out though is the late Professor Roy Jastram, whose works on gold lead him to an investigation into silver’s monetary history and record. His book ‘Silver: the restless metal’ is much cited by silver experts like David Morgan, but being out of print is now not that easy to get hold of. The Amazon book markets in the US and UK were trading at >$140 when we looked, so we headed down to the British Library in London to get hold of a copy. Published in 1981, this book is a look at silver’s recorded monetary history with a forward look at what the future might hold for the silver price.

The historical depth of data used in the compiling of this book is impressive. The main historical analysis focuses on England and the USA, and the statistical story of silver begins in England in 1273. Although American data begins later, this monetary analysis seeks to separate periods of inflation and deflation, has some interesting findings.

Inflation, deflation and silver.

Unsurprisingly, and as other monetary experts we cite find, Professor Jastram finds that “annual rates of inflation were not at all severe until the twentieth century”. More interesting is the finding that silver actually lost purchasing power against commodities in every period of inflation in England since the end of the sixteenth century. Similar more general findings of loss of purchasing power during inflations had also been found for gold in Jastram’s ‘The Golden Constant’. Only during the inflation deemed to start after 1933 in England was silver found to gain in ‘operational wealth’. This period may be of more relevance to investors today, and we return to this later.

In the USA the silver price is broadly found to be an almost constant between 1800 and 1827, before a downward trend from 1873 to 1932, before a contemporary trend of appreciation from 1932 onwards. As for gold, it is found that silver lost purchasing power in all American episodes of inflation until the present one beginning in 1951. In fact “the record of the two precious metals is remarkably similar”.

Professor Jastram is drawn to ask where gold and silver get their long standing reputations as hedges against inflation. Perhaps this is a post Great Depression phenomenon, but an analysis of 150 years of American and 300 years of English monetary records suggests this “lore was not borne out by the facts”.

Within the American data there is one period that goes a significant way to destroying silver’s reputation as a potential long term store of value; in the 40 years after 1890 silver lost 76 per cent of its purchasing power. This was deemed to be “cataclysmic for a precious metal” with reference that “gold never behaved that way in all the history of Britain and America”. It was silver’s “ceaseless fluctuations in purchasing power” that drew the Professor Jastram to term it ‘the restless metal’.

Silver’s performance during deflations in England and America is found to be quite different than during inflations. As far as recorded English monetary shows, silver “did very well as an instrument of accrual in periods of deflation. The pattern of increased purchasing power failed only in the depression of 1873 to 1896. Even then it behaved well, down only 6 per cent, in the face of a 50 per cent collapse in the price of silver per ounce”.

Whilst there were fewer periods of deflation to assess in America than in England, Professor Jastram finds gold and silver performing well in deflations. One should note that the silver price had enjoyed government support from as early as the 1878 Bland-Allison Act.

The two precious metals gained in operational wealth in deflations.

Conquest for silver in South America

When we think of the Spanish conquest of South America and the precious metal riches shipped back to Spain, it might be typical to associate this with the power and glory of the Spanish crown. Professor Jastram finds an interestingly different reality. We are told this conquest almost solely involved silver, and was a largely private endeavour:

- It was nearly all silver (98 per cent) and very little gold (2 per cent) after 1560; before that, the physical quantity of gold was minor.

- Most of it was to private interests (74 per cent) and not the crown (26 per cent) between 1500 and 1660

- The proportionate augmentation to the royal revenues in Spain was really rather small (falling from a peak of 22 per cent in 1958 to roughly 10 per cent during the first half of the next century).

Silver in the contemporary era

Silver was found to be a different beast in the latest inflations in England and America (starting 1932 and 1951 respectively), with significant gains in purchasing power against commodities. Gold had acted not entirely differently, and perhaps the reputation of the precious metals being inflation hedges is a more contemporary phenomenon than we might first think. Either way Professor Jastram has some interesting things to say about the silver price going forward (from 1981).

More recent analysts have commented on this also, and in his era Professor Jastram found peculiar differences in the supply and demand functions of silver compared to most other commodities.

“In all, the conclusion is that the world supply of silver is price-inelastic into the foreseeable future. This is consistent with recent years: between 1972 and 1979 price went up by 550 per cent, yet total silver available for world consumption increased by only 1 per cent.”

The supply component of today’s silver market has also been described as similarly price inelastic, with two thirds of supply coming from the mining of other metals which due to epithermal depositioning is less lucrative the deeper you mine. At the time of Professor Jastram’s writing the demand component was also found to be significantly price inelastic, and a case can be made that silver’s industrial uses are far greater in number today.

We come out, then, with a model of a commodity market for which both supply and demand are inelastic with respect to movements in price, especially in an upward direction. This means that an increase in price by any given percentage, once touched off, will result in a less than proportionate increase in supply and a less than proportionate increase in demand. Such a market is highly unstable in an upward direction.

What Jastram saw ahead for silver

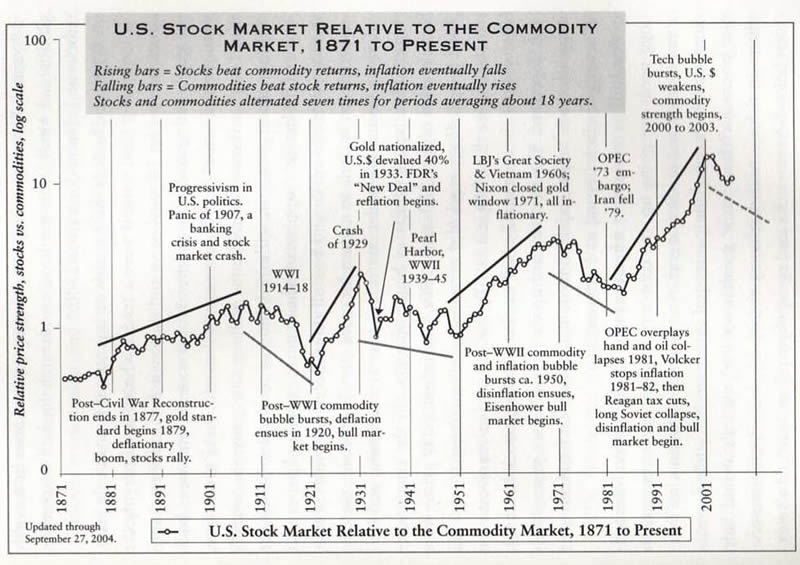

We should note that from the date of publication (1981) until 2004 the silver price did not rise as it was predicted it might. The silver price between 1980 and 1988 did exhibit some volatility that would have attracted speculators, but the 15 year period between 1988 and 2003 appears remarkably calm for the ‘restless’ metal. A stable silver price during these years could have rewarded investors amidst wider deflation, and this time represented a bear market in commodities generally. It might be better to term this era as a period of disinflation, and the chart below (often cited by Jim Rogers) produced by Barry Bannister shows the stock markets relative outperformance of commodities as inflation falls.

It might also be useful to assess the properties of gold and silver since 2000, to see if monetary instability have the potential to make silver an even more restless metal?. We’ll compare the gold and silver prices against the Rogers International Commodity Index (RICI) (we feel this index is the most representative of the cost of living). We use the rises and falls of the RICI to define periods of inflation or deflation since 2000. We crudely define January 2000 to January 2001 as an inflation, January 2001 to January 2002 as a deflation, January 2002 to June 2008 as an inflation, June 2008 to February 2009 as a deflation, and February 2009 to February 2012 as an inflation.

Inflation: January 2000 – January 2001

The RICI ended January 2000 at 1,345.23, and hit 1,621.64 in January 2001, giving a gain of 20.5%. During this period the gold price moved from $283/ounce to $264/ounce; a loss of 6.7%. The silver price during this period moved from $5.3/ounce to $4.8/ounce; a loss of 9.4%. During this short period of inflating commodity prices gold and silver had lost operational wealth.

Deflation: January 2001 – January 2002

The RICI ended January 2001 at 1,621.64 and closed January 2002 at 1,275.59, marking a retreat of 21.3%. During this period the gold price moved from $264/ounce to $281/ounce; a gain of 6.7%. The silver price during this period moved from $4.8/ounce to $4.3/ounce; a loss of 10.4%. Gold and silver had gained in operational wealth, with gold being the more impressive performer.

Inflation: January 2002 – June 2008

The RICI closed January 2002 at 1,275.59 and saw out June 2008 at 5,718.06, marking growth of 448.3%. During this period the gold price moved from $281/ounce to $930/ounce; a gain of 331%. The silver price during this period moved from $4.3/ounce to $17.5/ounce; a gain of 407%. As Professor Jastram had previously found, gold and silver had lost operational wealth during an inflationary period. Silver had been the better performer.

Deflation: June 2008 – February 2009

The RICI finished June 2008 at 5,718.06 and ended February 2009 at 2,365.84, marking losses of 58.6%. During this period the gold price moved from $930/ounce to over $950/ounce; a gain of 2.2%. The silver price during this period moved from $17.5/ounce to $13/ounce; a loss of 25.7%. Once more gold and silver had gained in operational wealth, with gold being the more impressive performer. One should note that the metals appeared to bottom before the RICI did in this deflation, and were standing at somewhat recovered prices by February 2009 (compared to December 2008).

Inflation: February 2009 – February 2012

The RICI closed February 2009 at 2,365.84 and ended February 2012 at 3,915.45, marking growth of 65.5%. During this period the gold price moved from $950/ounce to $1780/ounce; a gain of 87.4%. The silver price during this period moved from $13/ounce to $35.5/ounce; a rise of 173%. Interestingly during this inflation both gold and especially silver gained operational wealth.

So apart from our latest period of inflation, gold and silver have performed as Professor Jastram’s historical data suggests; both metals lost purchasing power during inflations, and gained it during deflation. Perhaps the professor’s finding of performance during inflation was restriced to certain long periods since 1932 in England and 1951 in the USA, although this specific finding of his is bolstered by gold and silver’s performance since February 2009.

For savers looking for a single currency vehicle for wealth preservation over the long haul, it would best be metallic, and given silver’s less certain ‘store of value’ properties and decline between 1890 to 1930, it would probably be gold. The precious metals lose so much less operational wealth during inflations than fiat monies, that when fiat monies outperform them at times during a deflation the metals are losing a temporary battle during a greater war. Gold and silver are still better for saving than government sponsored paper money.

It is impossible to know whether our latest inflationary period is the start of new behaviours, but we can certainly say that the interventions and stimulus of central bankers are on a scale never seen before. Perhaps this has given the precious metals even more of an advantage over fiat currency during this inflation.

Final thoughts

It would be impossible to read Professor Jastram’s work and not find him an eminent monetary scholar; ‘The Golden Constant’ and ‘Silver: The Restless Metal’ are still important books to the precious metals. His monetary history is as scientific as you would expect from a Berkley professor and is as engagingly written as it is statistical. He ends his book with a pragmatic reflection on the history of money that would see heads nodding amongst the Austrian school of thought, and an issue that is just as relevant today as it was then.

We have escaped from clipped, debased, and manipulated coinage into manipulated, debased, and politicised paper – not much of an exchange. World stability rests on sound money. Where can discipline be found?

Now a good time to load up on silver? Buy silver bullion quickly and easily using our next generation dealing platform…

Will Bancroft

For The Real Asset Company.

Aside from being Co-Founder and COO, Will regularly contributes to The Real Asset Company’s Research Desk. His passion for politics, philosophy and economics led him to develop a keen interest in Austrian economics, gold and silver. Will holds a BSc Econ Politics from Cardiff University.

© 2012 Copyright Will Bancroft - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.