Is 2012 the Next 1897? Juniors Prepare for Yukon Gold Rush

Commodities / Gold & Silver Stocks Feb 29, 2012 - 01:43 AM GMTBy: Submissions

Chris Devauld writes: When it comes to gold mining, the Yukon needs little introduction. The westernmost territory’s frigid climate and unforgiving terrain hasn’t deterred prospectors, past and present. The end of the 19th century saw gold miners rush in on mere rumours of the yellow metal, which eventually lead to the renowned Klondike Gold Rush in 1897. Now, it appears, history is repeating as the high price of gold drives ambitious juniors back into the rush for riches.

Chris Devauld writes: When it comes to gold mining, the Yukon needs little introduction. The westernmost territory’s frigid climate and unforgiving terrain hasn’t deterred prospectors, past and present. The end of the 19th century saw gold miners rush in on mere rumours of the yellow metal, which eventually lead to the renowned Klondike Gold Rush in 1897. Now, it appears, history is repeating as the high price of gold drives ambitious juniors back into the rush for riches.

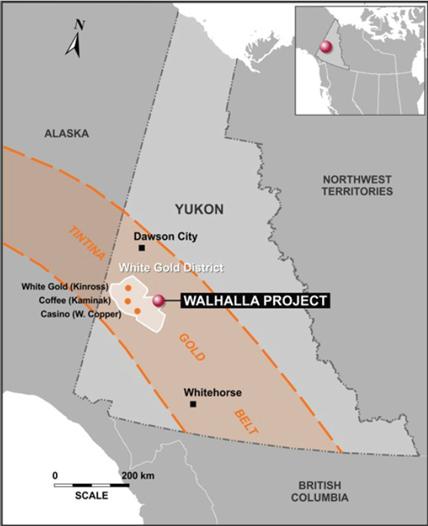

Of particular interest to many exploration companies vying for space in the Yukon is the renowned White Gold District. This district sits on the Tintina Gold Belt, which is a 2,000km long region of mineralization that stretches NW from British Columbia through the Yukon and into central Alaska. The Tintina has seen over 70 million ounces of gold mined over the last 30 years, with recent large discoveries including the 36 million ounce gold discovery at the Barrick/Nova Donlin Creek project, the 10 million ounce discovery at the International Tower Hills Livengood deposit and Kinross’s 5.7 million ounce Fort Knox deposit.

The Tintina, as you may have guessed, is the site of the historic Yukon Gold Rush. And despite the year-end take down of the gold price in 2011 (and the turbulent 2011 summer), Yukon-based exploration miners are now seeing their share prices rebound. Many are now gearing up for ambitious 2012 drill programs, anticipating a strong year ahead.

Of these juniors, Ethos Capital Corp [ECC – TSX.V] stands out as a well-positioned junior with “substantial mineral land positions” in the heart of the White Gold and Klondike Gold districts. As ECC’s image (left) illustrates, the Company’s claims lie in the middle of the Tintina Gold Belt, south of Dawson Creek. Among juniors, Ethos is one of the leading land holders in the region, with more than 1,000 square kilometres on which the Company is searching for epithermal-mesothermal gold and porphyry copper-molybdenum-gold systems. Within this land package, ECC has the Betty, Bridget, Hayes, Hen and Wolfe projects.

The Company’s soil sampling programs in 2011 have now given way to a 2012 drilling campaign. A recent press release from the Betty Property has confirmed trench pit work, with assays of 12.7 g/t Au over 2 metres and 1.3 g/t Au over 15 metres. On top of the recent results from Betty, ECC is actively pursuing exploration on its other Yukon projects, which it expects to highlight as the year unfolds.

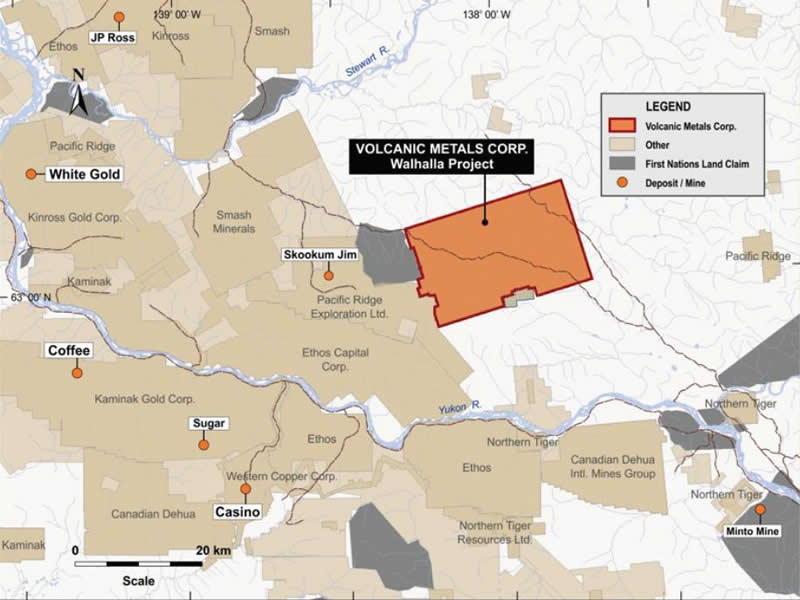

Hot on the heels of Ethos, proving up a solid land package and business model, is Volcanic Metals [VOL – TSX.V]. With a strong team of experienced Yukon geologists and a solid $2 million market cap, Volcanic Metals is focusing on its 100% owned and strategically located Walhalla Project, also located within the White Gold District.

The Walhalla presents Volcanic Metals with the opportunity to prove up a promising deposit in a highly prolific and active area. The 41,800 hectare property (418 km²) is located only 120 km south of Dawson City and is within a short distance from more than 10 million ounces of identified gold from three large deposits: Kinross’s White Gold, Kaminak’s Coffee and Western Copper’s Casino. With companies like Kinross in the vicinity, the area saw about $300 million in exploration expenditures in 2011.

Work on the Walhalla Project has uncovered substantial promise for future exploration. Within the large land package, Volcanic Metals has sampled a small portion of the 1,988 quartz claims. The 2011 Phase 1 exploration program, which only covered less than a third of the property, identified strong anomalous gold zones and anomalous pathfinder elements. Highlights from the 1,019 ridge and spur soil samples, with 50-100m spacing, include the following:

- 3.41 g/t gold-in-soil anomaly in the southeast region. This is one of the top ten historically reported anomaly results in the entire White Gold District. It was taken from the C horizon at 90cm depth with a manual deep auger in a 100-200m spaced soil line.

- A large number of grouped gold-in-soil anomalies (>65 with greater than 20ppb)

- A large brecciated system in the northeast

For Volcanic Metals, a strong start with its Phase 1 exploration program leaves the door wide open for 2012. On top of the soil sampling in 2011, Volcanic Metals completed a 4,500 line-km airborne geophysical survey. This survey, along with Phase 1 results, will greatly assist as the Company moves into the Phase 2 grid/trenching/pit program.

The $750,000 Phase 2 field program will start in June 2012 and will identify potential drill targets, while continuing ridge and spur sampling on the rest of the property. Of particular interest to investors, Phase 2 will include follow up samples to the 3.4 g/t Au anomaly, which could lead to the discovery of a deposit with blue-sky potential.

As 2012 unfolds, we expect to hear a steady stream of news from miners such as Ethos Capital and Volcanic Metals. Ethos’ 2012 drilling of its Yukon properties will likely push the Company further into the spotlight, attracting continued investor interest. Meanwhile, as spring nears Volcanic Metal’s management will focus on its summer exploration program.

Considering that Volcanic Metals’ substantial land package is right next to market players like Kinross in a prolific mining region, it’s safe to say that the Company’s 2012 exploration plans will attract a lot of eyes. And with the price of gold climbing back up and positive 2011 results adding to the White Gold District’s increasing buzz, this junior may be in just the right spot to participate in the next gold rush.

Other juniors of note in the region include: Smash Minerals, Victoria Gold Corp., Rockhaven Resources Ltd.

Chris Devauld ProspectingJournal.com

Disclaimer: The author does not currently hold any shares of any of the companies mentioned in the article. However, some members of Cordova Media Inc., which owns the ProspectingJournal.com, may or may not have interests in one or more of the companies mentioned at the time of publication. Staff members from the Prospecting Journal reserve the right to acquire interests in any of the companies mentioned after 36 hours have elapsed upon initial publication of this article. VOL is a sponsor of ProspectingJournal.com.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.