Gold and Silver, Are you buying the weakness or selling it?

Commodities / Gold and Silver 2012 Mar 08, 2012 - 03:01 AM GMTBy: Chad_Bennis

Gold and silver appear to have bottomed yesterday on good ‘ole turn around Tuesday. Greece’s drama is just drama thatvleads to fear, but always moves forward. Greece has given traders one of the best opportunities for buying in the past 9 months. Each time Greece’s problems scare the weak hands it allows the stronger players to pick up great positions to sell into strength.

Gold and silver appear to have bottomed yesterday on good ‘ole turn around Tuesday. Greece’s drama is just drama thatvleads to fear, but always moves forward. Greece has given traders one of the best opportunities for buying in the past 9 months. Each time Greece’s problems scare the weak hands it allows the stronger players to pick up great positions to sell into strength.

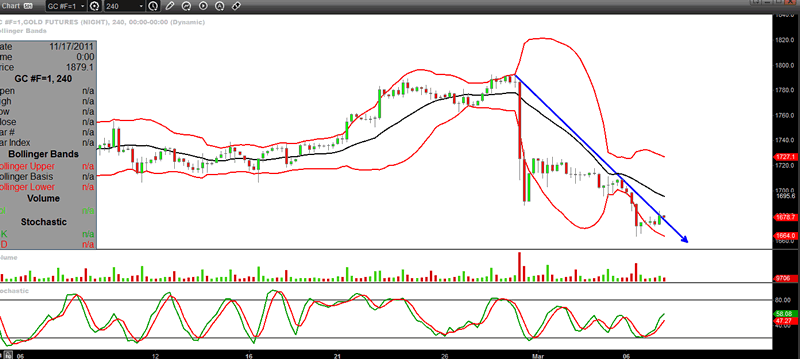

The 4 hour chart of gold shows the downtrend line being broken which usually indicates the fear selling has abated. A stop under yesterday’s lows would be a great strategy.

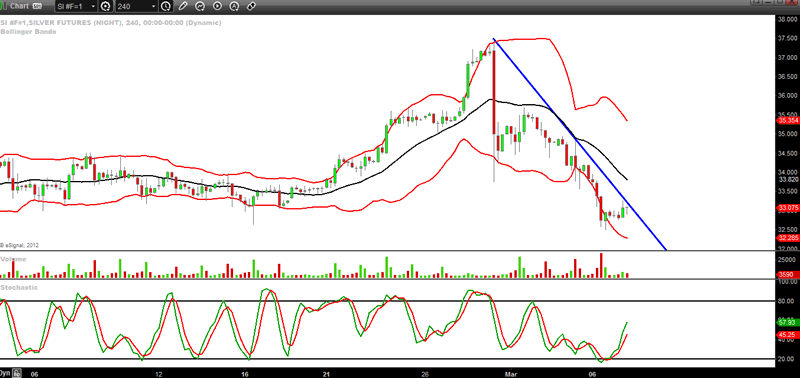

Silver is in the same position.

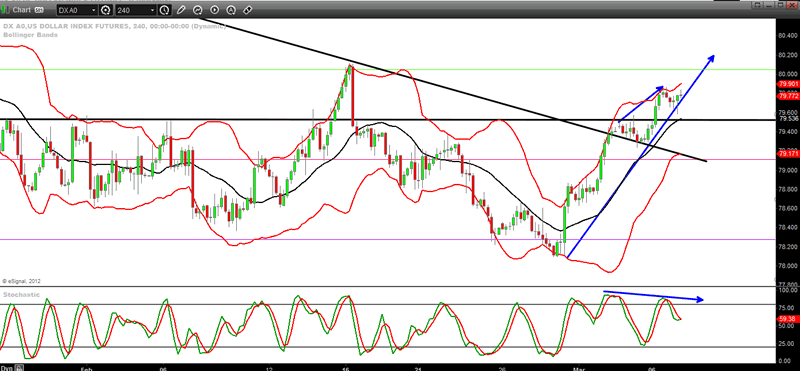

Plus, the US dollar appears to be running out of steam as there is negative divergence in the stochastic indicator as it made a lower high while prices made a higher high. This points to weakness in the rally. Below is the 4 hour chart.

And add to the fact that Warren Buffet agrees with the gold community’s reason for higher prices in gold by stating this in his newsletter:

“In the U.S., where the wish for a stable currency is strong, the dollar has fallen a staggering 86% in value since 1965, when I took over management of Berkshire. It takes no less than $7 today to buy what $1 did at that time.

In God We Trust may be imprinted on our currency, but the hand that activates our Government’s printing press has been all too human. High interest rates, of course, can compensate purchasers for the inflation risk they face with currency (dollar) based investments, and indeed rates in the early 1980′s did that job nicely. Current rates, however, do not come close to offsetting the purchasing power risk that investor’s assume. In other words, the interest rates in today’s money market accounts are not enough to offset inflation. You can’t see it, but due to inflation, if you leave cash in the bank, you will lose money every year. Investing in domestic money market accounts these days is like keeping your money under the mattress. It’s financial suicide. You don’t have to settle for that.”

Everyone please remember that gold and silver are in a BULL market which, by its very nature, is going to attempt to throw you out of your position. The best approach for many of you who write each time that a correction is occurring is twofold:

1) Don’t use margin and buy instruments like physical, non-leveraged etfs and mining shares with strong management teams.

2) Turn off your computer and stop checking your accounts for 1 week after the correction begins.

This bull market will continue until one thing changes. It will come to an end when central banks worldwide stop printing money and raise interest rates. This event is yet to occur.

Buy on weakness. Sell into strength. So simple.

Dr. Chad Bennis

www.wheatcorncattlepigs.com

wheatcorncattlepigs@gmail.com

@wheatcorncattle

© 2012 Copyright Dr. Chad Bennis - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.