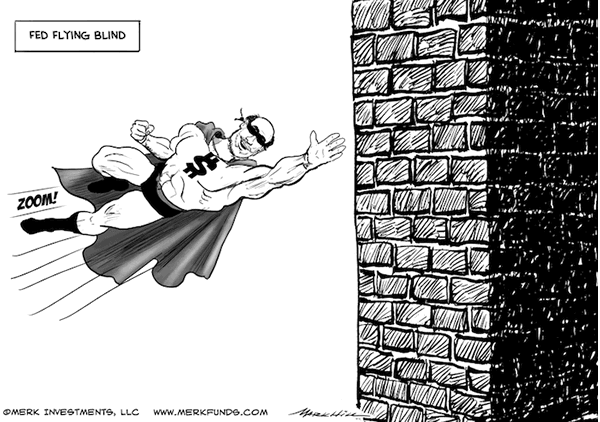

U.S. Fed Flying Blind

Politics / Central Banks Mar 07, 2012 - 02:46 AM GMTBy: Axel_Merk

In assessing whether to make tough decisions, policy makers tend to weigh the cost of action versus inaction. As critical as we are of our dear policy makers, when push comes to shove, they may rise to the occasion. But what if they are not told when it's time to act, when it's time to stop printing and spending trillions? In our assessment, the voice of reason has been silenced, posing potential risks to economic stability, as well as the U.S. dollar. That voice of reason is no other than the market itself. Let us explain.

In assessing whether to make tough decisions, policy makers tend to weigh the cost of action versus inaction. As critical as we are of our dear policy makers, when push comes to shove, they may rise to the occasion. But what if they are not told when it's time to act, when it's time to stop printing and spending trillions? In our assessment, the voice of reason has been silenced, posing potential risks to economic stability, as well as the U.S. dollar. That voice of reason is no other than the market itself. Let us explain.

As the Federal Reserve (Fed) has become ever more engaged in micro-managing the economy, we have moved from rate cuts to emergency rate cuts, to printing billions, then trillions, first to buy mortgage backed securities and more recently, Treasuries. Coming to the realization that talk is cheaper than action, the Fed has since switched gears and "committed" to keeping rates low, initially through mid-2013 and now through the end of 2014. The Fed has a buzzword to describe its policies: "transparency"; instead, you may want to call it the "fear not - we will take care of you" policy. There are reasons the Fed needs to signal that rates will stay low for such an extended period, amongst them: a reasonable person may believe that current monetary policy could be inflationary; a reasonable person may believe that the Fed actually wants to have inflation to bail out homeowners that are under water in their mortgages; finally, a reasonable person may have paid attention to Fed Chair Bernanke when he argued that raising rates too early was one of the biggest policy mistakes during the Great Depression, concluding that erring on the side of inflation is desirable. But "fear not - we will take care of you" is the message: the Fed is introducing an inflation target, providing assurance that inflation won't be a problem.

The alternative, of course, would be to conduct what we would deem sound monetary policy, so that a reasonable person wouldn't be concerned about the risks of money printing in the first place. But that's so yesterday. Instead, the Fed has engaged in Operation Twist, applying the Fed's firepower to lowering rates further out the yield curve (longer term interest rates). Indeed, the Fed now owns over 30% of all outstanding marketable U.S. Treasuries with maturities of 6-10 years; across the yield curve, from Treasury Bills to 30-year Treasury Bonds, the Fed has accumulated almost 20% of all outstanding securities.1 These days, the Fed owns more U.S. government debt than China.

As long as there is confidence in the Fed, the Fed's strategy may pan out, right? Maybe. We don't even question the motives of the Fed. However, we question the Fed's ability to conduct policy when its policy makers are blindfolded. We fear that some of the Fed's most important gauges used to set policy have been taken away, by the Fed itself. As if to prove the point himself, Fed Chair Bernanke told Congress last week that he is puzzled about incoming economic data, unable to explain why the unemployment rate has come down quite so rapidly. Consider the yield curve: typically, yields provide a wealth of information about the health of the economy, about inflationary pressures, to name a few. As such, an important feature of the yield curve is that it can sell off, amongst others, should inflationary pressures pick up or should investors be concerned about long-term fiscal sustainability. With the Fed becoming evermore engaged in yield curve management further along the curve, this gauge has been taken away.

Former Fed Governor Kevin Warsh, a critic of active yield curve management, has said the Fed is looking into the mirror in conducting policy. We agree. Luckily, the folks at the Fed are some of the smartest economists around. Unfortunately, though, they are human and should periodically be reminded that the greatest failures in monetary history have also been conducted by some of the smartest economists of the time.

If it weren't enough that the Fed is blindfolded, the Administration and Congress are no better off. At some point, bondholders might get antsy about unsustainable fiscal policies. Without major policy initiatives, the non-partisan Congressional Budget Office (CBO) estimates that the U.S. deficit will grow by $3.86 trillion (the 2013-2017 adjusted baseline scenario in the 2013 budget). Should the Administration be able to implement all its policy initiatives, the five-year addition to the deficit would "only" be $3.44 trillion. The math includes $560 billion in additional revenue by phasing out the Bush-era tax cuts. Should Congress find a way to extend those tax cuts, the Administration's proposals actually increase the deficit by $140 billion over the next five years (our special thanks to our Senior Economic Adviser Bill Poole, who helped us understand a budget that is most challenging to understand, even for experts). The tragedy here is that fiscal deficits are not taken seriously. We point this out not to single out the Administration: neither Congress, nor the presidential candidates, have come up with clear initiatives that would actually put the budget on a sustainable path.

Why not? Because the bond market lets policy makers get away with squandering money. Not so in Europe: Thanks to the "motivation" provided by the bond market, European policy makers are engaged in very serious structural reform. In our assessment, the language of the bond market is the only language policy makers understand. With the Fed's micro-management of the entire yield curve, warning shots by the bond market may come much later than they otherwise would. As we have seen in Europe, the longer policy makers wait before engaging in reform, the more painful the consequences. Ultimately, the Fed may not be strong enough to fight market pressures, but that may be of little consolidation: unlike the Eurozone, the U.S. has a significant current account deficit. Whereas in the Eurozone, notwithstanding significant bond market turmoil causing political havoc and pain, the euro held up relatively well, surprising most pundits to the upside. In contrast, a volatile bond market may have more dire consequences for the U.S. dollar, as it might be increasingly difficult to encourage foreigners to finance U.S. deficits.

It was in the earlier part of last decade when the late Wim Duisenberg, European Central Bank (ECB) President until 2003, said, "We hope and pray that there will be an orderly adjustment to global imbalances." - in those days, we were concerned that policy makers were overly reliant on hopes and prayers for solutions. Now, hope and prayer has moved to the forefront of Fed policy making, as the Fed has taken away what we deem are some of the most important gauges used to conduct monetary policy. Unfortunately, hope and prayer are no substitute for sound policy making. Prudent investors, as well as investment professionals with fiduciary duty over client accounts, may want to take this risk into account when allocating within their portfolios.

Please register for our upcoming Webinar on Thursday, March 13, or sign up for our newsletter to be informed as we discuss global dynamics and their impact on currencies.We manage the Merk Funds, including the Merk Hard Currency Fund. To learn more about the Funds, please visit www.merkfunds.com.

By Axel Merk

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.