Silver Surges 4.5% To Over $37/Oz On “Massive Fund Buying”

Commodities / Gold and Silver 2012 Feb 29, 2012 - 10:28 AM GMTBy: GoldCore

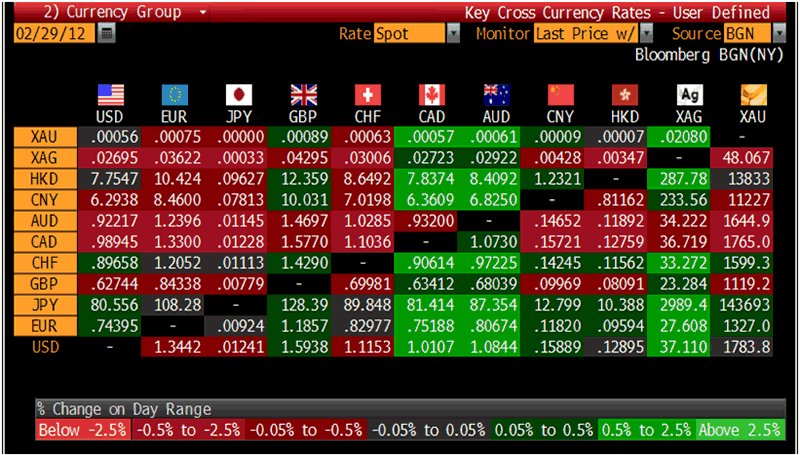

Gold’s London AM fix this morning was USD 1,788.00, EUR 1,329.96, and GBP 1,120.79 per ounce..

Gold’s London AM fix this morning was USD 1,788.00, EUR 1,329.96, and GBP 1,120.79 per ounce..

Yesterday's AM fix was USD 1,774.75, EUR 1,321.48, and GBP 1,120.42 per ounce.

Cross Currency Table – (Bloomberg)

Gold rose 1% in New York yesterday and closed at $1,783.90/oz. Gold rose in Asia to a high of $1,790.16 it’s highest since mid November then edged down. Europe this morning saw sideways trading until unusually volatile trading around the London AM fix saw gold rise from $1785.oz to over $1790/oz at 1030 GMT and then fall quickly to $1783/oz.

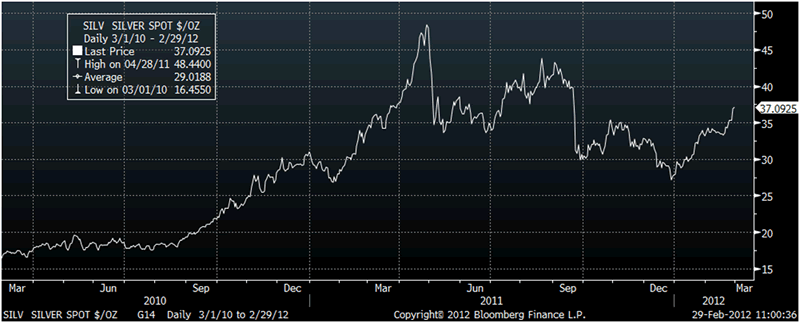

Spot silver has gained another 0.5% to $37.05 an ounce, after surging 4.5% yesterday once it rose above resistance at $35.50/oz. Silver reached a 5 month high of $37.21 but remains more than 30% below its nominal high in of April last year of $48.44.

Silver Spot $/oz – (Bloomberg)

Over 800 European banks have taken €529.5 billion from the ECB today after taking €489 billion euros at the first tender in December. The ECB’s 3 year lending is now near 1 trillion euros ($1.35 trillion) and the ECB’s balance sheet looks increasingly precarious.

Although the flood of paper has been credited with fuelling a rally on Europe’s distraught bond markets and safeguarding the region’s banks, it is another exercise in kicking the beer keg down the road as it fails to address the fundamental issue which is the insolvency of many European banks and many European nations and the obvious risk of contagion from that.

The continuation of ultra loose monetary policies increases the risk of inflation which will benefit gold which is an excellent inflation hedge. Extremely low yields on deposits and “risk free” sovereign debt means the opportunity cost of carrying non yielding bullion remains very low.

Spot silver gained 0.4% to $37.05 an ounce, after surging 4% and hitting a 5 month high of $37.21 in the previous session.

Silver as ever outperformed gold yesterday and traders attributed the surge to “massive fund buying” and to “panic” short covering. Some of the bullion banks with large concentrated short positions covered short positions after the technical level of $35.50/oz was breached easily.

Massive liquidity injections and ultra loose monetary policies make silver increasingly attractive for hedge funds, institutions and investors.

This time last year (February 28th 2011) silver was at $36.67/oz. Two months later on April 28th it had risen to $48.44/oz for a gain of 32% in 2 months.

There then came a very sharp correction and a period of consolidation in recent months. Silver’s fundamentals remain as bullish as ever and the technicals look increasingly bullish with strong gains seen in January and February.

Very bullish is the fact that silver also remains more than 30% below its record nominal high 32 years ago in 1980 and more than 75% below its inflation adjusted high of $140/oz in 1980.

The gold-silver ratio dropped to its lowest level in 5 months, after silver rose more than 12% so far this month and an enormous 34% this year, outperforming other precious metals.

Rising holdings of silver-backed ETF’s also indicated growing investor interest in the metal. The overall silver Exchange Traded Funds holdings rose to 491.079 million ounces, the highest since last May.

Spot platinum gained nearly 0.5% to $1,722.24, as investors await the latest in Impala Platinum's dealing with an illegal strike that has disrupted production at Rustenburg, the world's largest platinum mine.

For breaking news and commentary on financial markets and gold, follow us on Twitter.

OTHER NEWS

(AP) -- Silver Prices Jump, Playing Catch-up to Gold

Silver prices shot up 4.5 percent Tuesday, playing catch-up to gold.

Silver is both a precious and an industrial metal. Traders can buy it to hedge against a volatile stock market, as they do with gold. But it can also be used to make products like computer chips, meaning prices can rise when traders expect demand from manufacturers to go up.

In March contracts, silver rose $1.616 to $37.14 per ounce. It's up roughly 10 percent from where it was a year ago. Sterling Smith, senior market analyst at Country Hedging in St. Paul, Minn., said part of the reason silver is surging is that traders believe it's undervalued compared to gold. Gold closed at $1,788.40 an ounce, up $13.50 for the day. It's up about 26 percent compared to a year ago.

Copper rose 3.15 cents to $3.912 per pound, and platinum rose $9.20 to $1,723.50.

Energy contracts fell, partly because investors were pulling back after price gains last week. Oil prices remain close to nine-month highs because of concerns that Iran could cut shipments of crude to Europe and interfere with supplies elsewhere. The European Union and the U.S. are using sanctions against Iran because they fear the country is developing a nuclear weapon.

Benchmark oil fell $2.01 to finish at $106.55 per barrel on the New York Mercantile Exchange. Natural gas prices fell 8.5 cents to end at $2.627 per 1,000 cubic feet. Heating oil fell 6.28 cents to $3.2201 per gallon.

Smith said grains and other agricultural products have been enjoying a "winning streak" for the past week. Those movements are especially important now as farmers decide what to plant this year.

Soybean prices on Monday topped $13 a bushel for the first time in five months. That's because traders think there will be greater demand for U.S. exports of the protein-rich beans because smaller harvests from South America are expected.

On Tuesday, soybeans for March delivery rose less than 1 percent, to $13.125 per bushel from $13.025. March wheat rose 15.5 cents to finish at $6.6825 per bushel. Corn ended up 8.75 cents to $6.5725 per bushel.

The price of orange juice also rose. Cocoa and sugar fell.

(Bloomberg) -- Gold-Oil Correlation Rises to Eight-Month High

Gold’s strengthening correlation with oil means more gains for the metal as Brent near a nine- month high spurs demand for an inflation hedge, UBS AG said.

The CHART OF THE DAY shows Brent prices reached $125.55 a barrel in London on Feb. 24, the highest since early May, and are up 15 percent this year. Bullion has gained 14 percent in the period and reached $1,787.55 an ounce last week, the highest since Nov. 14. The 30-week correlation coefficient between the commodities rose to 0.61 today, the most since June. A figure of 1 means the two always move in the same direction.

Gold’s “rolling correlation with oil is slowly inching higher and we think this signals that some catching up lies ahead,” Edel Tully, an analyst at UBS in London, wrote today in a report. “To the extent that rising oil prices feed into higher inflation expectations, gold is bound to reap benefits.”

Some investors buy gold to hedge against accelerating consumer prices and as a protection from slowing growth and geopolitical risk. The metal, which generally earns holders returns only through price gains, rallied for an 11th year in 2011 as central banks in Europe and the U.S. kept interest rates near record lows. Oil advanced this year on concern the west’s dispute with Iran over the Islamic republic’s nuclear program may lead to a disruption in exports from the Middle East.

Investors are holding a record 2,398.2 metric tons of gold in exchange-traded products backed by the metal, valued at about $137.1 billion, according to data compiled by Bloomberg. The tonnage exceeds the holdings of all but four central banks, which are expanding reserves for the first time in a generation.

The Islamic republic has threatened to close the Strait of Hormuz, a transit point for about 20 percent of globally traded crude oil, if its exports are banned in sanctions. While UBS forecasts Brent at $110 a barrel in the second quarter, “any Iran-related headlines, military threats or small incidents in the Persian Gulf are likely to push oil prices sharply higher and potentially boost gold in turn,” Tully said.

(Bloomberg) -- Oil Set for Best Month Since October on Recovery Signs, Iran

Oil rose, heading for its best month since October in New York, amid signs of economic recovery and concern that tension with Iran threatens global crude supplies.

West Texas Intermediate futures climbed as much as 0.6 percent after sliding yesterday the most in five weeks. Industrial output in Japan and South Korea beat estimates and U.S. consumer confidence rose to the highest level in a year. Oil has advanced 8.8 percent in February, its first monthly gain in three, as sanctions tighten against Iran, OPEC’s second- biggest producer.

(Bloomberg) -- Impala Says Strike Halts 2 Billion Rand of Platinum Output

Impala Platinum Holdings Ltd. said 100,000 ounces of output, equivalent to sales of 2 billion rand ($265 million), was halted by a strike at its Rustenburg mine.

The company, based in Johannesburg, is working to resume output at the world’s biggest platinum mine after bringing back 9,800 of 17,200 staff fired during the illegal strike, Impala said today in a statement. About 15,800 didn’t join the strike.

“It is dependent on operational turnout of staff,” Impala said. Fired workers have until tomorrow to return on their prior terms after the walkout, which has entered a sixth week.

SILVER

Silver is trading at $37.14/oz, €27.64/oz and £23.30/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,723.00/oz, palladium at $710.00/oz and rhodium at $1,475/oz.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.