Silver – Is the Party Over?

Commodities / Gold and Silver 2012 Mar 01, 2012 - 06:03 AM GMTBy: Willem_Weytjens

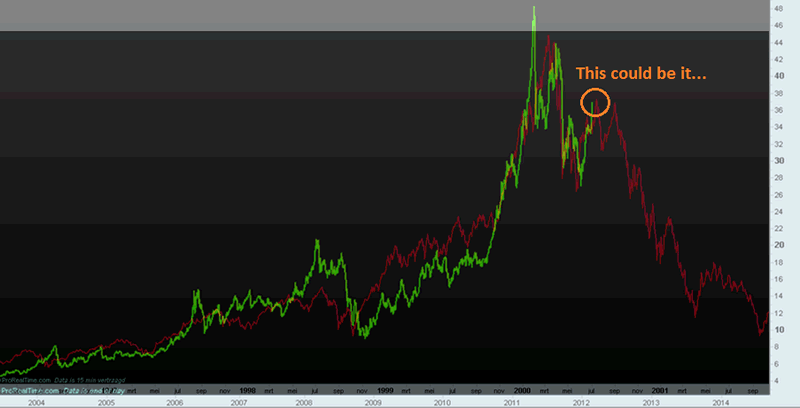

A couple of weeks ago, we compared the Bull market of Silver to the Nasdaq Bubble…

A couple of weeks ago, we compared the Bull market of Silver to the Nasdaq Bubble…

We wrote that Silver could go as high as $38, but that that might be an inflection point.

Silver reached a high of $37.22 last night and $37.62 today, and has thus reached its goal.

Below, you can see an updated version of the chart we posted a couple of weeks ago:

Chart courtesy Prorealtime.com

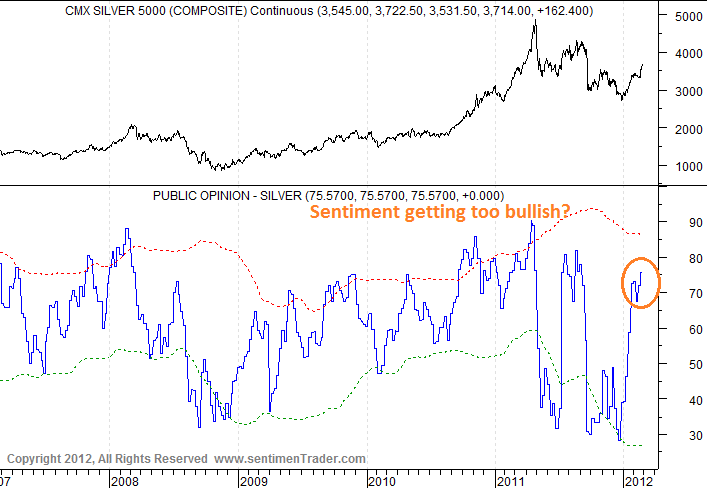

Sentiment is also getting (too?) bullish, as it has now reached 75.57% again:

Chart courtesy Sentimentrader.com

Sure, sentiment can still go up. Back in April 2011, Bullish Sentiment was over 90%…

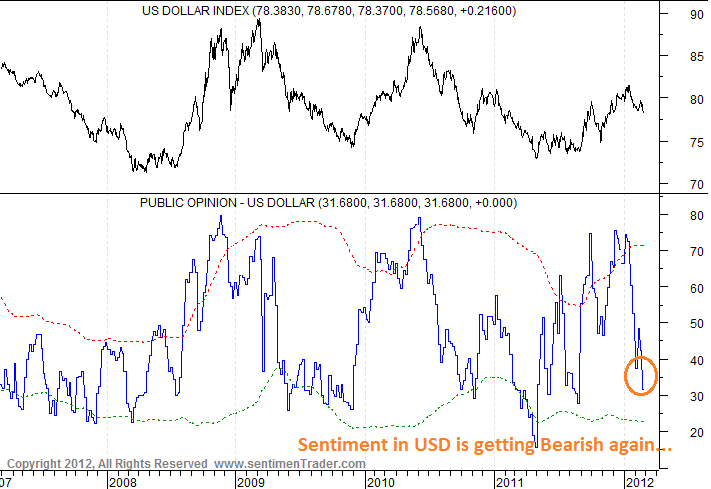

A lot will depend on the USD. Sentiment for the USD has come down sharply, meaning the dollar could be on the verge of setting a bottom soon.

Chart courtesy Sentimentrader.com

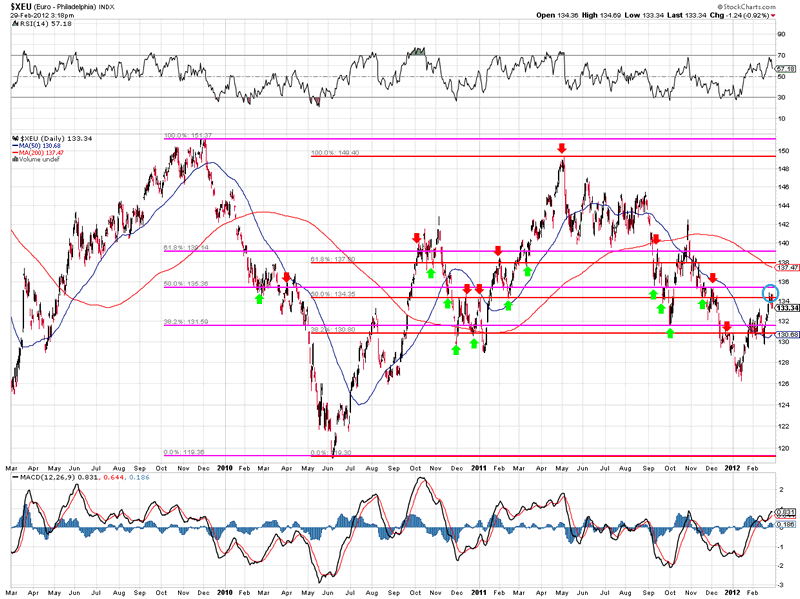

My subscribers know that my target for the EURUSD has been 1.3435 based on Fibonacci Retracement levels, and this level has now been reached. The higher highs are still confirmed by higher highs in the MACD and RSI, meaning the uptrend is still intact, as we don’t have negative divergence yet.

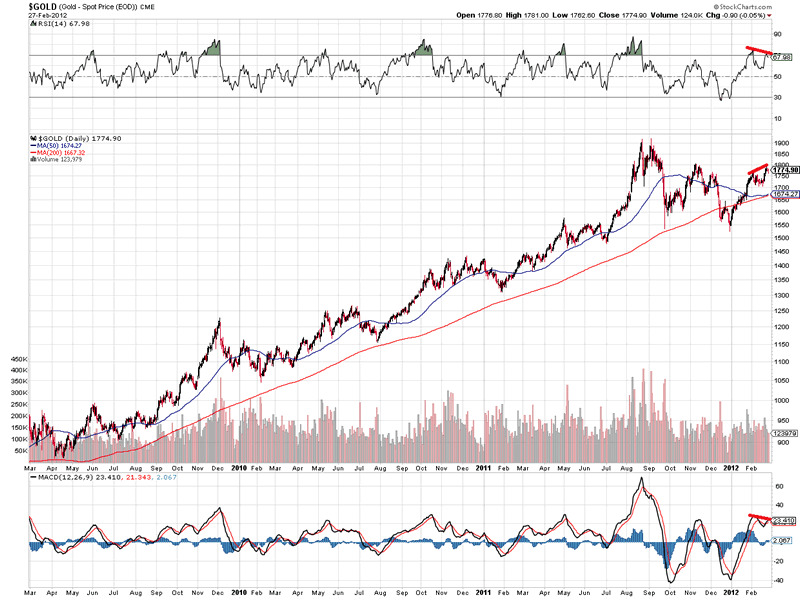

Chart courtesy Stockcharts.com

2 days ago, I wrote in the Nightly Report about the fact that negative divergence was building in both Silver and Gold. Below you find the chart I posted that day:

Chart courtesy Stockcharts.com

In the original article, I wrote:

If the pattern doesn’t hold, and silver blasts through $40, it’s probably on it’s way to the all-time high. In that case, the next big move would be to the upside, with potential targets of $70 and potentially triple digit silver prices.

As long as the pattern holds, I would be careful if silver hits $38.

Well, so far, the pattern holds.

At the moment, Silver is falling 5%, adding more weight to the Nasdaq comparison, even though many people will blame me for not looking at fundamentals. I do not write this post to trash silver. I like Silver. I like Gold. But I also like my own analyses and comparisons.

Do your own Due Diligence.

For more articles, trading Updates, Nightly Reports and much more, please visit www.profitimes.com and feel free to sign up for our services!

Willem Weytjens

www.profitimes.com

© 2012 Copyright Willem Weytjens - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.