To QE or Not to QE That is The Question

Interest-Rates / Quantitative Easing Feb 27, 2012 - 03:01 AM GMTBy: Tony_Pallotta

The Fed does not like to surprise the markets. They telegraph policy changes well in advance. The coded language of Alan Greenspan has been replaced with plain english and press conferences under Bernanke. The Fed's monetary policy may be questionable but their strategy of being more transparent to the market has improved albeit far from perfect.

The Fed does not like to surprise the markets. They telegraph policy changes well in advance. The coded language of Alan Greenspan has been replaced with plain english and press conferences under Bernanke. The Fed's monetary policy may be questionable but their strategy of being more transparent to the market has improved albeit far from perfect.

In an "era" or shall I say "error" of easy money policy the question remains when will the Fed further expand its balance sheet through the implementation of QE3. Traditional QE in my view won't happen for a long time if ever again.

There will be more emergency lending facilities such as TALF during the 2008 financial crisis but I believe the days of expanding the balance sheet to "foster full employment" or to "prevent a deflationary cycle" have passed.

Why do I say that? Because the Fed told me. No I am not Jon Hilsenrath of the Wall Street Journal who does have the ear of the Fed. Let me share with you what they did and did not say.

The Threat Of Deflation

In November 2010 the FOMC officially launched QE2 and their basis was clearly stated in the released statement.

"To promote a stronger pace of economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate, the Committee decided today to expand its holdings of securities."

So how does the Fed measure inflation? Bernanke made it clear that inflation expectations are the measure when he said the following.

"As long as longer-term inflation expectations are stable, increases in global commodity prices are unlikely to be built into domestic wage- and price-setting processes, and they should therefore have only transitory effects on the rate of inflation."

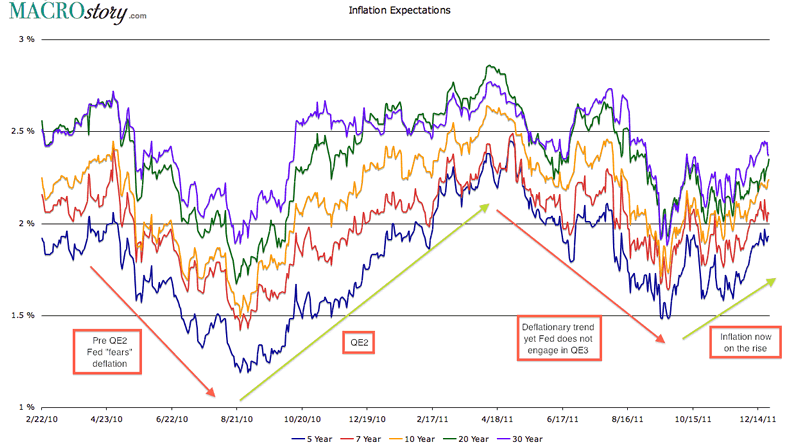

So let's take a look at inflation expectations as measured by Treasury TIPS (treasury inflation protected securities) across the yield curve as shown below. Notice the deflationary trend in the summer of 2010 which inspired QE2. Then notice the results where inflation expectations went from a downward trend to upward. The Fed could argue that QE did in fact eliminate "deflation expectations."

But here is where the Fed begins to tell us QE3 is not coming. Notice the return of the deflationary trend in the summer of 2011. When confronted with the decision to launch QE3 under the same deflationary trend that preceded QE2 the Fed opted to do no such thing. Instead they pushed out the earliest date in which they would raise rates to 2013.

As the trend continued into September they then opted to adjust the balance sheet through Operation Twist which was not an expansion of the balance sheet but a simple change in duration (i.e. sell short term debt and use those proceeds to buy longer term).

Bernanke Admits QE May No Longer Work

During the January FOMC press conference when asked about additional QE Bernanke said the following.

"The benefits (of QE) were clear but the effectiveness was now in doubt due to the "transmission mechanism" resulting from structural changes in the economy."

It Is An Election Year

Bernanke may or may not want another term as Fed Chairman but others on the committee probably do. One thing is sure the Fed does not want to see their power diminished. But that is a very real threat facing them.

Should in fact a republican win the White House Bernanke's chance of another term are slim. If he launches QE3 they are gone. But what is possibly more concerning to the Fed is legislation being introduced by republican leaders that would change the dual mandate of price stability and maximum employment to a single mandate of price stability.

The republicans through legislation are making it clear "no more QE." They have been equally vocal on the campaign trail.

A Fed Dove and QE Bull Is Saying Something Far Different

Leading up to QE2 St. Louis Fed President James Bullard was an outspoke advocate of QE. Then on February 24, 2012 he gave the following CNBC interview and completely backed away from further QE when he said.

"You have the situation in Iran being a wild card for global oil prices," Bullard said. "So you wouldn't want to feed into that with new policy moves from the Fed."

"With the better data, the super-easy policy already in place -- I think we've got a lot on the table here," Bullard said. "So this is a normal situation for the committee to sit back, get more data, try to collect our thoughts about the things that are affecting our economy right now."

Is The Economy Improving?

Bullard says it is. He even goes on to argue why the ECRI is wrong in their call that economic contraction is coming and possibly already at hand. In February when speaking before Congress Bernanke was far less optimistic about the economy when he said.

"The deteriorating economy pace, rising inflation and looming housing sector will remain a risk to consumer spending and overall economic growth."

Inflation Is Back

And let's finish a long post by revisiting the very first chart shown above. That deflationary trend that was in place in the summer of 2011 has now reversed. Inflation expectations for all maturities seven years and greater are now firmly above the 2% Fed target with the five year slightly below.

Bernanke and the Fed may tell you that "all policy tools are on the table" but their actions have shown you that QE is no longer readily accessible.

By Tony Pallotta

Bio: A Boston native, I now live in Denver, Colorado with my wife and two little girls. I trade for a living and primarily focus on options. I love selling theta and vega and taking the other side of a trade. I have a solid technical analysis background but much prefer the macro trade. Being able to combine both skills and an understanding of my "emotional capital" has helped me in my career.

© 2012 Copyright Tony Pallotta - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.