Should Iceland's Next Currency be Gold?

Currencies / Fiat Currency Mar 09, 2012 - 05:49 AM GMTBy: Money_Morning

Peter Krauth writes:

My eyes nearly popped out of my head when I read this headline: "Iceland Considers Adopting Canadian Loonie."

Peter Krauth writes:

My eyes nearly popped out of my head when I read this headline: "Iceland Considers Adopting Canadian Loonie."

The loonie is otherwise known as the Canadian dollar. Of course, gold would be a much a better choice as I'll explain later.

But the simple fact that this tiny nation of 330,000 is even thinking about using the Canadian dollar as its currency would have been unheard of just five short years ago.

After all, we live in a world that is literally littered with fiat money. In this world the U.S. dollar has been at the top of the heap.

That the loonie may be Iceland's top choice is just stunning.

But the fallout from the 2008 financial crisis has caused increasing doubt about the long-term health of the greenback.

And with trillions of fresh new Federal Reserve Notes issued since then, it would be hard to call the Fed a friend of the U.S. dollar.

Even the euro has taken its hits. The European banking crisis caused scores of former "euro fans" to bail from that major currency, too.

And it's no wonder.

The massive debt held by the "PIIGS" has compelled the European Central Bank (ECB) and the International Monetary Fund (IMF) to bail out these countries and scores of banks with trillions of euros.

Still, all of this printing is far from over...

Greece vs. Iceland: A Tale of Two Paths

The latest installment in Europe's pathetic financial soap opera was Greece's second bailout (of which there was never really any doubt). This latest rescue totals $170 billion from the European Union, ECB, and the IMF.

The result? Financial repression and riots in Athens that lead to some deaths.

Remember when former Greek Prime Minister George Papandreou announced there'd be a referendum at the eleventh hour?

That would have allowed the citizens of the "birthplace of democracy" to have a say on major issues affecting their future. Heaven forbid.

Papandreou was then summarily ousted, setting the stage for Greece's current path.

I'm convinced that, given the chance to vote, the Greek people would have rejected the proposed austerity plans. And in the process, they'd have - unintentionally at least - forced their government to do the right thing: default and exit the euro.

If that was the case, Greece would have then seen the return of its former currency, the drachma, though severely devalued against the euro.

That would bring serious hardship, but it would also be limited in time and scope, allowing them the chance to regain their competitiveness.

Instead, Greece will suffer under austerity for years, along with a shrinking economy and soaring unemployment. The "bailout" will simply serve to repay the mostly German and French banks that were highly invested in Greek debt.

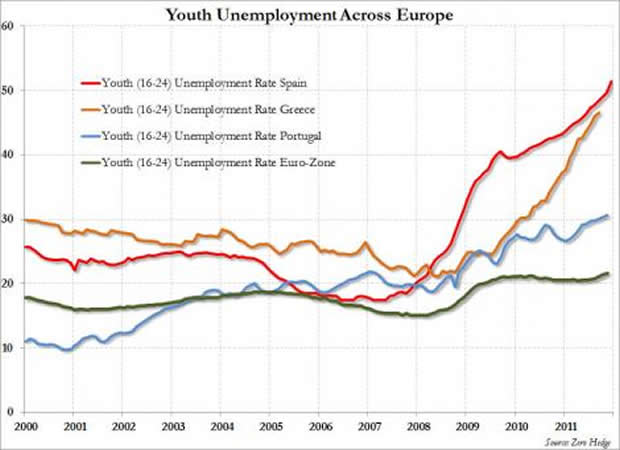

As is stands, Greece`s unemployment levels have exploded, with nearly one-in-two young Greeks out of work. That's a recipe for plenty more social unrest.

Greece's best case scenario is for its current debt-to-GDP of 160% to fall to 120% within eight years.

With the massive burden of severe austerity and the Greek economy shrinking to the tune of 16% since late 2007, how will Greece ever have the means to repay hundreds of billions in loans?

The truth is she won't.

In the end, the inevitable will be unavoidable: Greece, and probably others, will default and leave Europe.

But it doesn't have to be that way, as Iceland is proving there is a right way to do it.

Iceland Had the Freedom to Choose

You may remember that the 2008 mortgage meltdown was not confined to the United States.

That same year, overextended Icelandic banks also collapsed under the weight of their inflated mortgage "assets." Today, Iceland's financial sector is a mere fifth of its former self.

Thanks to its monetary sovereignty, Iceland was able to default on its bonds and devalue its currency. That's what Icelanders chose to do.

It wasn`t pleasant; unemployment soared and currency controls were put in place. But essentially, the free market was allowed to work.

Paul Rawkins, Senior Director in Fitch's Sovereign Rating Group, recently said:

"Iceland has successfully exited its IMF programme and gained renewed access to international capital markets. A promising economic recovery is underway, financial sector restructuring is well-advanced, while public debt/GDP appears to be close to peaking on the back of a robust fiscal consolidation programme."

In other words, the people of Iceland have not had their future mortgaged in order to bail out a bunch of greedy bankers.

Yes, the nation's financial system has contracted to only 20% of its previously bloated size. That's probably a good thing.

It's even expected that the Nordic country will attain a position of fiscal surplus this year and over the next several.

Just a few short years since Iceland's financial meltdown and default, Fitch ratings has upgraded Iceland to investment grade BBB with a stable outlook. They expect government debt will peak at 100% of GDP.

The Organisation for Economic Co-operation and Development (OECD) sees growth of 2.4% this year, following 2.9% last year. They see unemployment falling from 7% last year to 6.1% this year, and improving even further to 5.3% next year.

The Greeks can only dream of such a rosy outlook. Iceland, however, is not out of the Nordic woods yet.

There are still some legacy issues with the Icesave bank which, if a court ruling should go against Iceland, would push up public debt between 6% and 13%. Also, private debt is at 200% of disposable income and corporate debt is at 210% of GDP.

Still, Iceland is in much better shape than Greece and years ahead of it. But it does have major issues to resolve-namely choosing a direction for its currency.

The Quest for the Canadian Loonie

Before the 2008 financial meltdown, Iceland had been working toward becoming an EU member, with a goal of eventually adopting the euro. That's still the official government line.

But public and business interest in joining a failing political union and its quickly depreciating currency is waning.

I seriously doubt the euro (at least in its current state) will even exist long enough for Iceland to join the EU.

In the meantime, currency controls were imposed after Iceland's 2008 banking collapse, restricting foreign exchange transactions to 350,000 kronur (about $3,000). That limits foreign investors from repatriating profits.

Between 2001 and 2007, the krona rocketed 90%, and then gave it all back, crashing 92% the following year.

As capital controls are removed next year, many Icelanders are weary of a return to those wild currency gyrations.

In their search for a viable solution, Icelanders are favoring the Canadian dollar.

Heidar Gudjonsson of the Research Centre for Social and Economic Studies, the largest think tank in Iceland, summed it up like this:

"The average person looks at it this way: Canada is a younger version of the U.S. Canada has more natural resources than the U.S., it's less developed, has more land, lots of water. And Canada thinks about the Arctic."

Iceland could well take that route. They'd have no influence in Canada's monetary policy, and their small economy (Iceland is the smallest nation with its own currency) would be an afterthought in Canada's currency management.

The shocking part is that Icelanders favor the Canadian dollar over the U.S. dollar, traditionally the most sought after, and certainly the most widely held currency on the planet.

If nations are looking at alternative currencies to adopt, that speaks volumes about the Fed's mismanagement of the dollar.

The Currency End Game

In the end, the Canadian loonie may be a good alternative for Iceland. Its economy is skewed toward the fishing and aluminum sectors, and with its arctic shores, it's likely to become a new frontier for oil and gas.

Canada's dollar has been gaining in strength over the past decade, climbing alongside oil and the commodities complex.

But Canada is no model of fiscal restraint either. Most levels of government carry large debt levels. In the wake of the 2008 financial crisis, the federal government is running a $31 billion annual budget deficit.

Like most developed nations, Canada's central bank is pursuing a zero interest rate policy (ZIRP). That's likely to lead to the same effect it did in the U.S. and elsewhere, unsustainably inflating the insurance, finance, and real estate sectors.

When the next financial crisis hits, it's likely no country will escape.

Nations the world over are waging a lose-lose currency war against each other, devaluing their money to gain a slight and only temporary competitive edge.

Once interest rates rise substantially on even fatter levels of debt, the interest payments alone will become unsustainable.

That could bring about the end of our long running experiment with fiat money.

Gold is Real Money

Ironically, the industrialization of America, which ran into the early 20th century, took place under a gold standard.

It provided tremendous price stability as the money supply; the gold supply in fact, grew at roughly 2% per year.

As a productive nation, American exports were paid for in gold, which increased total gold ownership, allowing it to print more money, which was in turn invested in still more business ventures.

A gold standard means money is backed by a fixed asset-not paper.

This naturally self-regulates and stabilizes the economy, since the amount of gold a country has limits how much the government can print.

With a gold standard, inflation, budget deficits and debt are all but eradicated, since the supply of gold becomes the limiting factor.

Today, fiat money serves its purpose mostly as a medium of exchange.

Its other stated purpose, as a store of value, is failing miserably. It's not so much that the price of gold is rising as it is the value of fiat currencies are falling, dramatically.

Increasingly, the return to a gold standard is an idea that's gaining traction in ever wider circles.

In fact, just last fall, Steve Forbes predicted that within the next five years, America would return to a gold standard. To hear his comments you can click here.

It's not sexy, and it wouldn't be easy. But I submit the probabilities of ending up with a gold standard are multiplying daily.

Iceland could well go the way of the loonie for now.

But as a small, independent nation, why not seize the opportunity to make your mark as a forward-thinking place?

In my view this tiny Nordic nation ought to skip the Canadian dollar altogether and go straight to gold.

Today, Iceland has the chance to truly set a standard: the gold standard.

A move like that would certainly put Iceland back on the map.

Source http://moneymorning.com/2012/03/09/should-icelands-next-currency-be-the-canadian-loonie-or-gold/

Money Morning/The Money Map Report

©2012 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.