Economic and Financial Market Assumptions are Getting Very Ugly

Stock-Markets / Financial Markets 2012 Mar 06, 2012 - 02:52 AM GMT We are now just over two months into that oft-dreaded year of 2012, and the economic and financial projections/assumptions by public and private institutions across the world have noticeably worsened. These are the same institutions (i.e. politicians, bureaucrats and executives) that have everything to lose by painting an accurate portrait of their position in the global economy, so it’s an extremely safe bet that they are still over-estimating their prospects. Nevertheless, the fact that their inflated, yet worsening projections completely destroy the myth of an economic recovery is telling.

We are now just over two months into that oft-dreaded year of 2012, and the economic and financial projections/assumptions by public and private institutions across the world have noticeably worsened. These are the same institutions (i.e. politicians, bureaucrats and executives) that have everything to lose by painting an accurate portrait of their position in the global economy, so it’s an extremely safe bet that they are still over-estimating their prospects. Nevertheless, the fact that their inflated, yet worsening projections completely destroy the myth of an economic recovery is telling.

The Chinese government just lowered its 2012 growth projection to 7.5%, which is the lowest it has been since 2004. As Ilargi recently noted here, that lowered projection itself is based on assumptions of stabilized exports, rising domestic consumption and no “hard landing” from the collapse of its unprecedented property/infrastructure bubble. Once we factor all of those things in, along with a potential 150% public debt/GDP ratio in 2011, the one and only remaining driver of the global growth story becomes much more of a liability than a boon.

Moving on to Europe.

The alleged poster child for the ridiculous notion that bankster-benefitting austerity can lead to growth, Ireland, is unsurprisingly going to need another bailout once the money from the first one runs out, according to current assumptions by Moody’s. As mentioned a few days ago, that could end up being a huge obstacle for the country trying desperately to stick with the EU’s suicide mission. If the Irish people decide to reject the fiscal treaty compact in an upcoming referendum, then the country will be unable to receive additional aid from the ESM.

Citigroup economist Michael Saunders agrees with Moody’s assessment, and further suggests that - if you want to figure out whether Ireland will soon need a significant debt restructuring program just like Greece – flip a coin:

Ireland 'may need' second bailout

Separately, Citigroup economist Michael Saunders said investors face a 50 per cent chance of sharing in losses in Irish Government debt.

"We still expect a sizeable growth undershoot and deficit overshoot, and expect that Ireland will need a second financing package. . . beyond 2013," Mr Saunders said in a weekly broker’s note.

Meanwhile, Spain has officially bucked its 2012 Troika-mandated deficit target of 4.4% and projects it will only get to 5.8% by year’s end. This occurs after the country missed its 2011 deficit target of 6% by billions of miles, clocking in at a solid 8.5%. Who seriously thinks that the government can cut off almost 3% in one year as all of Europe contracts? Rating agency Fitch has stated that Spain’s [already dismal] sovereign debt rating is not at risk right now, because it had already assumed Spain was going to miss these targets.

Ambrose Evan-Pritchard comments on this gutsy (yet still unrealistic) projection by the Spanish leader:

Spain's sovereign thunderclap and the end of Merkel's Europe

As many readers will already have seen, Premier Mariano Rajoy has refused point blank to comply with the austerity demands of the European Commission and the European Council (hijacked by Merkozy).

Taking what he called a "sovereign decision", he simply announced that he intends to ignore the EU deficit target of 4.4pc of GDP for this year, setting his own target of 5.8pc instead (down from 8.5pc in 2011).

In the twenty years or so that I have been following EU affairs closely, I cannot remember such a bold and open act of defiance by any state. Usually such matters are fudged. Countries stretch the line, but do not actually cross it.

With condign symbolism, Mr Rajoy dropped his bombshell in Brussels after the EU summit, without first notifying the commission or fellow EU leaders. Indeed, he seemed to relish the fact that he was tearing up the rule book and disavowing the whole EU machinery of budgetary control.

Adding to the trend of deteriorating assumptions, The Institute of International Finance (IIF, a.k.a. banking syndicate) just issued a report stating that a Greek default and exit from the Eurozone could result in "contigent liabilities" of up to €1 trillion when factoring in all parties involved, which is basically every country and corporation in the world. As a reminder, that was the "agreed upon" size of the entire EFSF "bazooka" in a European Summit about 6 months ago, which never actually materialized because the agreement turned out to be a pack of lies that relied on large contributions from the IMF and China, among others.

Of course, this is simply an attempt to scare hedge fund holdouts into participating in the not-so-voluntary debt swap. The truth is that no one really knows how to quantify the daisy chain losses which would stem from a Greek exit, and they could easily be in excess of €1 trillion. What’s clear is that the uncertainty alone is enough to make some of the largest banks quiver in their boots and speculate on “end of the world” scenarios. The thing is, anyone who’s been paying attention knows that a Greek exit from the EMU is only a matter of time, as in less than two years from now.

Indeed, the Greek 1-year bond is now yielding a whopping 1000%+, which, for those still confused, does NOT indicate confidence in the country’s prospects, regardless of what lies are weaved between now and then. That means the [incalculable] losses stemming from a disorderly default and exit will occur no matter what, and will only grow larger if the Greek bailout/PSI package goes through. This has obviously been the underlying story of the entire global financial crisis since 2007-08 (big losses now or even bigger losses later), but the difference is that this reality is increasingly difficult for the plethora of relevant parties to ignore.

One such party is the Freedom Party of the Netherlands, which is the third largest in the Dutch Parliament. Ilargi reported in January that the party had commissioned a report from Lombard Street Research, which has now been officially released, and that its significance should not be under-estimated. The report is quite lengthy and showcases several different exit scenarios, but the conclusion is quite simple - the past benefits of the Euro are over-stated and the cost to the Netherlands of staying in the Eurozone, in terms of capital commitments and economic growth, is much greater than the cost of getting out.

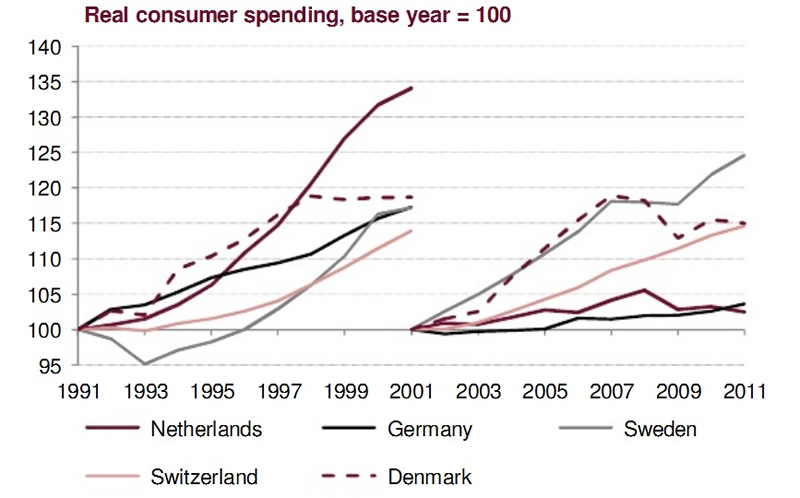

"While the euro has advantages that in principle are worth a once-off 2-2¼% of GDP to The Netherlands, these have been heavily outweighed by disadvantages. Growth of Dutch GDP has slumped from its pre-euro rate, as well as falling well short of growth in comparable non-euro countries, Sweden and Switzerland

"Divergence of inflation and growth between countries in the Eurozone has led directly to the current debt crisis in Mediterranean Europe (Med-Europe) as well as feather-bedding Dutch industries in a comfort zone of low labour costs, taking away the spur to innovation and productivity gains. Even before The Netherlands is presented with the potentially enormous bill for bailing out Med-Europe, it has suffered a substantial shortfall of net overseas assets."

"While unquantifiable, no spurious counterfactual story is required to showthat EMU membership to date has imposed substantial welfare losses onDutch citizens. Their own superior pre-euro performance, coupled with theirsubsequent inferiority compared with Sweden and Switzerland, isundeniable. Wasteful investment and intractable Med-Europe deficits, withcontinued dependency, make for a stressful future. It is difficult to see whatexplanation there could be other than the euro."

Keep in mind that all of the worsening assumptions above are still based on the fanciful notion that governments and central banks are ready, willing and able to provide adequate backstops to the global financial system in the event of contagion spreading from the periphery to the core. That means providing credible backstops to Spain, Italy, France, the Netherlands, the U.K., Germany, Japan and, eventually, the U.S. The fact that even the Federal Reserve has backed off from promises of further QE this year should be worrisome, to say the least. Which naturally brings us to the tried-and-true cognitive dissonance of the American pundits.

It is perhaps the only country that seems to remain wholly committed to its role as the boy in the biggest bubble. The Fed’s economic growth projections have certainly become gloomier over time, but they are still completely unrepresentative of reality, and most other mainstream institutions still claim the country can miraculously make it through a year riddled with worldwide risks without a scratch. So who wants to take bets on how long before the assumptions for America start disappointing in a major way? Anyone holding out until 2013? I didn’t think so.

Ashvin Pandurangi, third year law student at George Mason University

Website: http://theautomaticearth.blogspot.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

© 2012 Copyright Ashvin Pandurangi to - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.