Gold Bullion and Mining Shares Shakeout

Commodities / Gold & Silver Stocks Mar 03, 2012 - 05:46 AM GMTBy: Clif_Droke

Mining shares and the precious metals were hard hit on Wednesday after Fed Chairman Bernanke appeared before Congress. Bernanke gave his view on the U.S. economic outlook during and offered a mixed message. He touted the recovery in the job market while warning that unless growth accelerated, the unemployment rate wouldn't continue to drop.

Mining shares and the precious metals were hard hit on Wednesday after Fed Chairman Bernanke appeared before Congress. Bernanke gave his view on the U.S. economic outlook during and offered a mixed message. He touted the recovery in the job market while warning that unless growth accelerated, the unemployment rate wouldn't continue to drop.

But what caused consternation among traders was what the Fed Chairman didn't mention, namely the possibility that the Fed would be doing another round of quantitative easing (QE3). This omission was enough to catalyze heavy selling in gold and silver. The yellow metal was down 5% on the last day of February while silver declined over 6%.

The post-Fed market move was basically a short-sighted overreaction among traders who have been spoiled by Bernanke's constant reassurances regarding the Fed's loose money policy. As it stands, U.S. monetary policy remains loose and Bernanke acknowledged that interest rates are actually "too high," adding that "they are being constrained by the fact that interest rates can't go below zero." In point of fact, Bernanke had to temper his remarks due to the recent spike in fuel prices. He tacitly acknowledged that there could be a short-term spike in inflation because of this, and that's why there was no mention of additional monetary easing.

While the Fed has put plans for QE3 on hold, Europe has already embarked on its version of quantitative easing. As of Dec. 21, 2011, the European Central Bank (ECB) has offered to lend Europe's banks as much as money as needed for up to three years at an interest rate of 1%. The ECB effectively printed $600 billion in a single day in December and, in the words of one commentator, the ECB's action was "the equivalent of aiming a monetary cannon at Europe's debt crisis."

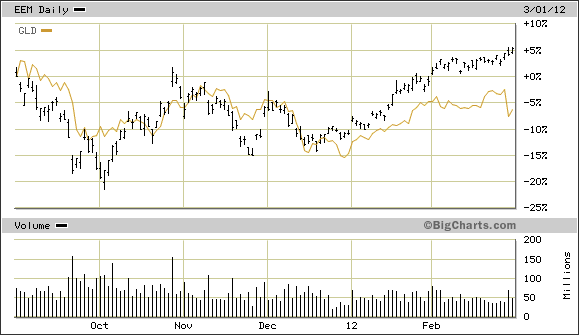

One barometer for the overall status of the global market recovery is the Emerging Market Index (EEM). Although the EEM is more directly concerned with the Asian markets, it has roughly followed the trajectory of the euro currency in recent years and is therefore an indirect indication of the strength of the eurozone recovery since the recent bailout. Not surprisingly, EEM has rallied impressively since late December 2011 when the ECB announced its intention of supporting Europe's banks at any cost.

The overall trend in the EEM has also loosely corresponded to the gold price trend over past few years. In recent weeks, however, the connection between EEM and gold has widened and EEM has continued to make higher highs and higher lows while the yellow metal price has remained stuck below its September 2011 high (when CME Group announced margin increases for gold).

Billionaire investors Warrant Buffett and George Soros have made some negative comments about gold in their public commentaries. Many independent investors take this to mean that the outlook for the precious metal is bleak since these men have a history of being correct in their financial assumptions. If we look beneath the surface of their public pronouncements, however, we find that both men have rather substantial direct as well as indirect stakes in the precious metals. To ascertain the intermediate-term outlook for the yellow metal we should look beyond the rhetoric and examine the market's internal condition.

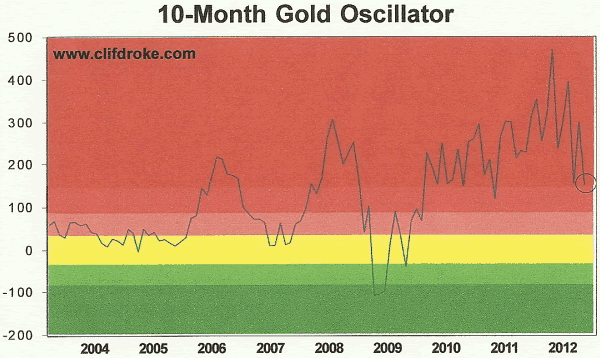

When we do this we find that while gold remains "overbought" on a longer-term basis as reflected by the 10-month price oscillator (see chart below), the longer-term overbought condition that has persisted for years is actually getting better. The oscillator is still in the red zone, which represents an overheated long-term condition, but the metal is cooling off a bit and this could allow gold enough leeway to attempt to move above the November 2011 pivotal high of $1,800 in the coming months.

Gold is in the odd position of being both shunned by investors and poised to benefit from the increased liquidity in the eurozone. On the one hand, investors have temporarily turned their backs on gold in light of the brighter prospects for recovery in 2012, especially now that investors are convinced that the Fed and the ECB will fight deflation with everything they've got. Equity prices will benefit from this monetary policy more than gold will and investors have positioned themselves accordingly. At the same time, gold will receive some residual benefits from the coordinated loose money policy. Some of this excess liquidity will undoubtedly find its way into gold, particularly as Asian investors are inclined to allot a portion of their earnings into the metals.

Gold may well underperform stocks in 2012 until the 4-year cycle peaks later this year, but it shouldn't be left completely in the dust. Gold may continue to lag U.S. and emerging market financial sectors but should be able to hold its own and loosely follow the trajectory of these markets in the coming months.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.