Bernanke Maintains Cautious Stance on Further Monetary Easing

Politics / Central Banks Mar 01, 2012 - 06:27 AM GMTBy: Asha_Bangalore

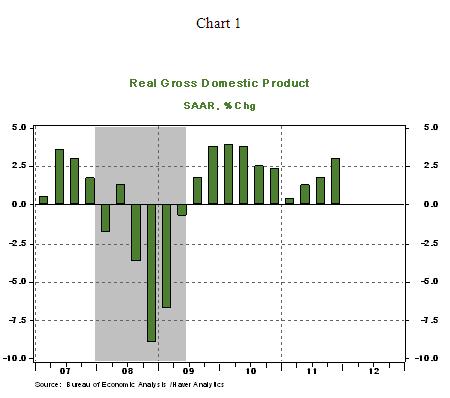

Chairman Bernanke maintained a cautious stance in today’s testimony at the Committee on Financial Services of the House of Representatives and left the door open for additional monetary policy easing. He opened his remarks with the observation that the “pace of expansion has been uneven and modest by historical standards.” In his opinion, economic activity is likely to match the pace seen in the latter half of 2011. The U.S. economy advanced at an average pace of 2.4% in the third and fourth quarters of 2011.

With regard to the labor market, Bernanke noted that the “decline in the unemployment rate over the past year has been somewhat more rapid than might have been expected, given that the economy appears to have been growing during that time frame at or below its longer-term trend: continued improvement in the job market is likely to require stronger growth in final demand and production. Notwithstanding the better recent data, the job market remains far from normal” (emphasis added). Essentially, the Fed continues to be place labor market challenges at the top of the priority list.

Bernanke indicated that although household spending advanced moderately in the second half of 2011, the “fundamentals that support spending continue to be week: Real household wealth and income were flat in 2011, and access to credit remained restricted for many potential borrowers.” In the housing sector, Bernanke sees lack of credit availability as a restraining factor. He reiterated that that inflation will run at or below 2.0% that is consistent with the mandate. The recent gain in gasoline prices as a temporary influence on prices. In this context, Bernanke pointed out that inflation expectations are consistent with the Fed’s view that inflation will remain subdued.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2012 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.