Stock Market Ending an Diagonal Top?

Stock-Markets / Financial Markets 2012 Mar 04, 2012 - 11:22 AM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX: Very Long-term trend - The very-long-term cycles are down and, if they make their lows when expected (after this bull market is over) there will be another steep and prolonged decline into late 2014. It is probable, however, that the steep correction of 2007-2009 will have curtailed the full downward pressure potential of the 120-yr cycle.

SPX: Intermediate trend - The intermediate uptrend is still intact, but a short-term top is forming.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discusses the course of longer market trends.

Market Overview

Last week's title was "SHORT-TERM TOP FORMING". Nothing has happened in the past week to persuade me to change that forecast. If anything, several things did occur which suggests that the long-awaited reversal is just around the corner, perhaps as early as next week. Cycles and structure point to it, as well as the following developments:

In the past, QQQ had been a good prognosticator of reversals. When it started to weaken ahead of the SPX, it was time to be cautious. However, QQQ has been distorted by Apple' surge, and it remains stronger than SPX even though other conditions point to a top. There is, however, another index which tends to lead the SPX, and that is the Russell 2000, an index of small-cap stocks. On the hourly chart of the SPX, below, I have added the Russell 2000 for relative strength comparison. We'll discuss it when we analyze the chart.

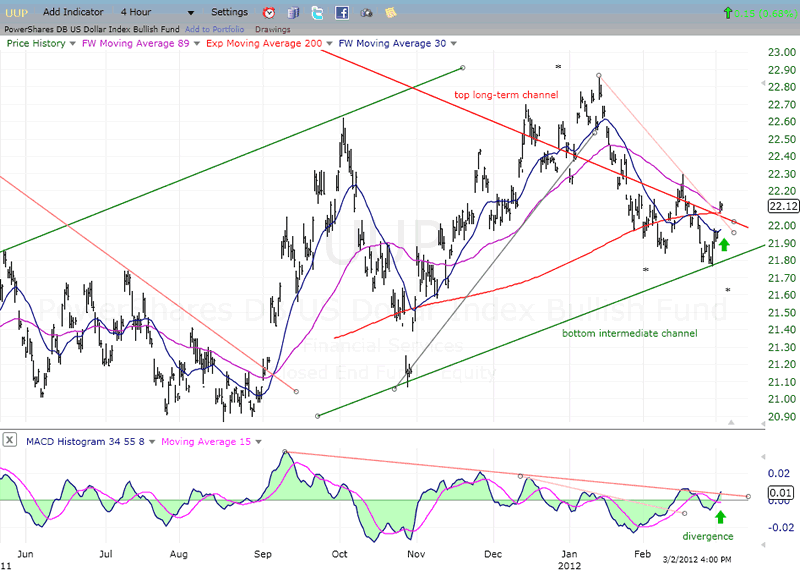

Another index which tends to be a contrary indicator and which seems to be getting under way is UUP. We'll also analyze its chart later on.

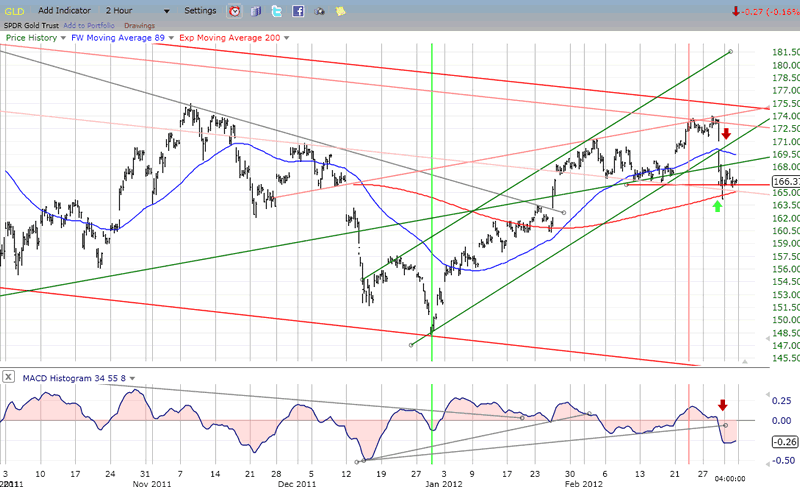

Gold had a sharp break last week. Lately, gold has generally been traveling in the same direction as the market. This time, it is acting as a messenger of good tidings for the frustrated bears.

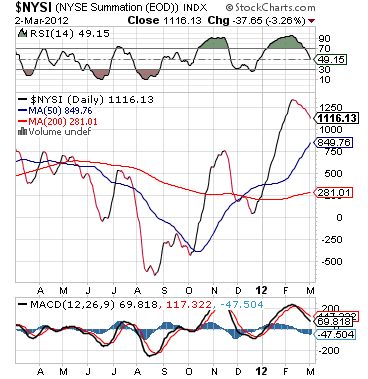

The Summation Index started to turn down two weeks ago. Last week's bad breadth has continued to push it down, and its RSI has already reached the 50% line from an overbought condition.

Structurally, most EW analysts are looking for the end of an ending diagonal before the reversal takes place. That could imply a near-term low, followed by the final rally peak.

Chart analysis

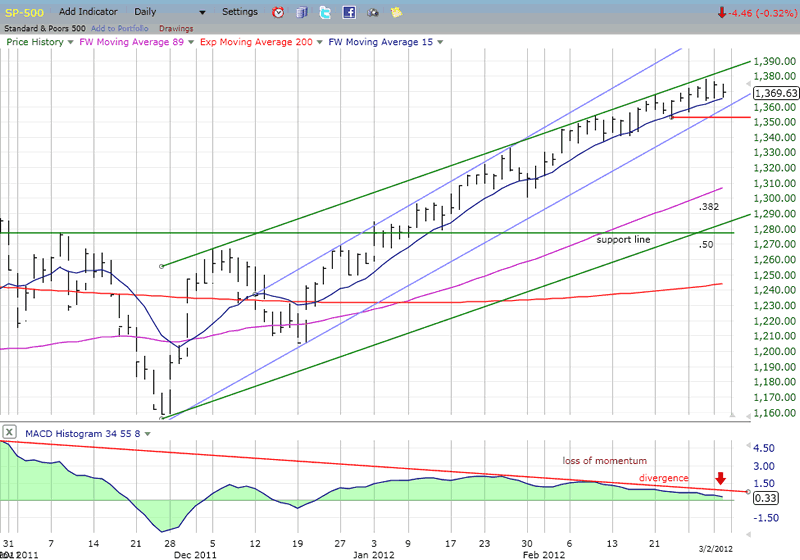

With the objective of keeping things simple, this Daily Chart of the SPX shows two channels, a short-term blue channel which encompasses the price movement from Dec. 19, and a wider green channel which starts at the end of November. There is an even wider channel representing the advance from the October low which is not shown here because it is not relevant to this week's analysis.

It is clear that the top green channel line has contained prices since early February, and it will probably continue to do so until we get a reversal over the next few days. It is pushing prices closer and closer to the lower blue channel line, forming a wedge pattern. That wedge pattern is the ending diagonal perceived by EW analysts, and it appears to need one more little push to the upside before completion.

Whether we get that final push or not, the critical level for the short-term uptrend to hold is 1353 (red horizontal line). A move below that level would put prices decisively outside the blue channel and below the moving average which has acted as support since mid-December.

The indicator at the bottom of the chart tells us that the days of the uptrend are numbered. There has been a steady loss of momentum which seems to be accelerating. A move below the zero line would most likely be a sell signal. I have placed a red arrow in anticipation of such a move.

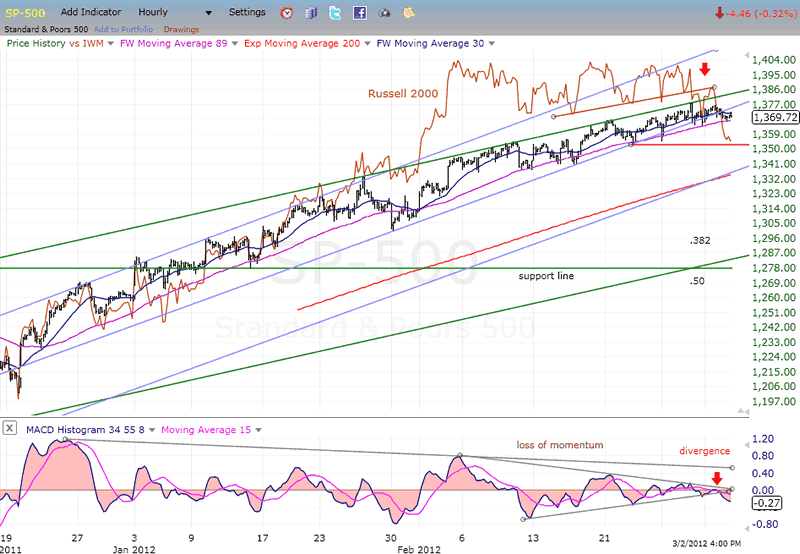

The Hourly Chart, besides providing a close-up look at the price movement has some added features, as well as some which were not discussed in the daily chart analysis. The same blue and green channels are there and I have added a median to the blue channel. It has acted as a support line ever since the beginning of the uptrend, keeping prices in the top half of the channel. But, on Friday, the index traded below it for most of the day -- the first chink in the armor of the uptrend. There is a small cycle due around Tuesday which could push prices down a little more (wave 4 of the ending diagonal?), and provide the necessary near-term low from which to start the final push. If, however, the index drops below 1353, it will have told us that it does not need a last push.

Another feature added to this chart is a comparable chart of the Russell 2000. At the beginning, I mentioned that it was normally the harbinger of a reversal. If we were to draw trend lines and channels for this index, we would see that it has already moved out of its blue channel and is resting on the bottom line of the green channel. It has also broken below the level comparable to 1353 on the SPX. Clearly, it has already given a sell signal.

I have marked the .382 and .50 retracement levels from the 1159 low, and have drawn what I consider to be a strong support line which falls between the two retracement points. That would be a good level to watch for the end of the decline. We can confirm it later with a P&F projection when the top distribution pattern has been completed.

The indicator is already negative and has already broken the trend line which marks the start of the ending diagonal pattern. Since it is usually one step ahead of the price move, it adds to the view that one more bounce is necessary to finish the ending pattern.

Cycles

I have already said that a small cycle is due (ideally) next Tuesday. It is part of a group of cycles coming together in this time frame.

The most important one, because of its consistency in bringing about significant reversals, is the 22-wk cycle. Its last accomplishment was the early October low!

Another important one which might pin-point the top is the 14-wk (about) high-to-high cycle which regularly identifies market tops, the last one being the late October high.

Breadth

The NYSE Summation Index (courtesy of StockCharts.com) -- like the Russell 2000 -- has already turned down, and we know from experience that the A/D reverses ahead of prices. This is another warning that should not be ignored.

Sentiment

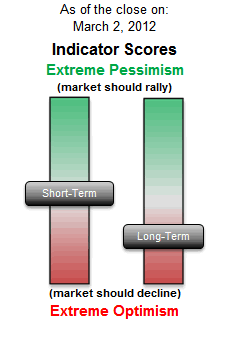

There is little change in the SentimenTrader (courtesy of same) long-term indicator this week. It remains in a negative position which is compatible with an interim market top.

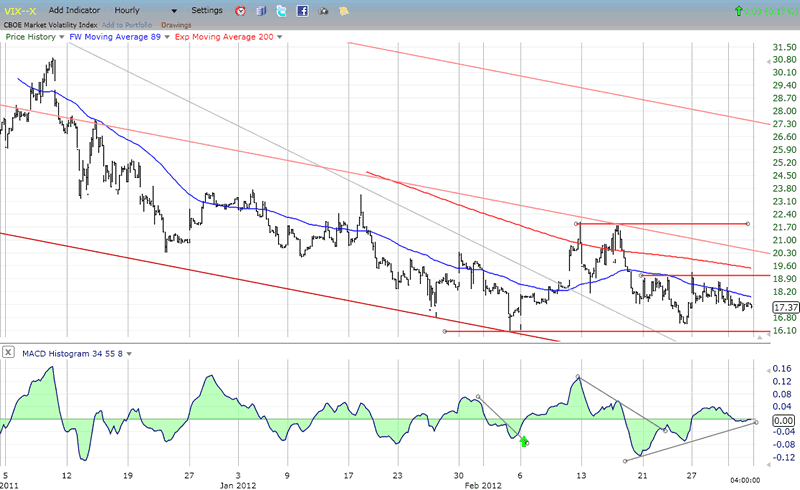

VIX

If there is one index which tells us that the market top has not yet arrived, it's the VIX. The Hourly Chart shows that it has been asleep for the past two weeks. But don't let that fool you! It is sleeping with one eye open, waiting for the right time to pounce upward in confirmation of a reversal in the SPX.

It made its low on February 6 and has been building a base ever since. On the P&F chart, that base has the capacity to initiate a move to 28. This should give us an idea of the extent of the market pull-back. We'll have to see what happens next, whether it pulls back into its base or consolidates at a higher level in preparation for a move to a higher high (which would be a market lower low).

The indicator is already in an uptrend, but there could be a little shake-out move before things get underway on the upside.

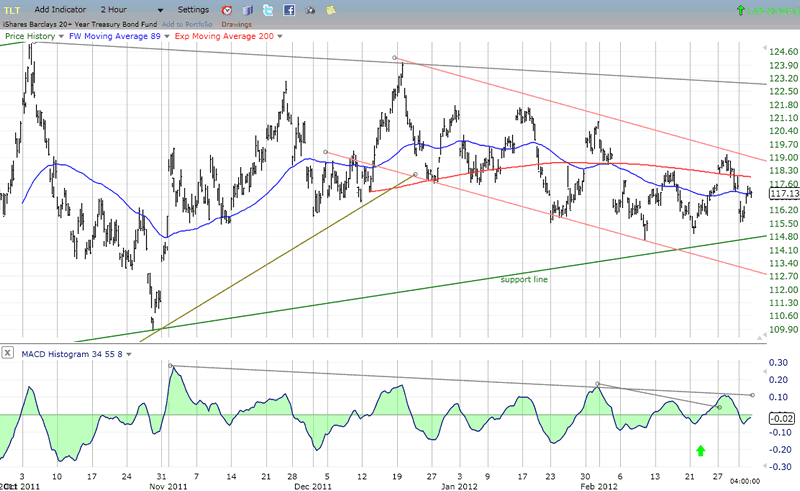

BONDS

I wanted to capture the intermediate consolidation pattern that TLT has been making since reaching its 125 projection. The Two-hour Chart does this best.

It looks as if TLT has been making a corrective A-B-C pattern and that it is now approaching the end of C. A move above the red down-channel line would probably get things going on the upside. The last three weeks already show a pattern of slightly higher highs and higher lows, indicating that the index may be ready to explode on the upside when the right moment arrives (that's the way this index seems to trade). It's as if everything we've analyzed, so far, is at the starting line, waiting for the pistol shot to start the race.

Assuming that everything remains the same, the P&F chart shows a potential move to 126 with a possible extension to 130.

UUP (Dollar ETF) - 4-hr Chart.

UUP has just given a near-term buy signal, but it may fizzle before going much higher. The index is still in a downtrend, but definitely trying to break out of its long-term downtrend channel once again. However, it looks as if it may need one more near-term pull back before it starts a short-term uptrend which would move it out of the long-term pattern.

GLD (ETF for gold)

In the last newsletter, I mentioned that GLD may have achieved its upside objective and might be ready for a pull-back. That happened last week with an instantaneous, precipitous 10-point correction which was probably due to a bottoming short-term cycle. The index has found support at the level of the previous low, as well as on an inner trend line.

The consolidation may last until the market has found its short-term top, then the index could drop to a short-term projection of 160. What happens after that should be an attempt at resuming its uptrend. If GLD requires more intermediate consolidation, that attempt will fail and the index could continue its decline into June in conjunction with the 25-26-wk cycle low -- the same cycle which created the drop into late December. If this should happen we'll look for a re-confirmation of the original count to 141-143.

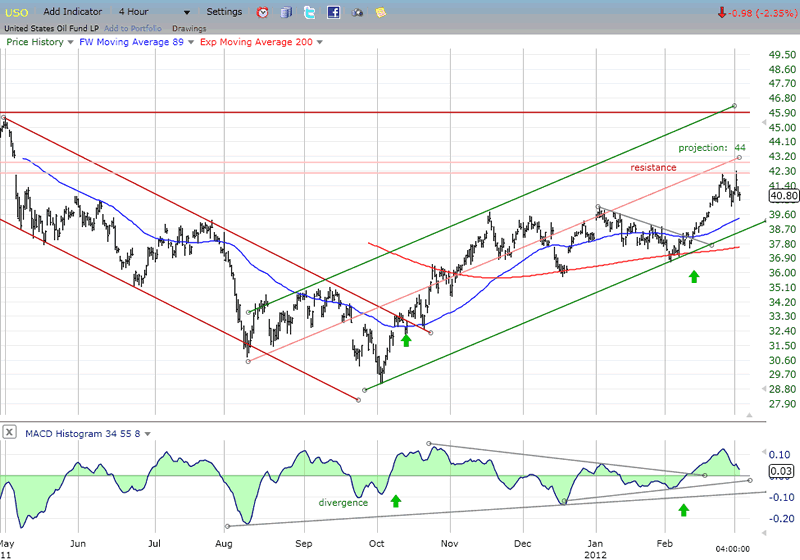

OIL - USO (United States Oil Fund)

USO met with resistance where expected and it has started a near-term consolidation. This may be a prelude to moving to its projection of 43-44 before settling down for a longer correction.

When the index met its initial 45 projection and went into a steep drop immediately afterwards, it created a gap between 44.01 and 42.05. Gaps tend to be filled the majority of the time, and that would fit perfectly with the Point & Figure projection mentioned above.

The stock has a potential longer-term target of 49, which matches a potential high for crude in the low to mid-130s.

WTIC (crude) had an interim projection to 110-111. On Thursday, it filled that count and pulled back sharply. That could mean that it has already reached its short-term target and may be ready for a longer consolidation. That would probably result in USO falling a little short of its own projection.

Summary

The short-term market top is now palpable. If EW analysts are correct, there remains one more little push upward to complete an ending diagonal pattern. Cycles are also pointing to a top, probably next week.

With the Summation Index, Russell 2000, and gold already taking the lead, the rest of the market should not be far behind.

FREE TRIAL SUBSCRIPTON

If precision in market timing for all time frames is something which is important to you, you should consider a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth.

For a FREE 4-week trial. Send an email to: ajg@cybertrails.com

For further subscription options, payment plans, and for important general information, I encourage you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my investment and trading strategies and my unique method of intra-day communication with Market Turning Points subscribers.

By Andre Gratian

MarketTurningPoints.com

A market advisory service should be evaluated on the basis of its forecasting accuracy and cost. At $25.00 per month, this service is probably the best all-around value. Two areas of analysis that are unmatched anywhere else -- cycles (from 2.5-wk to 18-years and longer) and accurate, coordinated Point & Figure and Fibonacci projections -- are combined with other methodologies to bring you weekly reports and frequent daily updates.

“By the Law of Periodical Repetition, everything which has happened once must happen again, and again, and again -- and not capriciously, but at regular periods, and each thing in its own period, not another’s, and each obeying its own law … The same Nature which delights in periodical repetition in the sky is the Nature which orders the affairs of the earth. Let us not underrate the value of that hint.” -- Mark Twain

You may also want to visit the Market Turning Points website to familiarize yourself with my philosophy and strategy.www.marketurningpoints.com

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.