Gold and Silver Outlook

Commodities / Gold and Silver 2012 Mar 06, 2012 - 06:15 AM GMTBy: John_Hampson

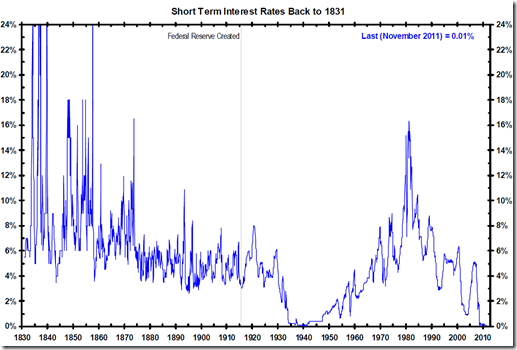

In the 1940s rising (secular) commodities played a key role in rising inflation. However, the US government maintained an environment of negligible interest rates, surpressed to hold down the costs of excess government debt built up in WW2. It did this by intervening in the money supply, much like today, and the result was debasement of the US dollar. Eventually it had to abandon the policy in 1951 as it had led to an explosion of debt monetization and uncontained inflation. However, the policy was successful in that it provided the sovereign debt support until a new cycle of growth was underway (a new secular stocks bull and the end of the inflationary commodities bull, a transition complete by 1951).

In the 1940s rising (secular) commodities played a key role in rising inflation. However, the US government maintained an environment of negligible interest rates, surpressed to hold down the costs of excess government debt built up in WW2. It did this by intervening in the money supply, much like today, and the result was debasement of the US dollar. Eventually it had to abandon the policy in 1951 as it had led to an explosion of debt monetization and uncontained inflation. However, the policy was successful in that it provided the sovereign debt support until a new cycle of growth was underway (a new secular stocks bull and the end of the inflationary commodities bull, a transition complete by 1951).

Source: Bianco Research

Fast forward to today and we have a very similar scenario of secular commodities bull, problematic inflation (especially when real undoctored inflation stats are considered), surpressed negligible rates, money supply intervention and currency debasement. Given the historical precedent, we might consider that central banks in the indebted developed nations might be successul in maintaining their manipulation policies until a new cycle of growth and a new secular stocks bull emerges. By solar cycles, that is likely to take hold in late 2014 or in 2015. Recently the Fed extended its commitment to ultra low rates until late 2014, which fits well.

Negative real interest rates are therefore likely to persist for some time yet, not just maintained by the Fed but also by the ECB, BOE and Japanese central bank. Precious metals perform well in an environment of negative real interest rates, but also as all these major currencies are debased simultaneously, hard money becomes a refuge, maintaining value.

Source: Tom McClellan

As the above chart shows, based on the last secular commodities bull finale of the late 1970s, precious metals may cease to do well when we have evidence of real interest rates starting to trend upwards. In other words, the secular uptrends in gold and silver may come to an end when central banks begin to signal an end to low interest rates and inflation starts to ebb.

Marc Faber blames money printing and negligible rates for a series of bubbles in the early 21st century, and expects more bubbles in the next couple of years as this backdrop continues. With currency debasement and negative real returns in cash and bonds, precious metals continue to look an attractive class for bubble-blowing. If precious metals peaked in 2011, as some suggest, then we will print a historic anomaly over the next couple of years whereby hard money performs poorly in an environment of negative real interest rates and currency debasement.

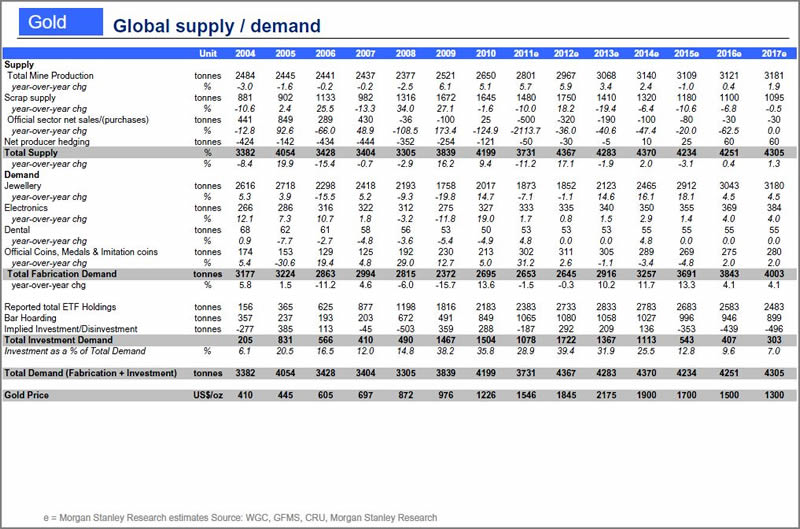

One key factor in the long term secular swinging between hard and paper assets is the supply lag of around in mines and energy fields from plan to production of around 10 years. Since the onset of the current commodities secular bull in 2000, supply in gold stayed flat through to 2010, but grew almost 4% in 2011 as new mines (initiated since 2000) finally started to reach production. However, offsetting that, central banks bought more gold in 2011 than any year since 1964, a net purchase of 440 tonnes. The central banks in question are mainly from the developing world, and they are seeking to diversify their increasing reserves away from one or two main currencies (namely, the ones being debased). Whilst demand for precious metals for technology and jewellery has weakened slightly, it remains robust. So although investment demand is the growth area in demand, it has not become totally dominant, and the situation remains healthy.

Disinvestment in gold is expected to begin around 2015 (again, fitting well with solar cycle predictions). Morgan Stanley estimates show a peak in demand in 2014, and supply increasing each year the next 3 years as more mines come on stream.

Source: Morgan Stanley

In line with the history of secular commodity inversions, that sets us up for lagged supply to be increasing as demand starts to drop, providing a gap between the two that will form the backdrop to a secular commodities bear. This change should occur around 2014-2015, just as a new growth cycle begins supporting a stocks bull, and the central banks drop their negligible interest rate policy.

Comparing previous secular commodity bull conclusions, we have not seen a speculative mania phase in precious metals, and nor have we reached the extremes in stocks:commodities and housing:commodities ratios that we would expect. We might counter that by acknowledging the commodities bull is mature and this asset class is historically relatively expensive to the others now, if not at an abolute extreme. However, looking ahead in 2012 and 2013, negative real interest rates, currency debasement and the demand-supply picture make it probable, in my opinion, that we will see that speculative ascent. The main threat to this scenario would be another major event or deflationary shock. But as we saw in 2008 and 2011, this only had a temporary effect of depressing precious metals, rather than inducing a major trend reversal.

John Hampson, UK / Self-taught global macro trader since 2004

www.solarcycles.net (formerly Amalgamator.co.uk) / Predicting The Financial Markets With The Sun

© 2012 Copyright John Hampson - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.