Asia Buys Gold Whilst the West Sells

Commodities / Gold and Silver 2012 Mar 08, 2012 - 07:46 AM GMTBy: GoldCore

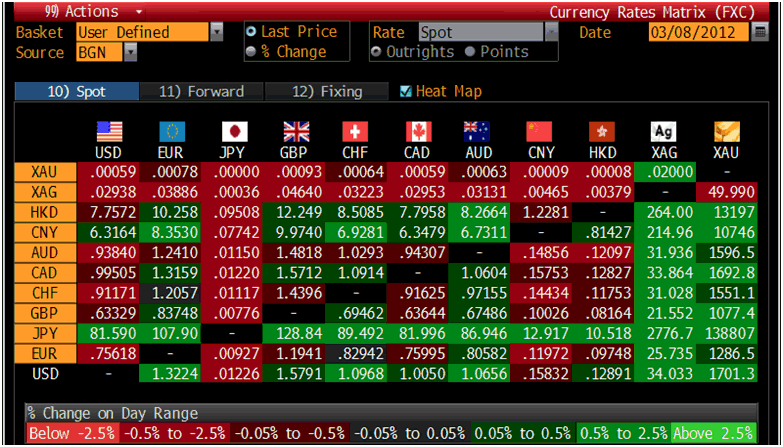

Gold’s London AM fix this morning was USD 1,701.50, EUR 1,287.26, and GBP 1,076.70 per ounce.

Gold’s London AM fix this morning was USD 1,701.50, EUR 1,287.26, and GBP 1,076.70 per ounce.

Yesterday's AM fix was USD 1682.50, EUR 1278.69 and GBP 1068.53 per ounce.

Cross Currency Table – (Bloomberg)

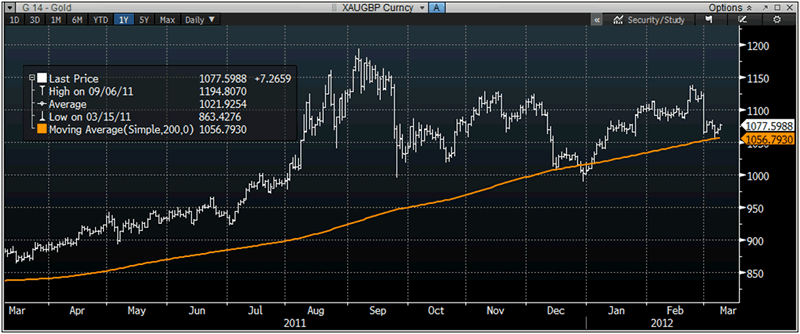

Gold rose 0.6% in New York yesterday and closed at $1,684.30/oz which importantly was above its 200 day moving average of $1,678. Gold rose in Asia and gains continued in European trading which has gold now trading above $1,700/oz at $1,701.20/oz.

Gold is gaining ahead of the Greek government’s debt acceptance deadline and European interest rate decisions later today.

Market participants expect that central banks will continue to maintain ultra loose monetary policies to promote growth but thereby debasing the pound and the euro.

XAU/EUR 1 Year – (Bloomberg)

On Friday, the U.S. nonfarm payrolls data will have investors searching for clues on whether the Fed is likely to launch even more stimulus plans and further debase the dollar.

Gold ETF holding’s are still at record highs and report another 269,000 ounces added since last Wednesday which shows that institutional demand remains robust and is stickier then the bears have proclaimed for months now.

Asian demand has returned after this most recent correction with Asian buyers again astutely buying on the dip. Strong physical demand was seen in Asia as prices fell below $1,700/oz.

In India, the wedding and festival season is underway, which should lead to India consuming some 900 tonnes of gold bullion again this year.

"Demand is pretty good as traders are finding these prices attractive," Ketan Shroff, director of Pushpak Bullion in Mumbai told Reuters.

Bullion demand in the UK and US has been quite lacklustre in recent weeks with bullion dealers reporting a decline in demand from the levels seen in Q4 2011.

XAU/GBP 1 Year – (Bloomberg)

Buyers were hesitant in recent weeks and this hesitancy was exacerbated by last Wednesday’s volatile sell off. We have a record amount of client funds in our accounts but many have instructed us to wait further instructions and are delaying their purchase until there is a more definitive price trend.

We have seen both a decline in purchases in recent weeks but also an increase in selling.

Indeed, we have seen a degree of selling of bullion in the last 2 weeks which we have never experienced before.

Clients sold due to being under financial pressure and having to sell their one liquid asset that has performed well.

Others sold due to the continuing assertions continuously expounded for some years now that gold is a “bubble”.

Warren Buffet’s massively contradictory op-ed piece regarding the dangers of paper money and bonds and asserting gold was a bubble was badly reported on and widely propagated.

Many took to heart the irresponsible ‘advice’ of the ‘Oracle of Omaha’ and sold an essential diversification and safe haven asset that will protect them and their families in the coming months and years.

The volatility of last Wednesday’s smash down also led to some selling.

This selling is of course very bullish from a contrarian perspective. The man in the street or “shoeshine boy” does not know today’s price of gold, is not lustily buying gold in the expectation of getting rich and is nowhere near the gold market.

The western public and many ‘gurus’ and ‘experts’ continue to focus almost exclusively on gold’s nominal price. They continually ignore the many real fundamentals and supply demand issues driving the market. They also completely ignore the value of gold – which is that it is an academically and historically proven safe haven asset.

People in Asia are conscious of the price and indeed buy gold on price dips. However, the primary focus of Asians is not on gold’s price but on gold’s value as a store of wealth that protects from inflation and currency devaluations.

In years to come people will be astounded at the ignorance that led so many to focus solely on gold’s nominal price and not its real value as a safe haven asset and currency.

Many in the West look down their noses at the majority of humanity in the developing world who value and save in gold and rightfully are nervous regarding fiat currencies and deposits in banks.

But the people of Turkey (see story below), China, India and much of the emerging market world will prosper in the coming years when the gold they own protects and preserves their savings and wealth.

For breaking news and commentary on financial markets and gold, follow us on Twitter.

OTHER NEWS

(Bloomberg) -- Turks Have $270 Billion of Gold ‘Under Pillows’, BHT Reports

Turks have an estimated $270 billion of gold stashed “under their pillows,” or about 5,000 tons, Ozcan Halac, head of the Istanbul Gold Exchange, said in a televised interview with Bloomberg HT in Istanbul today.

SILVER

Silver is trading at $34.07/oz, €25.70/oz and £21.55/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,641.00/oz, palladium at $691.48/oz and rhodium at $1,450/oz

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.