Gold Investing, When to be Greedy?

Commodities / Gold and Silver 2012 Mar 08, 2012 - 03:07 AM GMTBy: UnpuncturedCycle

There aren’t many things that are certain in life, but there is one thing can be written in stone. Fear and greed run the markets! It’s been that way since tulips were all the rage. The problem with the markets is that you have to buy when everybody is fearful and sell when everybody is greedy, and that goes against human nature. With respect to gold this human defect is magnified to a much larger degree, and is complicated by the fact that gold is perhaps the only market where greed and fear can work together. For years I have tried to convince readers to buy dips and sit through the declines, but to little avail. Gold is the only market I do that with and for good reason.

There aren’t many things that are certain in life, but there is one thing can be written in stone. Fear and greed run the markets! It’s been that way since tulips were all the rage. The problem with the markets is that you have to buy when everybody is fearful and sell when everybody is greedy, and that goes against human nature. With respect to gold this human defect is magnified to a much larger degree, and is complicated by the fact that gold is perhaps the only market where greed and fear can work together. For years I have tried to convince readers to buy dips and sit through the declines, but to little avail. Gold is the only market I do that with and for good reason.

The gold market is the most manipulated market in the world and investors are finally beginning to see that. What happened on February 29th is just one example, but perhaps the most blatant illustration that I’ve ever seen. Unfortunately I’ve put a label to it but I haven’t solved anything. I’ve been aware of the manipulation for years, since 2003 to be exact, and that’s when I started to by gold. Manipulation bothers me (like mosquitos), but I’m not afraid of it (like wasps!). Why? Manipulation can change the tertiary trend, modify or perhaps change the secondary trend, but has little or no affect on the primary trend and that’s the key. To beat the manipulators I needed to have time on my side and that means I must focus on the primary trend and use a buy and hold strategy.

How has this strategy worked? Gold has been climbing a wall of worry and doubt since the 2001 retest of the 1999 bottom. In the process it has carved out a profit each and every year since 2001:

YEAR CLOSING PRICE % GAIN

2001 $277 9.1%

2002 $343 19.3%

2003 $417 17.8%

2004 $437 4.6%

2005 $514 15.0%

2006 $636 19.2%

2007 $837 23.1%

2008 $865 8.4%

2009 $1,106 21.8%

2010 $1,410 21.6%

2011 $1,575 7.1%

Current $1,681 4.2%

Seven of the eleven years posted gains in double digits and that is much better than the Dow. In fact it’s much better than anything I could compare it too! Unfortunately there is a human problem whereby we are not conditioned to see the big picture (long term) and we all want instant gratification. My experience tells me that is a very hard nut to crack. I continue to receive e-mails from clients who jump in toward the top of tertiary moves and exit toward the bottom of secondary/tertiary reactions. One of life’s mysteries!

Every since the February 29th massacre I have received numerous e-mails from clients declaring “I’ve had enough”. In fact that’s been a theme since 2003 and if I had a dollar for each and everyone I received, I would be more than a few ounces of gold to the good! Still it solves nothing. Out of the hundreds of clients I have I estimate that no more than ten subscribe to and implement the buy and hold theory. The rest try to catch the latest wave and fail miserably. As recently as Sunday I told investors that I see the following possibilities over the short run:

- There is a fifty percent chance that gold bottomed on Wednesday and the reaction was a one-day wonder,

- There is a forty percent chance that gold will test good Fibonacci support at 1,676.50 early this week and then turn up, and

- There is a 10% chance that gold could run down as low as 1,659.30 before bottoming, consolidating and then turning back up.

I also said that regardless of how it plays out, it is not an earth shattering event and it does not warrant throwing away your positions in disgust. Yes, the reaction was made worse by manipulation but we’ve known for years that the market was being manipulated and we made the conscious decision to accept that risk when we purchased gold.

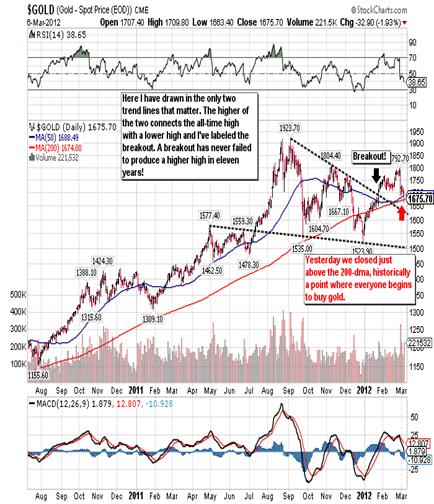

As it turns out gold did close at 1,675.70 yesterday, marginally below the below the 1,676.50 support and came close to testing the 1,659.30 support as you can see here:

This morning the spot gold is unchanged and trading in a tight 14.00 range as many investors wait for the next shoe to fall.

In the gold market one of the biggest problems we face is noise. By noise I mean useless commentary by ignorant people, or worse yet by people trying to purposely mislead. A simple chart would be a much better way to go:

Here I have drawn in two downward sloping trend lines, both connecting what were at that time all-time highs with lower highs followed later by breakouts to the upside. With respect to the higher of the two lines, I have labeled the breakout and you’ll see that this line now comes in around 1,622.00. In eleven years no breakout has every failed to produce a new all-time high so that’s your risk!

In money terms the risk is fifty dollars from the current price while the reward is a close above 1,923.70! If I am buying an April gold futures contract it’s five thousand dollars of down side risk, assuming I bought today, versus the probability of making thirty-one thousand dollars if history repeats itself. That’s the type of odds I like and look for when I want to buy. Aside from that note that yesterday’s close was marginally above the 200-dma and historically this is where investors buy. All the manipulation over the last eleven years hasn’t stopped investors from buying here, so you need to ask yourself why it should be different this time around. Of course the answer is that it isn’t!

With respect to Fibonacci support there are a series of price extensions that run from the 1981 all-time high of 850.00 and are really important. Here are a few of them:

SUPPORT RESISTANCE

1,671.50 1,746.22

1,596.86 1,820.90

1,522.18 1,895.58

1,447.50 1,970.30

If you take the time to look carefully at the spot chart for gold, you’ll see that these are the Holy Grail of Fibonacci numbers and they invariably play an important role. For example the 1,895.58 resistance stopped the last big move (the all-time closing high was 1,900.10) while the 1,522.18 stopped the last big sell-off. These are no accidents!

I remain convinced that the 1,523.90 bottom experienced on December 29th was in fact the bottom and the current reaction is nothing but a second degree (seven to nine days) counter trend move that will retrace no more than 7.5% and then we’ll move on. Manipulation is part of the game, it is annoying, but it is never terminal. If you’re intelligent and buy where history tells you to buy, you may be slightly off but you’ll always end up on top and that’s what you want. History says that this is the time to buy! Your risk is minimal and the gains would be significant. Is there a risk that gold has in fact topped? Only if you believe that the world’s central banks, the Fed included, have stopped printing and will live within their means. I know of no one who thinks that will happen.

Bloomberg says that you should buy the paper assets (the dollar and bond) of the world’s largest debtor, the United States. Gold should be avoided because it is too risky. Enough said! My best advise to anyone and everyone is to buy gold, physical where possible, and EFT’s and futures when not. This is where everyone sold so this is the place to buy. The current 7.5% correction is now out of the way and that leaves no more than 3% corrections along the way to a new all-time high. This is where fear has set in and it’s where you need to be greedy. Easy to say and hard to do! I remain convinced that we are on the cusp of the single biggest investment opportunity of our lives. Unfortunately if you want life’s rewards you need to pay the price, a very unpopular message given the press and politics of today’s immediate gratification world. That’s why we elect the Obama’s and Romney’s of the world; they tell us what we want to hear. Gold is the reality of the situation and my best advice is to plant both feet firmly on the ground and buy!

Giuseppe L. Borrelli

www.unpuncturedcycle.com

theunpuncturedcycle@gmail.com

Copyright © 2012 Giuseppe L. Borrelli

- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.