Financial and Commodity Markets Support and Trendlines Being Broken

Stock-Markets / Financial Markets 2012 Mar 06, 2012 - 02:59 AM GMT IWM (Russell 2000) has the most noticeable breakdown, but the other indices appear to be on a similar pattern. The initial impulse establishing the new trend is not yet complete. However, IWM seems to have broken through intermediate-term Trend Support at 80.78 and its hourly Cycle bottom support at 80.65. The 50 day moving average at 78.85 is the next potential level of support. If IWM exceeds it, then it may become resistance for the wave i bounce, which may take yet another day or two.

IWM (Russell 2000) has the most noticeable breakdown, but the other indices appear to be on a similar pattern. The initial impulse establishing the new trend is not yet complete. However, IWM seems to have broken through intermediate-term Trend Support at 80.78 and its hourly Cycle bottom support at 80.65. The 50 day moving average at 78.85 is the next potential level of support. If IWM exceeds it, then it may become resistance for the wave i bounce, which may take yet another day or two.

SPY appears to be about to break down through its mid-cycle support at 136.17 along with the lower trendline of its Orthodox Broadening Top formation, which has a potential target of 104.72.

However, SPY must first test either intermediate-term trend support at 134.03 or the 50-day moving average at 131.76. What follows the test is a bounce back to mid-cycle support/resistance, then the decline to the ultimate target.

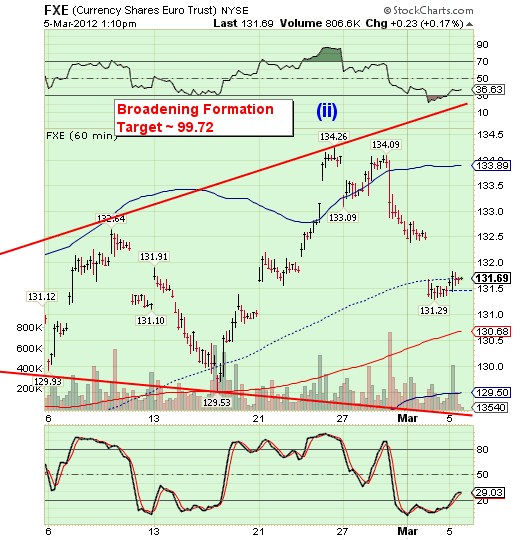

FXE appears stuck below mid-cycle resistance at 131.70. The wave pattern is very young and it still has far to go in its decline toward parity with the dollar. The decline may resume yet today.

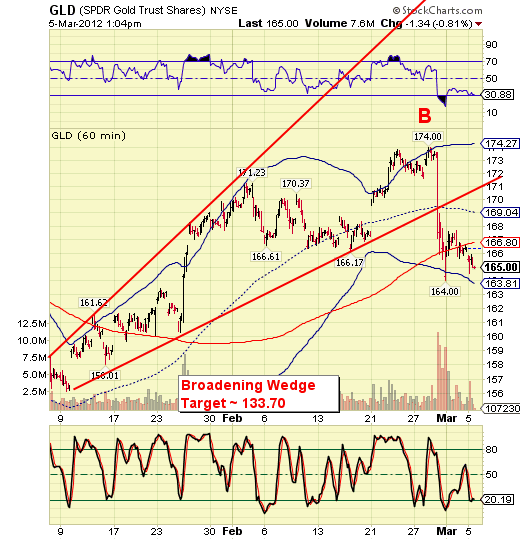

GLD still hasn’t enough energy to stage a decent bounce. Today is when margin calls are squared away from last Wednesday’s debacle. It may still manage a small bounce to intermediate-term trend resistance at 166.80, but a decline below cycle bottom support/resistance at 163.81 may negate the bounce potential.

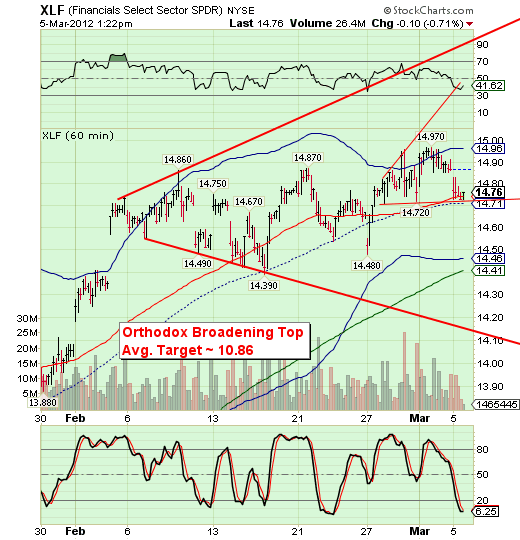

XLF has rolled over from its final extension within its Orthodox Broadening Top. The extension was also in the form of a Broadening Top formation. This is known as a fractal repetition.

The next support level is the Cycle Bottom support at 14.46 and intermediate-term trend support at 14.41. Both of these supports may be taken out in a matter of a day or two and set up conditions for a potential flash crash to the Orthodox Broadening Top target zone.

Good luck and good trading!

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.