China's SAFE: "We Wont Put All The Eggs In One Basket"

Commodities / Gold and Silver 2012 Mar 12, 2012 - 09:01 AM GMTBy: GoldCore

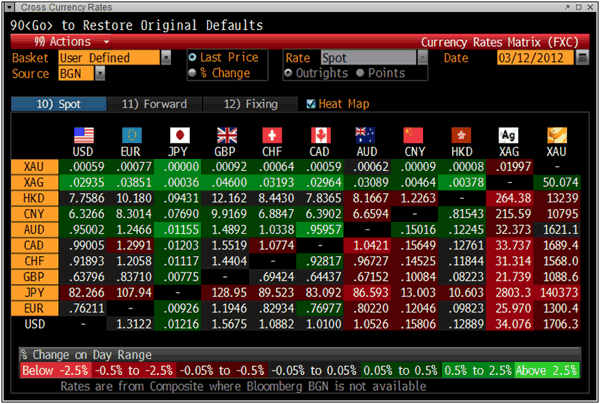

Gold’s London AM fix this morning was USD 1,705.25, EUR 1,299.93, and GBP 1,088.57 per ounce.

Gold’s London AM fix this morning was USD 1,705.25, EUR 1,299.93, and GBP 1,088.57 per ounce.

Friday's AM fix was USD 1,699.50, EUR 1,285.36 and GBP 1,078.30 per ounce.

Cross Currency Table – (Bloomberg)

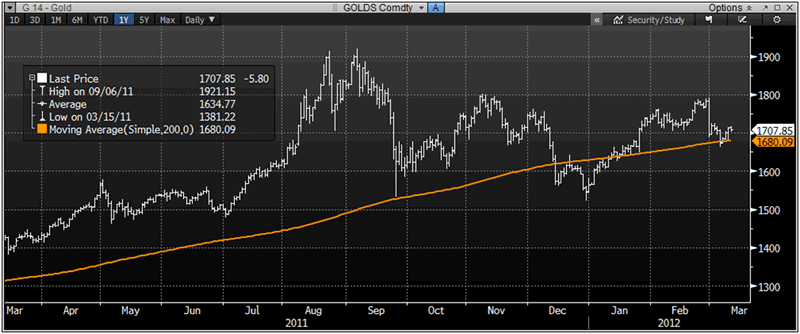

Gold rose nearly 1% in New York on Friday and closed at $1,713.50/oz. For the week, gold was 0.01% higher. The positive weekly close and the close above the 200 day moving average and the $1,700/oz level bodes well for this week.

Gold dropped in Asia and is marginally lower in European trading which has gold now trading at $1,704.30/oz.

Gold fell today as the US dollar rallied to its highest price in more than 7 weeks. Investors may be waiting for the US Federal Reserve meeting tomorrow before making further commitments in the market.

Gold 1 Year – (Bloomberg)

Gold is up 9% this year, and looks to continue its 11 consecutive years of price increases, after the Fed said it would keep rates near zero until at least 2014. If the US economy is showing some signs of recovery the Fed may have to reconsider its plans for any additional monetary easing during its meeting this week.

Money managers, institutions and hedge funds, lowered their exposure to gold reducing their bullish bets to the lowest level in five weeks during the week of March 6, as prices unwound from a late-February peak near $1,800/oz (see Other News below).

This is bullish from a contrarian perspective as it means that the speculative longs have been washed out of the market and that therefore further sharp falls are less likely and indeed that we may be close to an intermediate bottom.

China continues to diversify its massive $3.2 trillion in foreign exchange reserves.

China's chief foreign exchange regulator, the Head of the State Administration of Foreign Exchange (SAFE) and co-Chairman of the PBOC, Yi Gang said today that China will continue to implement the principle of diversifying its investment in foreign bonds.

Gang said in March 2010 that China was considering investing more of its foreign exchange reserves in gold "appropriately" based on market conditions.

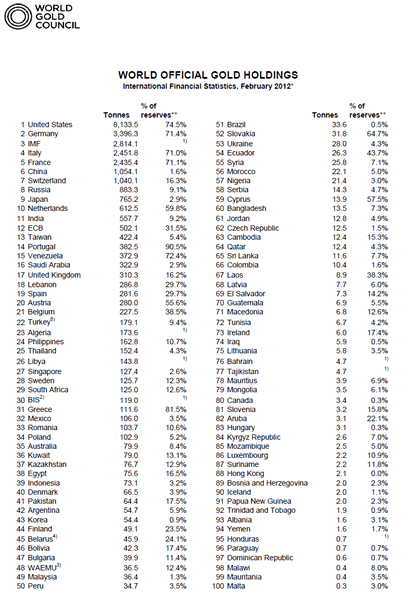

China's declared gold reserve amounts to 1,054 tons, ranking sixth in the world. China secretly purchased some 400 tons of gold in the years prior to announcing a near doubling of their reserves in 2003.

We are likely to see another surprise announcement of vastly higher Chinese gold reserves in the coming months.

Gang said the European debt crisis has eased a little bit recently with the European Central Bank (ECB) injecting huge liquidity into the market through its Long-term Refinancing Operation.

"But many problems have yet to be resolved, as the debt crisis is still developing," he said, adding that China supports a series of measures taken by the European Union, the ECB and the International Monetary Fund to work out solutions to the crisis.

Yi stressed that risk control will be the priority for China's foreign reserves investment, with an emphasis on safety, liquidity and potential revenues.

"We won't put all the eggs in one basket," he said, adding that the diversified investment strategy has helped China's foreign reserves assets withstand shocks from the U.S. subprime crisis, the bankruptcy of Lehman Brothers and the European sovereign debt crisis.

The People’s Bank of China isalmost certainly continuing to diversify a small part of its massive $3.2 trillion currency reserves into gold bullion in order to protect itself from massive dollar ($1.6 trillion dollars of US debt alone, according to the Treasury Department), euro and other currency exposure.

The People’s Bank of China will not telegraph its intentions or purchases to the market as doing so would lead to a surging gold price and to a further devaluation of its foreign exchange reserves.

China is clearly trying to position the yuan or renminbi as the alternative global reserve currency.

The Chinese realise that they will need to surpass the Federal Reserve’s official, but unaudited, gold holding of 8,133.5 tonnes. China is the fifth largest holder of gold reserves in the world today and officially has reserves of 1,054.1 tonnes which is less than half those of even Euro debtor nations France and Italy who are believed to have 2,435.4 and 2,451.8 tonnes respectively.

China’s gold reserves remain miniscule as a percent of their overall foreign exchange reserves – less than 2%. In marked contrast to the US, Germany and even France and Italy when gold’s share of national forex reserves is over 70%

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.